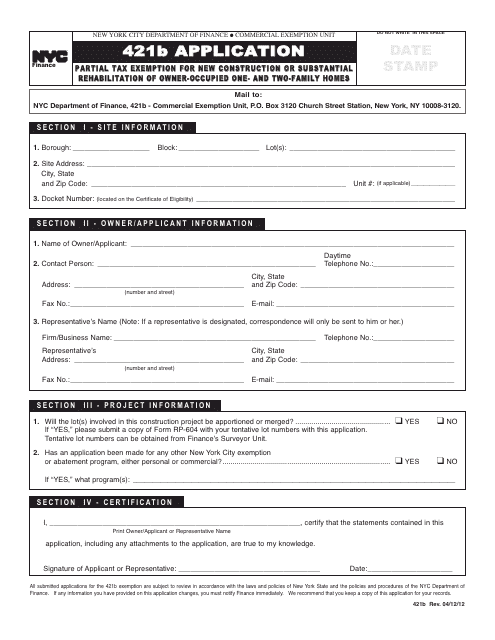

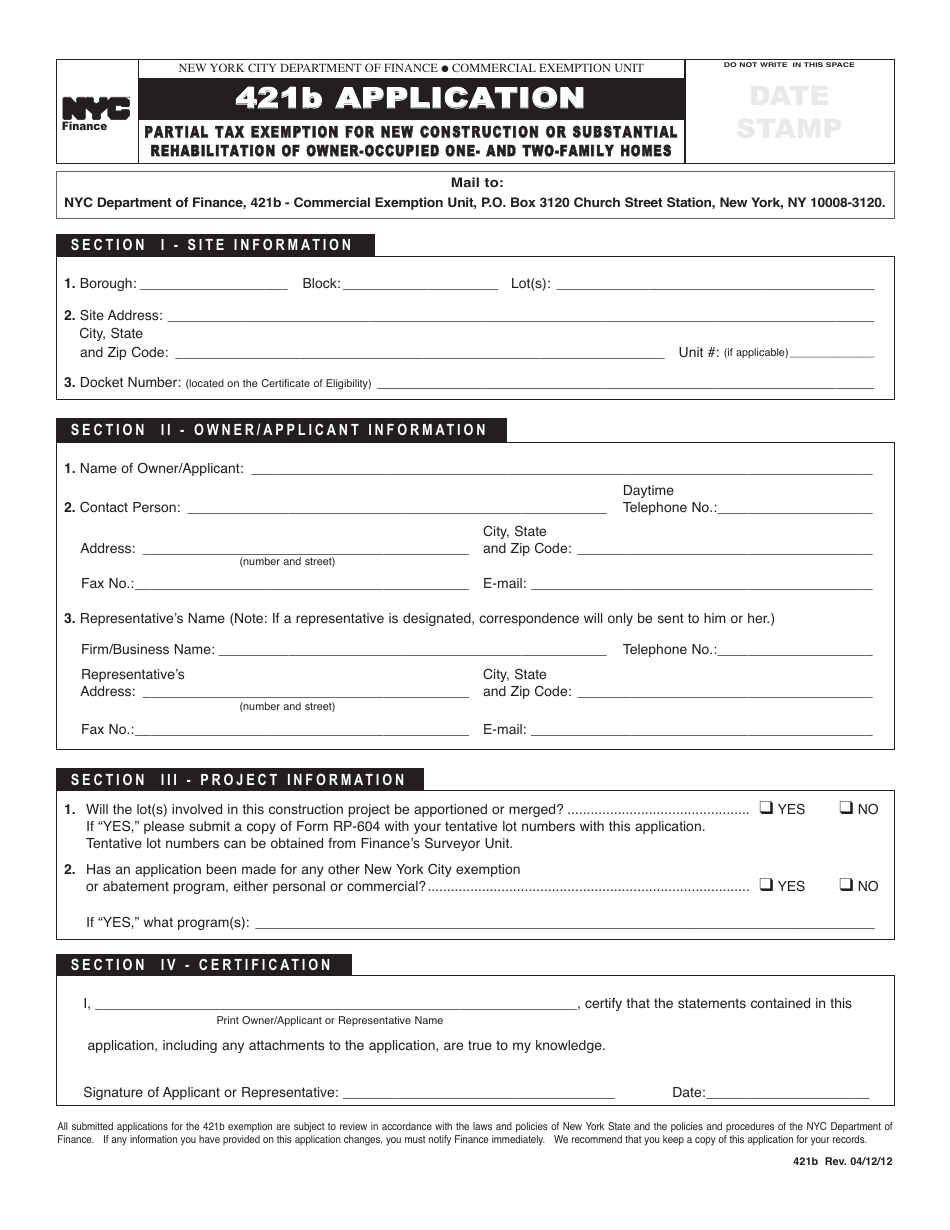

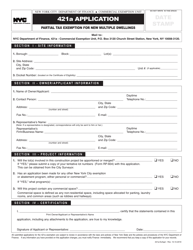

Form 421B Application for Partial Tax Exemption for New Construction or Substantial Rehabilitation of Owner-Occupied One- and Two-Family Homes - New York City

What Is Form 421B?

This is a legal form that was released by the New York City Department of Finance - a government authority operating within New York City. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 421B?

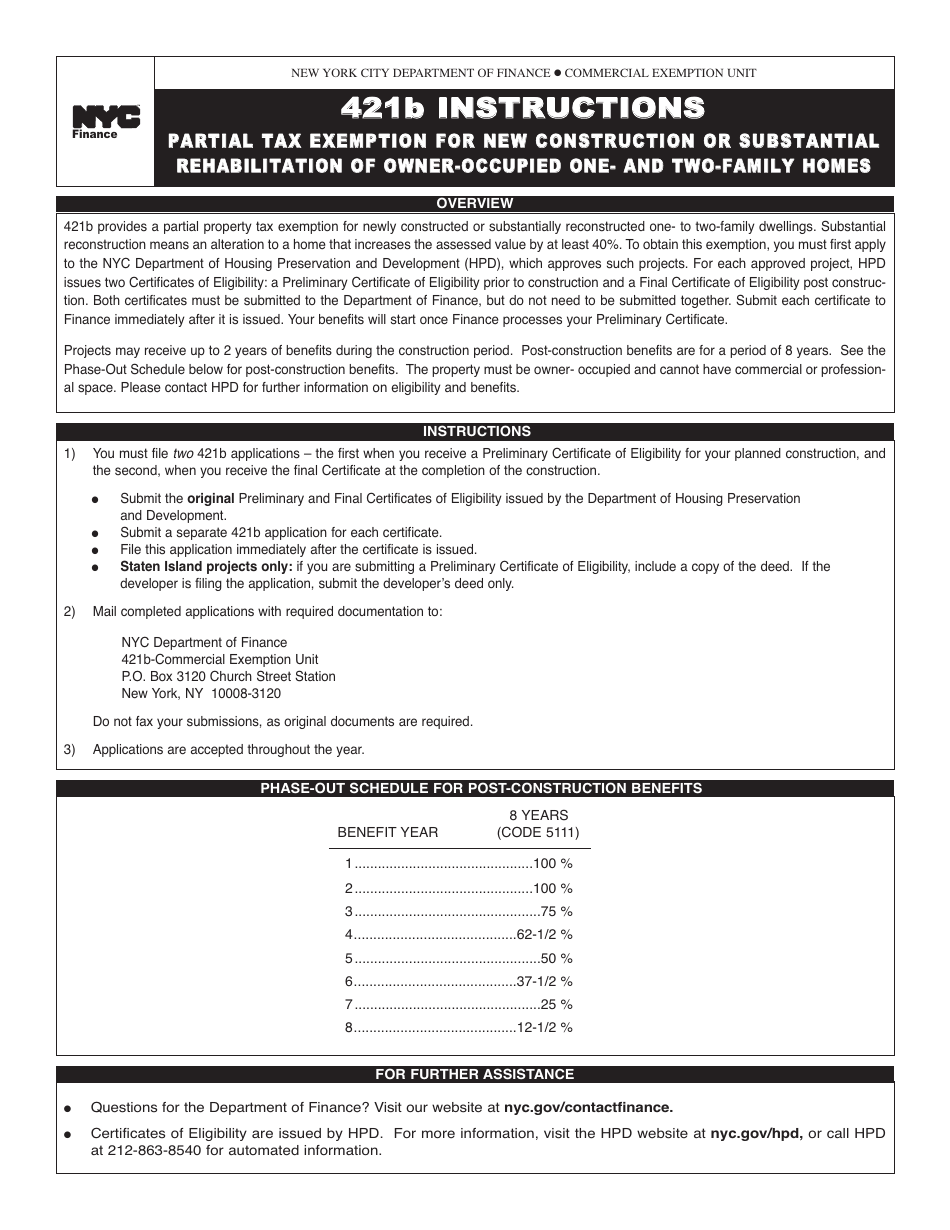

A: Form 421B is an application for partial tax exemption for new construction or substantial rehabilitation of owner-occupied one- and two-family homes in New York City.

Q: Who can apply for the tax exemption?

A: Owners of one- and two-family homes in New York City who are also occupying the property as their primary residence can apply for the tax exemption.

Q: What is the purpose of this exemption?

A: The purpose of this exemption is to provide financial relief to homeowners who have made significant improvements to their property.

Q: What does 'partial tax exemption' mean?

A: 'Partial tax exemption' means that the homeowner will only have to pay a reduced amount of property taxes based on the assessed value of their home after the improvements.

Form Details:

- Released on April 12, 2012;

- The latest edition provided by the New York City Department of Finance;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form 421B by clicking the link below or browse more documents and templates provided by the New York City Department of Finance.