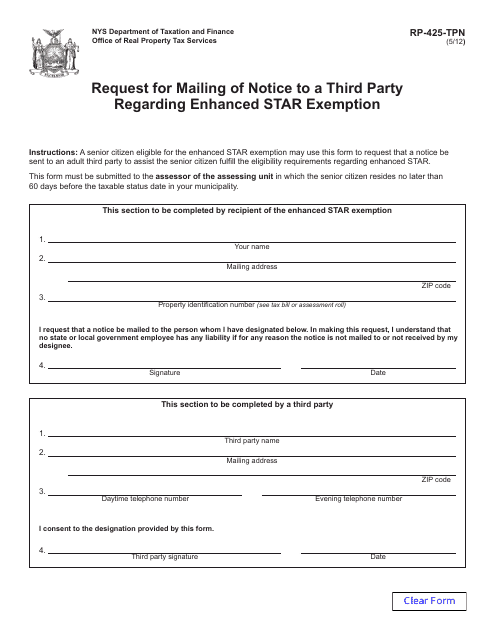

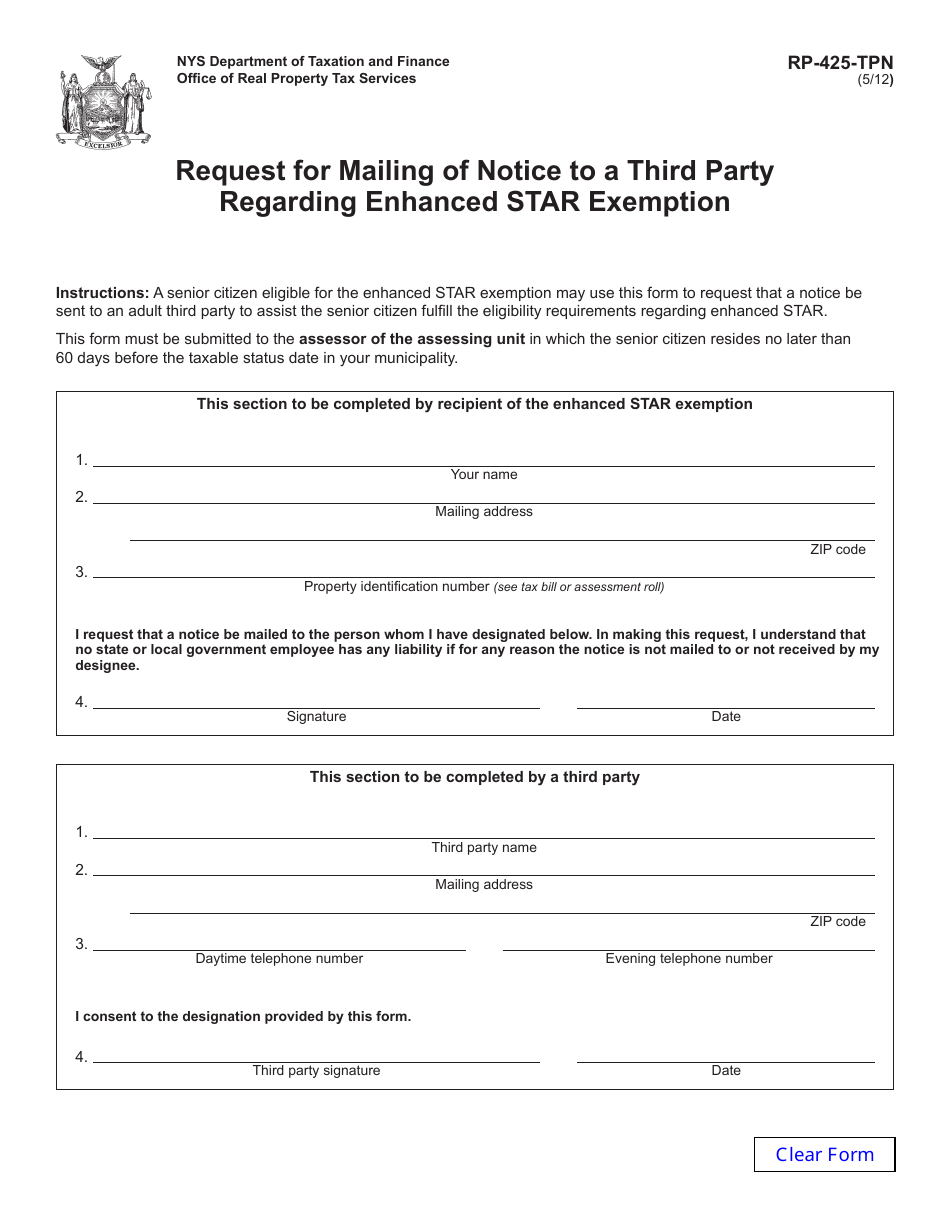

Form RP-425-TPN Request for Mailing of Notice to a Third Party Regarding Enhanced Star Exemption - New York

What Is Form RP-425-TPN?

This is a legal form that was released by the New York State Department of Taxation and Finance - a government authority operating within New York. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form RP-425-TPN?

A: Form RP-425-TPN is a request form for mailing a notice to a third party regarding Enhanced Star Exemption in New York.

Q: What is Enhanced Star Exemption?

A: Enhanced Star Exemption is a property tax exemption in New York State for senior citizens.

Q: Who can use Form RP-425-TPN?

A: Any individual in New York who wishes to request the mailing of a notice to a third party regarding their Enhanced Star Exemption can use Form RP-425-TPN.

Q: What is the purpose of mailing a notice to a third party?

A: Mailing a notice to a third party is done to inform them about the Enhanced Star Exemption and to verify the applicant's eligibility for the exemption.

Q: Is there a deadline for submitting Form RP-425-TPN?

A: Yes, the form should be submitted on or before the taxable status date of the applicable fiscal year, as specified by the local assessor.

Form Details:

- Released on May 1, 2012;

- The latest edition provided by the New York State Department of Taxation and Finance;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form RP-425-TPN by clicking the link below or browse more documents and templates provided by the New York State Department of Taxation and Finance.