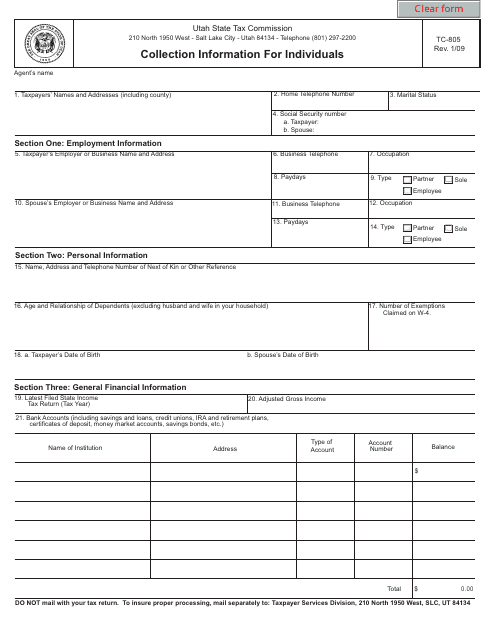

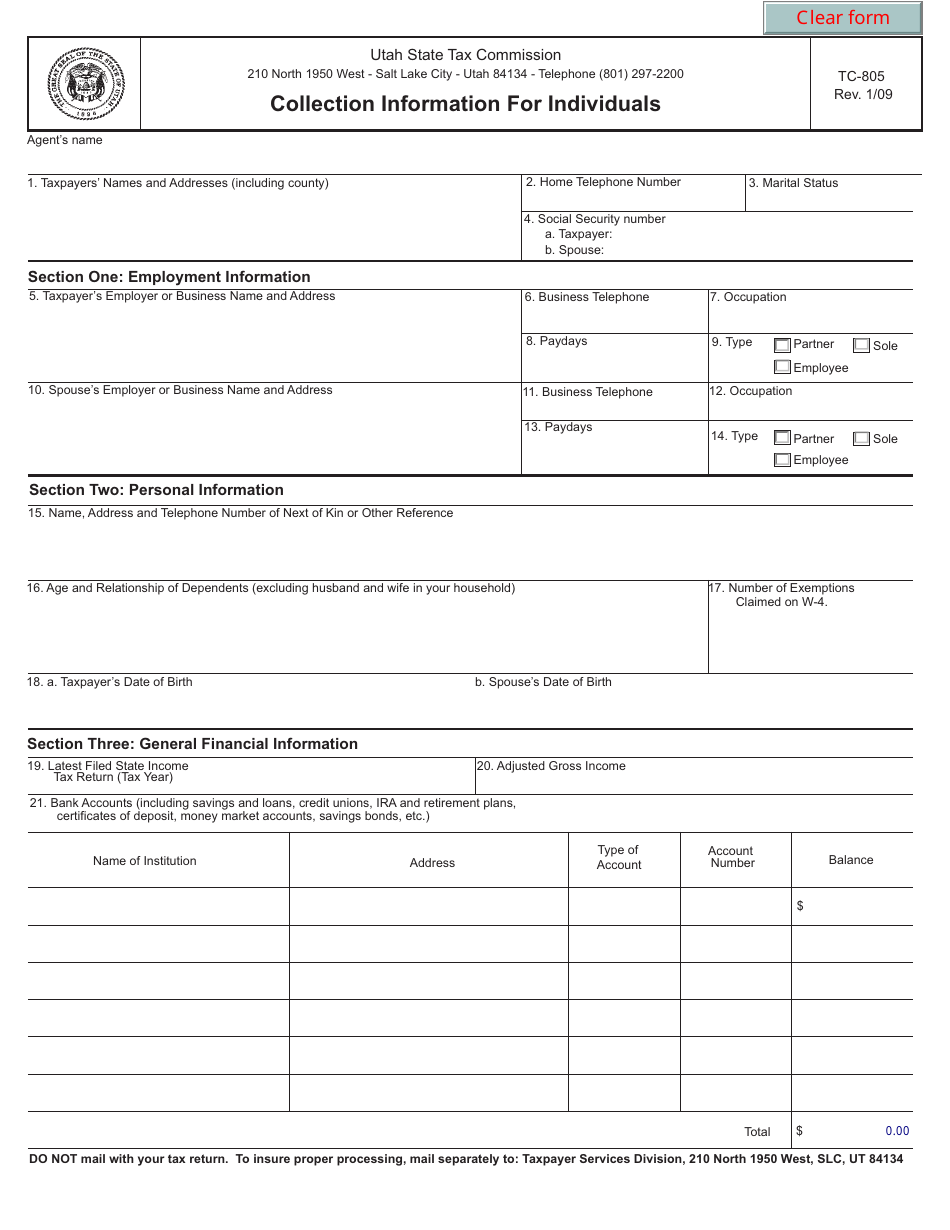

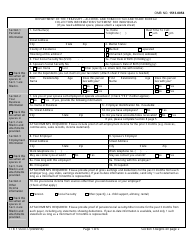

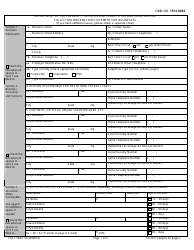

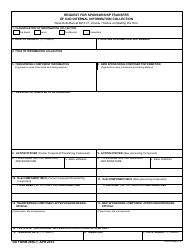

Form TC-805 Collection Information for Individuals - Utah

What Is Form TC-805?

This is a legal form that was released by the Utah State Tax Commission - a government authority operating within Utah. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form TC-805?

A: Form TC-805 is a Collection Information for Individuals form in Utah.

Q: Who needs to fill out Form TC-805?

A: Individuals who owe taxes or other debts to the State of Utah may need to fill out Form TC-805.

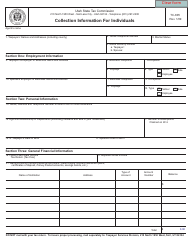

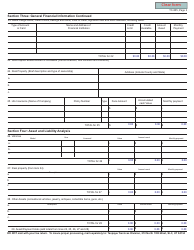

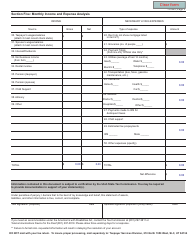

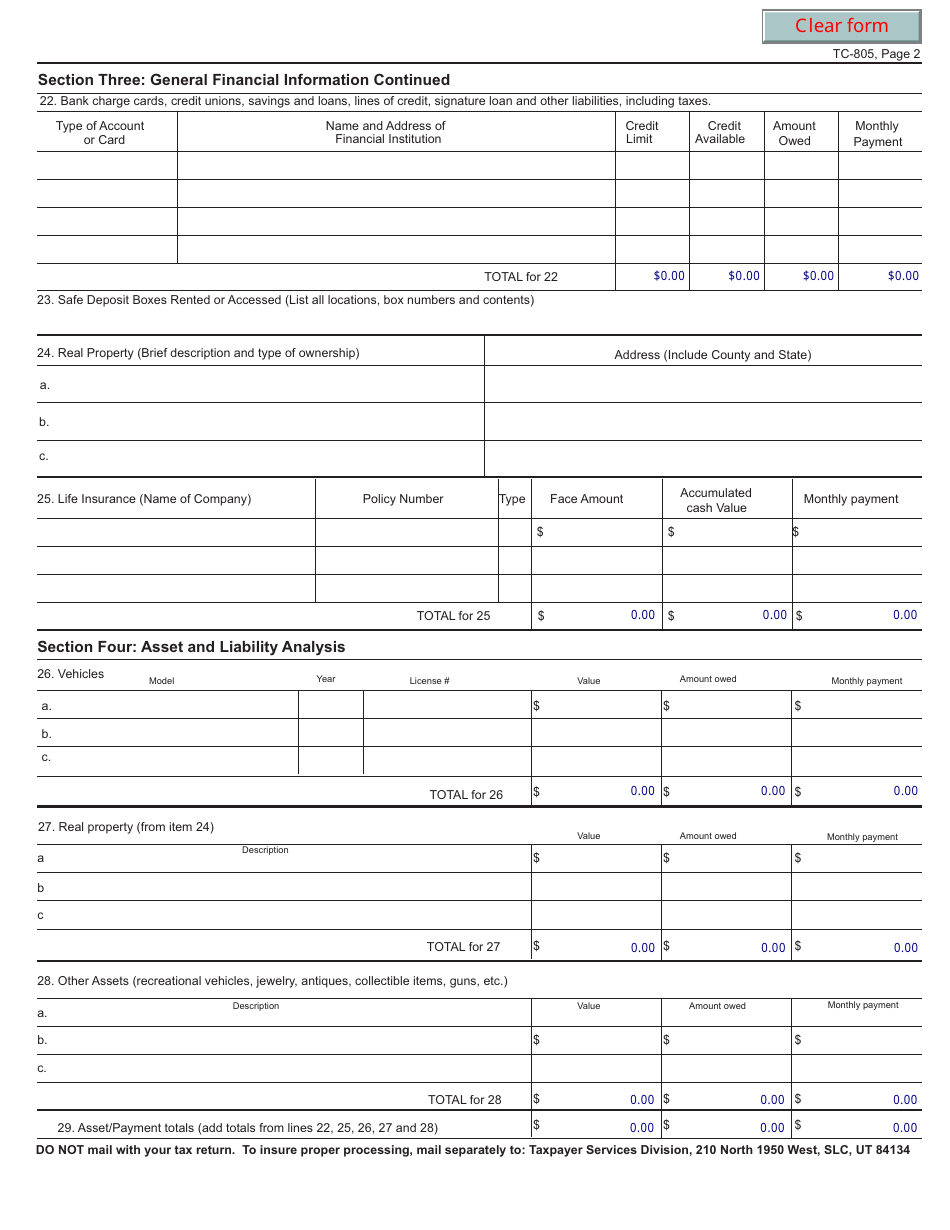

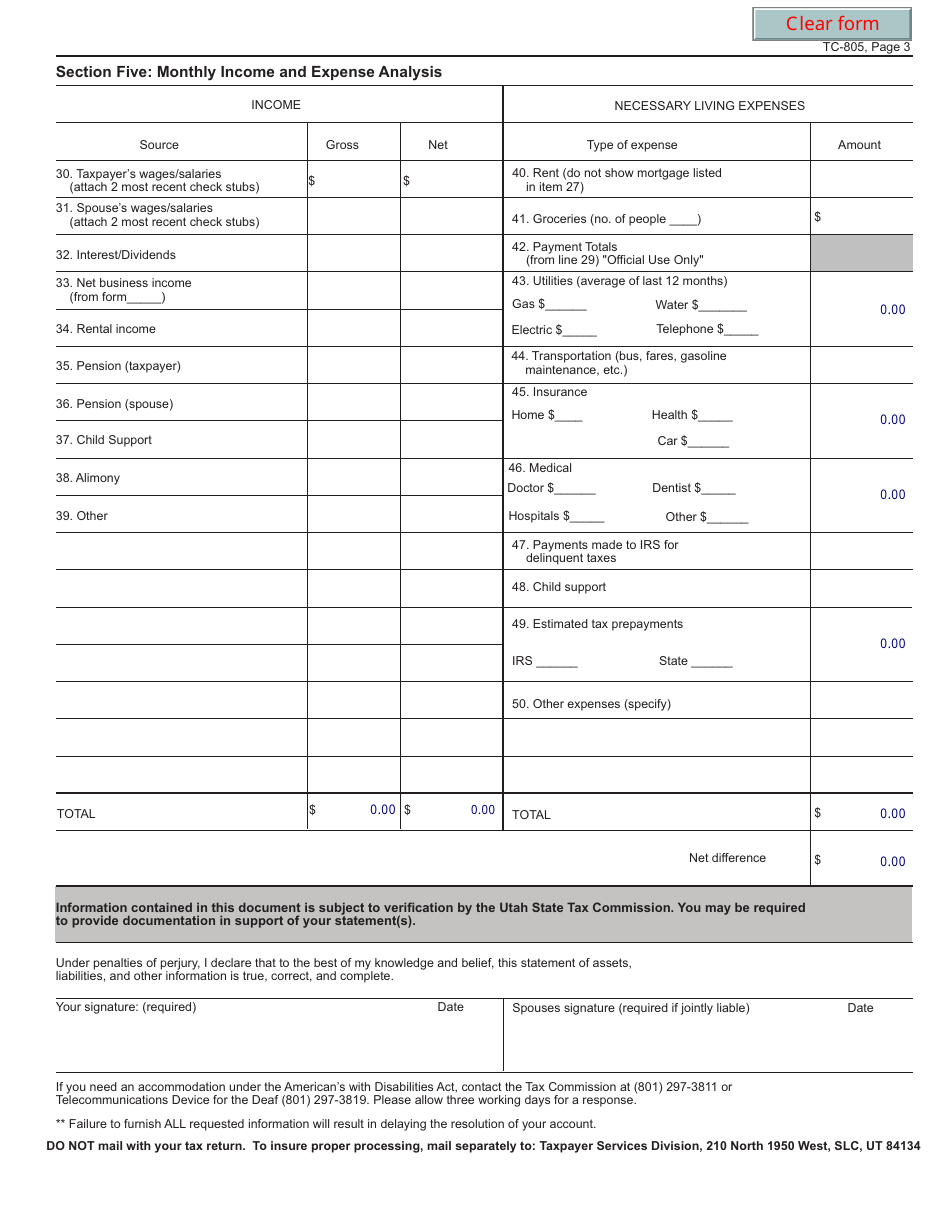

Q: What information is required on Form TC-805?

A: Form TC-805 requires personal identifying information, details about the debt, and financial information.

Q: Is Form TC-805 confidential?

A: Yes, the information provided on Form TC-805 is confidential and protected by law.

Q: What happens after I submit Form TC-805?

A: The Utah State Tax Commission will review your information and determine the best course of action for collecting the debt.

Q: Can I appeal a decision made based on the information provided on Form TC-805?

A: Yes, you have the right to appeal a decision made by the Utah State Tax Commission based on the information provided on Form TC-805.

Q: Is there a deadline for submitting Form TC-805?

A: There is no specific deadline for submitting Form TC-805, but it is recommended to do so as soon as possible to avoid further penalties and collection actions.

Q: Who can I contact for more information about Form TC-805?

A: You can contact the Utah State Tax Commission directly for more information about Form TC-805.

Form Details:

- Released on January 1, 2009;

- The latest edition provided by the Utah State Tax Commission;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form TC-805 by clicking the link below or browse more documents and templates provided by the Utah State Tax Commission.