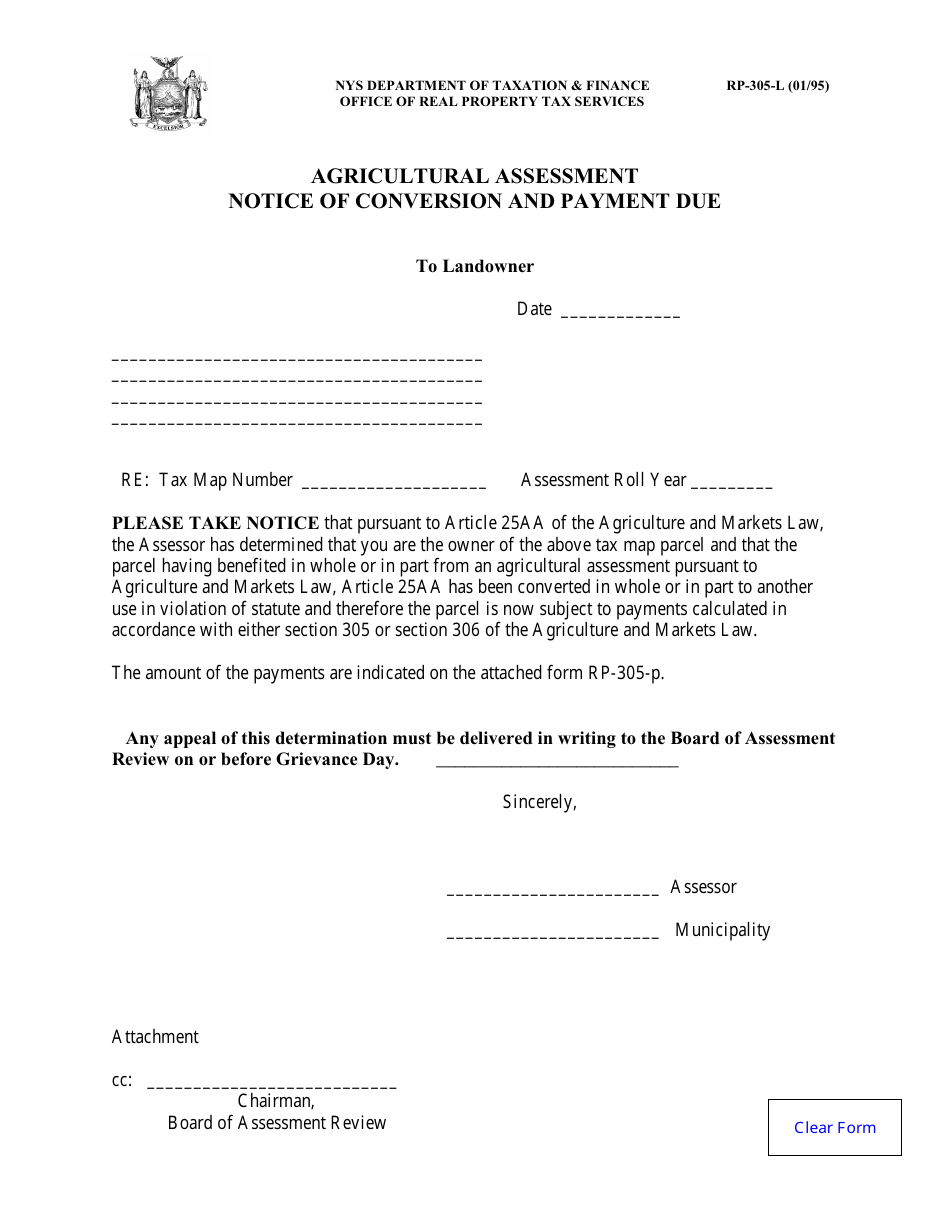

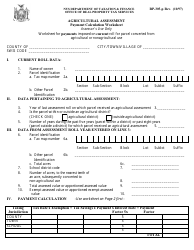

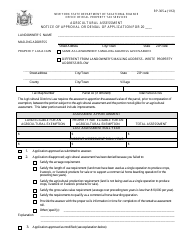

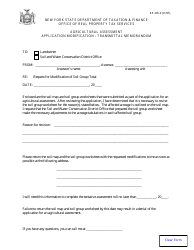

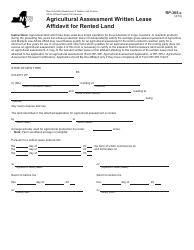

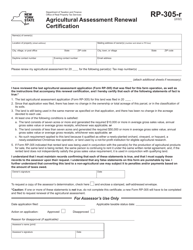

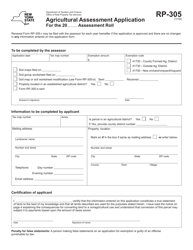

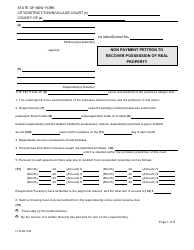

Form RP-305-L Agricultural Assessment - Notice of Conversion and Payment Due - New York

What Is Form RP-305-L?

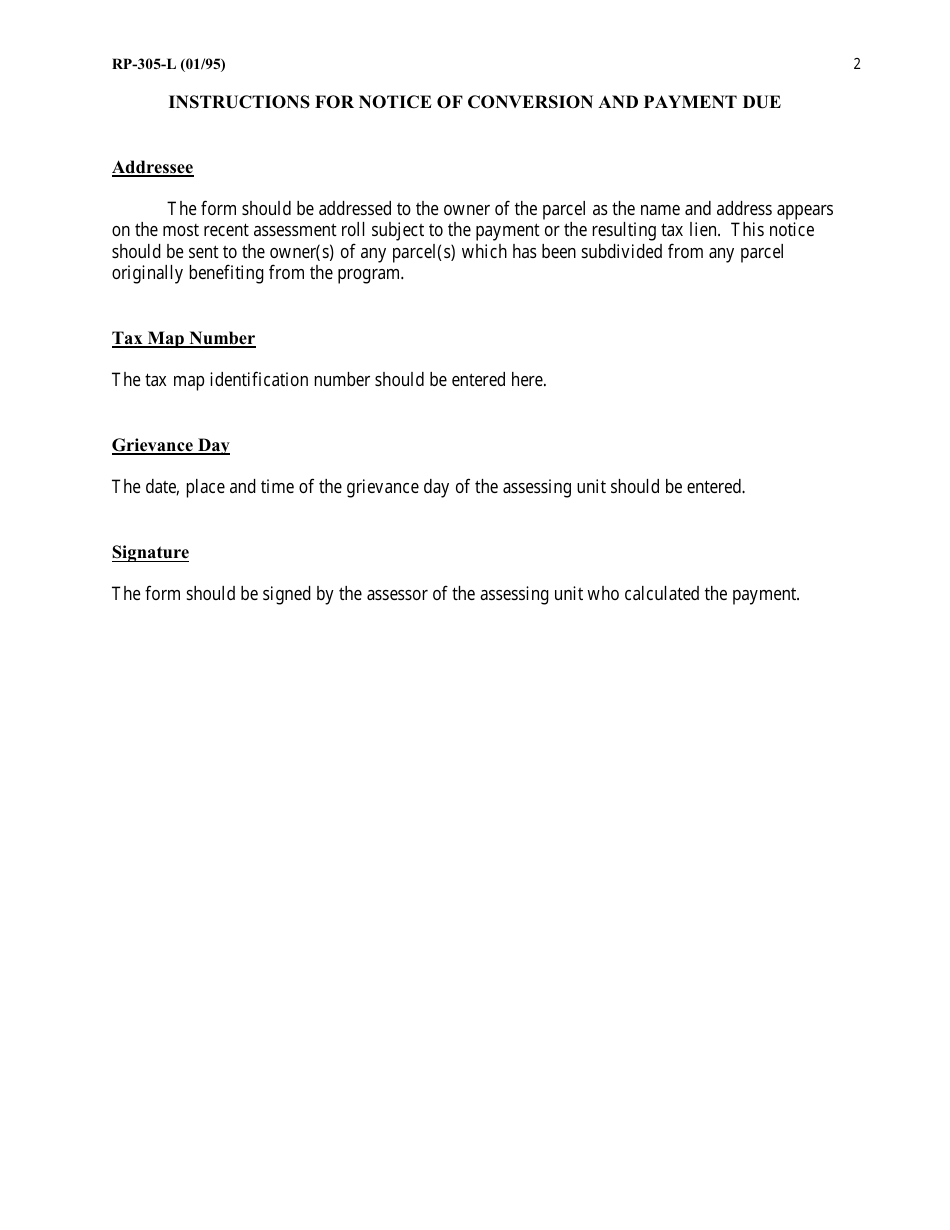

This is a legal form that was released by the New York State Department of Taxation and Finance - a government authority operating within New York. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is RP-305-L?

A: RP-305-L is a specific form used in New York for Agricultural Assessment purposes.

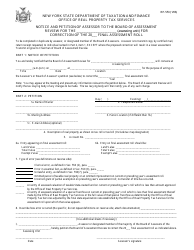

Q: What is the purpose of RP-305-L?

A: The purpose of RP-305-L is to notify property owners of the conversion of land from agricultural use and the payment due.

Q: Who uses RP-305-L?

A: RP-305-L is used by property owners in New York who have land that was previously classified for agricultural assessment.

Q: What does RP-305-L notify property owners about?

A: RP-305-L notifies property owners about the conversion of their land from agricultural use and the payment due as a result.

Q: Is RP-305-L specific to any state?

A: Yes, RP-305-L is specific to New York.

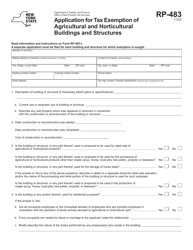

Q: What is Agricultural Assessment?

A: Agricultural Assessment is a program in New York that provides property tax benefits for eligible agricultural lands.

Form Details:

- Released on January 1, 1995;

- The latest edition provided by the New York State Department of Taxation and Finance;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form RP-305-L by clicking the link below or browse more documents and templates provided by the New York State Department of Taxation and Finance.