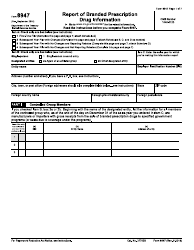

Instructions for IRS Form 8937 Report of Organizational Actions Affecting Basis of Securities

This document contains official instructions for IRS Form 8937 , Report of Organizational Actions Affecting Basis of Securities - a tax form released and collected by the Internal Revenue Service (IRS), a subdivision of the U.S. Department of the Treasury. An up-to-date fillable IRS Form 8937 is available for download through this link.

FAQ

Q: What is IRS Form 8937?

A: IRS Form 8937 is a report that documents organizational actions that may affect the basis of securities.

Q: What does IRS Form 8937 report?

A: IRS Form 8937 reports organizational actions that can result in changes to the cost basis or tax treatment of securities.

Q: Who is required to file IRS Form 8937?

A: The issuer of securities that undergo organizational actions affecting basis is required to file IRS Form 8937.

Q: What are examples of organizational actions that may require filing IRS Form 8937?

A: Examples of organizational actions include stock splits, mergers, acquisitions, spin-offs, and dividend reinvestment programs.

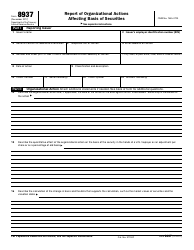

Q: What information is included in IRS Form 8937?

A: IRS Form 8937 includes details about the organizational action, the affected securities, and the calculated change in basis or other tax consequences.

Q: Is filing IRS Form 8937 optional?

A: No, filing IRS Form 8937 is mandatory for issuers of securities that undergo organizational actions affecting basis.

Instruction Details:

- This 2-page document is available for download in PDF;

- Actual and applicable for filing 2023 taxes;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of IRS-released tax documents.