This version of the form is not currently in use and is provided for reference only. Download this version of

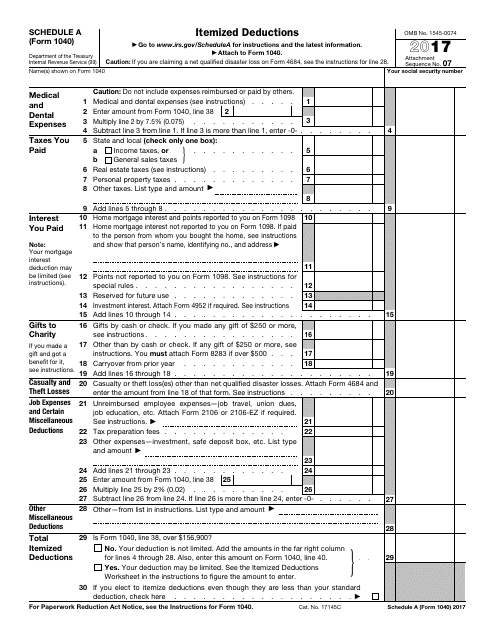

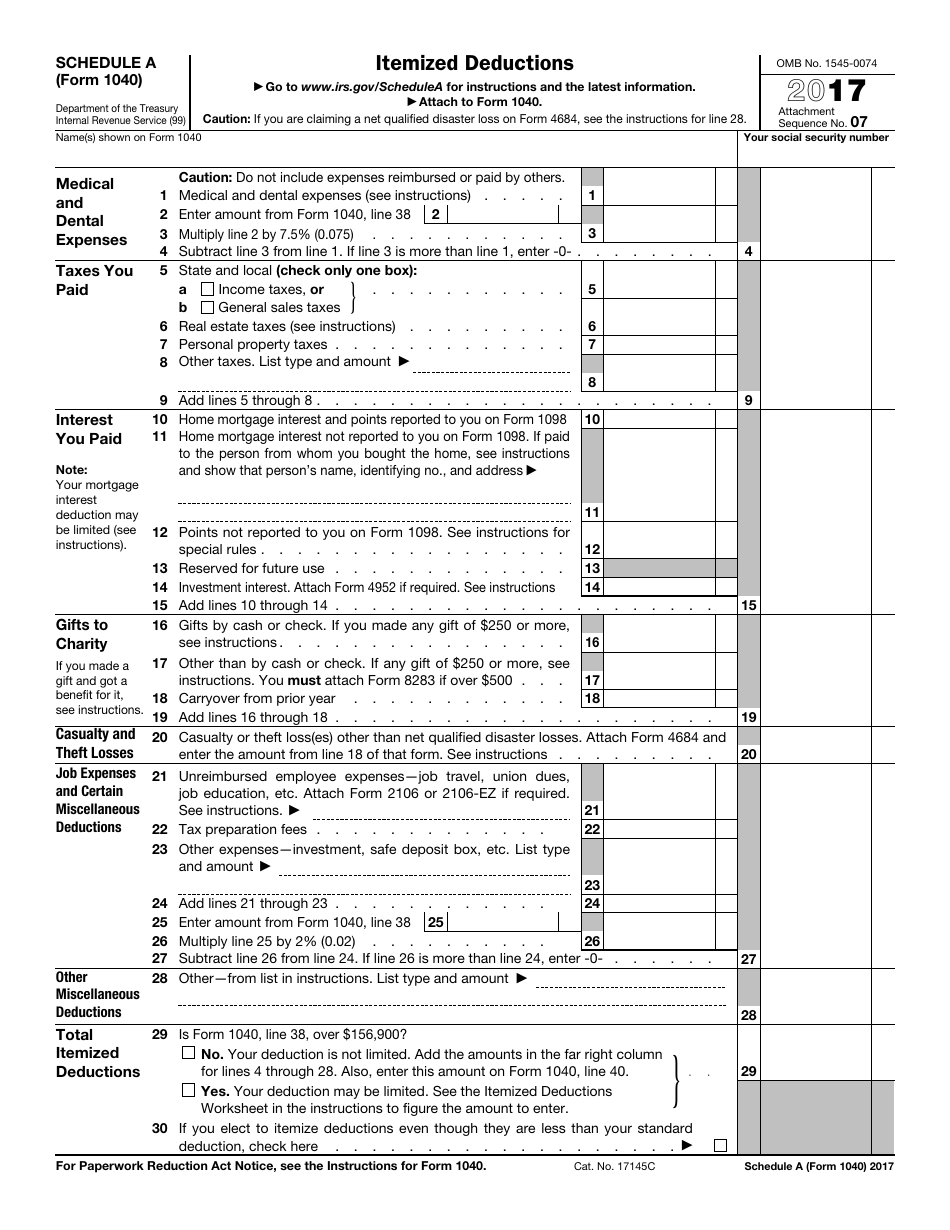

IRS Form 1040 Schedule A

for the current year.

IRS Form 1040 Schedule A Itemized Deductions

What Is IRS Form 1040 Schedule A?

This is a tax form that was released by the Internal Revenue Service (IRS) - a subdivision of the U.S. Department of the Treasury on January 1, 2017. The document is a supplement to IRS Form 1040, U.S. Individual Income Tax Return. As of today, no separate filing guidelines for the form are provided by the IRS.

FAQ

Q: What is IRS Form 1040 Schedule A?

A: IRS Form 1040 Schedule A is a tax form used to report itemized deductions.

Q: What are itemized deductions?

A: Itemized deductions are expenses that you can claim on your tax return to lower your taxable income.

Q: What expenses can be claimed as itemized deductions?

A: Common itemized deductions include medical expenses, state and local taxes, mortgage interest, and charitable donations.

Q: Who can use IRS Form 1040 Schedule A?

A: Any taxpayer who has eligible itemized deductions can use IRS Form 1040 Schedule A.

Q: Do I need to itemize my deductions?

A: No, you can choose to take the standard deduction instead of itemizing your deductions.

Q: How do I know if I should itemize my deductions?

A: You should consider itemizing your deductions if your total eligible expenses exceed the standard deduction amount for your filing status.

Q: When is the deadline to file IRS Form 1040 Schedule A?

A: The deadline to file IRS Form 1040 Schedule A is usually the same as the deadline to file your federal tax return, which is April 15th.

Q: Can I e-file IRS Form 1040 Schedule A?

A: Yes, you can e-file IRS Form 1040 Schedule A along with your federal tax return.

Form Details:

- A 1-page form available for download in PDF;

- This form cannot be used to file taxes for the current year. Choose a more recent version to file for the current tax year;

- Editable, printable, and free;

- Fill out the form in our online filing application.

Download a fillable version of IRS Form 1040 Schedule A through the link below or browse more documents in our library of IRS Forms.