This version of the form is not currently in use and is provided for reference only. Download this version of

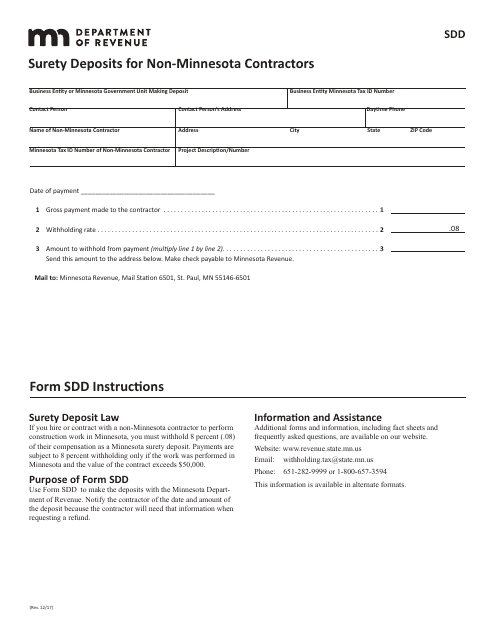

Form SDD

for the current year.

Form SDD Surety Deposits for Non-minnesota Contractors - Minnesota

What Is Form SDD?

This is a legal form that was released by the Minnesota Department of Revenue - a government authority operating within Minnesota. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is an SDD surety deposit?

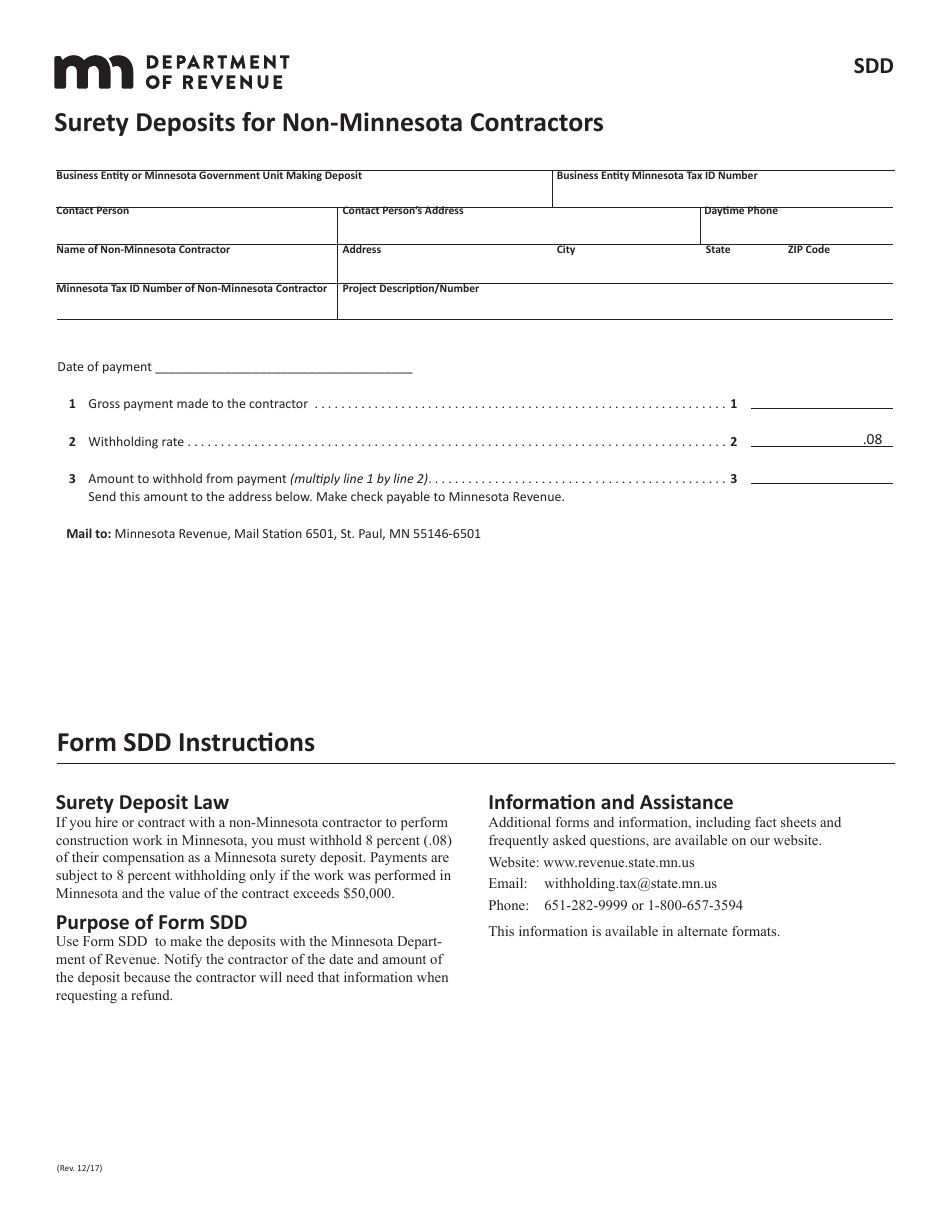

A: An SDD surety deposit is a form of financial security required for non-Minnesota contractors performing work in Minnesota.

Q: Who needs to submit an SDD surety deposit?

A: Non-Minnesota contractors who are performing work in Minnesota are required to submit an SDD surety deposit.

Q: Why is an SDD surety deposit required?

A: The SDD surety deposit serves as a form of financial protection for Minnesota homeowners and businesses in case the contractor fails to fulfill their obligations.

Q: How much is the SDD surety deposit?

A: The amount of the SDD surety deposit is determined based on the contract amount and can vary.

Q: How can I submit the SDD surety deposit?

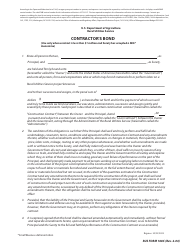

A: The SDD surety deposit can be submitted through a certified check or bond.

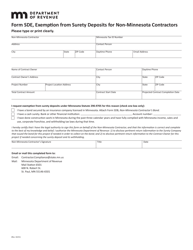

Q: Are there any alternatives to the SDD surety deposit?

A: Yes, contractors can provide an approved bond or an irrevocable letter of credit in lieu of the SDD surety deposit.

Q: What happens if the contractor fails to submit the SDD surety deposit?

A: If the contractor fails to submit the SDD surety deposit, they may be subject to penalties and may not be able to legally perform work in Minnesota.

Q: How long is the SDD surety deposit held?

A: The SDD surety deposit is held for a period of three years after the completion of the contract.

Q: Can the SDD surety deposit be returned?

A: Yes, the SDD surety deposit can be returned to the contractor if there are no claims against it.

Form Details:

- Released on December 1, 2017;

- The latest edition provided by the Minnesota Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form SDD by clicking the link below or browse more documents and templates provided by the Minnesota Department of Revenue.