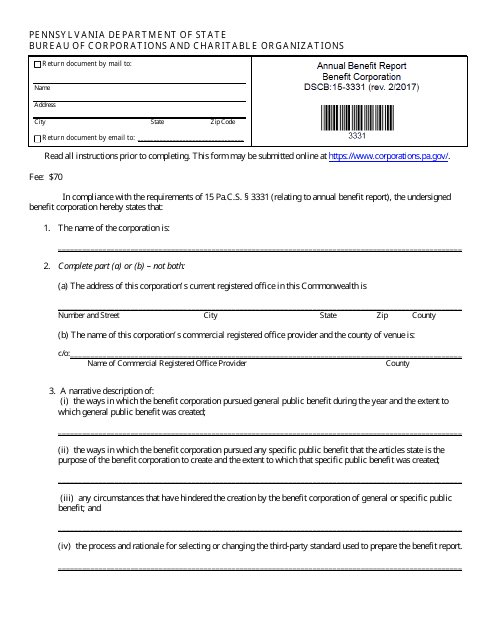

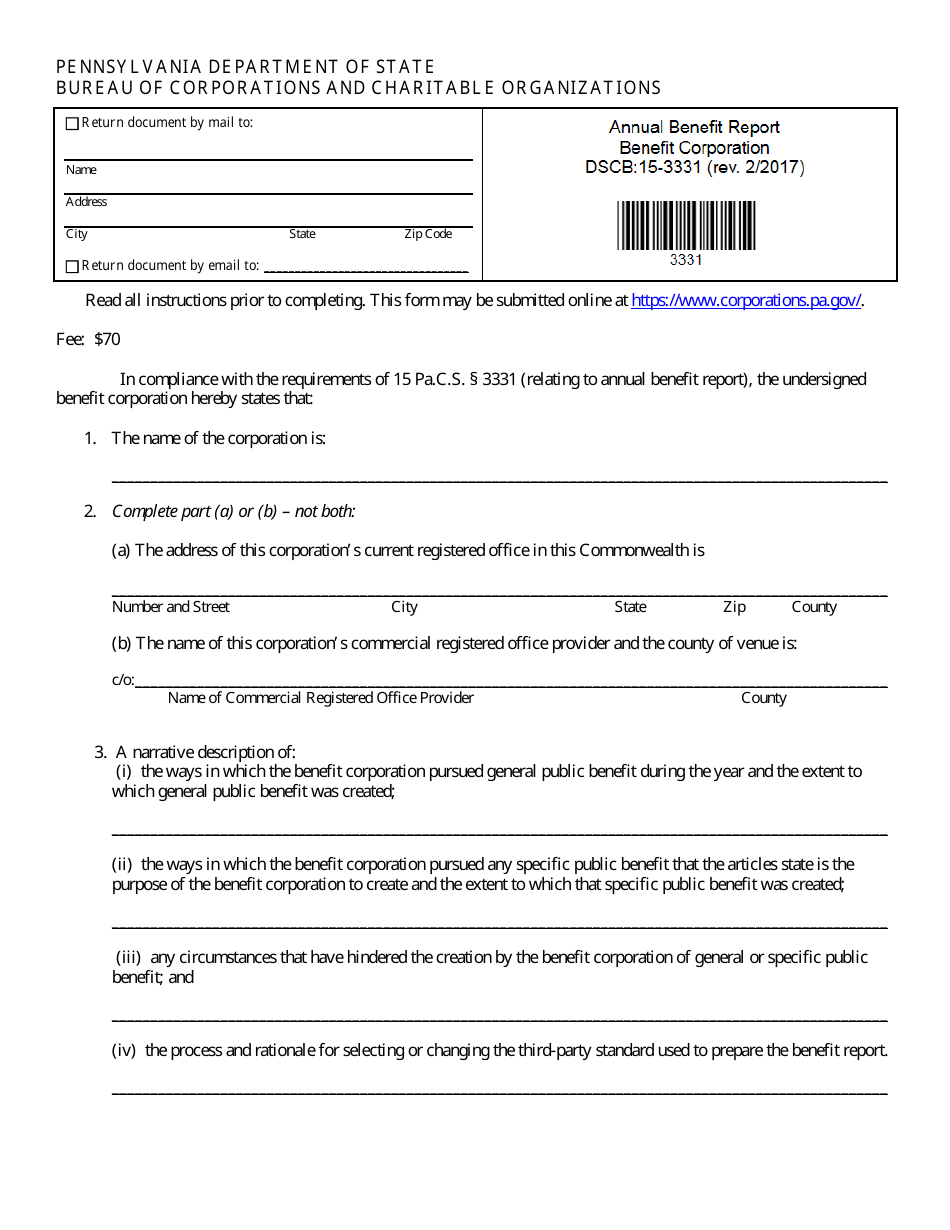

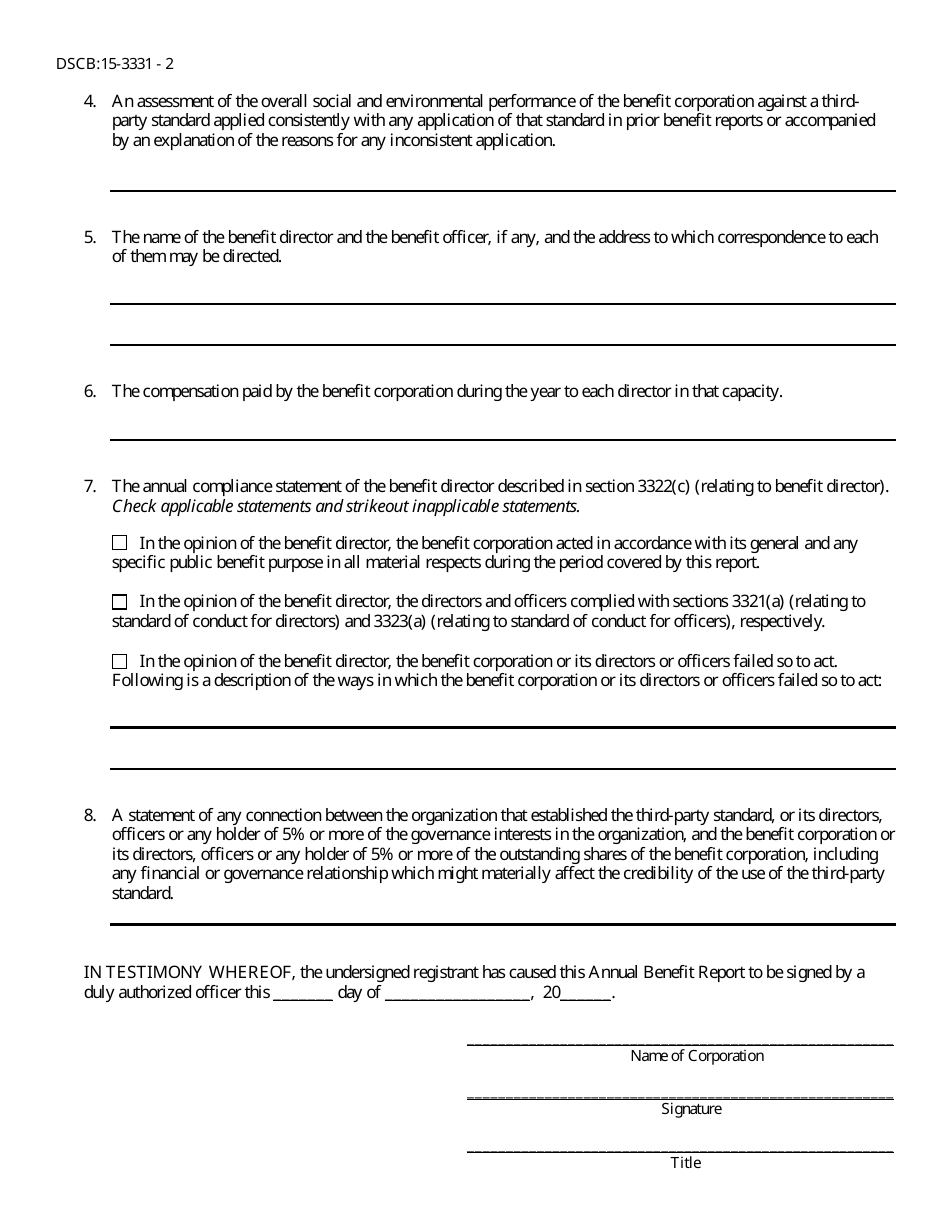

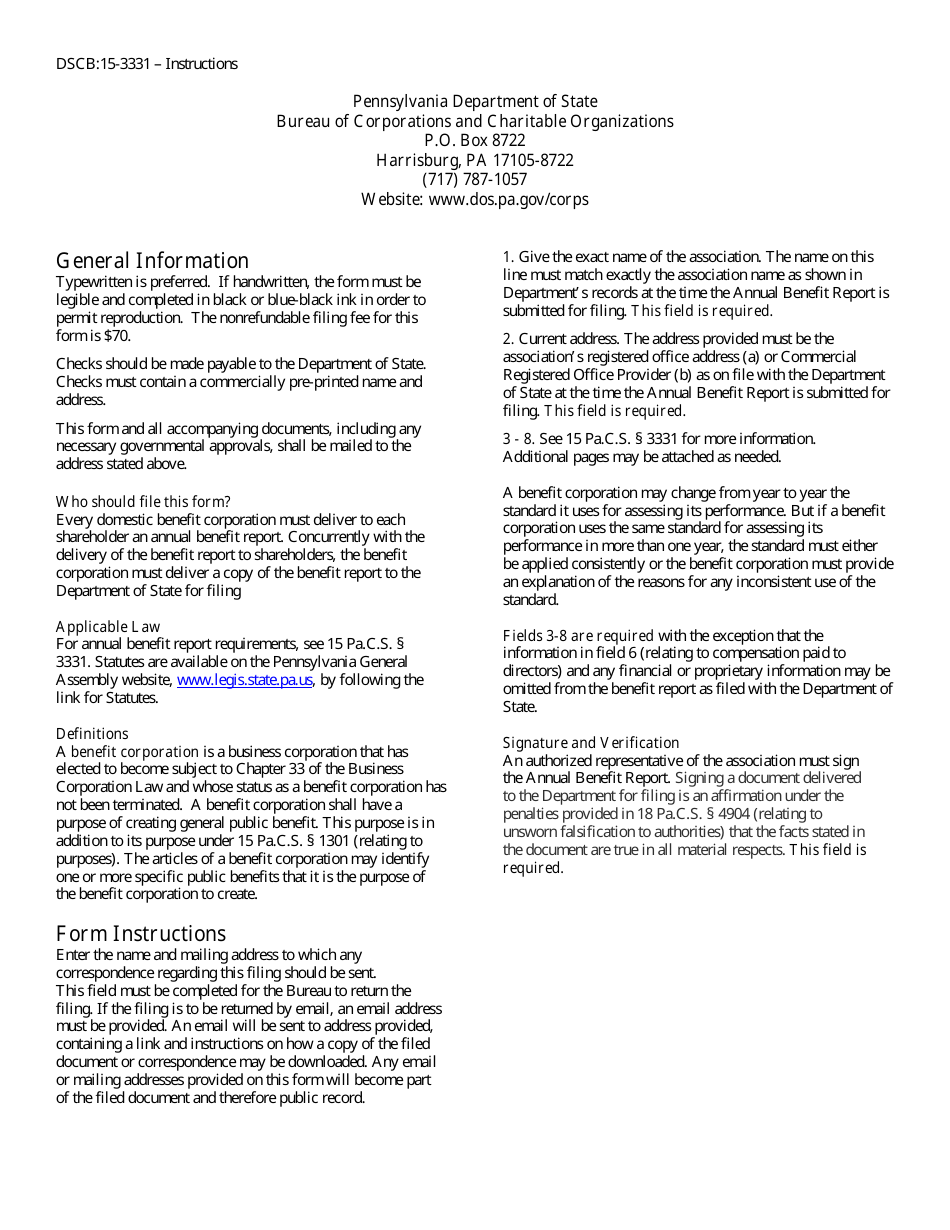

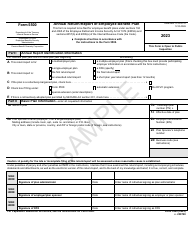

Form DSCB:15-3331 Annual Benefit Report - Pennsylvania

What Is Form DSCB:15-3331?

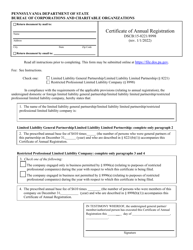

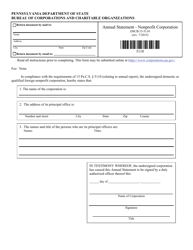

This is a legal form that was released by the Pennsylvania Department of State - a government authority operating within Pennsylvania. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form DSCB:15-3331?

A: Form DSCB:15-3331 is the Annual Benefit Report in Pennsylvania.

Q: Who needs to file the Form DSCB:15-3331?

A: Any business entity authorized to transact business in Pennsylvania needs to file the Form DSCB:15-3331.

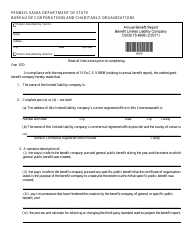

Q: What is the purpose of the Annual Benefit Report?

A: The purpose of the Annual Benefit Report is to provide information about the financial benefits provided by the business entity to its directors, officers, and other insiders.

Q: What information needs to be included in the Annual Benefit Report?

A: The Annual Benefit Report should include a detailed description of any financial benefits provided to directors, officers, and other insiders, along with the total value of those benefits.

Q: When is the deadline to file the Annual Benefit Report?

A: The deadline to file the Annual Benefit Report is on or before the 15th day of the 5th month following the close of the business entity's fiscal year.

Q: Is there a fee for filing the Annual Benefit Report?

A: Yes, there is a fee for filing the Annual Benefit Report. The fee may vary depending on the business entity's authorized capital stock or net worth.

Q: Are there any penalties for late or incomplete filing of the Annual Benefit Report?

A: Yes, there are penalties for late or incomplete filing of the Annual Benefit Report. Failure to file or filing an incomplete report may result in the business entity being administratively dissolved.

Form Details:

- Released on February 1, 2017;

- The latest edition provided by the Pennsylvania Department of State;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form DSCB:15-3331 by clicking the link below or browse more documents and templates provided by the Pennsylvania Department of State.