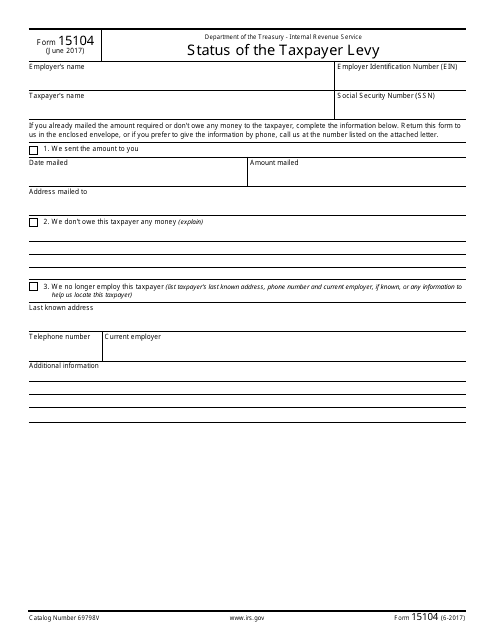

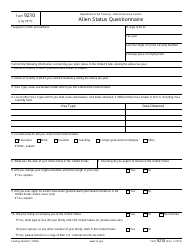

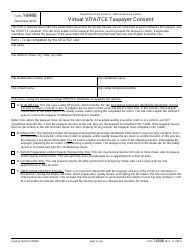

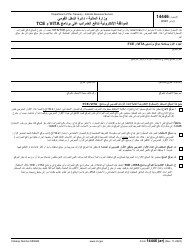

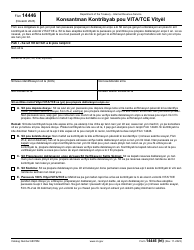

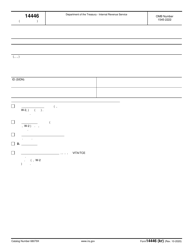

IRS Form 15104 Status of the Taxpayer Levy

What Is IRS Form 15104?

This is a tax form that was released by the Internal Revenue Service (IRS) - a subdivision of the U.S. Department of the Treasury on June 1, 2017. As of today, no separate filing guidelines for the form are provided by the IRS.

FAQ

Q: What is IRS Form 15104?

A: IRS Form 15104 is the form used to request the status of a taxpayer levy.

Q: What is a taxpayer levy?

A: A taxpayer levy is a legal action by the IRS to seize property or assets to satisfy a tax debt.

Q: How can I request the status of a taxpayer levy?

A: You can request the status of a taxpayer levy by completing and submitting IRS Form 15104.

Q: Is there a fee for requesting the status of a taxpayer levy?

A: No, there is no fee for requesting the status of a taxpayer levy on IRS Form 15104.

Form Details:

- A 1-page form available for download in PDF;

- Actual and valid for filing 2023 taxes;

- Editable, printable, and free;

- Fill out the form in our online filing application.

Download a fillable version of IRS Form 15104 through the link below or browse more documents in our library of IRS Forms.