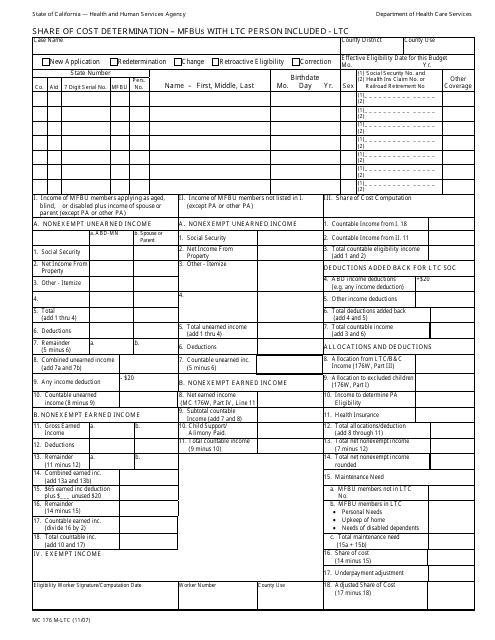

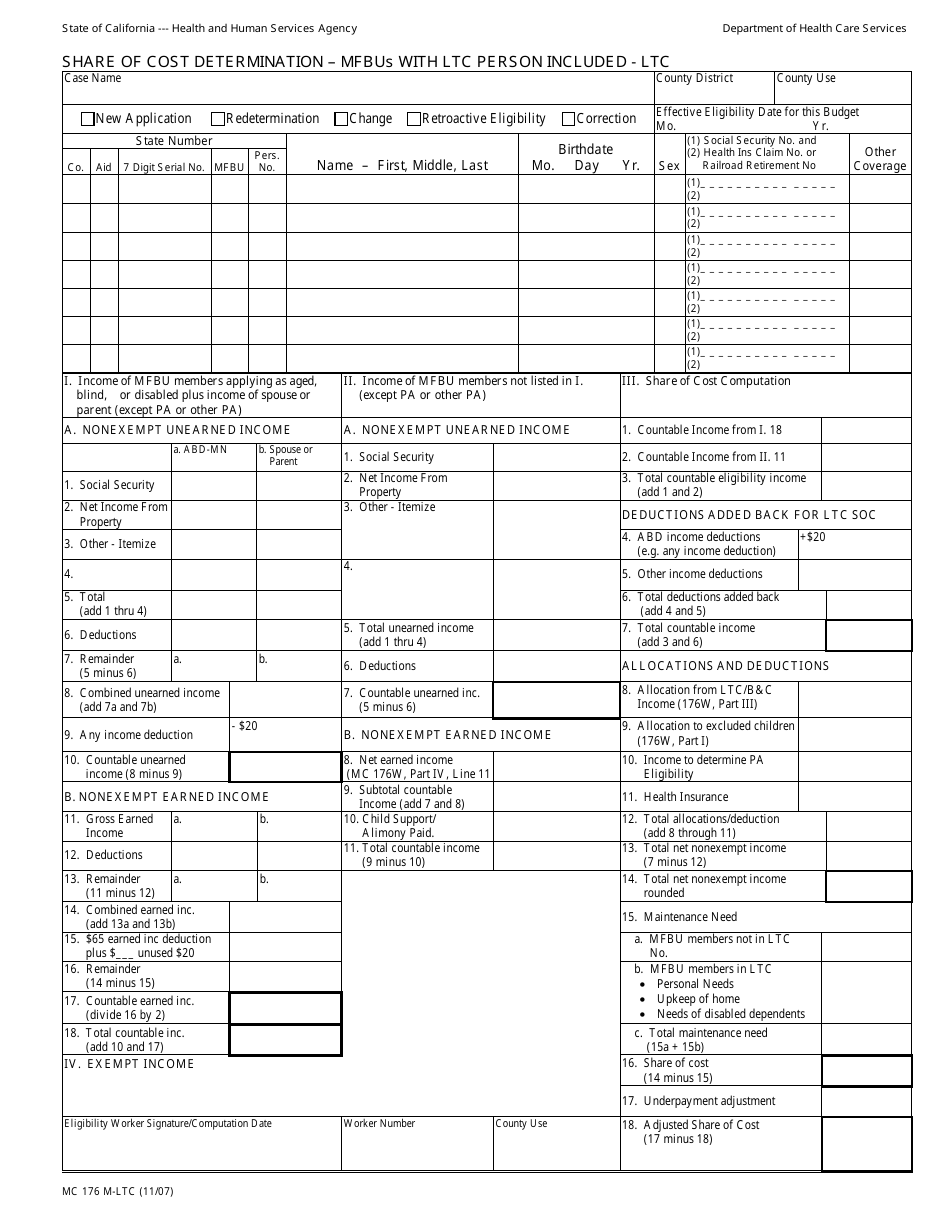

Form MC176 M-LTC Share of Cost Determination - Mfbus With Ltc Person Included - Ltc - California

What Is Form MC176 M-LTC?

This is a legal form that was released by the California Department of Health Care Services - a government authority operating within California. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form MC176?

A: Form MC176 is the Share of Cost Determination form used in California for Long-Term Care (LTC) purposes.

Q: What is the purpose of Form MC176?

A: The purpose of Form MC176 is to determine the share of cost for an individual receiving Long-Term Care services in California.

Q: Who needs to fill out Form MC176?

A: The individual receiving Long-Term Care services, along with their authorized representative, must fill out Form MC176.

Q: What information is required on Form MC176?

A: Form MC176 requires information about the individual receiving Long-Term Care services, including their income, assets, expenses, and the amount they pay for their care.

Q: Is there a deadline for submitting Form MC176?

A: Yes, there is a deadline for submitting Form MC176. The specific deadline will be provided by the Long-Term Care agency handling the case.

Q: Can I appeal the decision made based on Form MC176?

A: Yes, if you disagree with the decision made based on Form MC176, you have the right to appeal the decision.

Q: Who can I contact for assistance with Form MC176?

A: You can contact the Long-Term Care agency or the California Department of Health Care Services for assistance with Form MC176.

Form Details:

- Released on November 1, 2007;

- The latest edition provided by the California Department of Health Care Services;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form MC176 M-LTC by clicking the link below or browse more documents and templates provided by the California Department of Health Care Services.