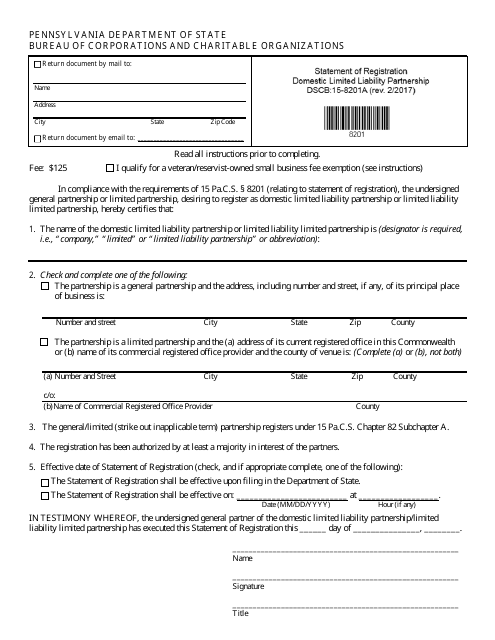

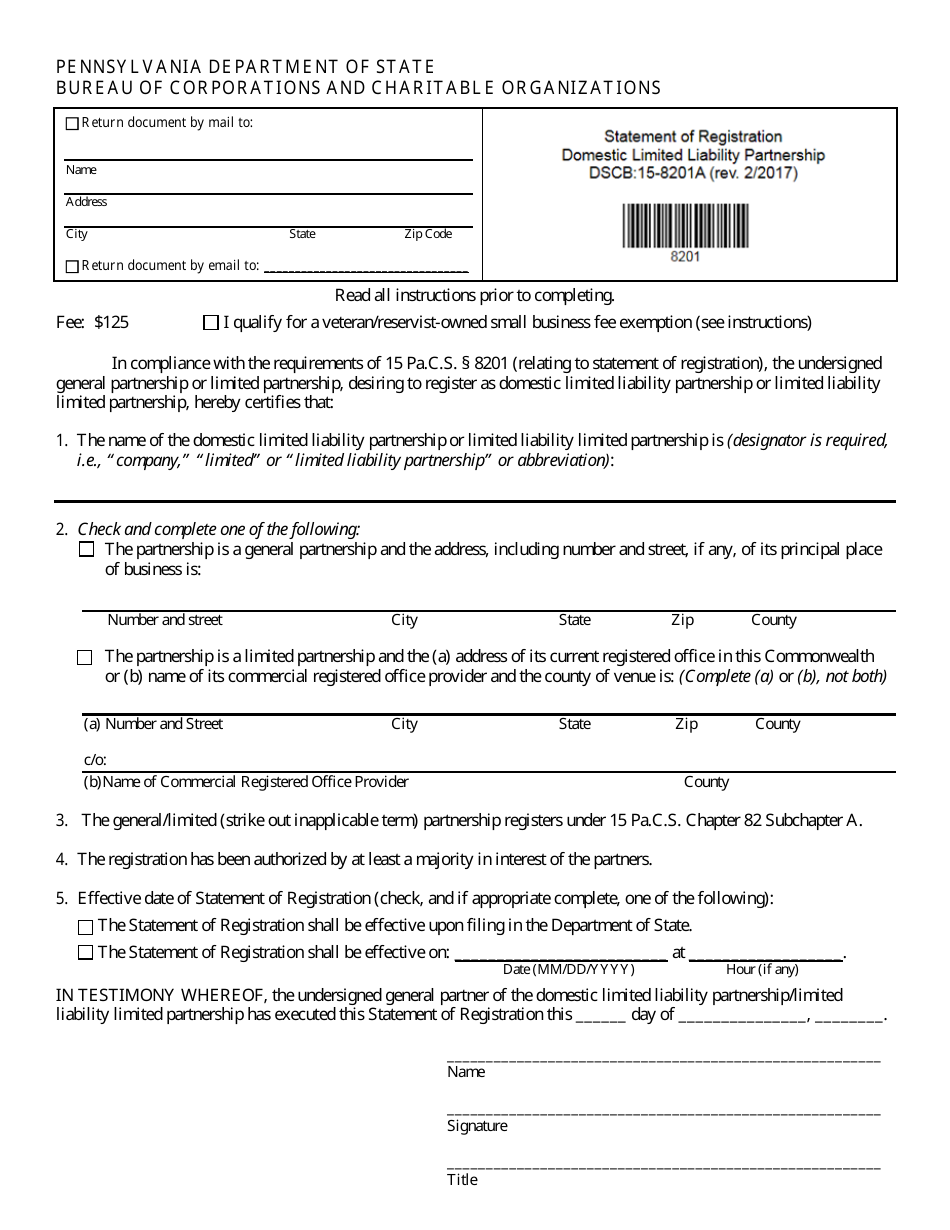

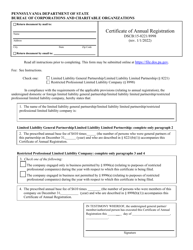

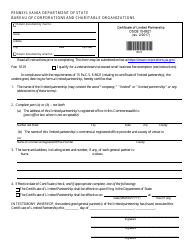

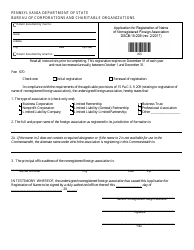

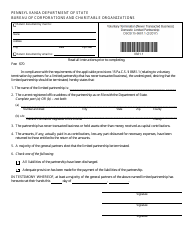

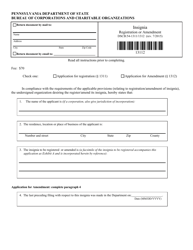

Form DSCB:15-8201A Statement of Registration - Domestic Registered Limited Liability Partnership - Pennsylvania

What Is Form DSCB:15-8201A?

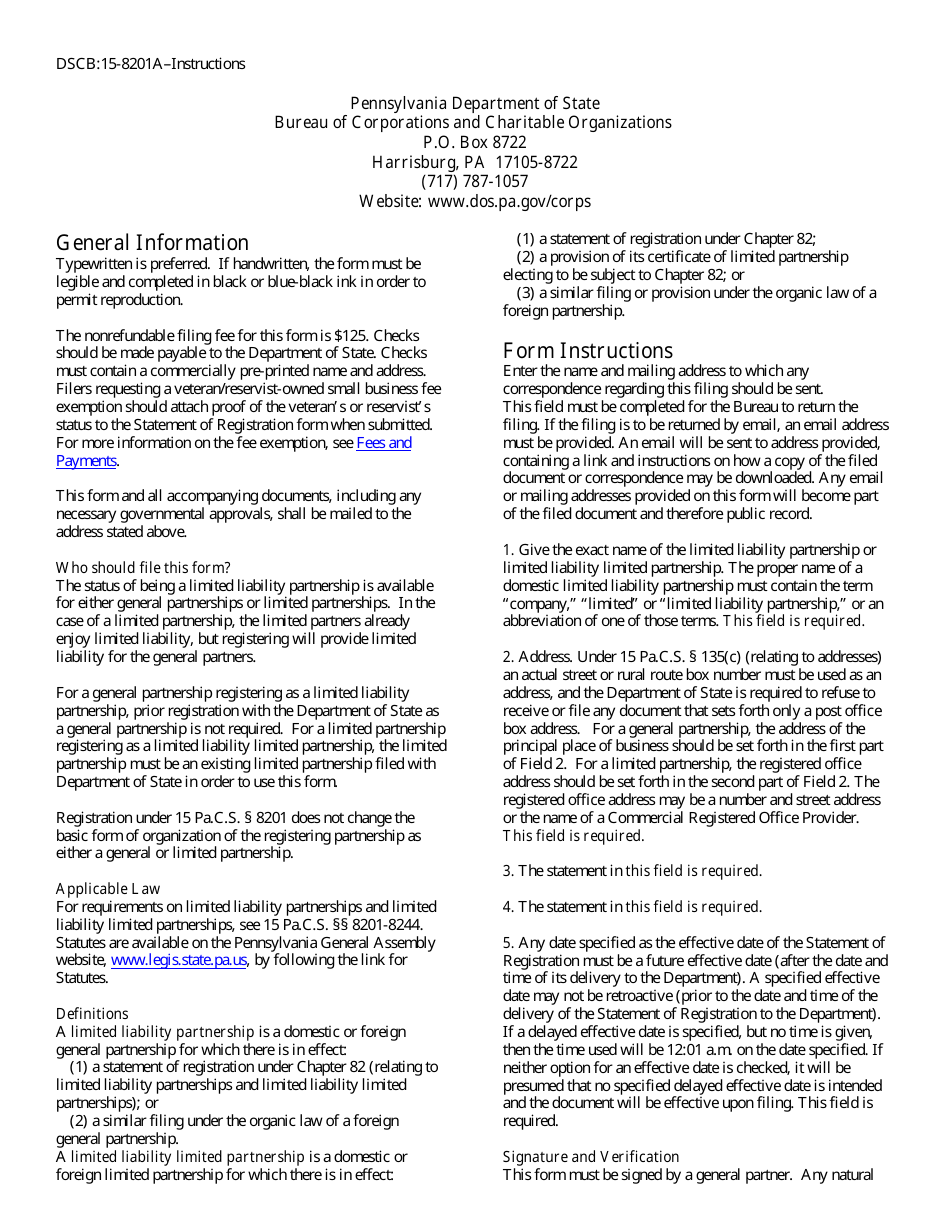

This is a legal form that was released by the Pennsylvania Department of State - a government authority operating within Pennsylvania. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form DSCB:15-8201A?

A: Form DSCB:15-8201A is a statement of registration for a domestic registered limited liability partnership in Pennsylvania.

Q: What is a domestic registered limited liability partnership?

A: A domestic registered limited liability partnership is a type of business entity in Pennsylvania that provides the partners with limited liability protection.

Q: Who needs to file Form DSCB:15-8201A?

A: Partnerships that want to become a registered limited liability partnership in Pennsylvania need to file Form DSCB:15-8201A.

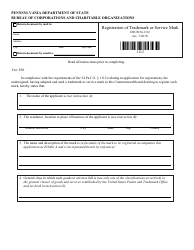

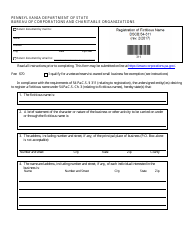

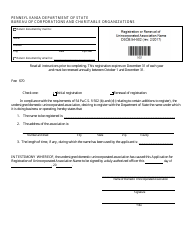

Q: What information is required on Form DSCB:15-8201A?

A: Form DSCB:15-8201A requires information about the partnership's name, address, registered agent, partners' names, and other details.

Q: Are there any additional requirements for registered limited liability partnerships in Pennsylvania?

A: Yes, registered limited liability partnerships in Pennsylvania must maintain certain records and comply with ongoing filing requirements.

Q: Can I convert an existing partnership into a registered limited liability partnership?

A: Yes, existing partnerships can convert into a registered limited liability partnership by filing the necessary forms and meeting the requirements set by the Pennsylvania Department of State.

Q: What are the benefits of registering as a limited liability partnership?

A: Registering as a limited liability partnership provides partners with limited liability protection, meaning their personal assets are generally protected from the partnership's debts and liabilities.

Form Details:

- Released on February 1, 2017;

- The latest edition provided by the Pennsylvania Department of State;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form DSCB:15-8201A by clicking the link below or browse more documents and templates provided by the Pennsylvania Department of State.