This version of the form is not currently in use and is provided for reference only. Download this version of

Instructions for IRS Form 1024-A

for the current year.

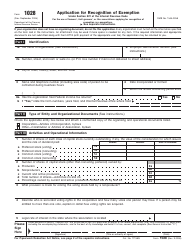

Instructions for IRS Form 1024-A Application for Recognition of Exemption Under Section 501(C)(4) of the Internal Revenue Code

This document contains official instructions for IRS Form 1024-A , Application for Recognition of Exemption Under Section 501(C)(4) of the Internal Revenue Code - a tax form released and collected by the Internal Revenue Service (IRS), a subdivision of the U.S. Department of the Treasury. An up-to-date fillable IRS Form 1024-A is available for download through this link.

FAQ

Q: What is IRS Form 1024-A?

A: IRS Form 1024-A is an application for recognition of exemption under Section 501(c)(4) of the Internal Revenue Code.

Q: Who needs to file IRS Form 1024-A?

A: Organizations seeking tax-exempt status under Section 501(c)(4) of the Internal Revenue Code need to file Form 1024-A.

Q: What does recognition of exemption mean?

A: Recognition of exemption means that the organization is exempt from paying federal income tax.

Q: What is Section 501(c)(4) of the Internal Revenue Code?

A: Section 501(c)(4) of the Internal Revenue Code provides exemption for social welfare organizations.

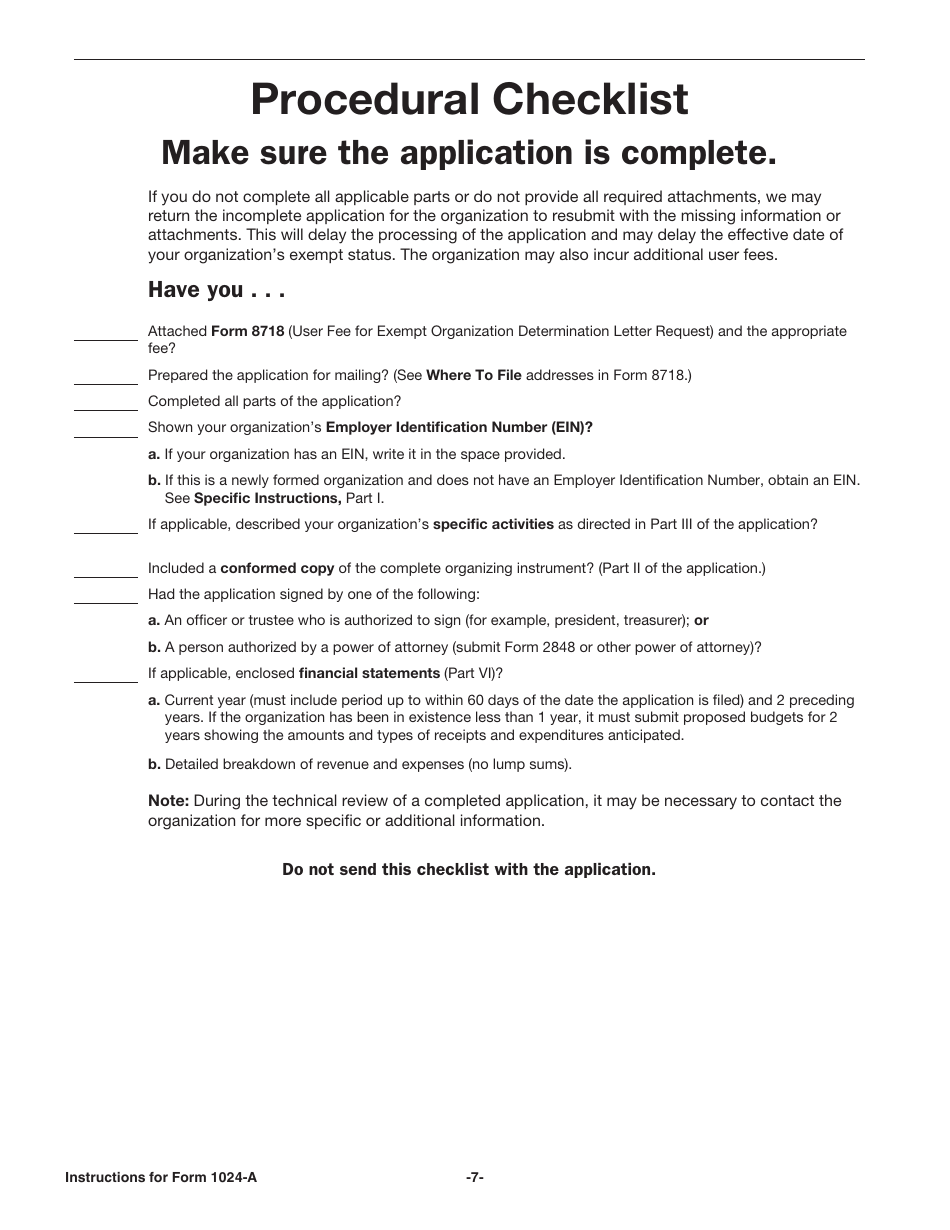

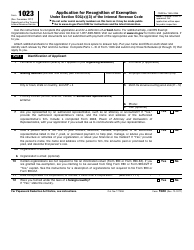

Q: What documents are required to be submitted with IRS Form 1024-A?

A: Certain documents, such as the organization's articles of incorporation and bylaws, need to be submitted along with Form 1024-A.

Q: How long does it take to process IRS Form 1024-A?

A: The processing time for Form 1024-A can vary, but it usually takes several months for the IRS to make a determination.

Q: How will I know if my application is approved?

A: The IRS will notify you in writing regarding the approval or denial of your application for recognition of exemption.

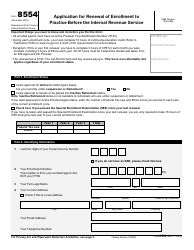

Q: Can I file IRS Form 1024-A electronically?

A: No, Form 1024-A can only be filed by mail, along with the required documents and filing fee.

Instruction Details:

- This 7-page document is available for download in PDF;

- Actual and applicable for filing 2023 taxes;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of IRS-released tax documents.