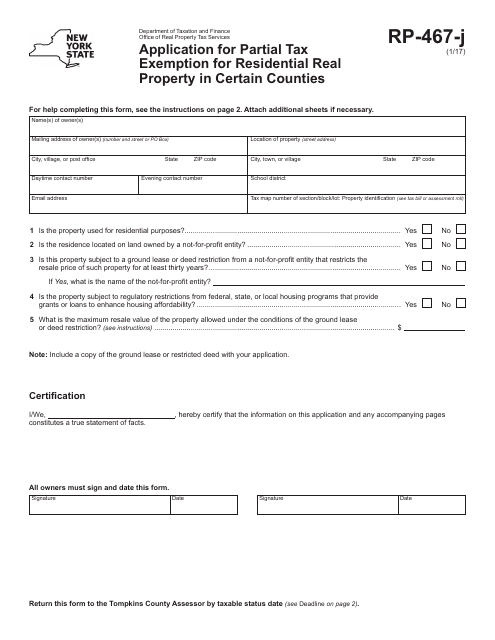

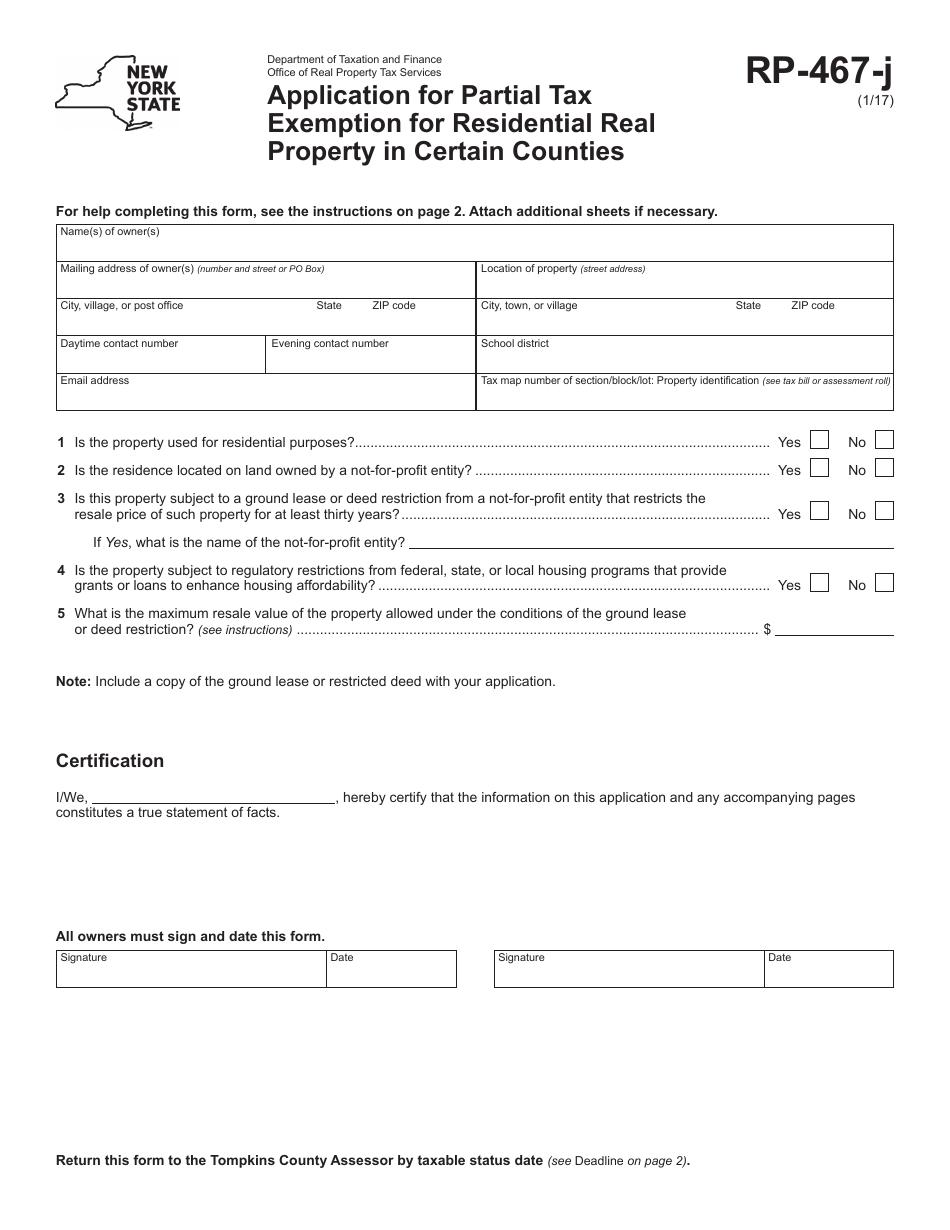

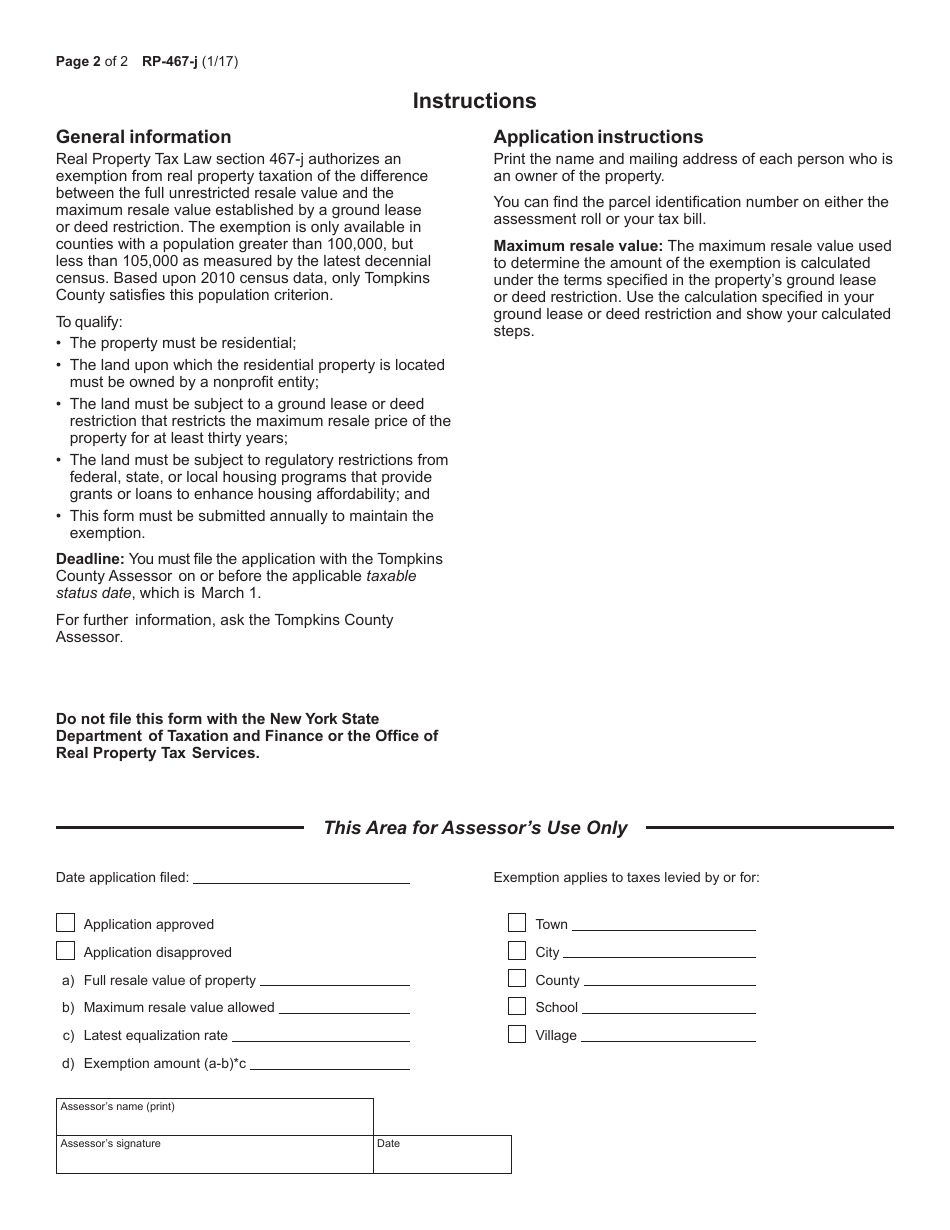

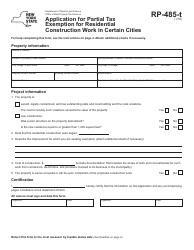

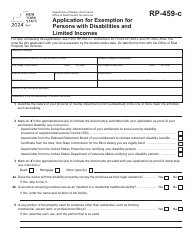

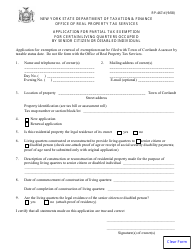

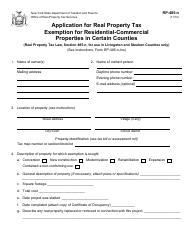

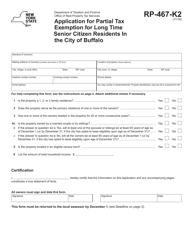

Form RP-467-J Application for Partial Tax Exemption for Residential Real Property in Certain Counties - New York

What Is Form RP-467-J?

This is a legal form that was released by the New York State Department of Taxation and Finance - a government authority operating within New York. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form RP-467-J?

A: Form RP-467-J is an application for a partial tax exemption for residential real property in certain counties in New York.

Q: Who can apply for the partial tax exemption?

A: Property owners who meet certain criteria in designated counties in New York can apply for the partial tax exemption.

Q: What is the purpose of the partial tax exemption?

A: The purpose of the partial tax exemption is to provide relief to eligible property owners by reducing their property tax burden.

Q: Which counties in New York are eligible for the partial tax exemption?

A: The eligible counties may vary, so it's important to refer to the specific requirements for each county.

Q: What documents do I need to submit with Form RP-467-J?

A: The specific documentation required may vary, but generally you will need to provide proof of ownership and other relevant information.

Q: Is there a deadline for submitting Form RP-467-J?

A: Yes, there is usually a deadline for submitting the application. It is important to check the deadlines for each county or consult with the local assessor's office.

Q: Who should I contact if I have questions about Form RP-467-J?

A: If you have questions about Form RP-467-J or the partial tax exemption, you should contact the local assessor's office or the county's Department of Taxation and Finance.

Form Details:

- Released on January 1, 2017;

- The latest edition provided by the New York State Department of Taxation and Finance;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form RP-467-J by clicking the link below or browse more documents and templates provided by the New York State Department of Taxation and Finance.

![Document preview: Form RP-485-I [ROME] Application for Residential Investment Real Property Tax Exemption; Certain Cities - New York](https://data.templateroller.com/pdf_docs_html/1733/17334/1733439/form-rp-485-i-rome-application-residential-investment-real-property-tax-exemption-certain-cities-new-york.png)

![Document preview: Form RP-485-M [ROME SD] Application for Residential Investment Real Property Tax Exemption; Certain School Districts - New York](https://data.templateroller.com/pdf_docs_html/1733/17339/1733929/form-rp-485-m-rome-sd-application-residential-investment-real-property-tax-exemption-certain-school-districts-new-york.png)

![Document preview: Form RP-485-K [UTICA SD] Application for Residential Investment Real Property Tax Exemption; Certain School Districts - City of Utica, New York](https://data.templateroller.com/pdf_docs_html/1349/13498/1349829/form-rp-485-k-utica-sd-application-for-residential-investment-real-property-tax-exemption-certain-school-districts-city-of-utica-new-york.png)