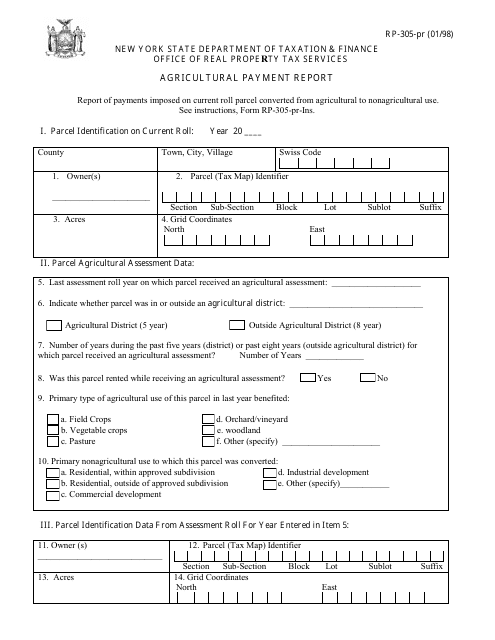

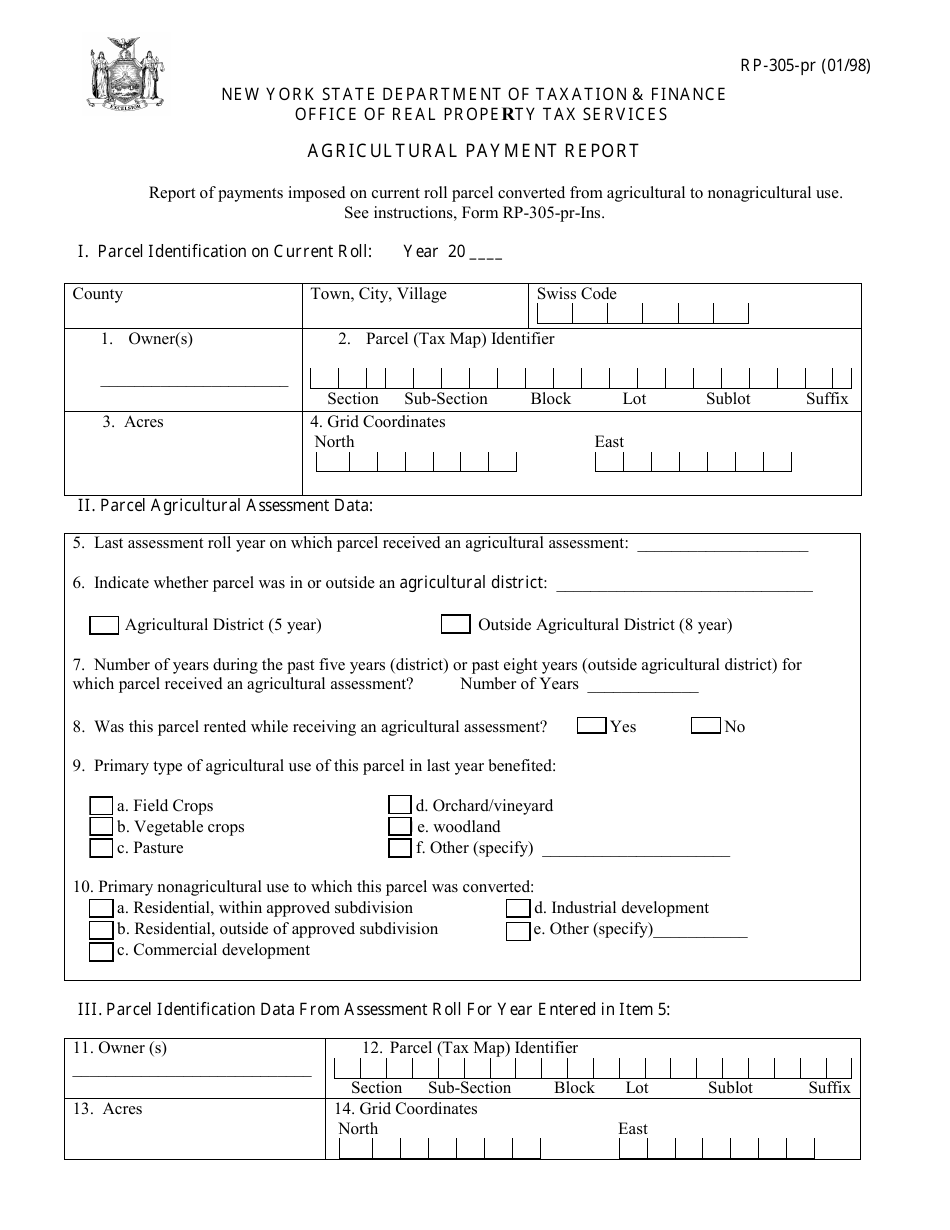

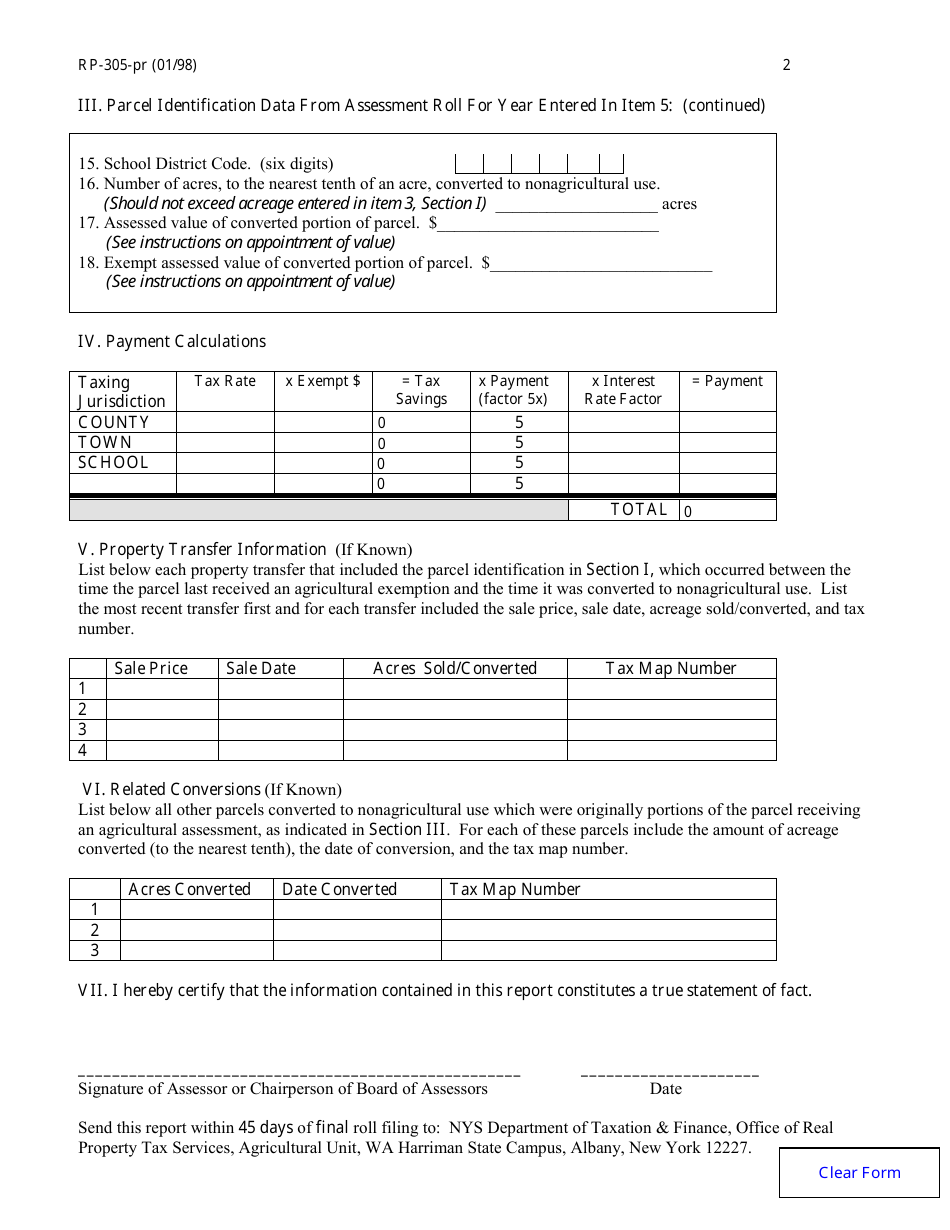

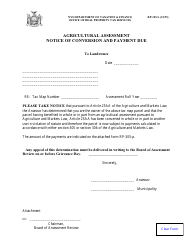

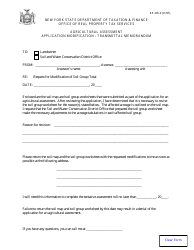

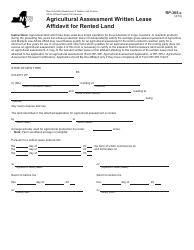

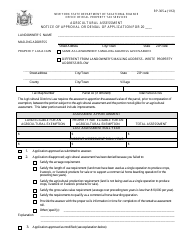

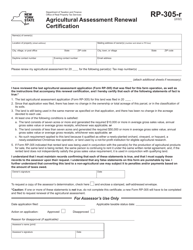

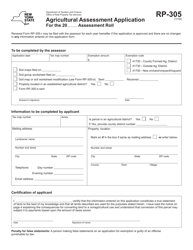

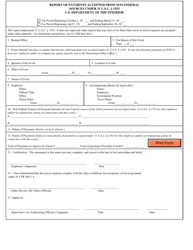

Form RP-305-PR Agricultural Payment Report - New York

What Is Form RP-305-PR?

This is a legal form that was released by the New York State Department of Taxation and Finance - a government authority operating within New York. Check the official instructions before completing and submitting the form.

FAQ

Q: What is Form RP-305-PR?

A: Form RP-305-PR is the Agricultural Payment Report.

Q: What is the purpose of Form RP-305-PR?

A: The purpose of Form RP-305-PR is to report agricultural payments.

Q: Who needs to file Form RP-305-PR?

A: Farmers and agricultural businesses in New York need to file Form RP-305-PR.

Q: What information is required on Form RP-305-PR?

A: Form RP-305-PR requires information such as the type and amount of agricultural payments received.

Q: When is Form RP-305-PR due?

A: Form RP-305-PR is due by March 1st each year.

Q: Is there a penalty for not filing Form RP-305-PR?

A: Yes, failing to file Form RP-305-PR may result in penalties and interest.

Q: What should I do if I made a mistake on Form RP-305-PR?

A: If you made a mistake on Form RP-305-PR, you should contact the New York State Department of Taxation and Finance to request a correction.

Q: Are there any exemptions or deductions available for agricultural payments?

A: Yes, there may be exemptions or deductions available for agricultural payments. You should consult the instructions for Form RP-305-PR or contact the New York State Department of Taxation and Finance for more information.

Form Details:

- Released on January 1, 1998;

- The latest edition provided by the New York State Department of Taxation and Finance;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form RP-305-PR by clicking the link below or browse more documents and templates provided by the New York State Department of Taxation and Finance.