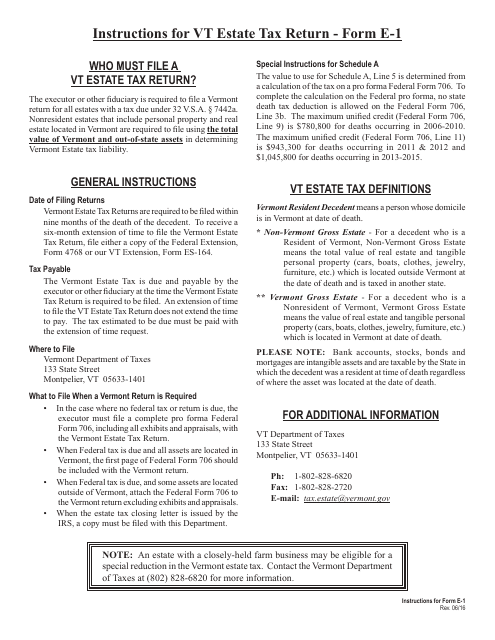

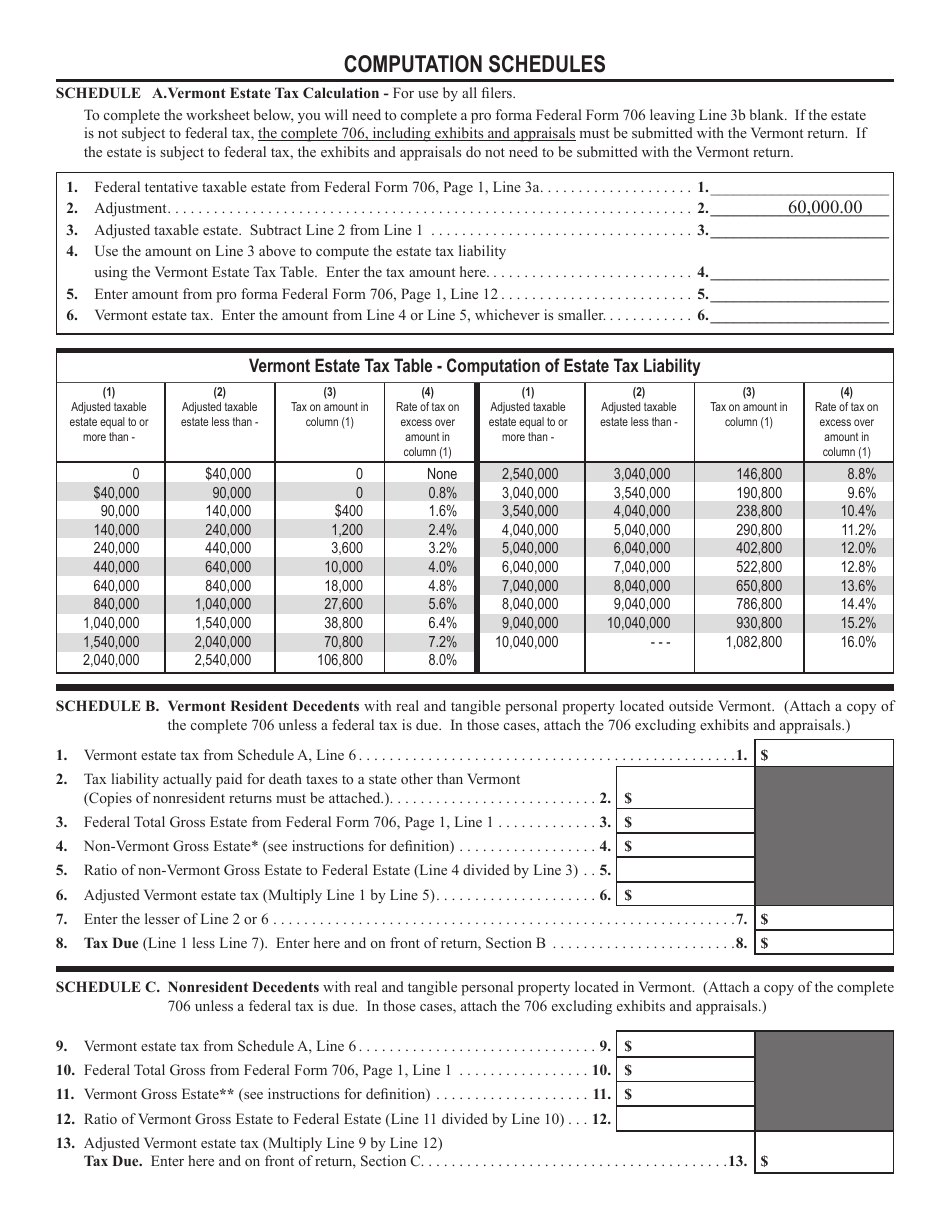

VT Form E-1 Estate Tax Return - Vermont

What Is VT Form E-1?

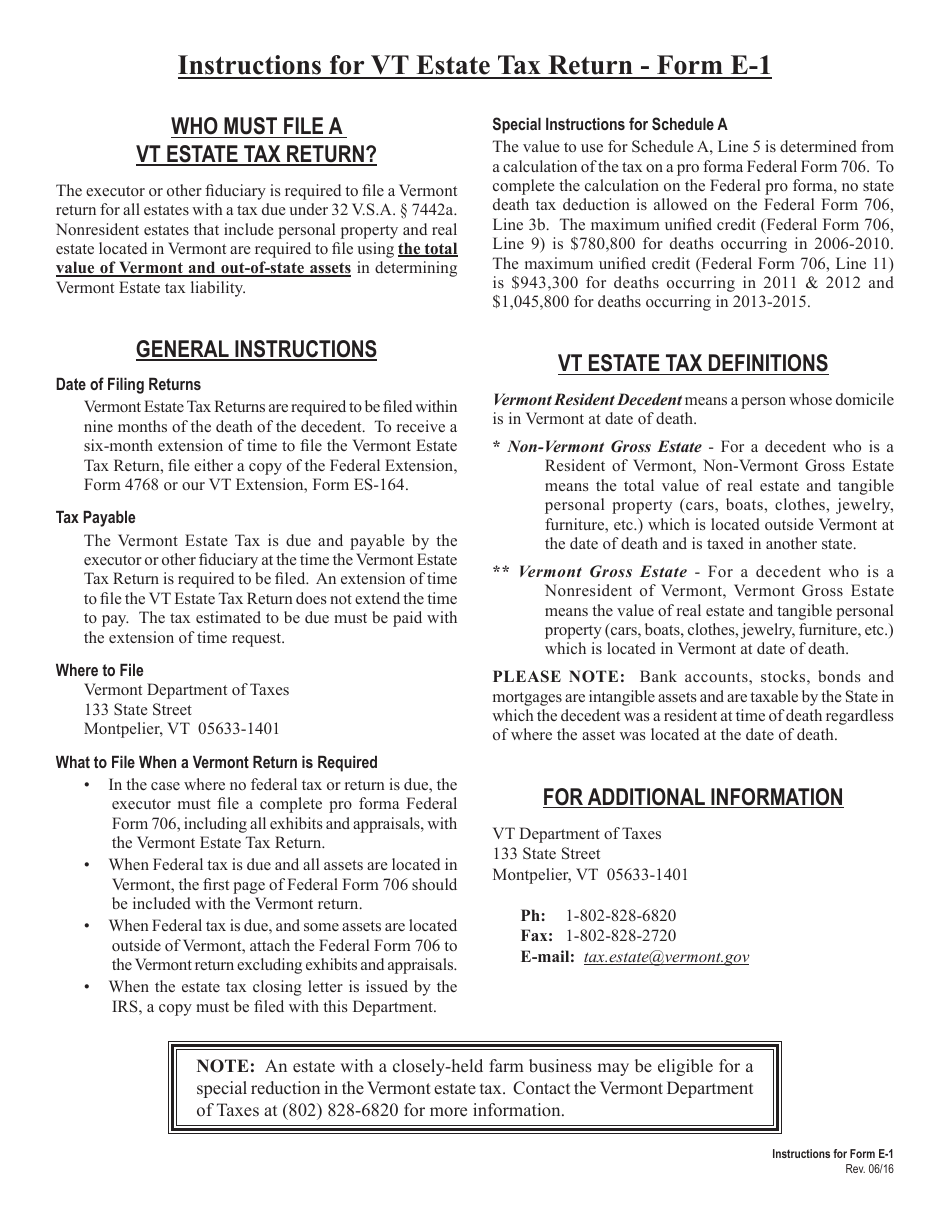

This is a legal form that was released by the Vermont Department of Taxes - a government authority operating within Vermont. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form E-1?

A: Form E-1 is the Vermont Estate Tax Return.

Q: Who needs to file Form E-1?

A: Any person or estate with a tax liability for Vermont estate tax needs to file Form E-1.

Q: What is the purpose of Form E-1?

A: Form E-1 is used to calculate and report Vermont estate tax liability.

Q: When do I need to file Form E-1?

A: Form E-1 must be filed within 9 months of the decedent's date of death.

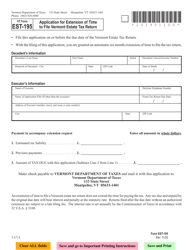

Q: Are there any filing extensions available for Form E-1?

A: Yes, you can request a 6-month extension to file Form E-1.

Q: How do I pay the Vermont estate tax?

A: Payment for the Vermont estate tax can be made by check or electronically.

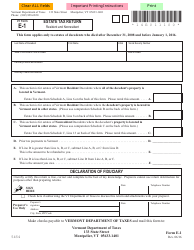

Q: What documentation should be attached to Form E-1?

A: You should attach a copy of the federal estate tax return (IRS Form 706), if applicable.

Q: What happens if I don't file Form E-1 or pay the Vermont estate tax?

A: Failure to file Form E-1 or pay the Vermont estate tax may result in penalties and interest charges.

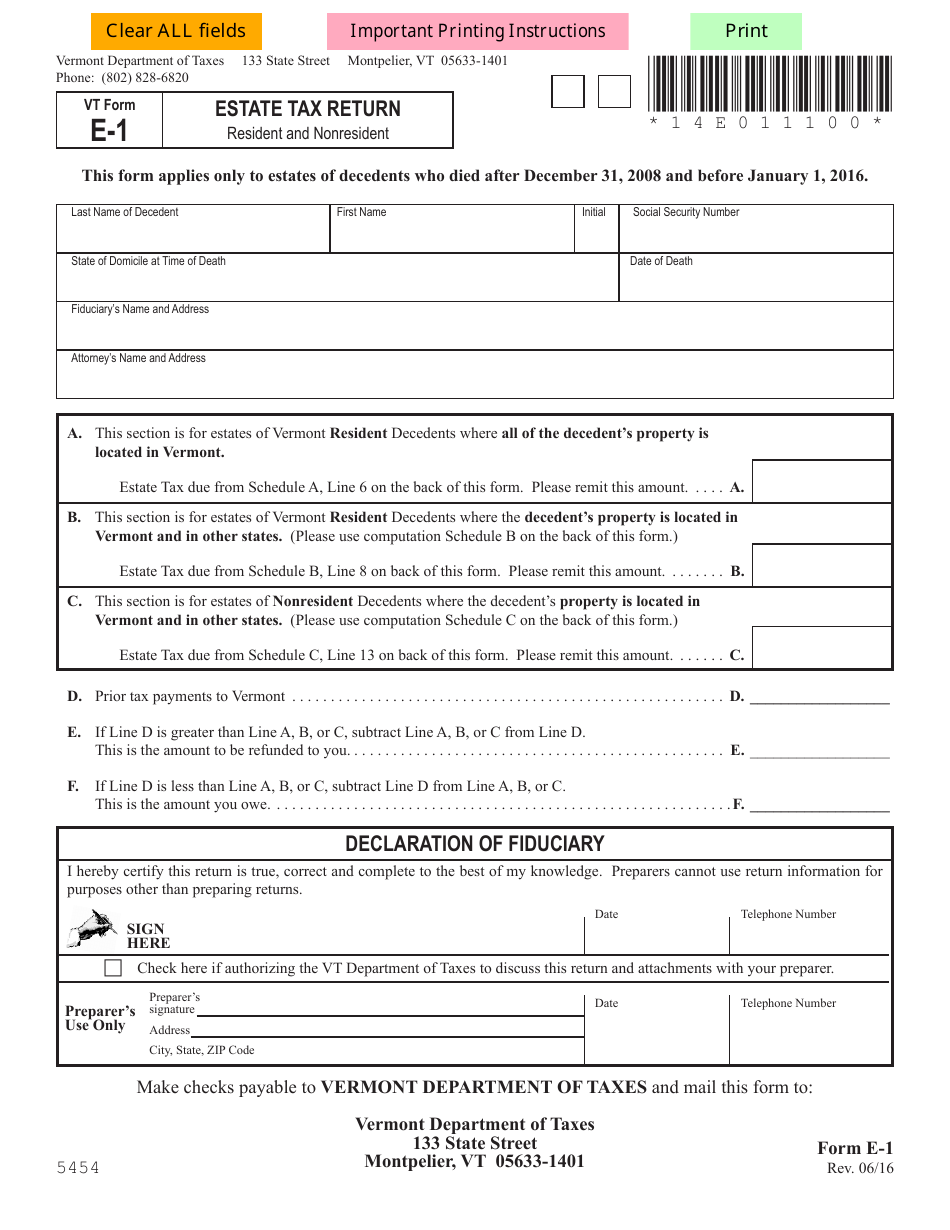

Form Details:

- Released on June 1, 2016;

- The latest edition provided by the Vermont Department of Taxes;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of VT Form E-1 by clicking the link below or browse more documents and templates provided by the Vermont Department of Taxes.