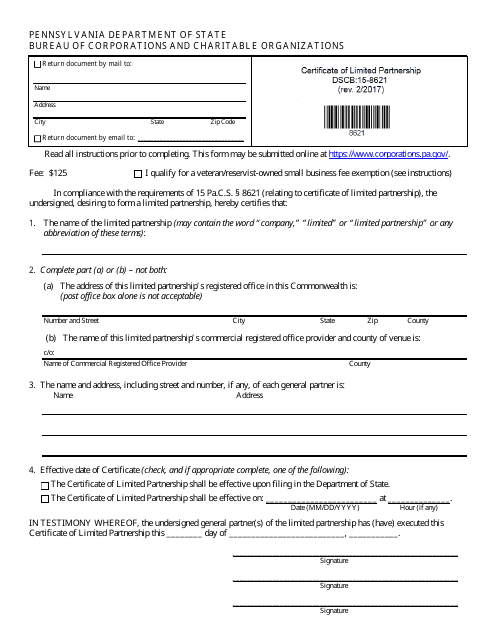

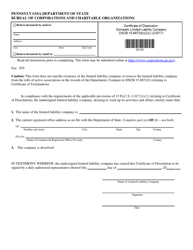

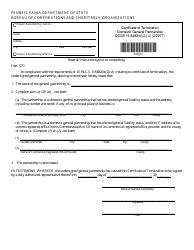

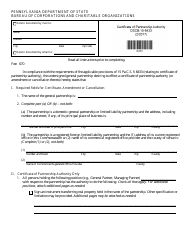

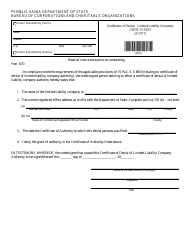

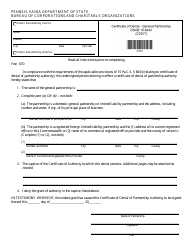

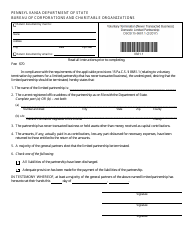

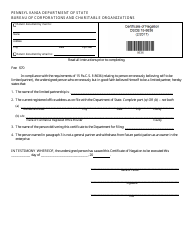

Form DSCB:15-8621 Certificate of Limited Partnership - Pennsylvania

What Is Form DSCB:15-8621?

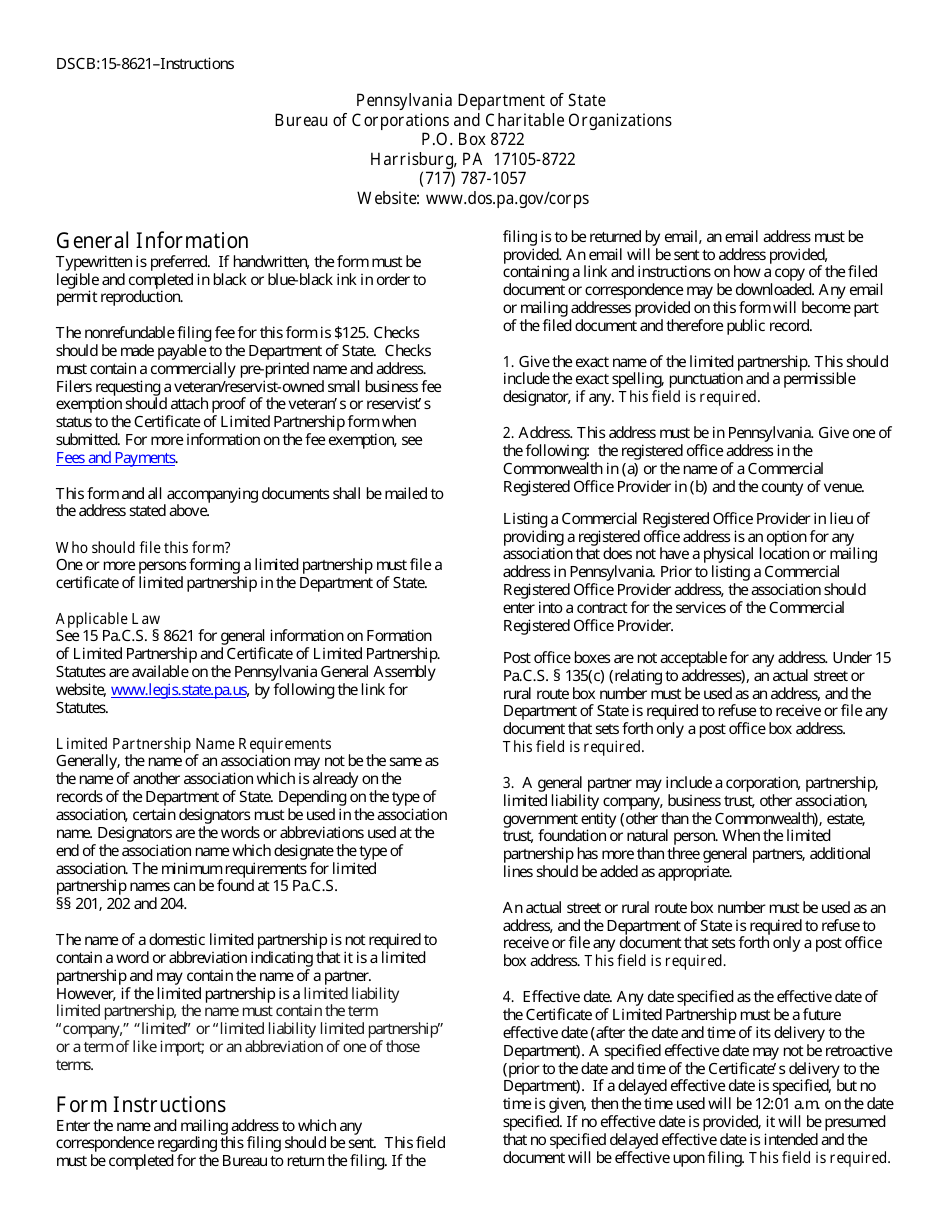

This is a legal form that was released by the Pennsylvania Department of State - a government authority operating within Pennsylvania. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form DSCB:15-8621?

A: Form DSCB:15-8621 is the Certificate of Limited Partnership for Pennsylvania.

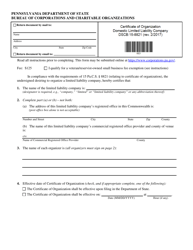

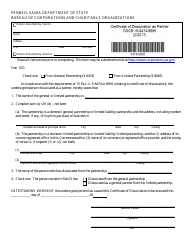

Q: What is a Certificate of Limited Partnership?

A: A Certificate of Limited Partnership is a legal document that establishes the creation of a limited partnership.

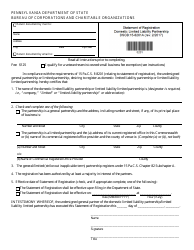

Q: What is a limited partnership?

A: A limited partnership is a business structure where there are one or more general partners who manage the business and have unlimited liability, and one or more limited partners who only contribute capital and have limited liability.

Q: Who needs to file Form DSCB:15-8621?

A: Any individual or entity that wants to form a limited partnership in Pennsylvania needs to file Form DSCB:15-8621.

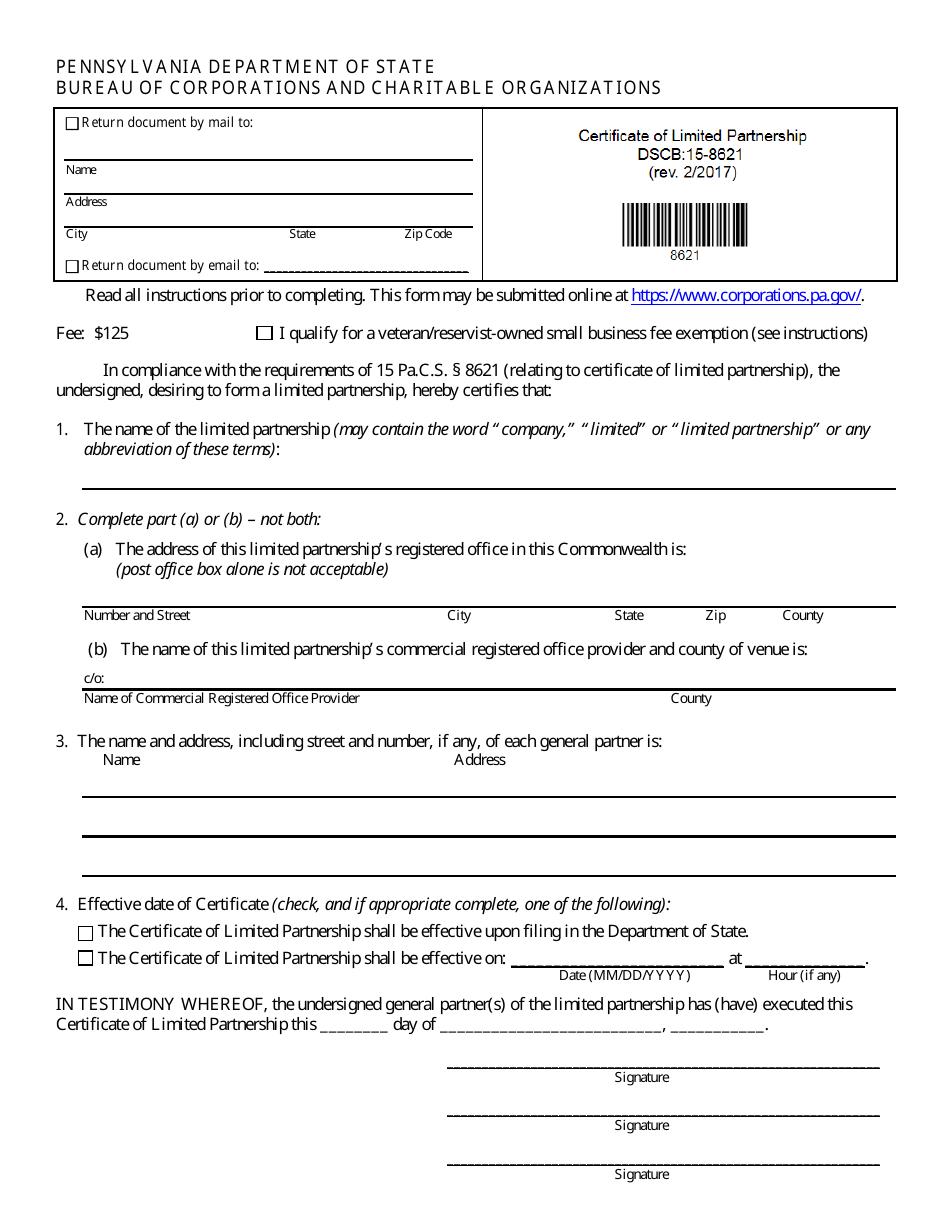

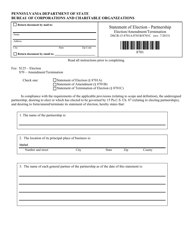

Q: What information is required on Form DSCB:15-8621?

A: Form DSCB:15-8621 requires information such as the name of the limited partnership, the names and addresses of the general partners, the duration of the partnership, and the address of the partnership's principal place of business.

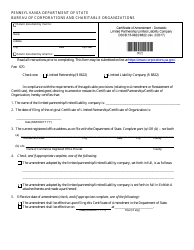

Q: What happens after I file Form DSCB:15-8621?

A: After you file Form DSCB:15-8621 and pay the required fee, the Pennsylvania Department of State will review the form and, if everything is in order, issue a Certificate of Limited Partnership.

Q: Do I need an attorney to file Form DSCB:15-8621?

A: While it is not required to have an attorney, it can be helpful to consult with a legal professional who is knowledgeable about business formations and Pennsylvania's laws regarding limited partnerships.

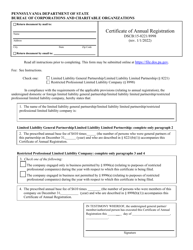

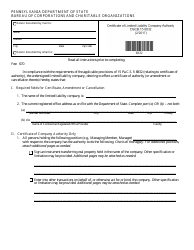

Form Details:

- Released on February 1, 2017;

- The latest edition provided by the Pennsylvania Department of State;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form DSCB:15-8621 by clicking the link below or browse more documents and templates provided by the Pennsylvania Department of State.