This version of the form is not currently in use and is provided for reference only. Download this version of

the document

for the current year.

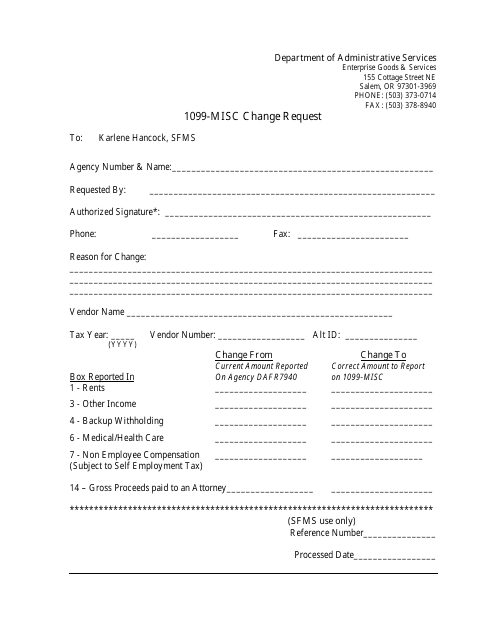

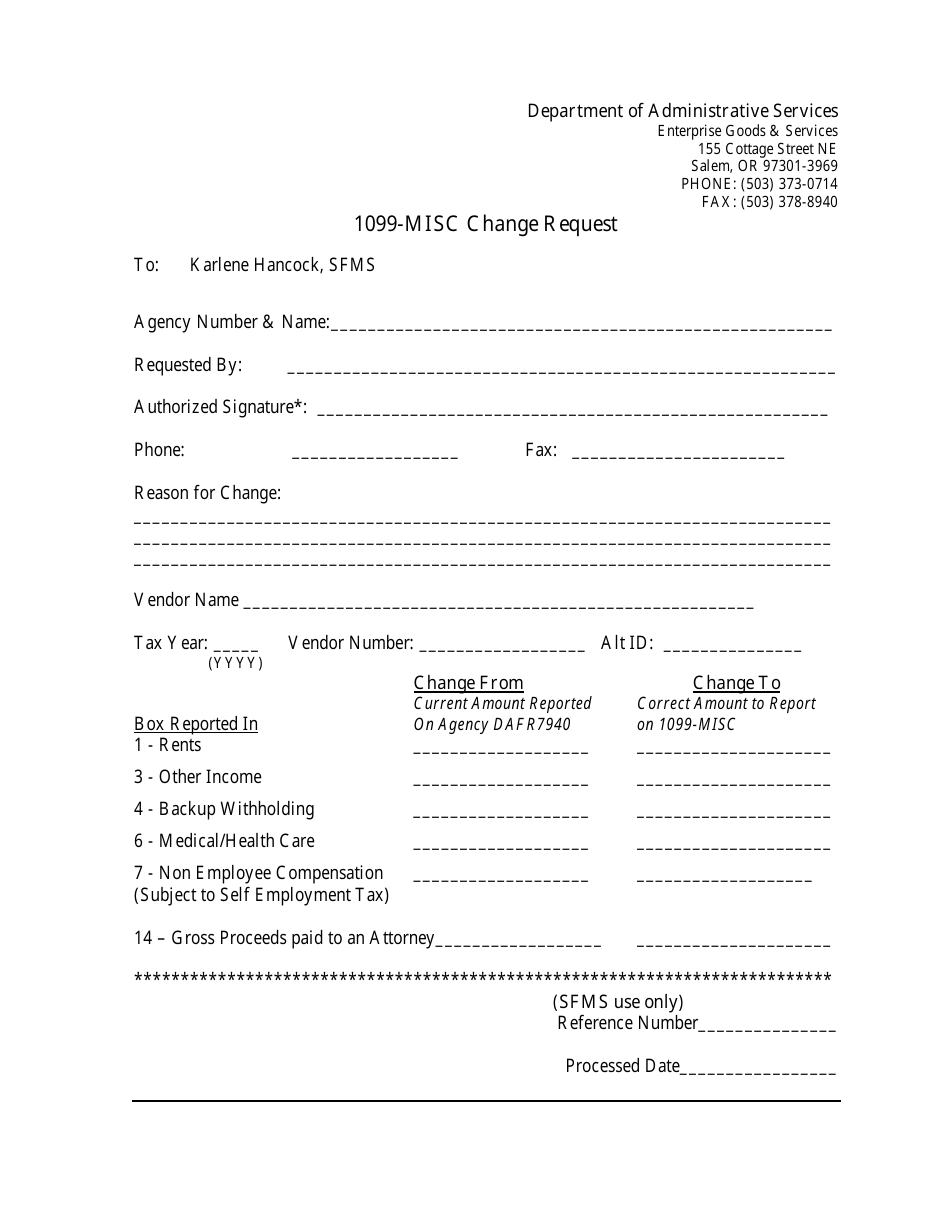

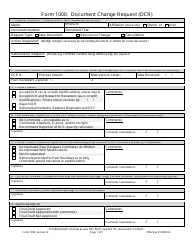

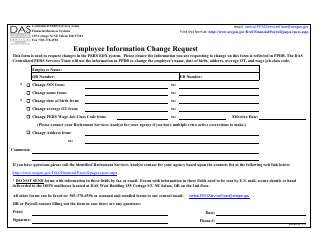

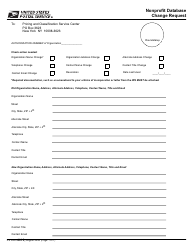

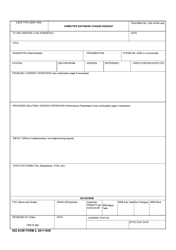

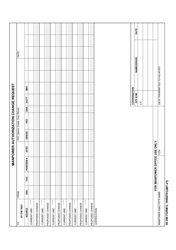

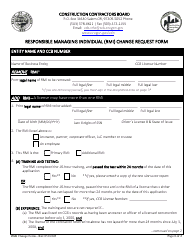

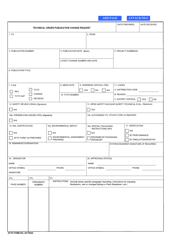

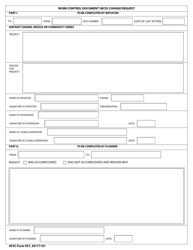

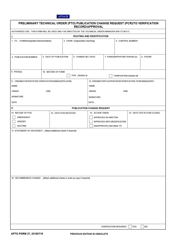

1099-misc Change Request - Oregon

1099-misc Change Request is a legal document that was released by the Oregon Department of Administrative Services - a government authority operating within Oregon.

FAQ

Q: What is a 1099-MISC?

A: A 1099-MISC is a tax form used to report income received by freelance workers, independent contractors, and other non-employee individuals.

Q: What is a 1099-MISC Change Request?

A: A 1099-MISC Change Request is a request to correct or update information on a previously issued 1099-MISC form.

Q: How do I request a change to my 1099-MISC in Oregon?

A: To request a change to your 1099-MISC in Oregon, you need to contact the Oregon Department of Revenue and provide them with the necessary information.

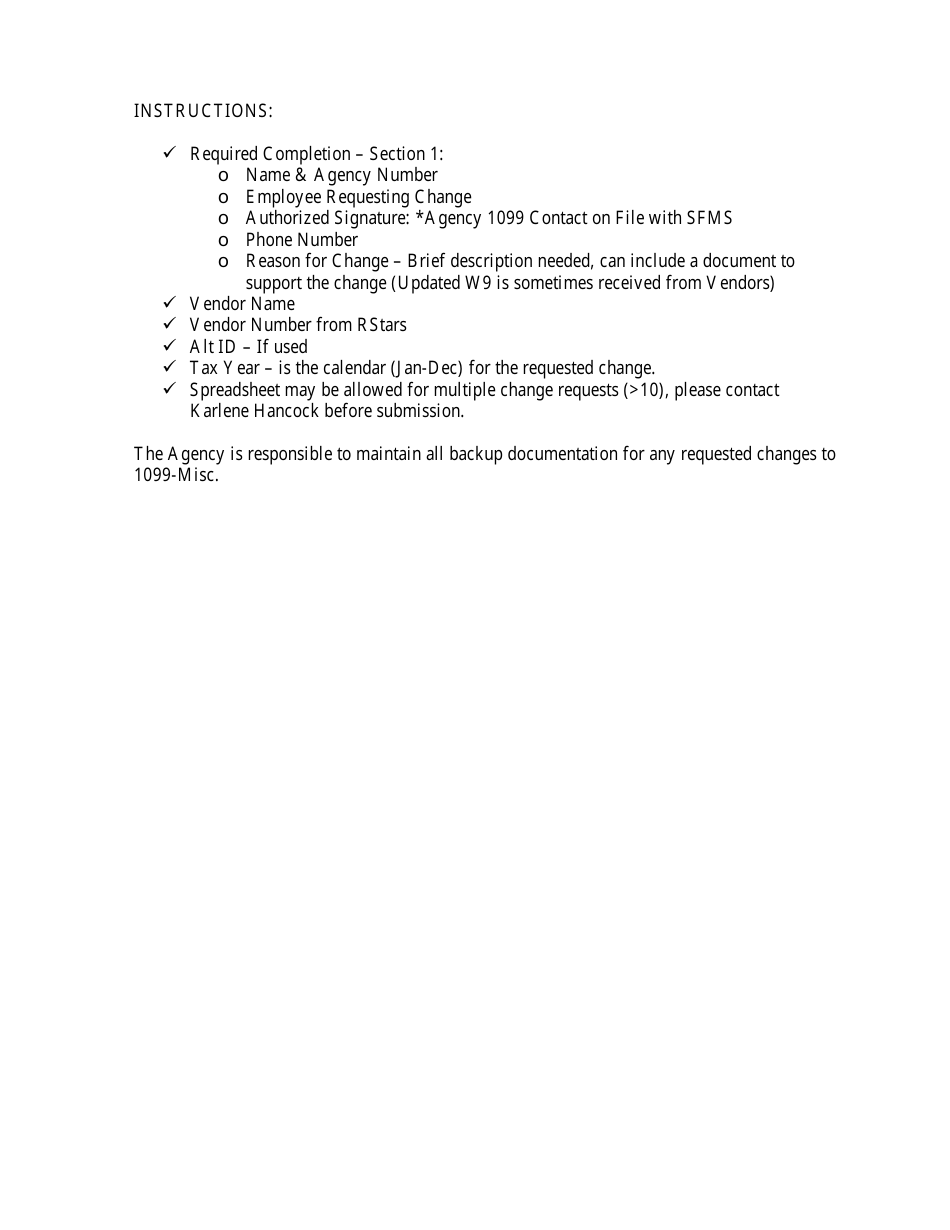

Q: What information do I need to provide for a 1099-MISC change request?

A: You will need to provide your name, Social Security Number or Tax Identification Number, the 1099-MISC form number, and the specific changes you need to make.

Q: Is there a deadline for submitting a 1099-MISC change request in Oregon?

A: The Oregon Department of Revenue recommends submitting any change requests as soon as you become aware of the errors, but there is no specific deadline.

Q: Can I request a change to someone else's 1099-MISC form?

A: No, you can only request changes to your own 1099-MISC form. If you notice errors on someone else's form, you should advise them to contact the Oregon Department of Revenue.

Q: Is there a fee for requesting a change to my 1099-MISC in Oregon?

A: There is no specific fee mentioned for requesting a change to your 1099-MISC form in Oregon, but you should contact the Oregon Department of Revenue to confirm.

Q: How long does it take for a 1099-MISC change request to be processed?

A: The processing time for a 1099-MISC change request can vary, so it's best to contact the Oregon Department of Revenue for an estimate.

Q: What should I do if I receive a corrected 1099-MISC form?

A: If you receive a corrected 1099-MISC form after requesting a change, you should compare the corrected form with the original and ensure that the necessary changes have been made.

Q: Do I need to amend my tax return if I receive a corrected 1099-MISC?

A: If you receive a corrected 1099-MISC after filing your tax return, you may need to amend your return to reflect the corrected information. It's advised to consult with a tax professional for guidance.

Form Details:

- The latest edition currently provided by the Oregon Department of Administrative Services;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of the form by clicking the link below or browse more documents and templates provided by the Oregon Department of Administrative Services.