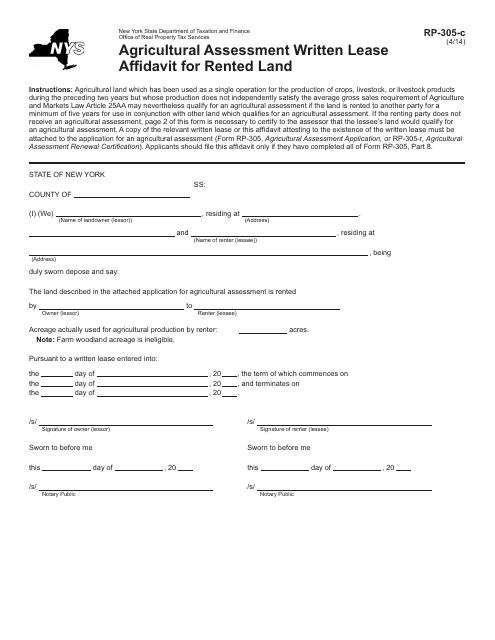

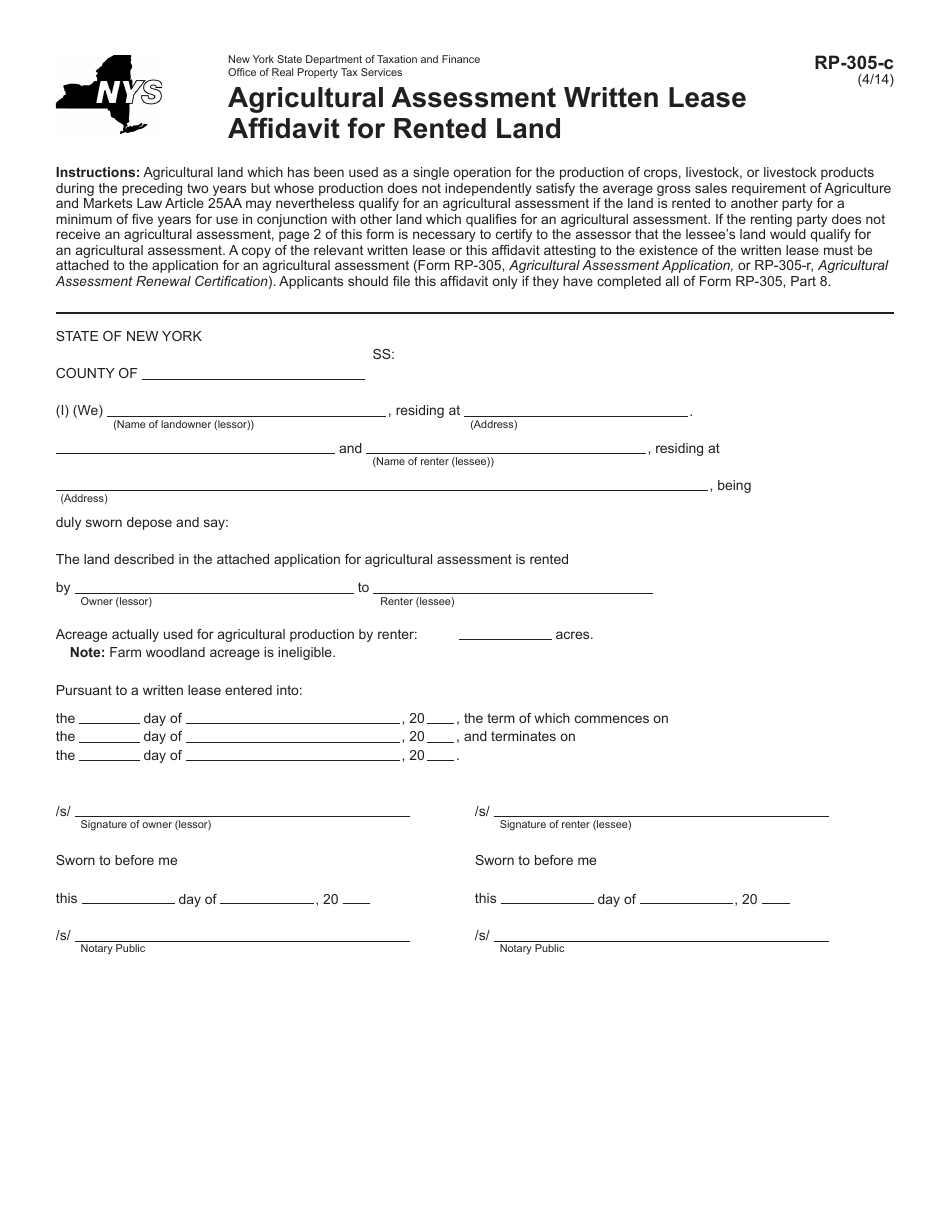

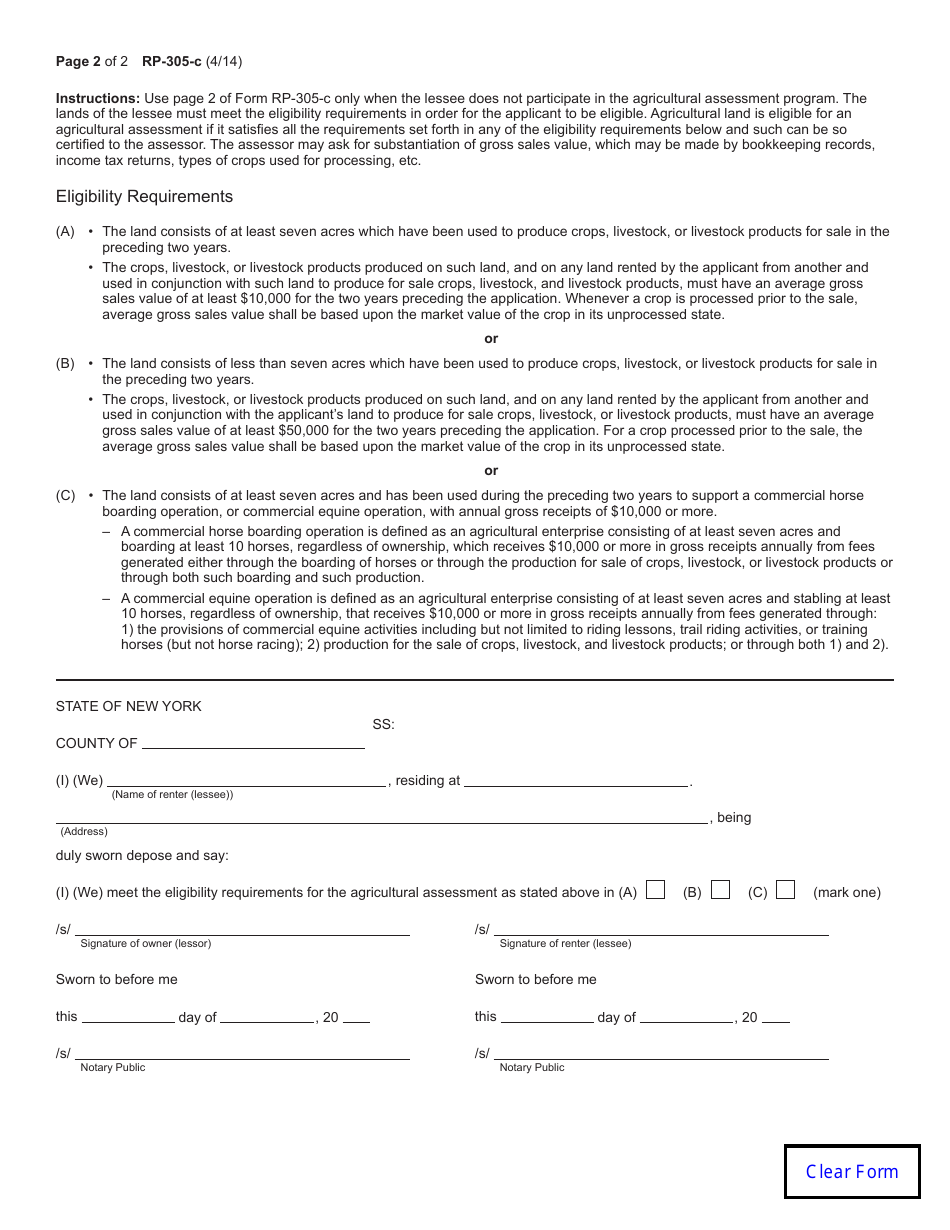

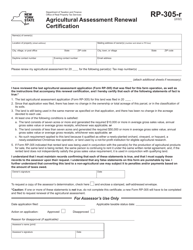

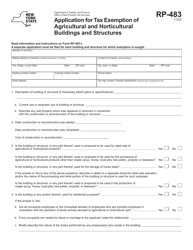

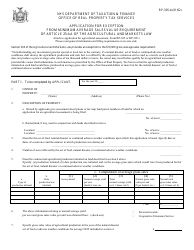

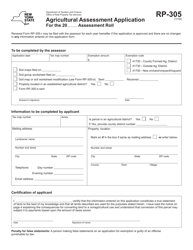

Form RP-305-C Agricultural Assessment - Written Lease Affidavit for Rented Land - New York

What Is Form RP-305-C?

This is a legal form that was released by the New York State Department of Taxation and Finance - a government authority operating within New York. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is the Form RP-305-C?

A: Form RP-305-C is the Agricultural Assessment - Written Lease Affidavit for Rented Land form in New York.

Q: What is the purpose of Form RP-305-C?

A: The purpose of Form RP-305-C is to establish the eligibility for agricultural assessment of leased land.

Q: Who needs to fill out Form RP-305-C?

A: Both the landowner and the tenant must fill out Form RP-305-C.

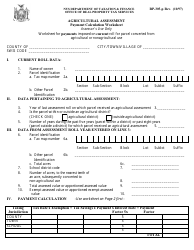

Q: What is agricultural assessment?

A: Agricultural assessment is a reduced property tax assessment for eligible agricultural land.

Q: What information is required on Form RP-305-C?

A: Form RP-305-C requires information about the leased land, the lease agreement, and both the landowner and tenant's information.

Q: Is there a fee to file Form RP-305-C?

A: There is no fee to file Form RP-305-C, but you may be required to pay a filing fee if submitting it in person.

Q: Are there any deadlines for submitting Form RP-305-C?

A: Yes, Form RP-305-C must be filed with the assessor on or before March 1st of the tax year for which the agricultural assessment is sought.

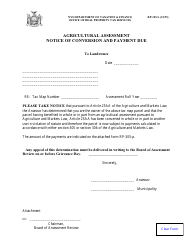

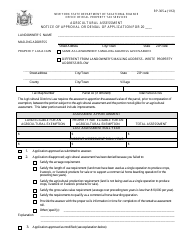

Q: What happens after submitting Form RP-305-C?

A: After submitting Form RP-305-C, the assessor will review the information provided and determine the eligibility for agricultural assessment for the leased land.

Form Details:

- Released on April 1, 2014;

- The latest edition provided by the New York State Department of Taxation and Finance;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form RP-305-C by clicking the link below or browse more documents and templates provided by the New York State Department of Taxation and Finance.