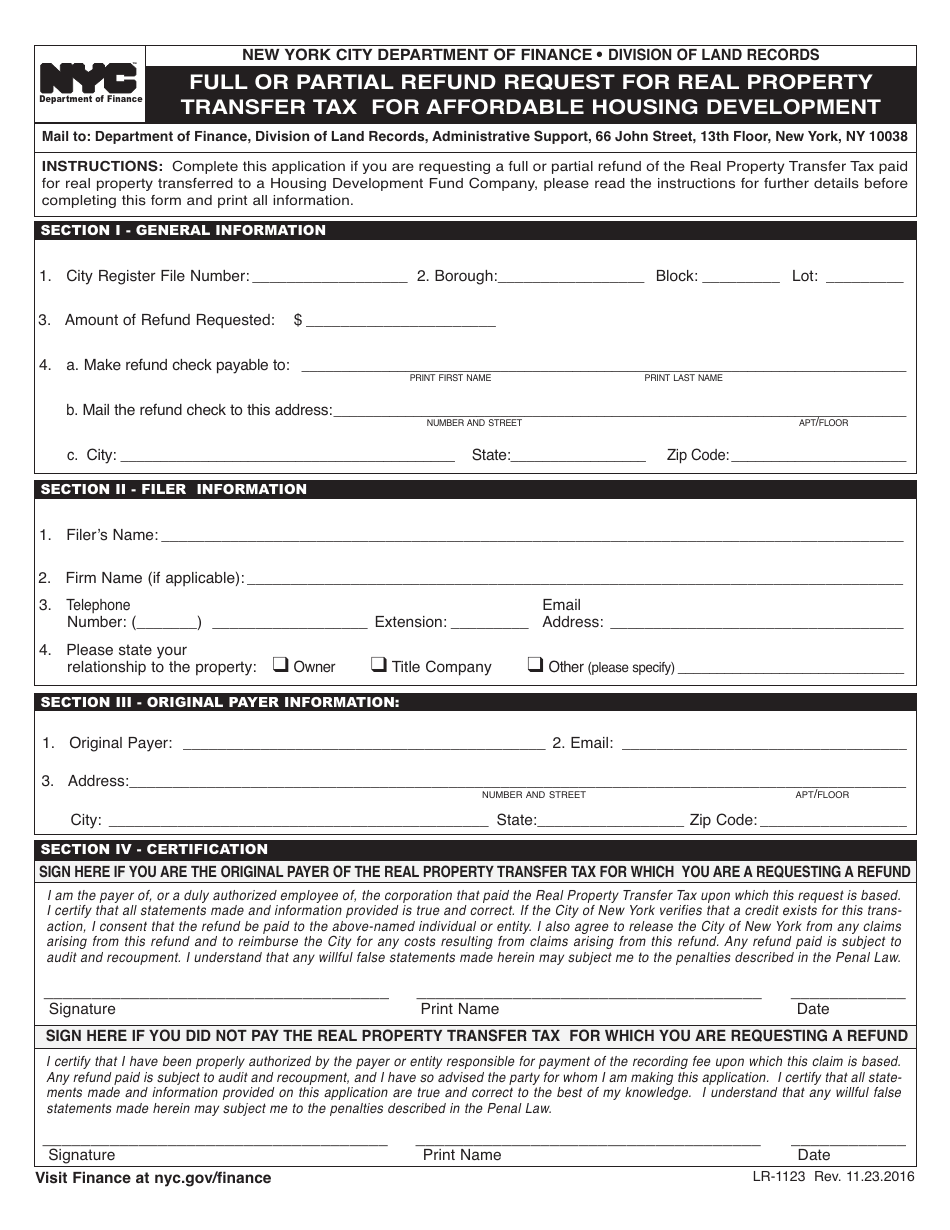

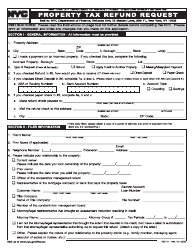

Form LR-1123 Full or Partial Refund Request for Real Property Transfer Tax for Affordable Housing Development - New York City

What Is Form LR-1123?

This is a legal form that was released by the New York City Department of Finance - a government authority operating within New York City. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is LR-1123?

A: LR-1123 is a form for requesting a full or partial refund of the Real Property Transfer Tax for an affordable housing development in New York City.

Q: What is the Real Property Transfer Tax?

A: The Real Property Transfer Tax is a tax imposed by New York City on the transfer of real property.

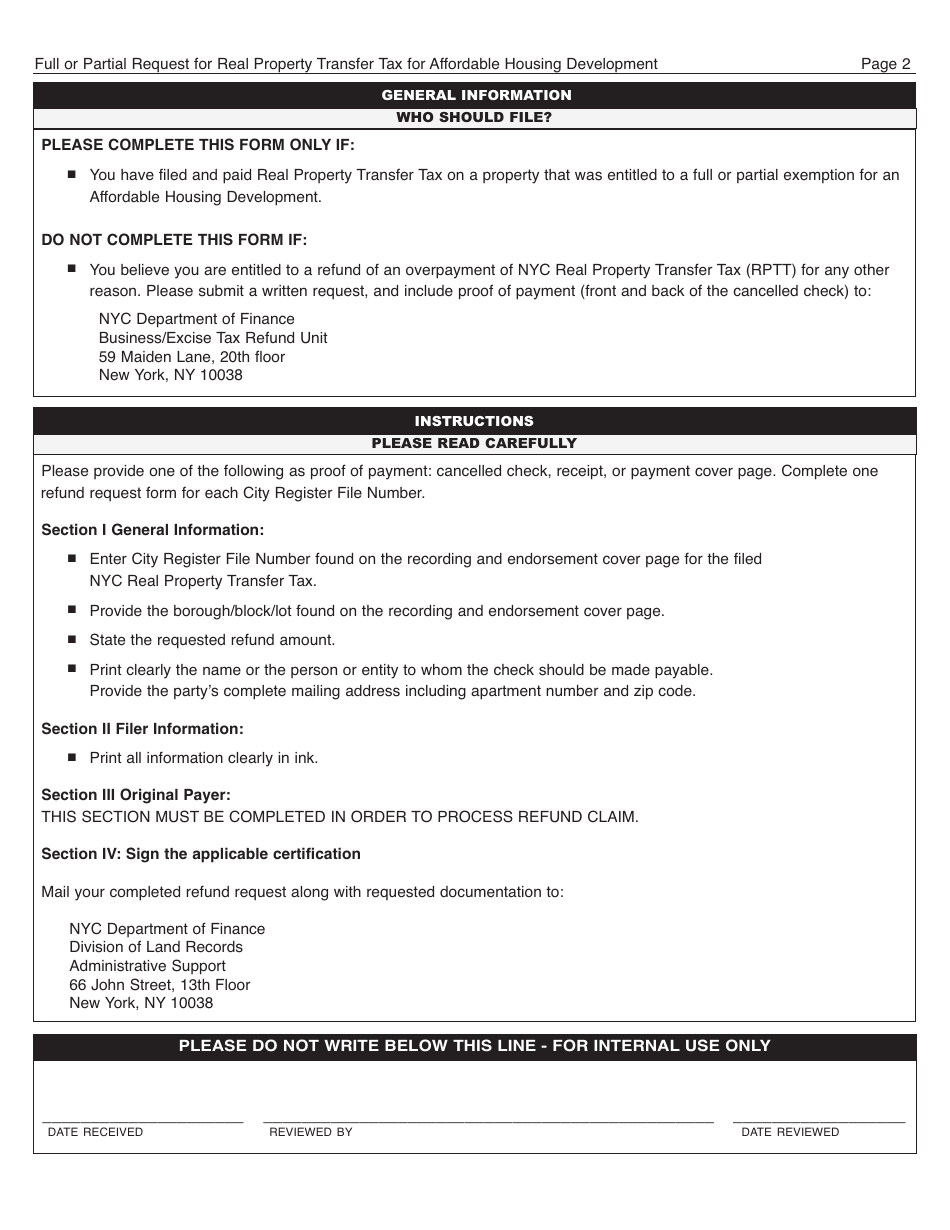

Q: Who can use LR-1123?

A: LR-1123 can be used by developers of affordable housing projects in New York City.

Q: What does LR-1123 allow for?

A: LR-1123 allows developers to request a refund of the Real Property Transfer Tax paid for the affordable housing development.

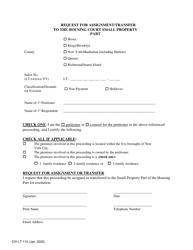

Q: What should be included in the LR-1123 form?

A: The LR-1123 form should include information about the affordable housing development and the amount of Real Property Transfer Tax paid.

Q: Is LR-1123 applicable for all real property transfers in New York City?

A: No, LR-1123 is specifically for affordable housing developments.

Q: Is there a deadline for submitting the LR-1123 form?

A: Yes, the LR-1123 form must be submitted within four years from the date of the real property transfer.

Q: What is the purpose of the refund request?

A: The purpose of the refund request is to provide financial incentives for developers to create and maintain affordable housing in New York City.

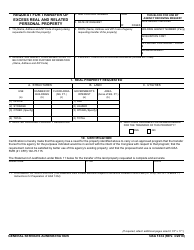

Q: Are there any eligibility criteria for obtaining a refund?

A: Yes, there are specific eligibility criteria that must be met to obtain a refund, such as income restrictions for tenants and compliance with affordable housing requirements.

Form Details:

- Released on November 23, 2016;

- The latest edition provided by the New York City Department of Finance;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form LR-1123 by clicking the link below or browse more documents and templates provided by the New York City Department of Finance.