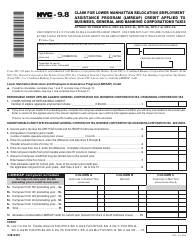

This version of the form is not currently in use and is provided for reference only. Download this version of

Form REAP-SEB

for the current year.

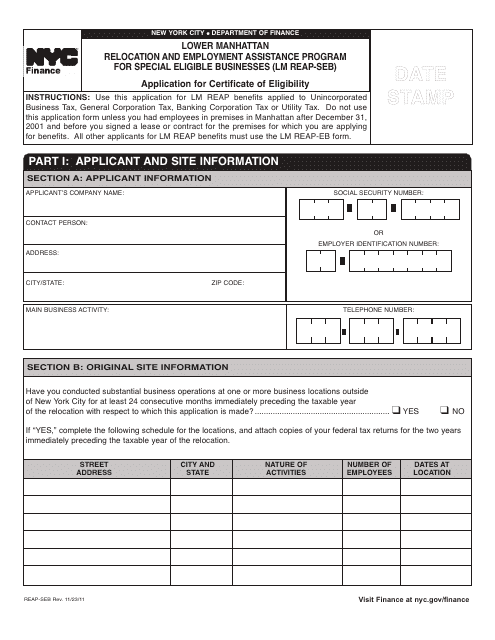

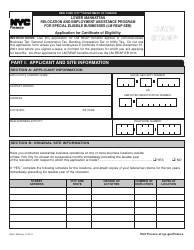

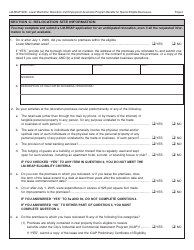

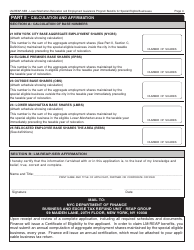

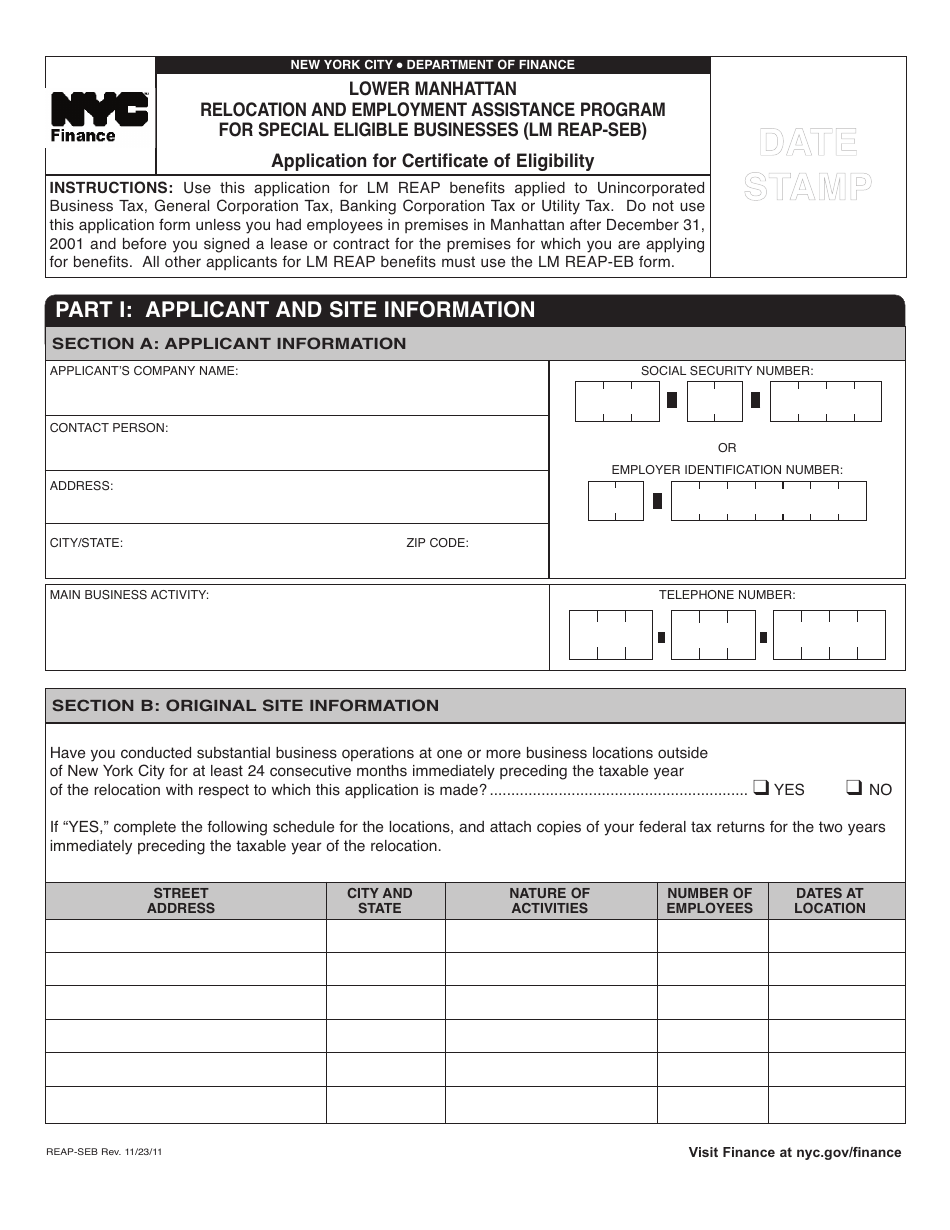

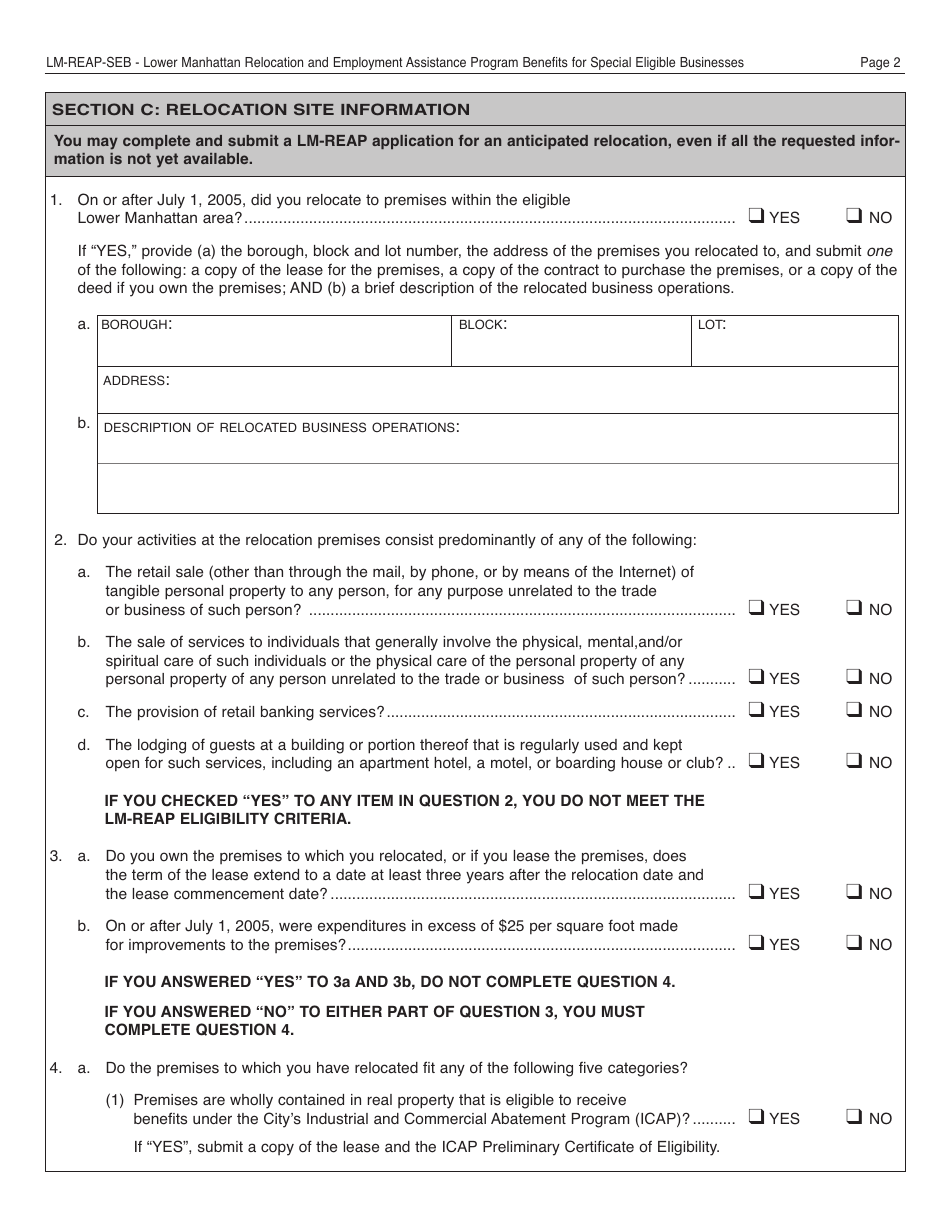

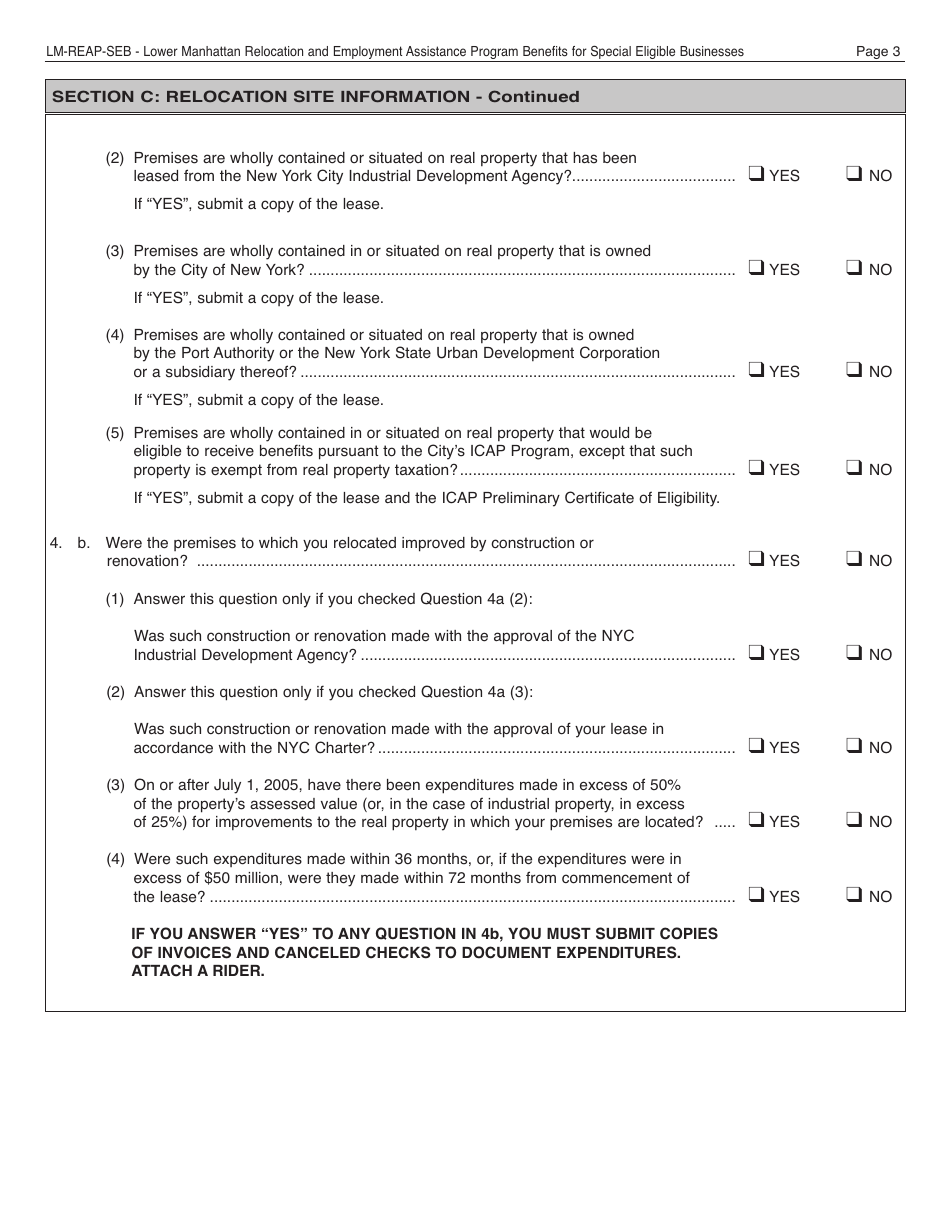

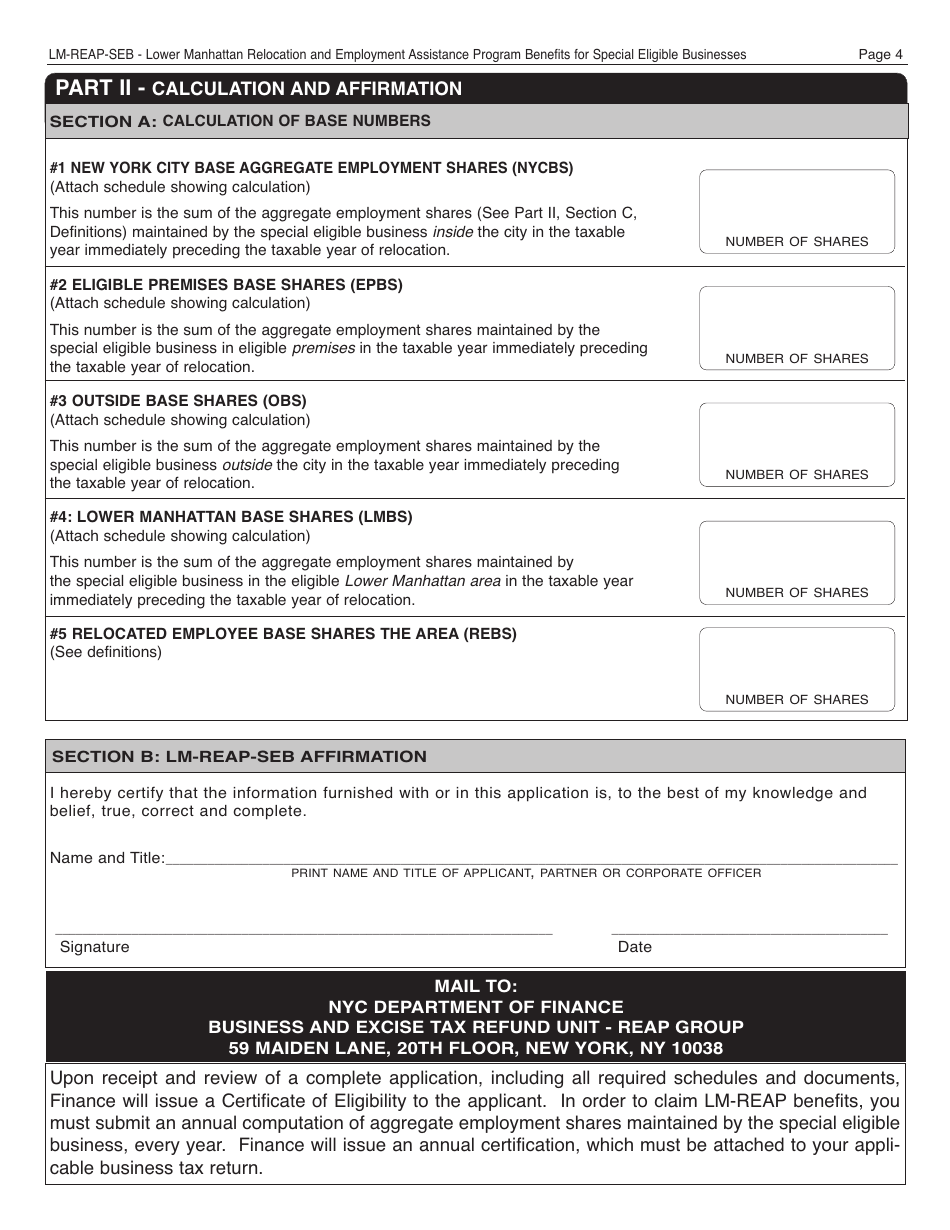

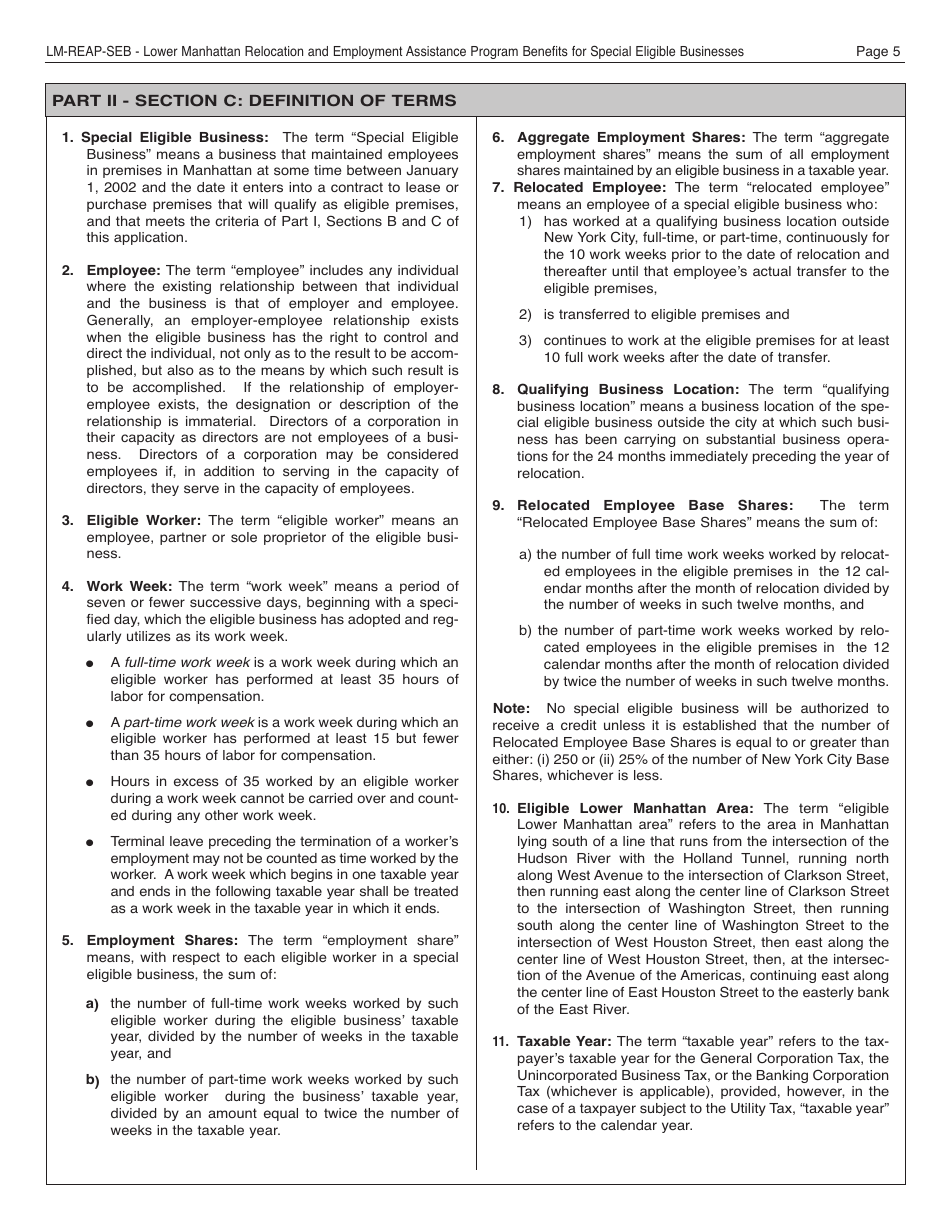

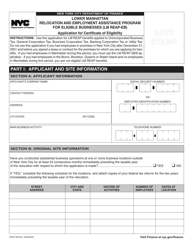

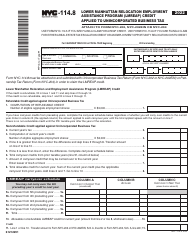

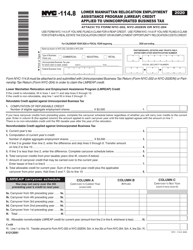

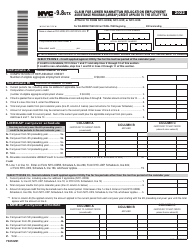

Form REAP-SEB Lower Manhattan Relocation and Employment Assistance Program Benefits for Special Eligible Businesses - New York City

What Is Form REAP-SEB?

This is a legal form that was released by the New York City Department of Finance - a government authority operating within New York City. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is the REAP-SEB Lower Manhattan Relocation and Employment Assistance Program?

A: The REAP-SEB program is a relocation and employment assistance program for special eligible businesses in Lower Manhattan, New York City.

Q: Who is eligible for the REAP-SEB program?

A: Special eligible businesses in Lower Manhattan are eligible for the REAP-SEB program.

Q: What benefits does the REAP-SEB program provide?

A: The REAP-SEB program provides various benefits, such as financial assistance for relocation, employment assistance services, and tax incentives.

Q: How can businesses apply for the REAP-SEB program?

A: Businesses can apply for the REAP-SEB program by contacting the relevant authorities or agencies in Lower Manhattan, New York City.

Form Details:

- Released on November 23, 2011;

- The latest edition provided by the New York City Department of Finance;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form REAP-SEB by clicking the link below or browse more documents and templates provided by the New York City Department of Finance.