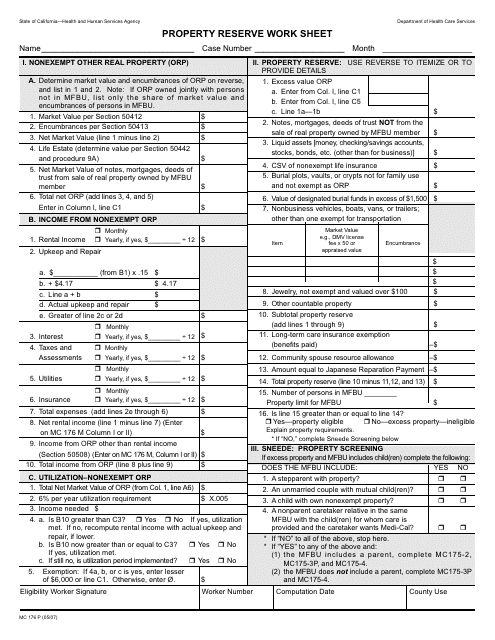

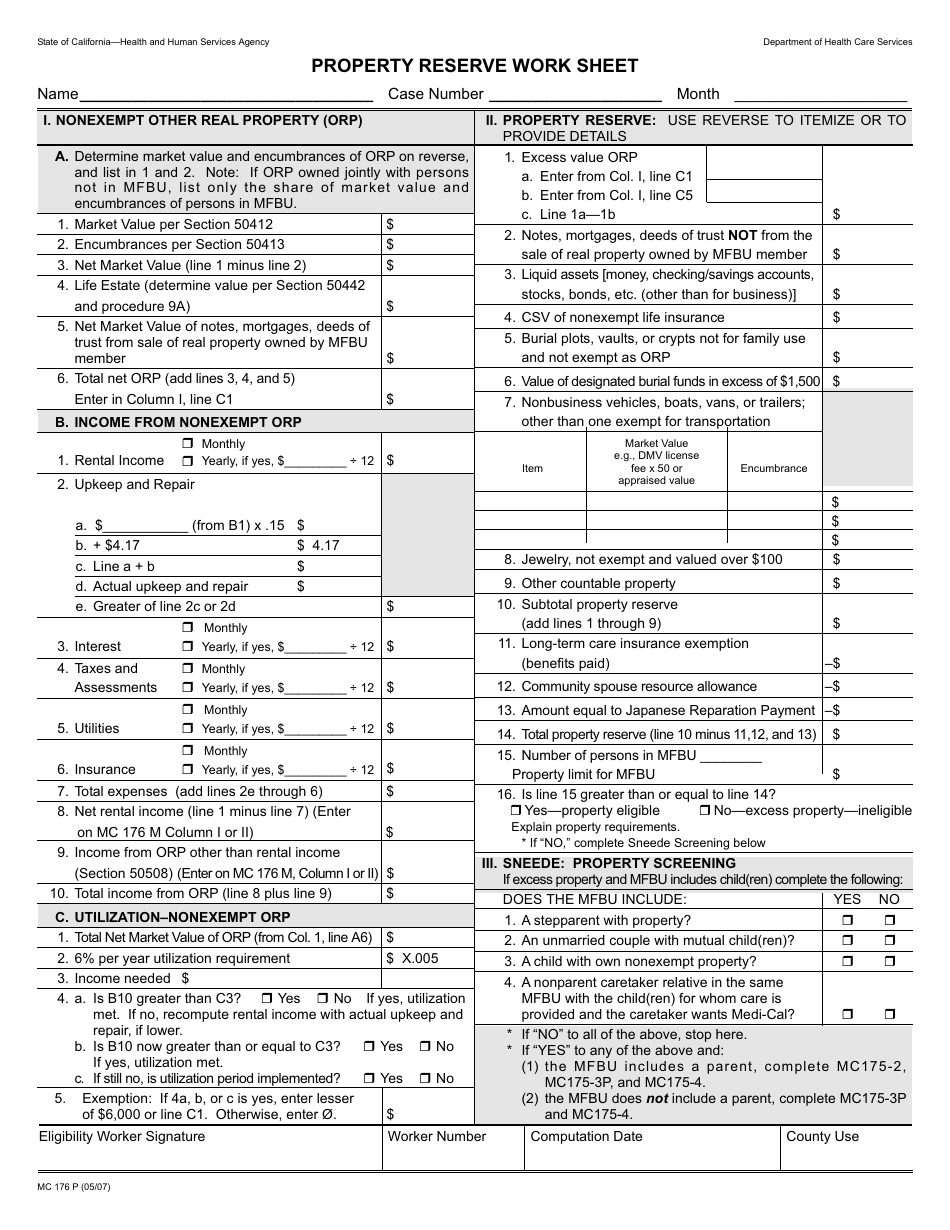

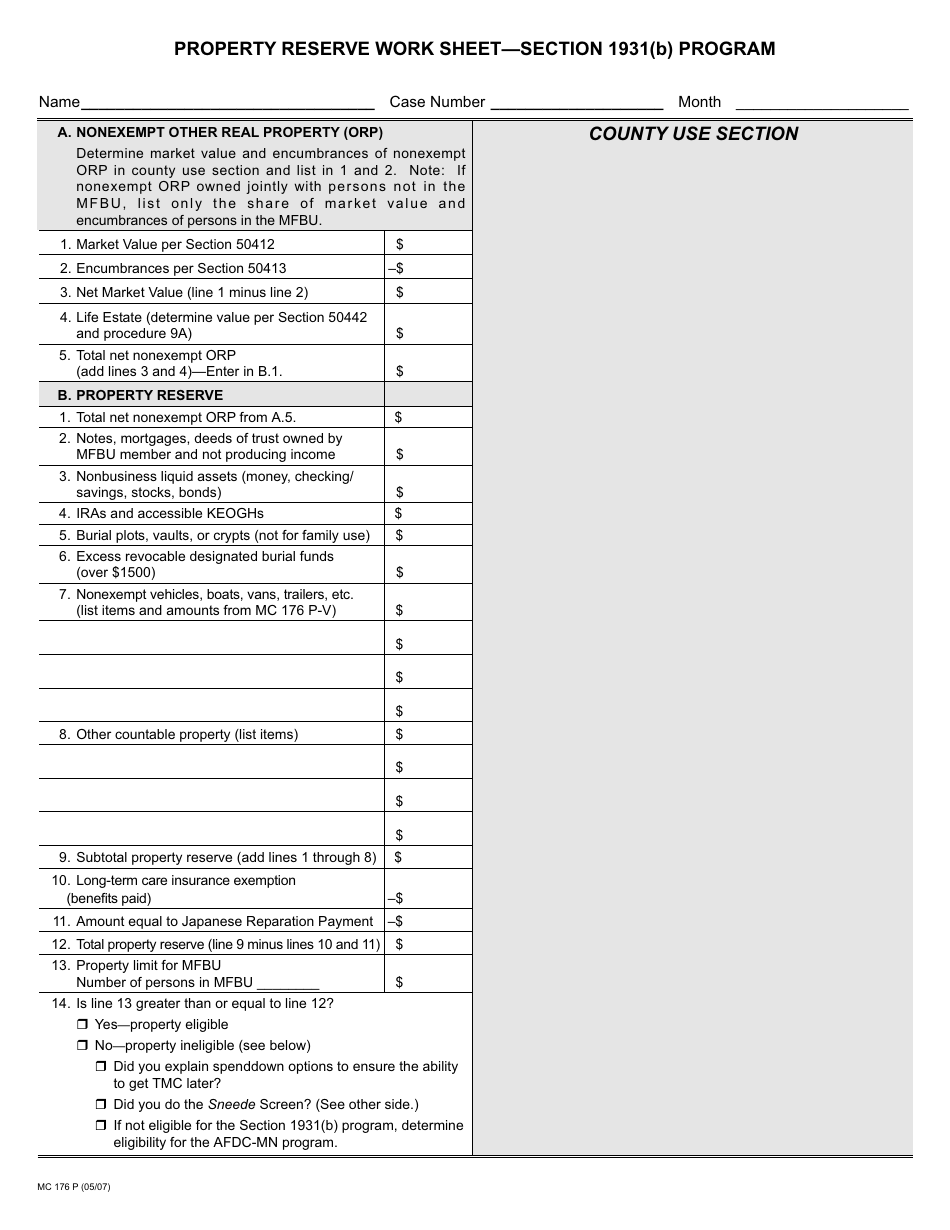

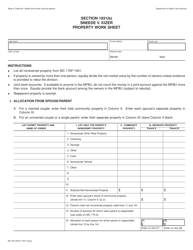

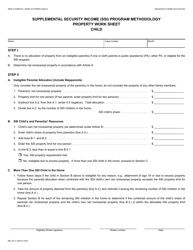

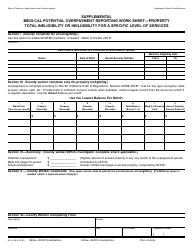

Form MC176 P Property Reserve Work Sheet - California

What Is Form MC176 P?

This is a legal form that was released by the California Department of Health Care Services - a government authority operating within California. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form MC176 P?

A: Form MC176 P is the Property Reserve Work Sheet for California.

Q: What is the purpose of Form MC176 P?

A: The purpose of Form MC176 P is to calculate the amount of property tax that can be deferred by a qualified property owner in California.

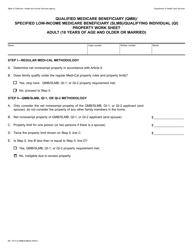

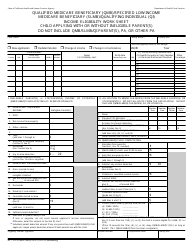

Q: Who can use Form MC176 P?

A: Form MC176 P can be used by qualified property owners in California who meet certain criteria.

Q: How do I qualify to use Form MC176 P?

A: To qualify, you must be a property owner in California who is either blind, disabled, or at least 62 years old.

Q: What information is required on Form MC176 P?

A: Form MC176 P requires information about your property, your income, and your eligibility for property tax deferral in California.

Q: Are there any filing fees for Form MC176 P?

A: No, there are no filing fees for submitting Form MC176 P.

Q: What is the deadline for filing Form MC176 P?

A: The deadline for filing Form MC176 P is typically February 10th of each year, but it is recommended to check with the California State Controller's Office for the specific deadline.

Form Details:

- Released on May 1, 2007;

- The latest edition provided by the California Department of Health Care Services;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form MC176 P by clicking the link below or browse more documents and templates provided by the California Department of Health Care Services.