This version of the form is not currently in use and is provided for reference only. Download this version of

Form SDE

for the current year.

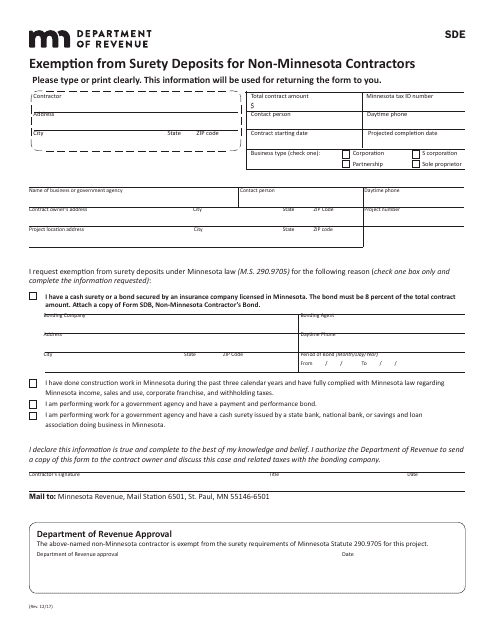

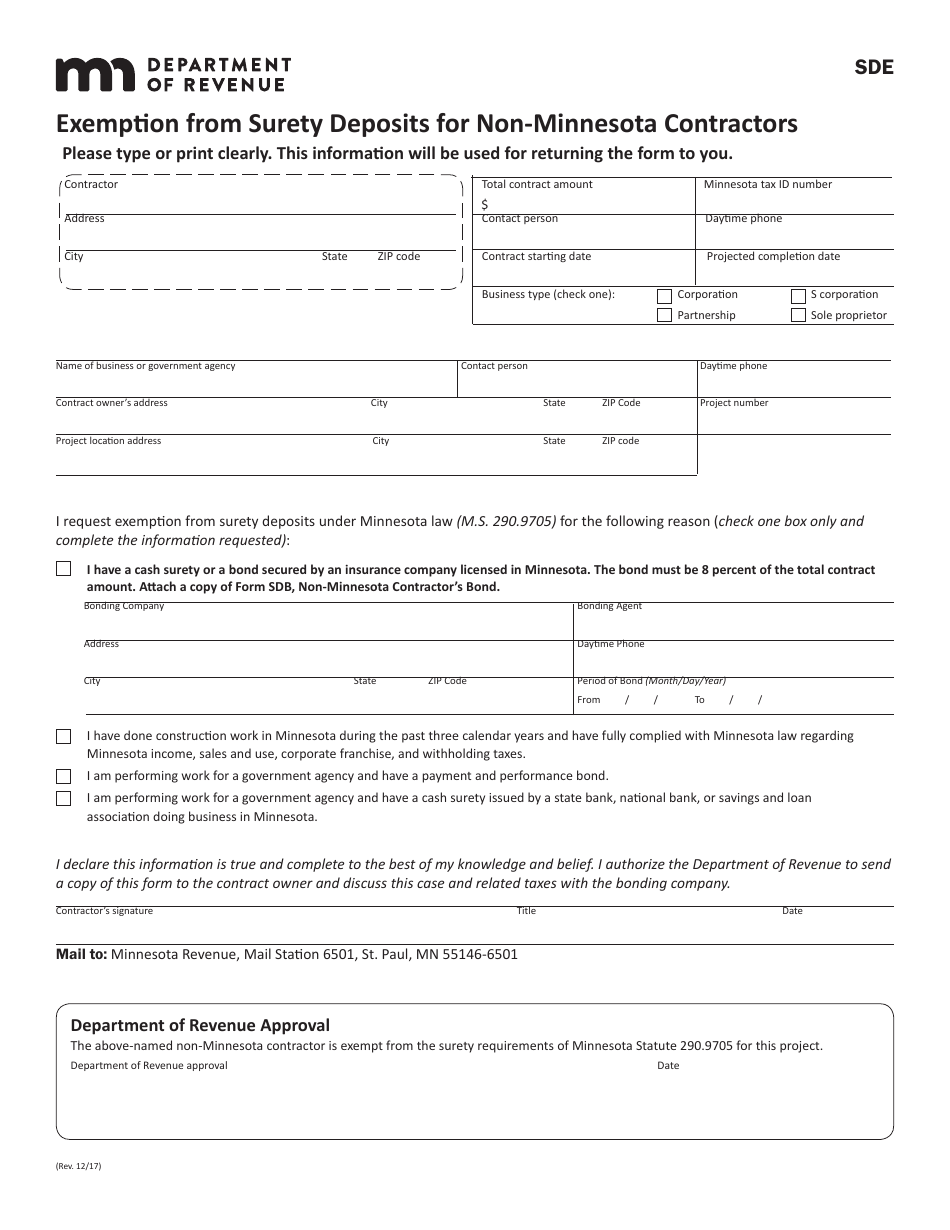

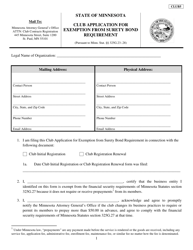

Form SDE Exemption From Surety Deposits for Non-minnesota Contractors - Minnesota

What Is Form SDE?

This is a legal form that was released by the Minnesota Department of Revenue - a government authority operating within Minnesota. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form SDE?

A: Form SDE is a document that allows non-Minnesota contractors to apply for exemption from surety deposits.

Q: Who can use Form SDE?

A: Non-Minnesota contractors who want to apply for exemption from surety deposits can use Form SDE.

Q: What are surety deposits?

A: Surety deposits are financial guarantees that contractors must provide to ensure the completion of construction projects.

Q: Why would a non-Minnesota contractor want to be exempt from surety deposits?

A: Being exempt from surety deposits can reduce the financial burden for non-Minnesota contractors and make it easier for them to participate in construction projects in Minnesota.

Q: How can non-Minnesota contractors apply for exemption from surety deposits?

A: Non-Minnesota contractors can apply for exemption from surety deposits by completing and submitting Form SDE.

Q: Are there any eligibility requirements for exemption from surety deposits?

A: Yes, non-Minnesota contractors must meet certain eligibility requirements to qualify for exemption from surety deposits.

Q: What are the eligibility requirements for exemption from surety deposits?

A: The eligibility requirements for exemption from surety deposits include having a good credit rating, having no unresolved complaints or claims related to construction projects, and being registered with the DLI.

Q: Is there a fee for applying for exemption from surety deposits?

A: Yes, there is a fee for applying for exemption from surety deposits. The fee amount is determined by the DLI.

Q: How long does it take to process an application for exemption from surety deposits?

A: The processing time for an application for exemption from surety deposits can vary, but it typically takes several weeks.

Form Details:

- Released on December 1, 2017;

- The latest edition provided by the Minnesota Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form SDE by clicking the link below or browse more documents and templates provided by the Minnesota Department of Revenue.