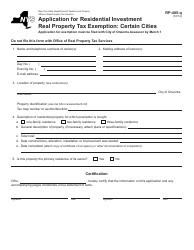

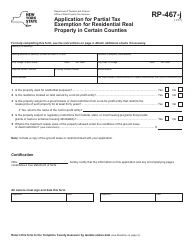

Form RP-485-K [UTICA SD] Application for Residential Investment Real Property Tax Exemption; Certain School Districts - City of Utica, New York

What Is Form RP-485-K [UTICA SD]?

This is a legal form that was released by the New York State Department of Taxation and Finance - a government authority operating within New York. The form may be used strictly within City of Utica. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form RP-485-K?

A: Form RP-485-K is an application for residential investmentreal property tax exemption in certain school districts.

Q: Who is eligible to fill out Form RP-485-K?

A: Property owners in the City of Utica, New York who are seeking a tax exemption for residential investment real property.

Q: What is the purpose of Form RP-485-K?

A: The purpose of Form RP-485-K is to apply for a tax exemption on residential investment real property in certain school districts.

Q: What should I include when filling out Form RP-485-K?

A: You should include detailed information about the residential investment real property you are seeking a tax exemption for.

Q: Are there any deadlines for submitting Form RP-485-K?

A: Yes, there may be deadlines for submitting Form RP-485-K. It is recommended to check with the City of Utica, New York's tax department for specific deadlines.

Q: Is there a fee for submitting Form RP-485-K?

A: There may be a fee associated with submitting Form RP-485-K. Contact the City of Utica, New York's tax department for more information.

Q: What happens after I submit Form RP-485-K?

A: After submitting Form RP-485-K, the City of Utica, New York's tax department will review your application and determine if you are eligible for the tax exemption.

Q: How long does it take to process Form RP-485-K?

A: The processing time for Form RP-485-K may vary. Contact the City of Utica, New York's tax department for more information on processing times.

Form Details:

- Released on July 1, 2006;

- The latest edition provided by the New York State Department of Taxation and Finance;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form RP-485-K [UTICA SD] by clicking the link below or browse more documents and templates provided by the New York State Department of Taxation and Finance.

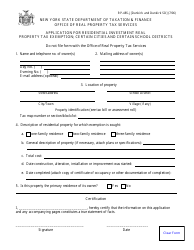

![Form RP-485-K [UTICA SD] Printable Pdf](https://data.templateroller.com/pdf_docs_html/1349/13498/1349829/form-rp-485-k-utica-sd-application-for-residential-investment-real-property-tax-exemption-certain-school-districts-city-of-utica-new-york_big.png)

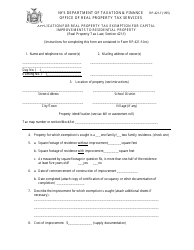

![Form RP-485-K [UTICA SD] Application for Residential Investment Real Property Tax Exemption; Certain School Districts - City of Utica, New York](https://data.templateroller.com/pdf_docs_html/1349/13498/1349829/page_1_thumb.png)

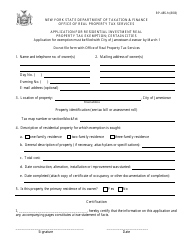

![Form RP-485-K [UTICA SD] Application for Residential Investment Real Property Tax Exemption; Certain School Districts - City of Utica, New York, Page 2](https://data.templateroller.com/pdf_docs_html/1349/13498/1349829/page_2_thumb.png)

![Form RP-485-K [UTICA SD] Application for Residential Investment Real Property Tax Exemption; Certain School Districts - City of Utica, New York, Page 1](https://data.templateroller.com/pdf_docs_html/1349/13498/1349829/page_1_thumb_950.png)

![Form RP-485-K [UTICA SD] Application for Residential Investment Real Property Tax Exemption; Certain School Districts - City of Utica, New York, Page 2](https://data.templateroller.com/pdf_docs_html/1349/13498/1349829/page_2_thumb_950.png)

![Document preview: Form RP-485-J [UTICA] Application for Residential Investment Real Property Tax Exemption - City of Utica, New York](https://data.templateroller.com/pdf_docs_html/578/5786/578659/form-rp-485-j-utica-application-for-residential-investment-real-property-tax-exemption-city-of-utica-new-york.png)

![Document preview: Form RP-485-M [ROME SD] Application for Residential Investment Real Property Tax Exemption; Certain School Districts - New York](https://data.templateroller.com/pdf_docs_html/1733/17339/1733929/form-rp-485-m-rome-sd-application-residential-investment-real-property-tax-exemption-certain-school-districts-new-york.png)

![Document preview: Form RP-485-I [ROME] Application for Residential Investment Real Property Tax Exemption; Certain Cities - New York](https://data.templateroller.com/pdf_docs_html/1733/17334/1733439/form-rp-485-i-rome-application-residential-investment-real-property-tax-exemption-certain-cities-new-york.png)

![Document preview: Form RP-485-J [SYRACUSE] Application for Residential Investment Real Property Tax Exemption - City of Syracuse, New York](https://data.templateroller.com/pdf_docs_html/578/5786/578658/form-rp-485-j-syracuse-application-for-residential-investment-real-property-tax-exemption-city-of-syracuse-new-york.png)

![Document preview: Form RP-485-I [AMSTERDAM SD] Application for Residential Investment Real Property Tax Exemption; Certain School Districts - New York](https://data.templateroller.com/pdf_docs_html/1733/17339/1733928/form-rp-485-i-amsterdam-sd-application-residential-investment-real-property-tax-exemption-certain-school-districts-new-york.png)

![Document preview: Form RP-485-I [JAMESTOWN SD] Application for Residential Investment Real Property Tax Exemption; Certain School Districts - New York](https://data.templateroller.com/pdf_docs_html/578/5786/578655/form-rp-485-i-jamestown-sd-application-residential-investment-real-property-tax-exemption-certain-school-districts-new-york.png)

![Document preview: Form RP-485-J [AMSTERDAM] Application for Residential Investment Real Property Tax Exemption - City of Amsterdam, New York](https://data.templateroller.com/pdf_docs_html/578/5786/578657/form-rp-485-j-amsterdam-application-for-residential-investment-real-property-tax-exemption-city-of-amsterdam-new-york.png)

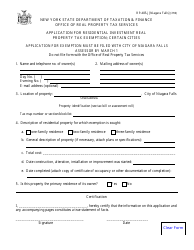

![Document preview: Form RP-421-J [NIAGARA FALLS] Application for Capital Investment in Multiple Dwellings Real Property Tax Exemption; Certain Cities - City of Niagara Falls, New York](https://data.templateroller.com/pdf_docs_html/1349/13498/1349861/form-rp-421-j-niagara-falls-application-for-capital-investment-in-multiple-dwellings-real-property-tax-exemption-certain-cities-city-of-niagara-falls-new-york.png)