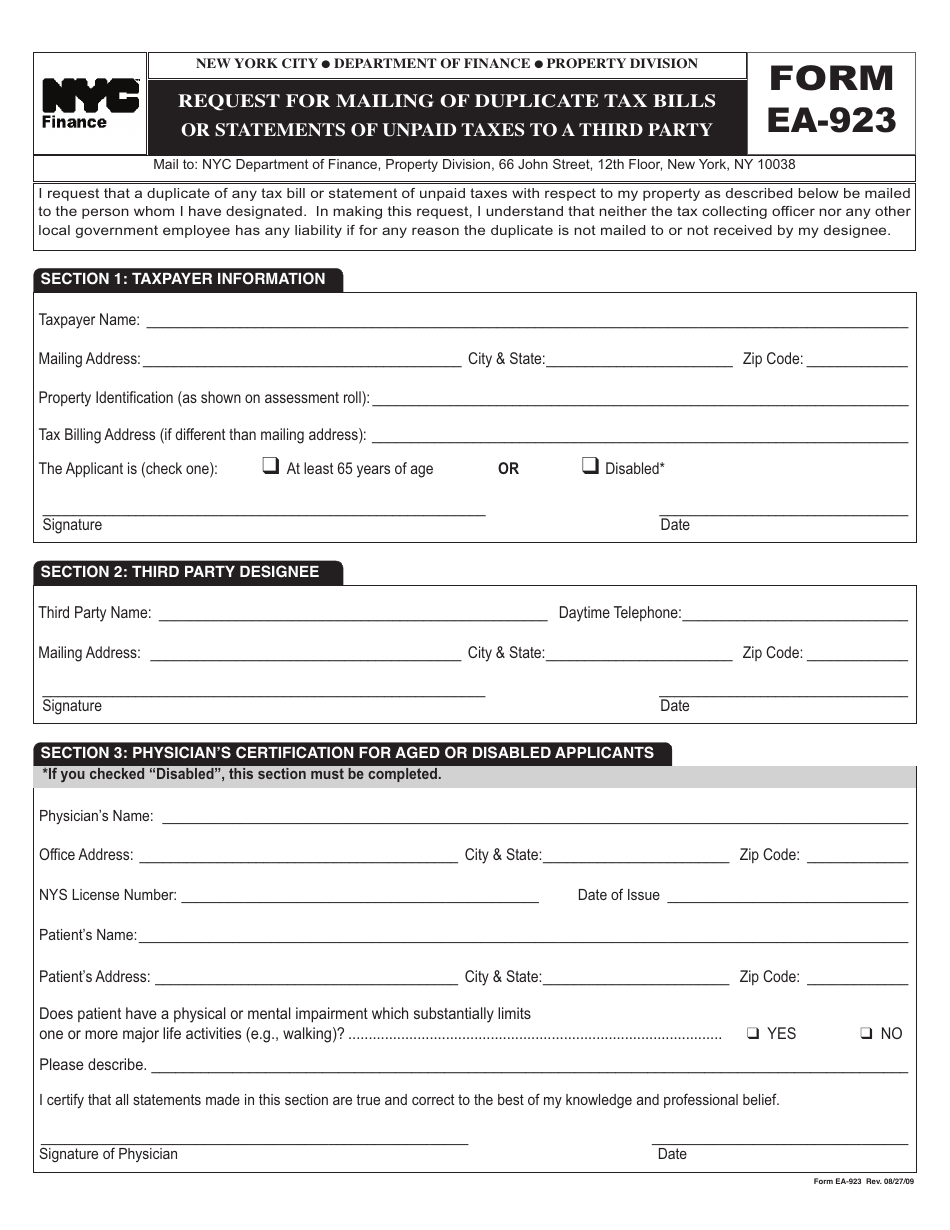

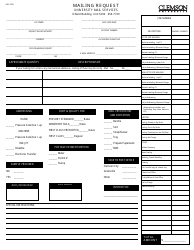

Form EA-923 Request for Mailing of Duplicate Tax Bills or Statements of Unpaid Taxes to a Third Party - New York City

What Is Form EA-923?

This is a legal form that was released by the New York City Department of Finance - a government authority operating within New York City. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form EA-923?

A: Form EA-923 is a request form for mailing duplicate tax bills or statements of unpaid taxes to a third party in New York City.

Q: What is the purpose of Form EA-923?

A: The purpose of Form EA-923 is to authorize the New York City Department of Finance to send duplicate tax bills or statements of unpaid taxes to a third party.

Q: Who can use Form EA-923?

A: Anyone who wants to have duplicate tax bills or statements of unpaid taxes mailed to a third party in New York City can use Form EA-923.

Q: Is there a fee for submitting Form EA-923?

A: No, there is no fee for submitting Form EA-923.

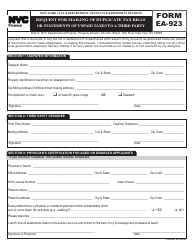

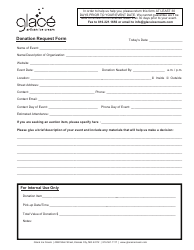

Q: What information is required on Form EA-923?

A: Form EA-923 requires you to provide your contact information, the third party's contact information, and information about the property or tax account in question.

Q: Can I submit Form EA-923 electronically?

A: No, currently Form EA-923 cannot be submitted electronically and must be mailed to the Department of Finance.

Q: How long does it take to process Form EA-923?

A: The processing time for Form EA-923 may vary, but it is typically processed within a few weeks of receipt.

Form Details:

- Released on August 27, 2009;

- The latest edition provided by the New York City Department of Finance;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form EA-923 by clicking the link below or browse more documents and templates provided by the New York City Department of Finance.