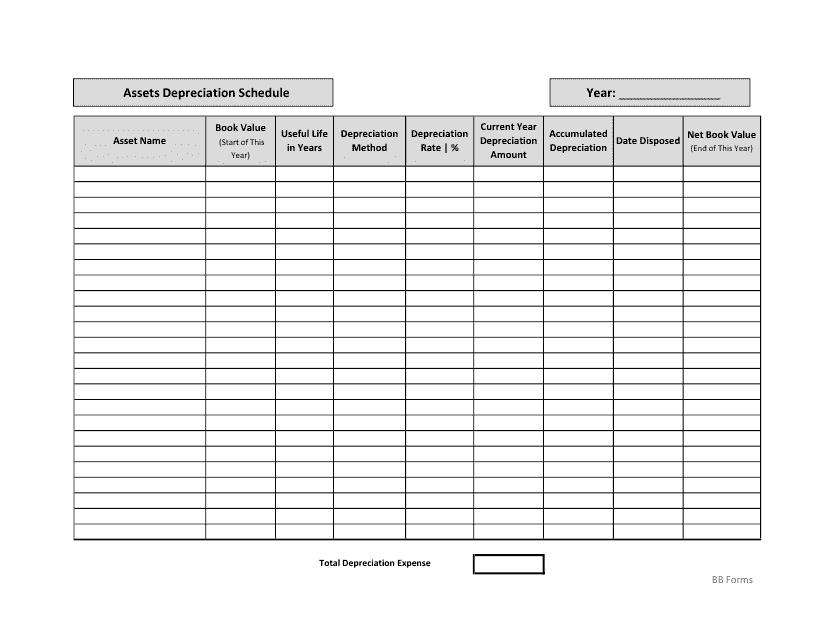

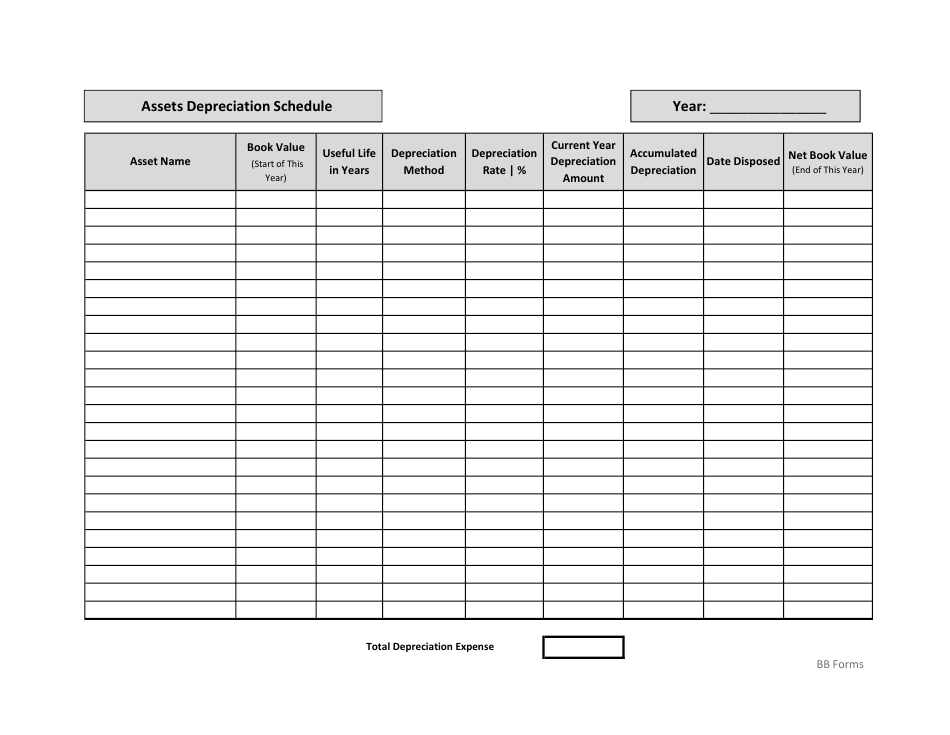

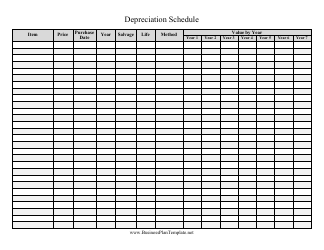

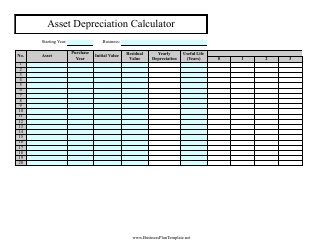

Assets Depreciation Schedule Template

An Assets Depreciation Schedule Template is a document used to track and record the depreciation of assets over a specific period of time. It helps an organization to accurately calculate the decrease in value of their assets and plan for replacement or future investments.

The assets depreciation schedule template is typically filed by the company's accounting or finance department.

FAQ

Q: What is an assets depreciation schedule?

A: An assets depreciation schedule is a record that shows the depreciation expense for each asset over a specific period of time.

Q: Why is an assets depreciation schedule important?

A: An assets depreciation schedule is important because it helps businesses track the decrease in value of their assets over time and calculate the corresponding depreciation expenses.

Q: What information is typically included in an assets depreciation schedule?

A: An assets depreciation schedule typically includes the name of the asset, its purchase date, its total cost, its estimated useful life, and the method used to calculate depreciation.

Q: How often should an assets depreciation schedule be updated?

A: An assets depreciation schedule should be updated annually or whenever there is a significant change in an asset's value or useful life.