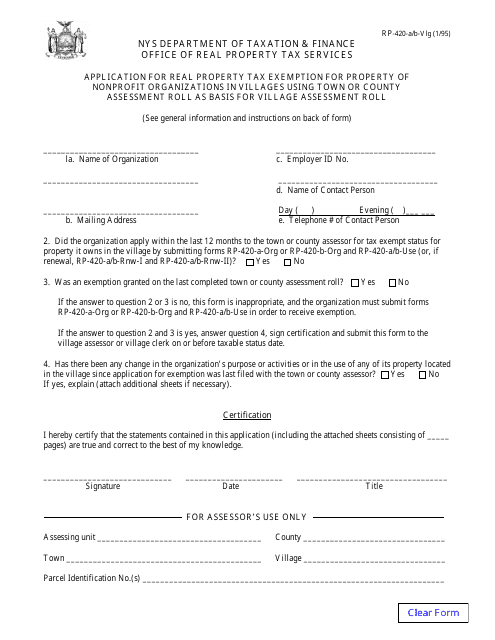

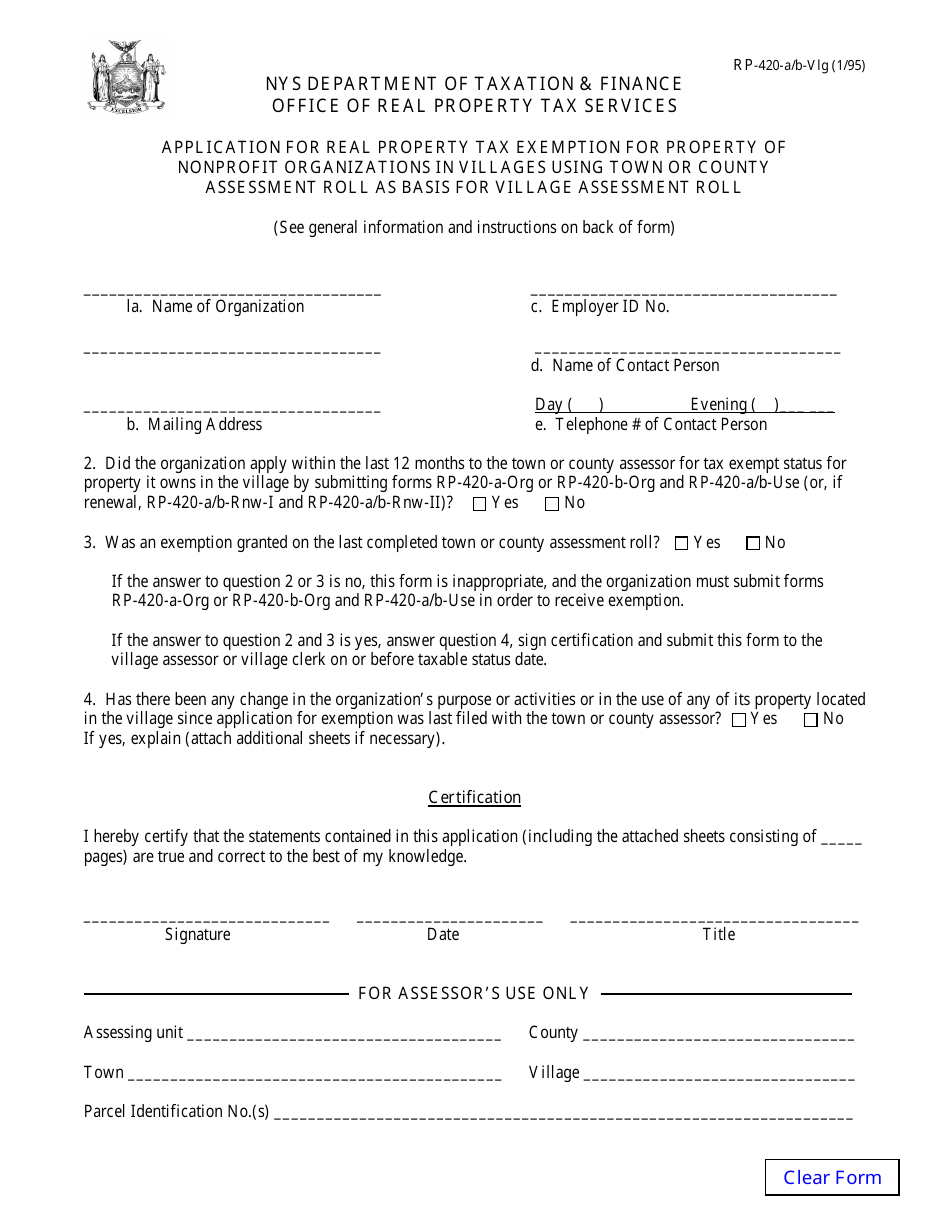

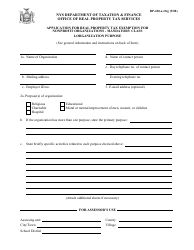

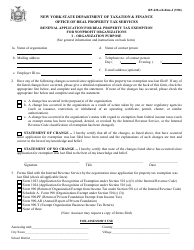

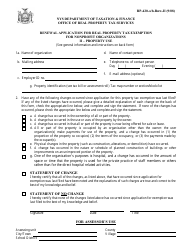

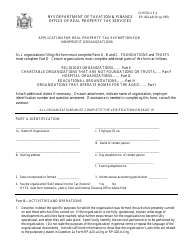

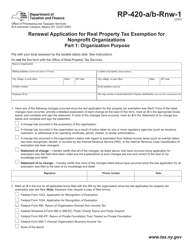

Form RP-420-A / B-VLG Application for Real Property Tax Exemption for Property of Nonprofit Organizations in Villages Using Town or County Assessment Roll as Basis for Village Assessment Roll - New York

What Is Form RP-420-A/B-VLG?

This is a legal form that was released by the New York State Department of Taxation and Finance - a government authority operating within New York. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form RP-420-A/B-VLG?

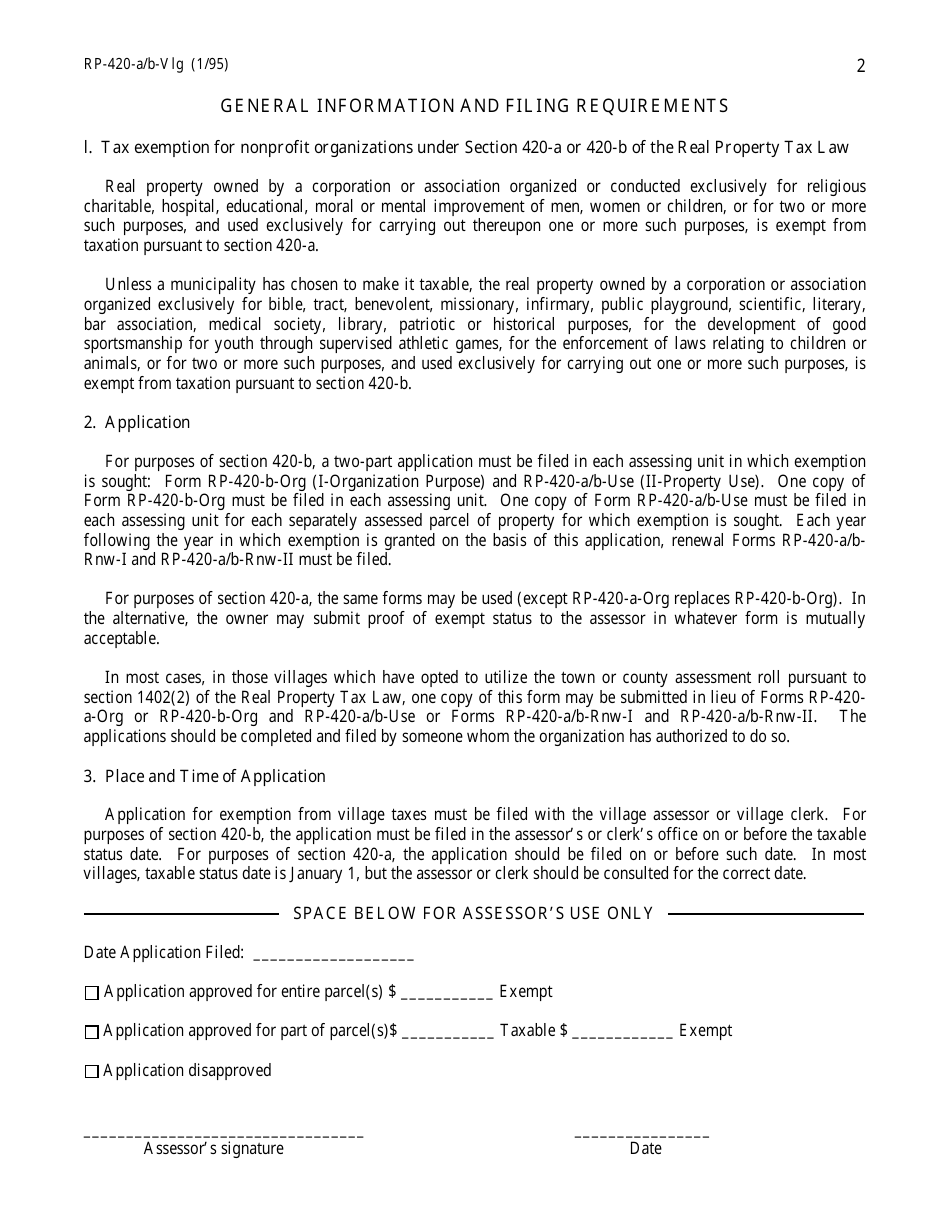

A: Form RP-420-A/B-VLG is an application for real property tax exemption for property owned by nonprofit organizations in villages in New York.

Q: Who can use Form RP-420-A/B-VLG?

A: Nonprofit organizations in villages can use Form RP-420-A/B-VLG to apply for a real property tax exemption.

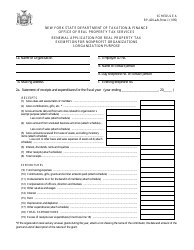

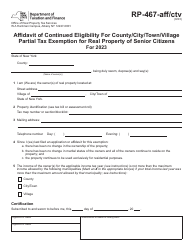

Q: What is the purpose of the application?

A: The application is used to request a tax exemption for qualifying nonprofit organization properties in villages.

Q: What is the assessment roll used for?

A: The assessment roll is used as a basis for determining the value of the property for tax purposes.

Form Details:

- Released on January 1, 1995;

- The latest edition provided by the New York State Department of Taxation and Finance;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form RP-420-A/B-VLG by clicking the link below or browse more documents and templates provided by the New York State Department of Taxation and Finance.