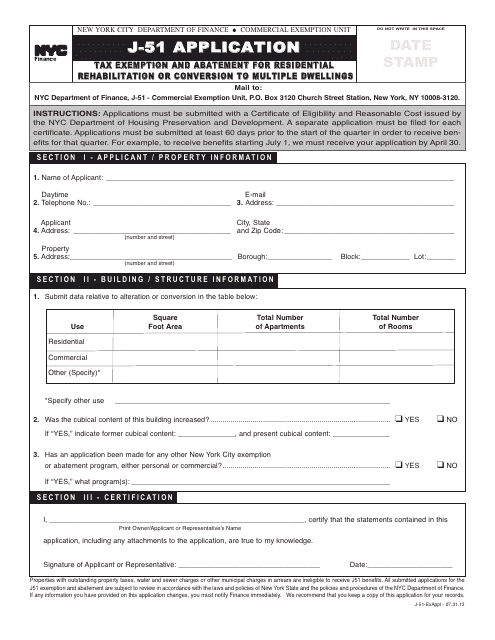

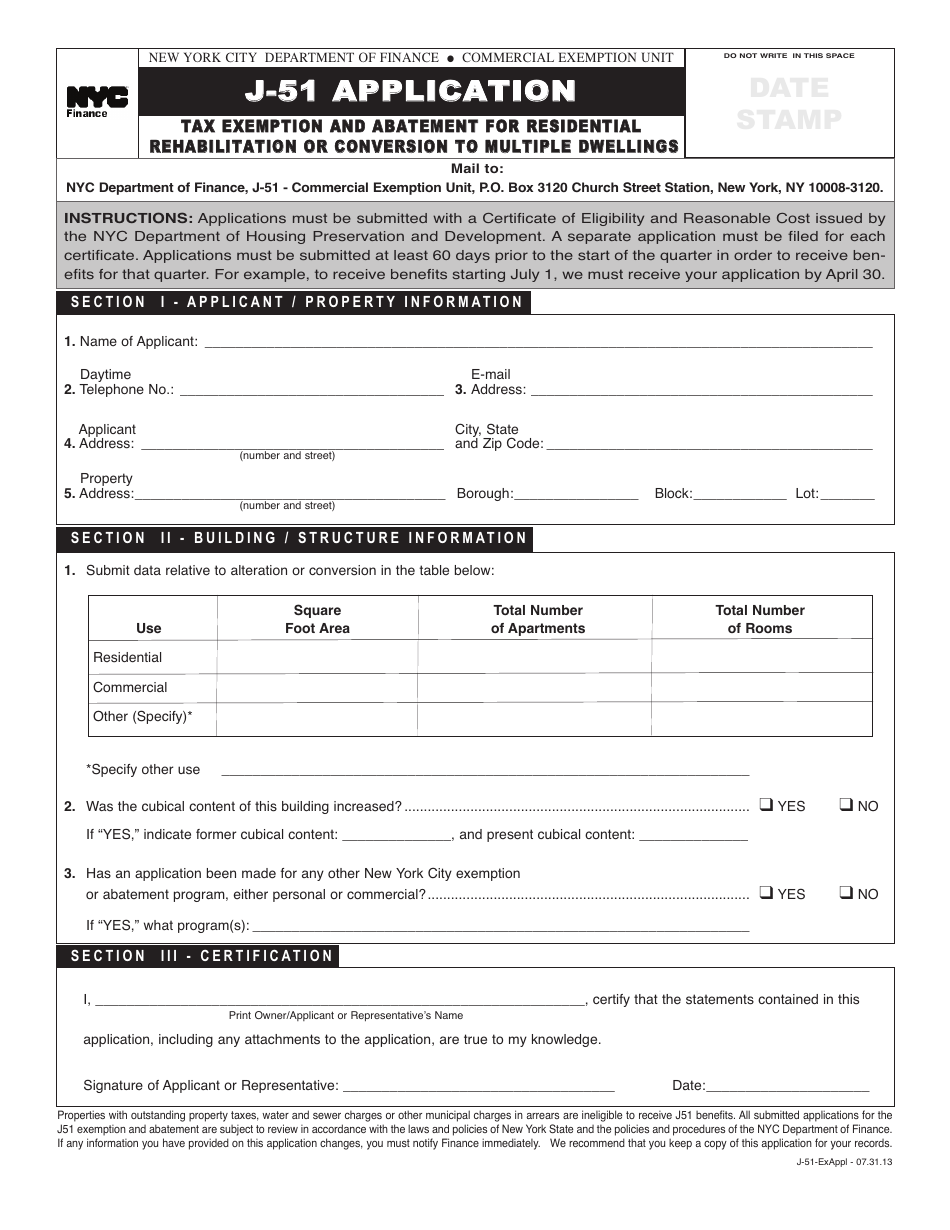

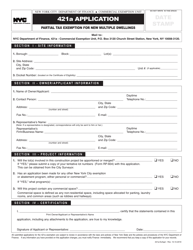

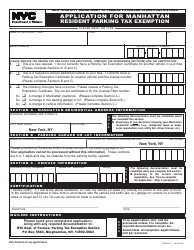

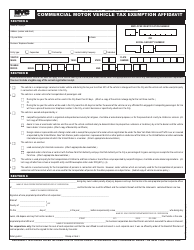

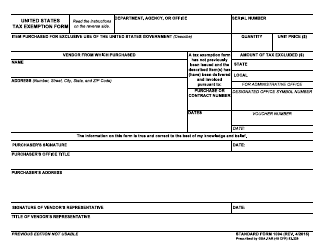

Form J-51 Tax Exemption and Abatement for Residential Rehabilitation or Conversion to Multiple Dwellings Application - New York City

What Is Form J-51?

This is a legal form that was released by the New York City Department of Finance - a government authority operating within New York City. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is the Form J-51 Tax Exemption and Abatement?

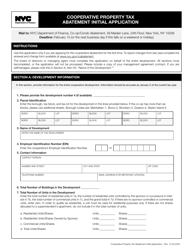

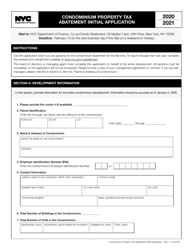

A: The Form J-51 Tax Exemption and Abatement is a program offered in New York City that provides tax benefits for residential rehabilitation or conversion to multiple dwellings.

Q: Who is eligible for the Form J-51 Tax Exemption and Abatement?

A: Property owners in New York City who are rehabilitating or converting residential buildings into multiple dwellings may be eligible for the Form J-51 Tax Exemption and Abatement.

Q: What are the benefits of the Form J-51 Tax Exemption and Abatement?

A: The benefits of the Form J-51 Tax Exemption and Abatement include tax exemptions and abatements, which can help reduce the property owner's tax liability.

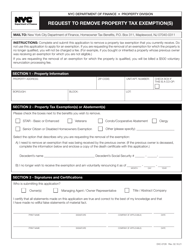

Q: How do I apply for the Form J-51 Tax Exemption and Abatement?

A: To apply for the Form J-51 Tax Exemption and Abatement, property owners must submit the application form, along with supporting documentation, to the New York City Department of Housing Preservation and Development.

Q: Are there any deadlines for applying for the Form J-51 Tax Exemption and Abatement?

A: Yes, there are deadlines for applying for the Form J-51 Tax Exemption and Abatement. Property owners must submit their applications within 60 days of commencing work on the rehabilitation or conversion project.

Form Details:

- Released on July 31, 2013;

- The latest edition provided by the New York City Department of Finance;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form J-51 by clicking the link below or browse more documents and templates provided by the New York City Department of Finance.