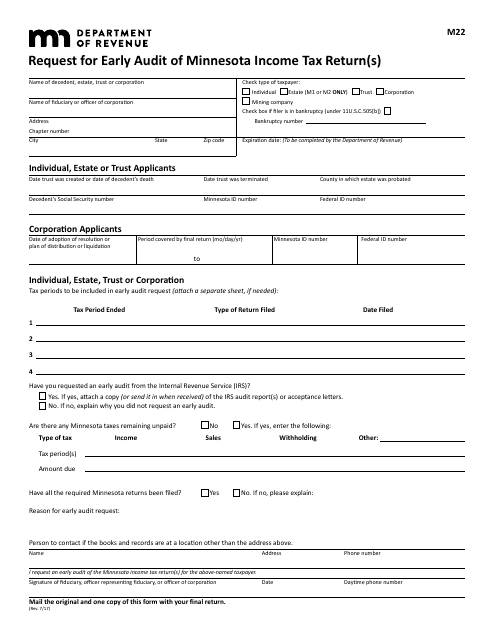

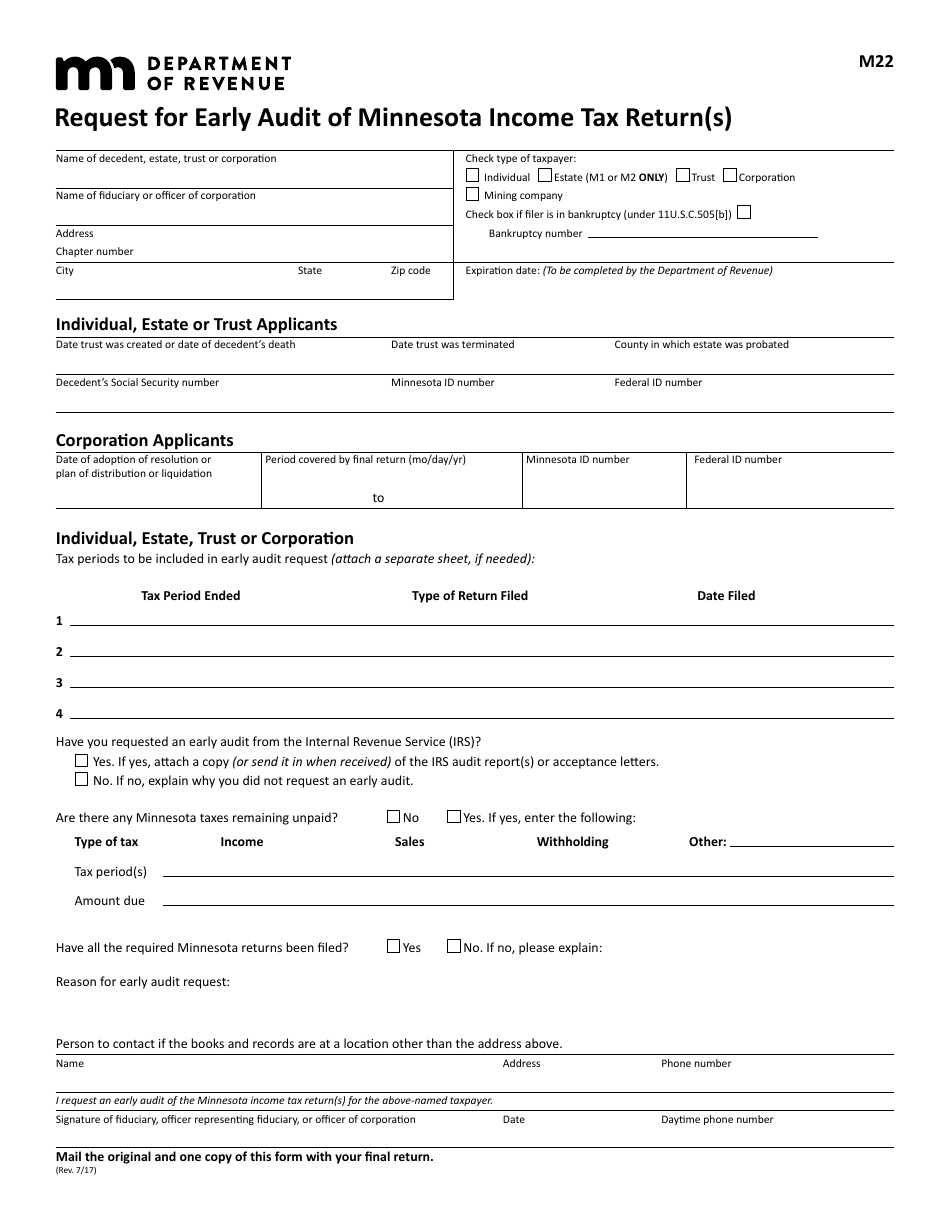

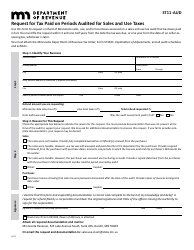

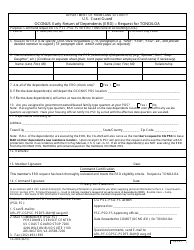

Form M22 Request for Early Audit of Minnesota Income Tax Return(S) - Minnesota

What Is Form M22?

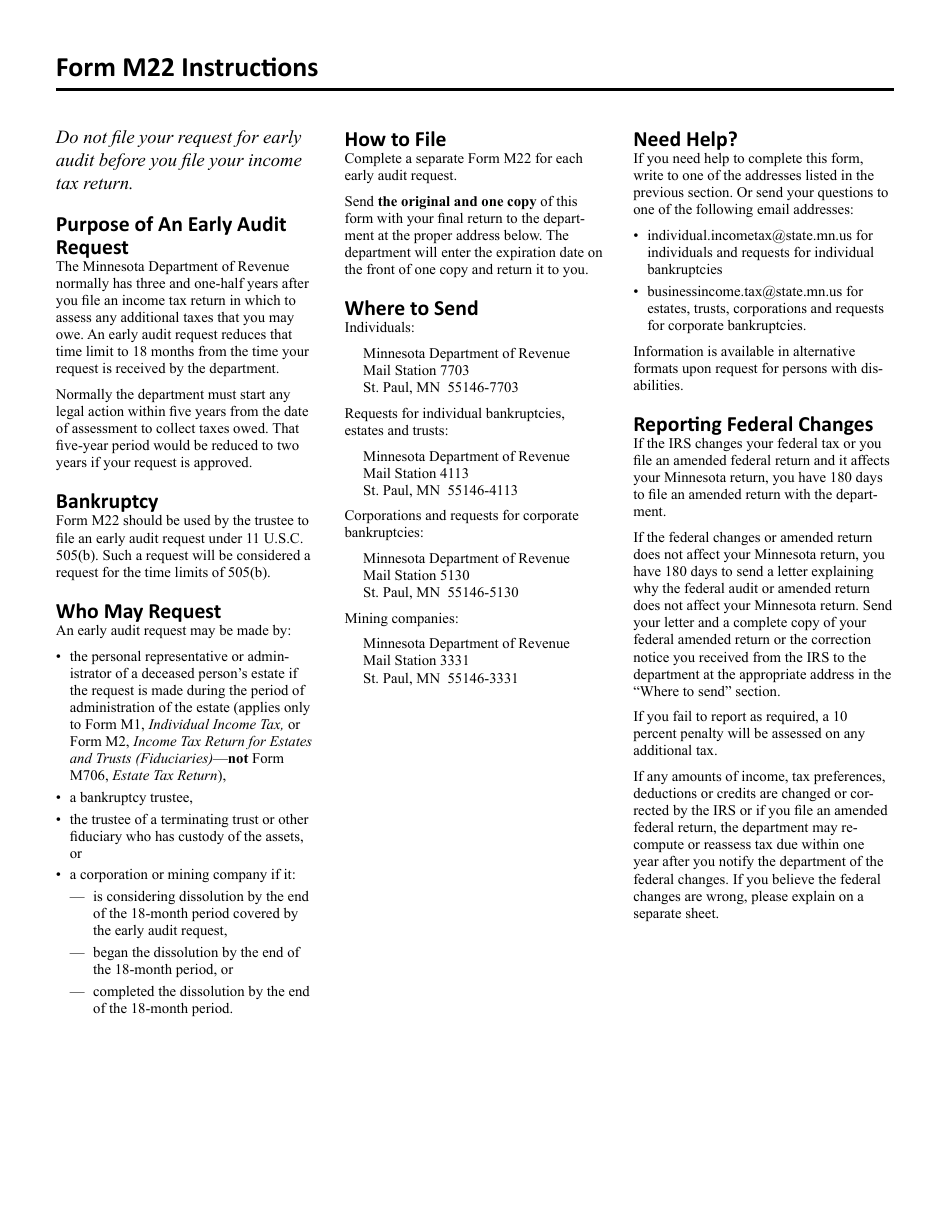

This is a legal form that was released by the Minnesota Department of Revenue - a government authority operating within Minnesota. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form M22?

A: Form M22 is a request for an early audit of Minnesota income tax return(s).

Q: Why would someone request an early audit of their Minnesota income tax return?

A: There could be several reasons why someone would request an early audit. It might be to resolve any potential issues or discrepancies before the regular audit process begins.

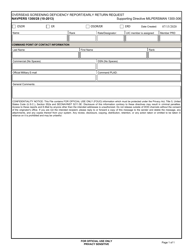

Q: Do I need to provide any supporting documents with Form M22?

A: Yes, you may need to provide supporting documents depending on the nature of the audit request. It is recommended to follow the instructions provided with the form.

Q: Is there a deadline for submitting Form M22?

A: Yes, there is a deadline for submitting Form M22. It is recommended to check the instructions provided with the form or contact the Minnesota Department of Revenue for specific deadlines.

Q: Can I request an early audit for multiple tax returns on one Form M22?

A: Yes, you can request an early audit for multiple tax returns on one Form M22. Make sure to provide all necessary information for each return.

Q: What happens after I submit Form M22?

A: After you submit Form M22, the Minnesota Department of Revenue will review your request and determine if an early audit will be conducted.

Q: How long does it take for the Minnesota Department of Revenue to respond to a Form M22 request?

A: The response time may vary. It is recommended to contact the Minnesota Department of Revenue for an estimated timeline.

Form Details:

- Released on July 1, 2017;

- The latest edition provided by the Minnesota Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form M22 by clicking the link below or browse more documents and templates provided by the Minnesota Department of Revenue.