This version of the form is not currently in use and is provided for reference only. Download this version of

Form RP-483

for the current year.

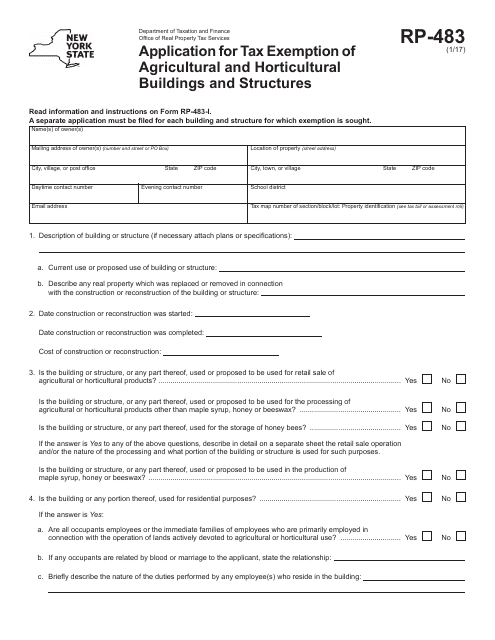

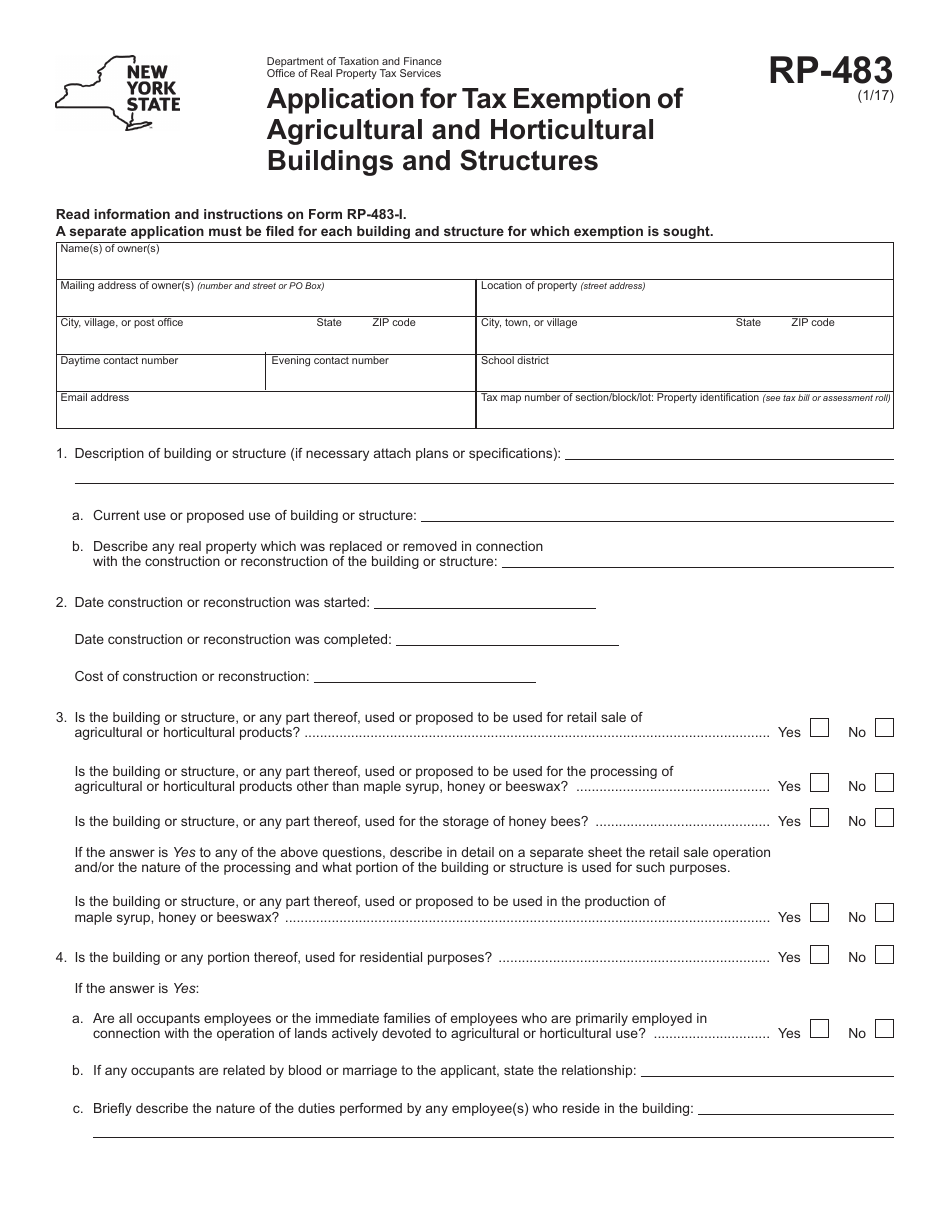

Form RP-483 Application for Tax Exemption of Agricultural and Horticultural Buildings and Structures - New York

What Is Form RP-483?

This is a legal form that was released by the New York State Department of Taxation and Finance - a government authority operating within New York. Check the official instructions before completing and submitting the form.

FAQ

Q: What is Form RP-483?

A: Form RP-483 is an application for tax exemption of agricultural and horticultural buildings and structures in New York.

Q: Who can use Form RP-483?

A: Farmers and horticulturists in New York can use Form RP-483 to apply for tax exemption on their agricultural and horticultural buildings and structures.

Q: What is the purpose of Form RP-483?

A: The purpose of Form RP-483 is to allow eligible agricultural and horticultural property owners to apply for tax exemption on their buildings and structures.

Q: How do I fill out Form RP-483?

A: You need to provide information about your property, including its location, size, and use. You will also need to provide supporting documentation to show that your property qualifies for tax exemption.

Q: Are there any deadlines for filing Form RP-483?

A: Yes, there are specific deadlines for filing Form RP-483. You should check with your local assessor's office or the New York State Department of Taxation and Finance for the current deadlines.

Q: What are the eligibility criteria for tax exemption on agricultural and horticultural buildings and structures?

A: To be eligible for tax exemption, your property must be used primarily for agricultural or horticultural purposes. The specific criteria may vary, so it is important to review the instructions and guidelines provided with Form RP-483.

Q: Will filing Form RP-483 guarantee tax exemption?

A: Filing Form RP-483 is the first step in the application process for tax exemption. The final determination of eligibility for tax exemption will be made by the local assessor or designated agency.

Q: Is there a fee for filing Form RP-483?

A: There is no fee associated with filing Form RP-483.

Q: What should I do if I have additional questions or need assistance with Form RP-483?

A: If you have additional questions or need assistance with Form RP-483, you can contact your local assessor's office or the New York State Department of Taxation and Finance for guidance.

Form Details:

- Released on January 1, 2017;

- The latest edition provided by the New York State Department of Taxation and Finance;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form RP-483 by clicking the link below or browse more documents and templates provided by the New York State Department of Taxation and Finance.

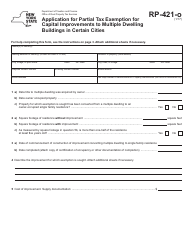

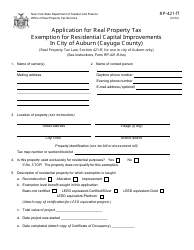

![Document preview: Form RP-421-J [COHOES] Application for Real Property Tax Exemption for Capital Improvements to Multiple Dwelling Buildings Within Certain Cities - City of Cohoes, New York](https://data.templateroller.com/pdf_docs_html/1349/13498/1349863/form-rp-421-j-cohoes-application-for-real-property-tax-exemption-for-capital-improvements-to-multiple-dwelling-buildings-within-certain-cities-city-of-cohoes-new-york.png)

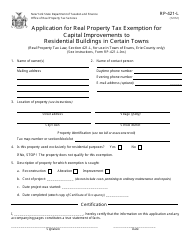

![Document preview: Form RP-421-I [ALBANY] Application for Real Property Tax Exemption for Capital Improvements to Multiple Dwelling Buildings Within Certain Cities - Albany, New York](https://data.templateroller.com/pdf_docs_html/1349/13498/1349867/form-rp-421-i-albany-application-for-real-property-tax-exemption-for-capital-improvements-to-multiple-dwelling-buildings-within-certain-cities-albany-new-york.png)

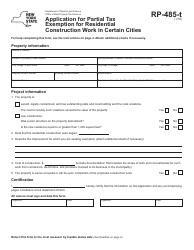

![Document preview: Form RP-421-N [ONEONTA] Application for Real Property Tax Exemption for Capital Improvements to Multiple Dwelling Buildings Within Certain Cities - City of Oneonta, New York](https://data.templateroller.com/pdf_docs_html/1349/13498/1349854/form-rp-421-n-oneonta-application-for-real-property-tax-exemption-for-capital-improvements-to-multiple-dwelling-buildings-within-certain-cities-city-of-oneonta-new-york.png)

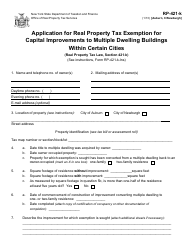

![Document preview: Form RP-421-I [BUFFALO] Application for Real Property Tax Exemption for Capital Improvements to Multiple Dwelling Buildings Within Certain Cities - City of Buffalo, New York](https://data.templateroller.com/pdf_docs_html/1349/13498/1349865/form-rp-421-i-buffalo-application-for-real-property-tax-exemption-for-capital-improvements-to-multiple-dwelling-buildings-within-certain-cities-city-of-buffalo-new-york.png)