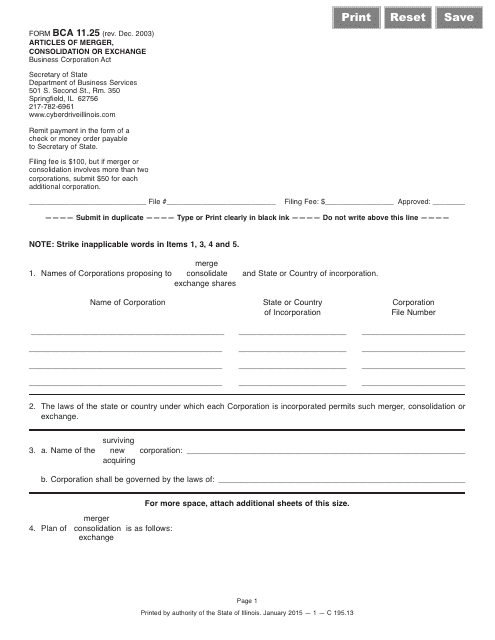

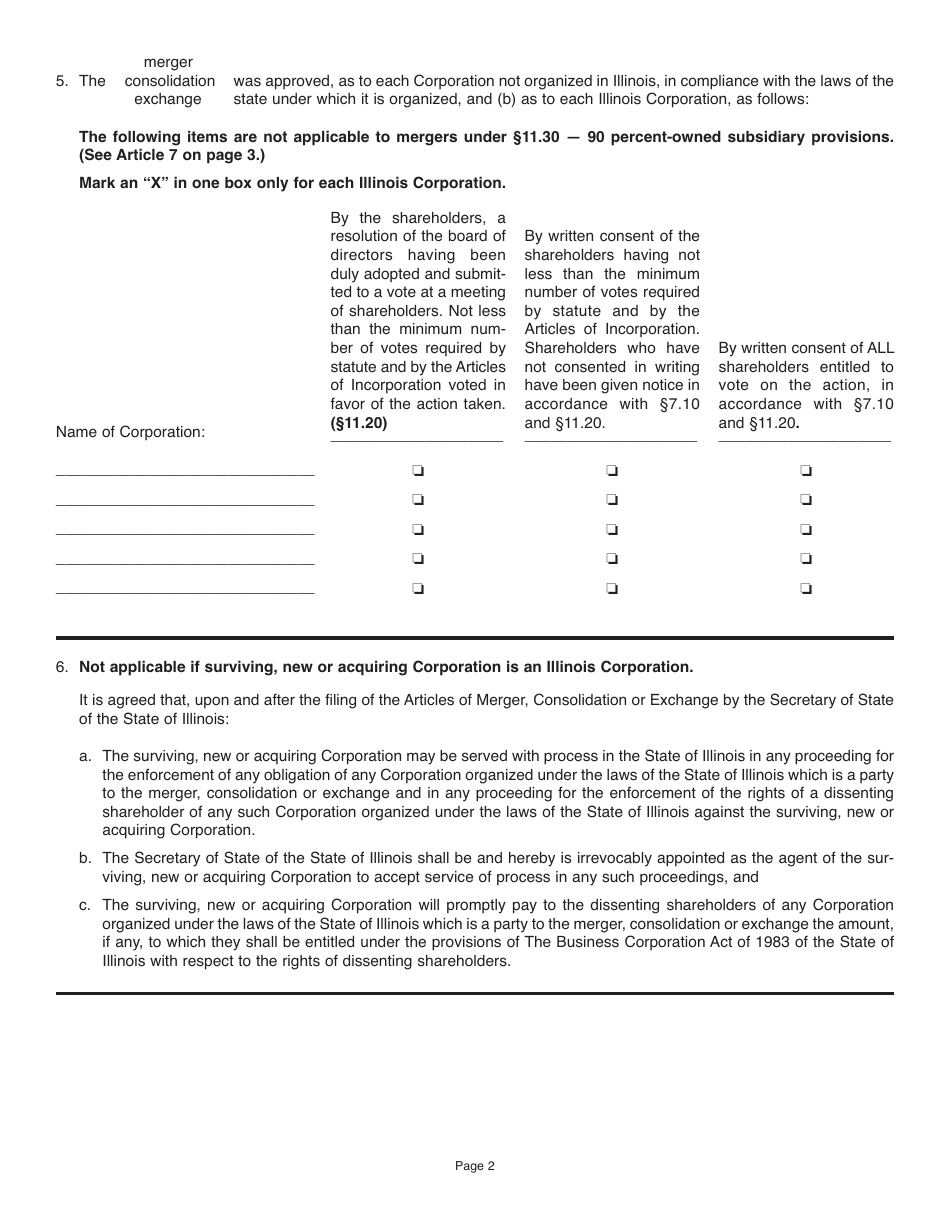

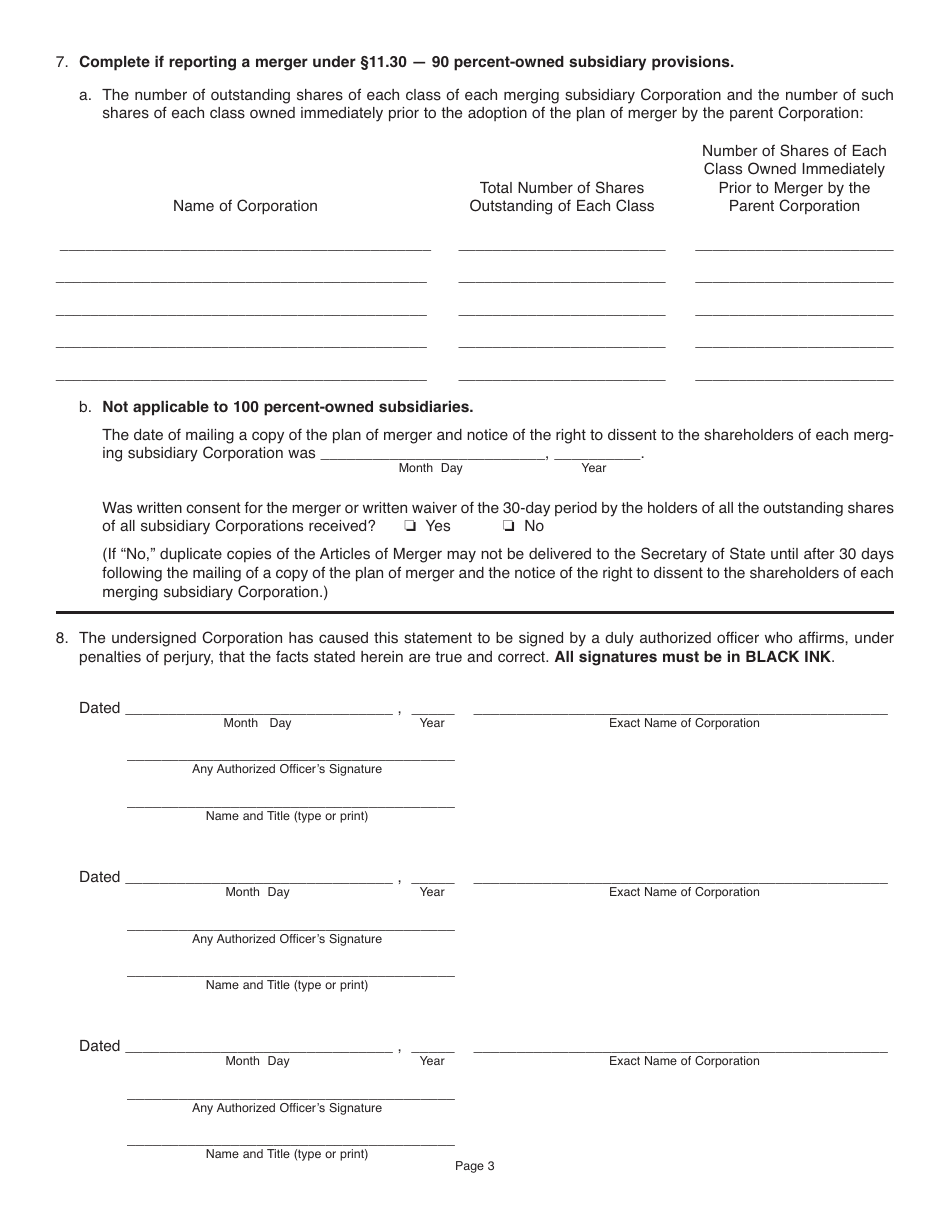

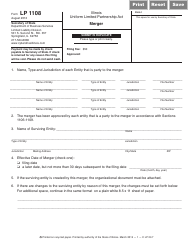

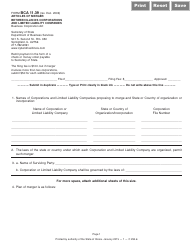

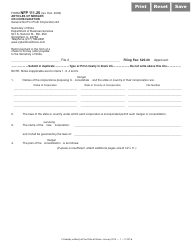

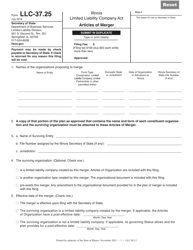

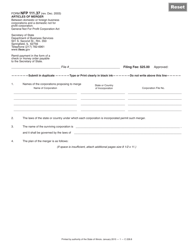

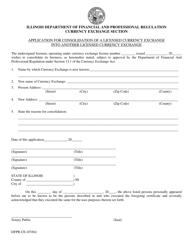

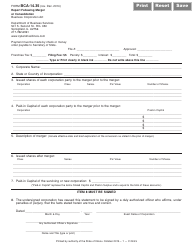

Form BCA11.25 Articles of Merger, Consolidation or Exchange - Illinois

What Is Form BCA11.25?

This is a legal form that was released by the Illinois Secretary of State - a government authority operating within Illinois. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form BCA11.25?

A: Form BCA11.25 is the Articles of Merger, Consolidation or Exchange used in Illinois.

Q: What is the purpose of Form BCA11.25?

A: Form BCA11.25 is used to document the merger, consolidation, or exchange of entities in Illinois.

Q: When is Form BCA11.25 used?

A: Form BCA11.25 is used when two or more entities are merging, consolidating, or exchanging their assets or shares.

Q: Is Form BCA11.25 specific to Illinois?

A: Yes, Form BCA11.25 is specific to Illinois and is used for mergers, consolidations, or exchanges within the state.

Q: Are there any filing fees for Form BCA11.25?

A: Yes, there are filing fees associated with Form BCA11.25. The exact fees may vary depending on the type and size of the entities involved.

Q: Is legal assistance required to complete Form BCA11.25?

A: While legal assistance is not required, it is recommended to consult with a knowledgeable professional to ensure the form is completed accurately.

Q: What information is required in Form BCA11.25?

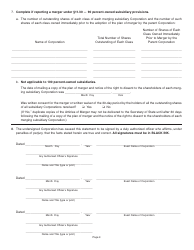

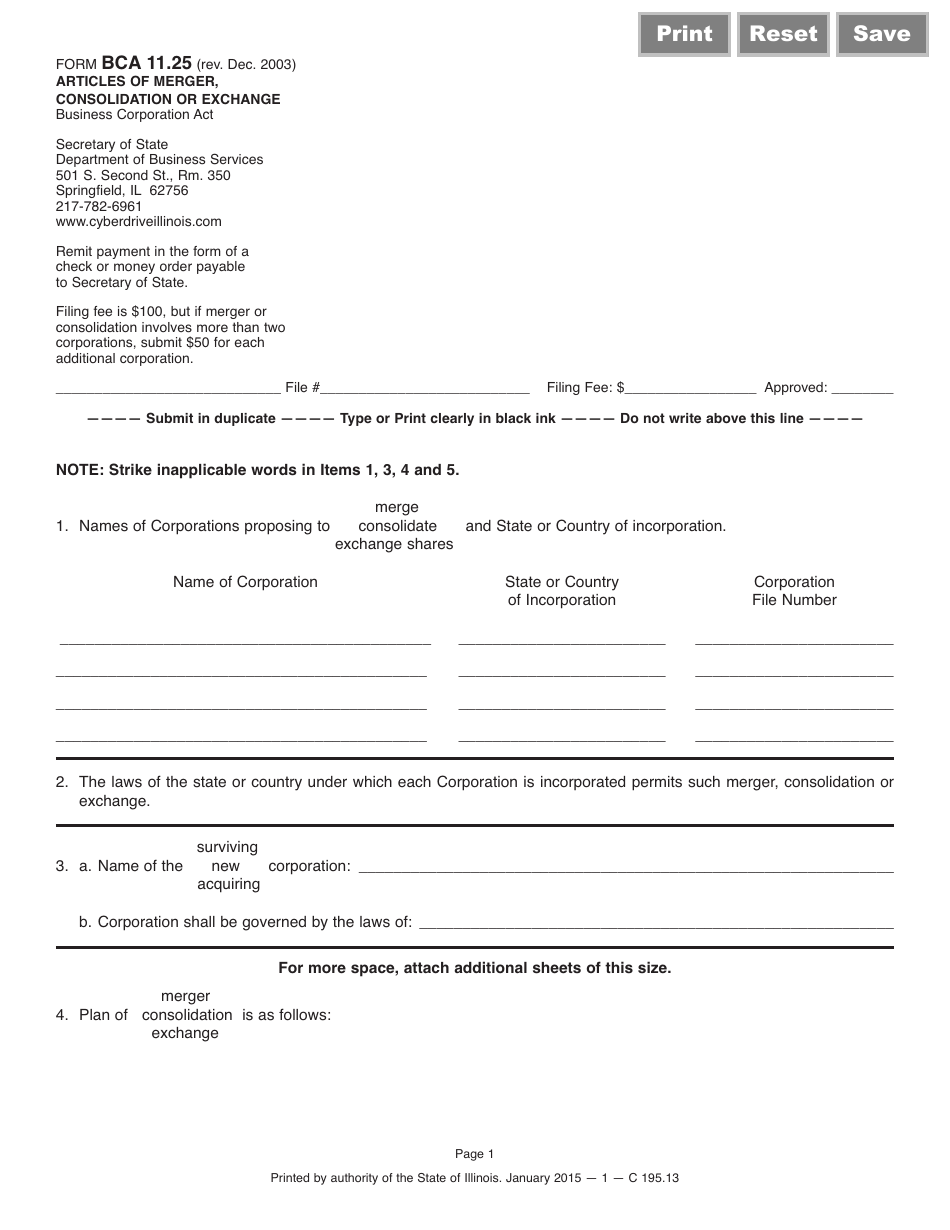

A: Form BCA11.25 requires information such as the names of the entities involved, the details of the merger, consolidation, or exchange, and the authorized individuals signing the form.

Q: Are there any additional documents required with Form BCA11.25?

A: Yes, depending on the specific circumstances, additional documents may be required to accompany Form BCA11.25, such as resolutions or agreements.

Q: What happens after Form BCA11.25 is filed?

A: Once Form BCA11.25 is filed and approved, the merger, consolidation, or exchange becomes legally effective and the entities involved are combined or transferred according to the terms specified in the form.

Form Details:

- Released on December 1, 2003;

- The latest edition provided by the Illinois Secretary of State;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form BCA11.25 by clicking the link below or browse more documents and templates provided by the Illinois Secretary of State.