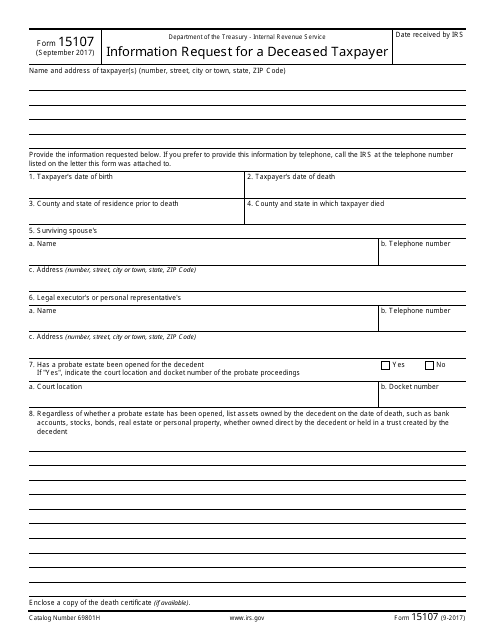

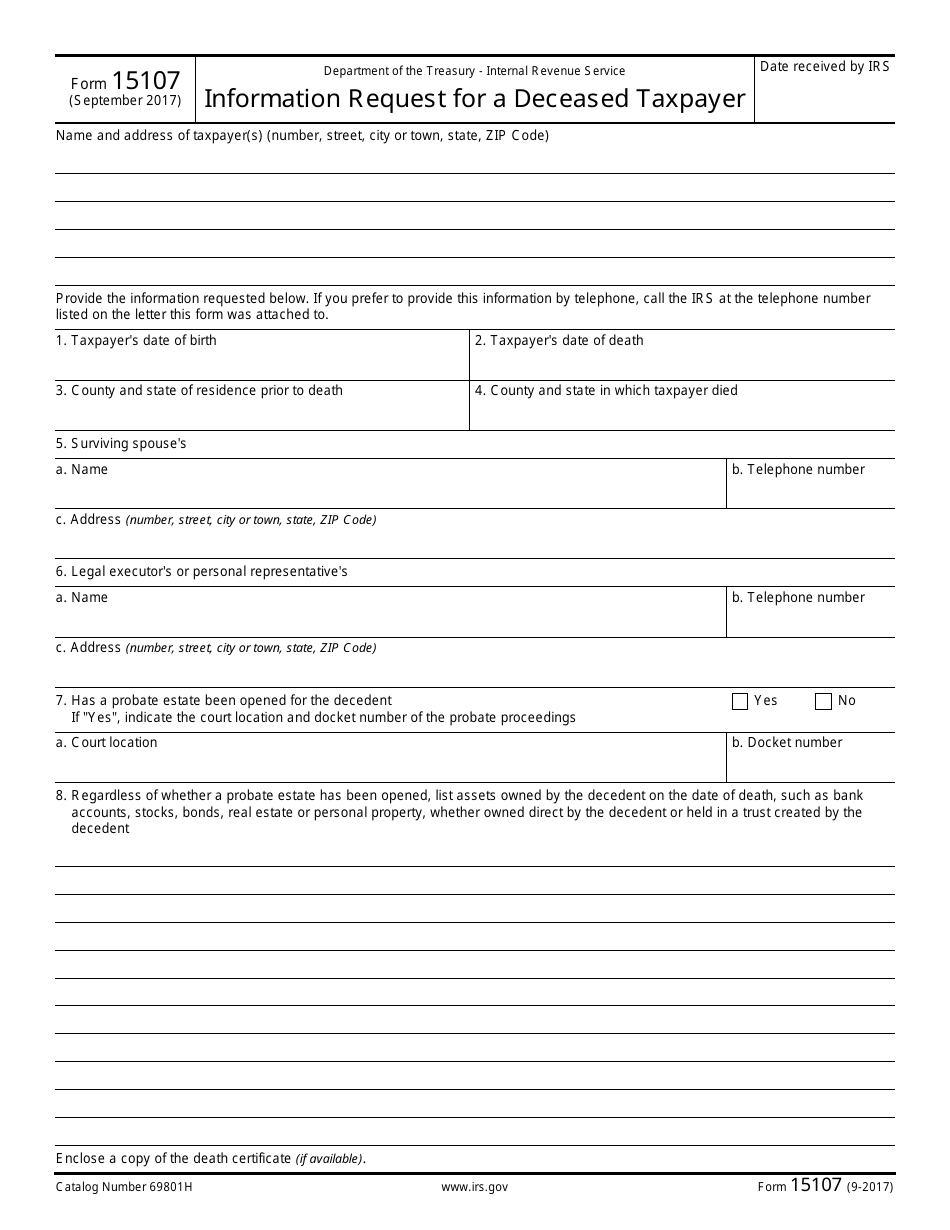

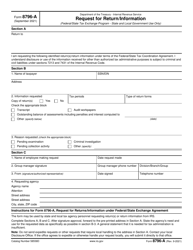

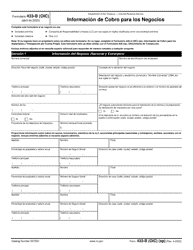

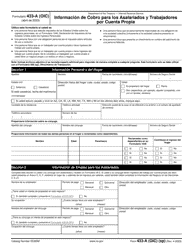

IRS Form 15107 Information Request for a Deceased Taxpayer

What Is IRS Form 15107?

This is a tax form that was released by the Internal Revenue Service (IRS) - a subdivision of the U.S. Department of the Treasury on September 1, 2017. As of today, no separate filing guidelines for the form are provided by the IRS.

FAQ

Q: What is IRS Form 15107?

A: IRS Form 15107 is an Information Request form used by the IRS to gather information about a deceased taxpayer.

Q: When is IRS Form 15107 used?

A: IRS Form 15107 is used when the IRS needs information about a deceased taxpayer for tax purposes.

Q: Who can submit IRS Form 15107?

A: IRS Form 15107 can be submitted by the executor or administrator of the deceased taxpayer's estate.

Q: What information is required on IRS Form 15107?

A: IRS Form 15107 requires information about the deceased taxpayer, including their name, Social Security number, and date of death.

Q: Are there any deadlines for submitting IRS Form 15107?

A: There is no specific deadline for submitting IRS Form 15107, but it should be completed and submitted as soon as possible after the taxpayer's death.

Form Details:

- A 1-page form available for download in PDF;

- Actual and valid for filing 2023 taxes;

- Editable, printable, and free;

- Fill out the form in our online filing application.

Download a fillable version of IRS Form 15107 through the link below or browse more documents in our library of IRS Forms.