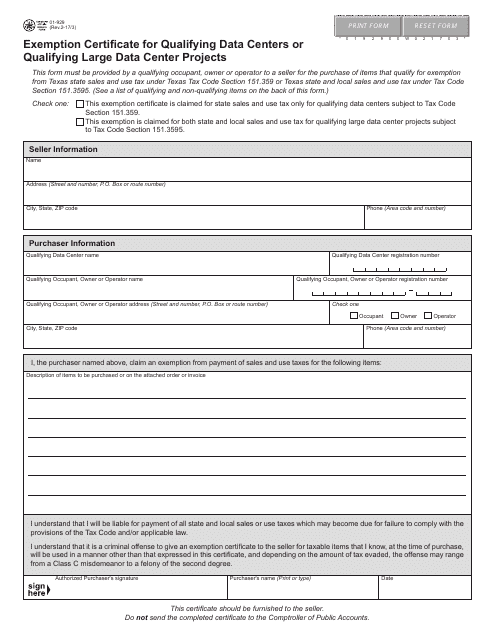

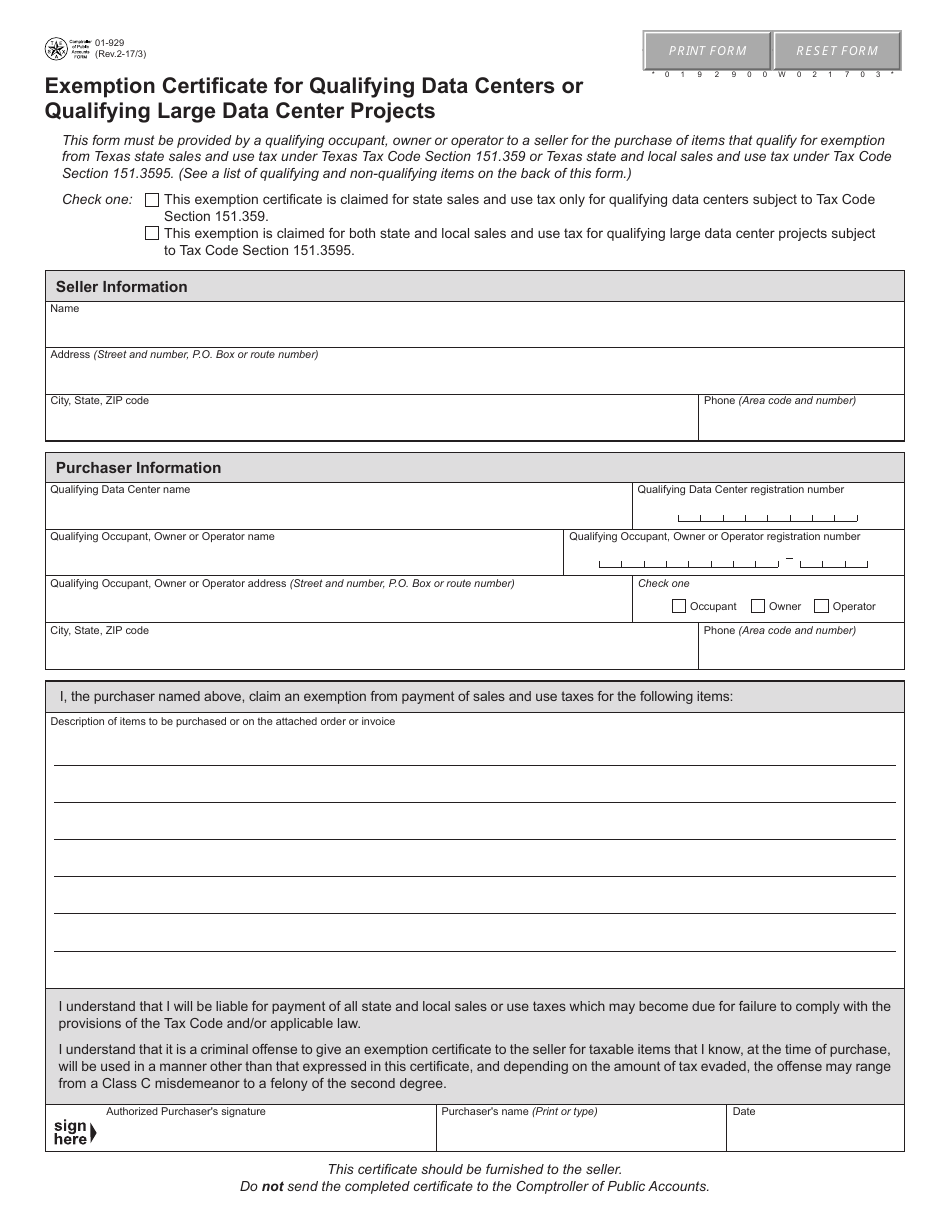

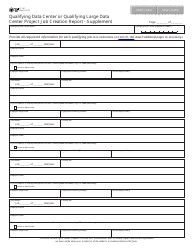

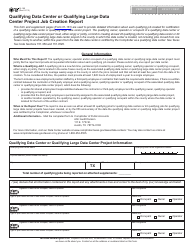

Form 01-929 Exemption Certificate for Qualifying Data Centers or Qualifying Large Data Center Projects - Texas

What Is Form 01-929?

This is a legal form that was released by the Texas Comptroller of Public Accounts - a government authority operating within Texas. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 01-929?

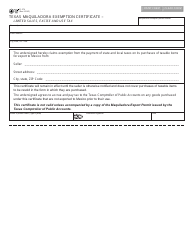

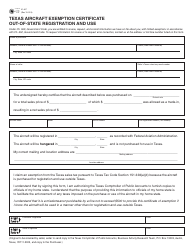

A: Form 01-929 is the Exemption Certificate for Qualifying Data Centers or Qualifying Large Data Center Projects in Texas.

Q: Who can use Form 01-929?

A: Form 01-929 can be used by qualifying data centers or qualifying large data center projects in Texas to claim an exemption.

Q: What is the purpose of Form 01-929?

A: The purpose of Form 01-929 is to certify that a data center or data center project meets the qualifying criteria for exemption from certain taxes in Texas.

Q: What taxes can be exempted with Form 01-929?

A: Form 01-929 can be used to claim exemption from sales and use tax, property tax, and limited sales, excise and use tax.

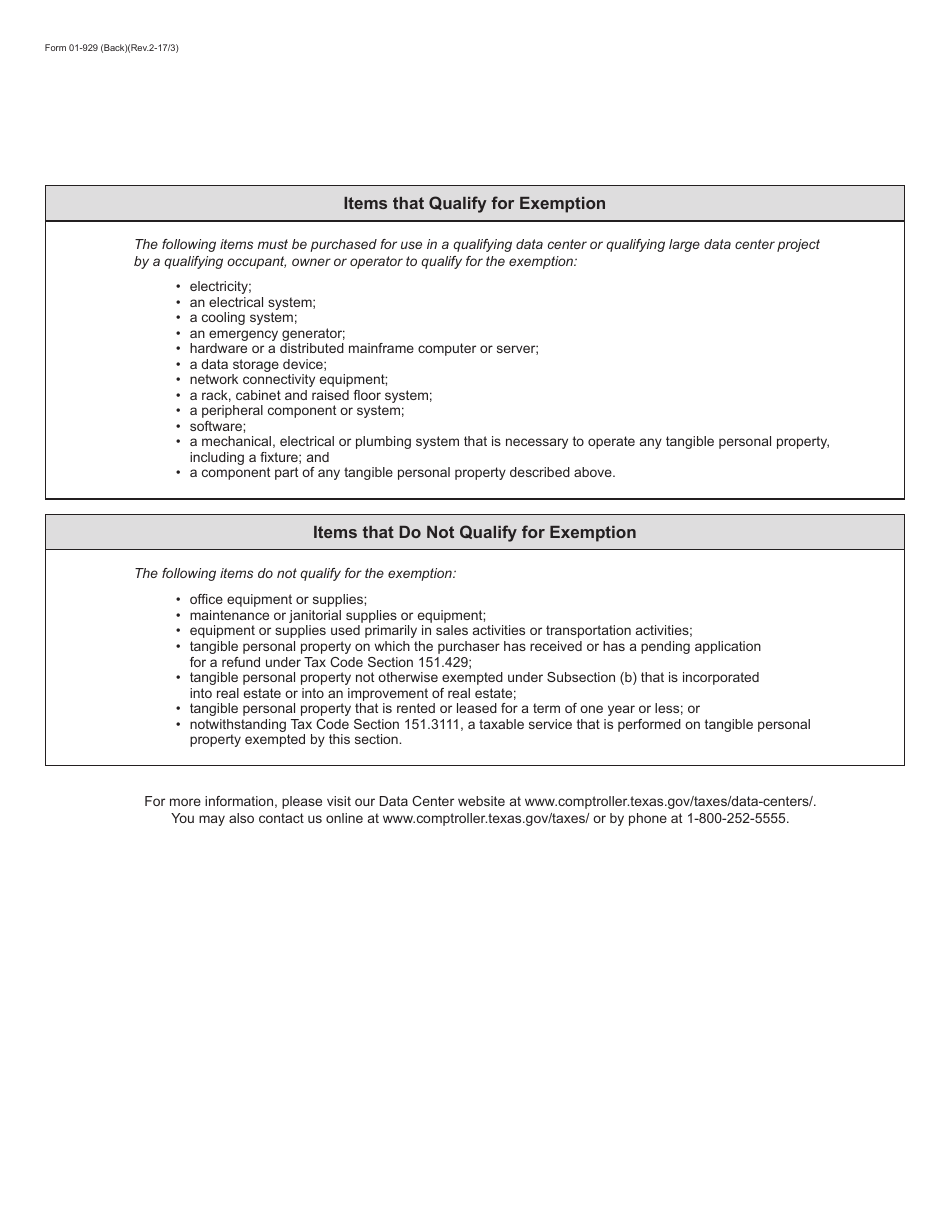

Q: What are the qualifying criteria for the exemption?

A: The qualifying criteria for the exemption include, among others, meeting minimum investment and employment requirements.

Q: When should I file Form 01-929?

A: Form 01-929 should be filed at least 60 days before the date the exemption is expected to begin.

Q: Is there a fee for filing Form 01-929?

A: Yes, there is a non-refundable fee for filing Form 01-929. The fee amount depends on the investment amount of the data center or data center project.

Q: Are there any reporting requirements after obtaining the exemption?

A: Yes, data centers and data center projects that receive the exemption are required to file annual reports with the Comptroller's office.

Form Details:

- Released on February 1, 2017;

- The latest edition provided by the Texas Comptroller of Public Accounts;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 01-929 by clicking the link below or browse more documents and templates provided by the Texas Comptroller of Public Accounts.