This version of the form is not currently in use and is provided for reference only. Download this version of

Instructions for IRS Form 706-GS(D-1)

for the current year.

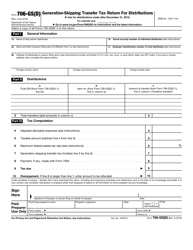

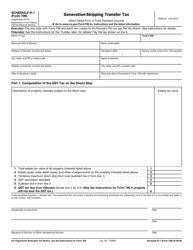

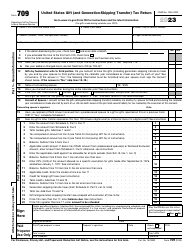

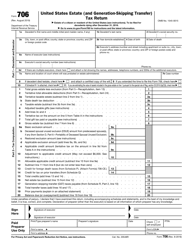

Instructions for IRS Form 706-GS(D-1) Notification of Distribution From a Generation-Skipping Trust

This document contains official instructions for IRS Form 706-GS(D-1) , Notification of Distribution From a Generation-Skipping Trust - a tax form released and collected by the Internal Revenue Service (IRS), a subdivision of the U.S. Department of the Treasury. An up-to-date fillable IRS Form 706-GS(D-1) is available for download through this link.

FAQ

Q: What is IRS Form 706-GS(D-1)?

A: IRS Form 706-GS(D-1) is used to report the notification of distribution from a generation-skipping trust.

Q: Who needs to file IRS Form 706-GS(D-1)?

A: The trustee of a generation-skipping trust needs to file IRS Form 706-GS(D-1) to report the distribution.

Q: What information is required on IRS Form 706-GS(D-1)?

A: IRS Form 706-GS(D-1) requires information about the trust, the beneficiary receiving the distribution, and details of the distribution.

Q: When is the deadline for filing IRS Form 706-GS(D-1)?

A: The deadline for filing IRS Form 706-GS(D-1) is generally within 30 days after the distribution is made.

Q: Are there any penalties for not filing IRS Form 706-GS(D-1)?

A: Yes, there can be penalties for not filing IRS Form 706-GS(D-1) or for filing it late. It is important to comply with the filing requirements.

Instruction Details:

- This 5-page document is available for download in PDF;

- Actual and applicable for filing 2023 taxes;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of IRS-released tax documents.