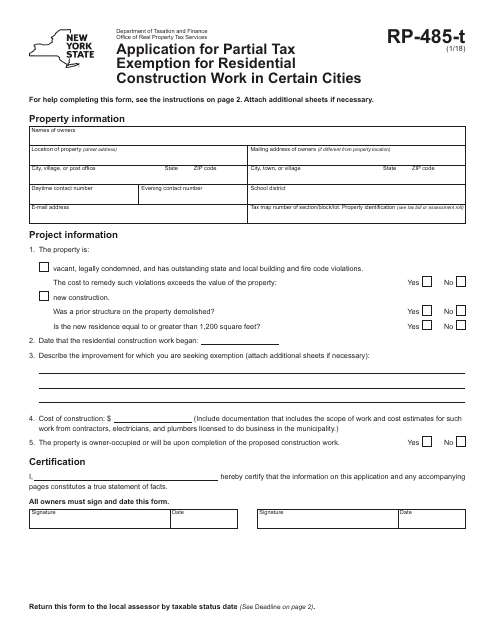

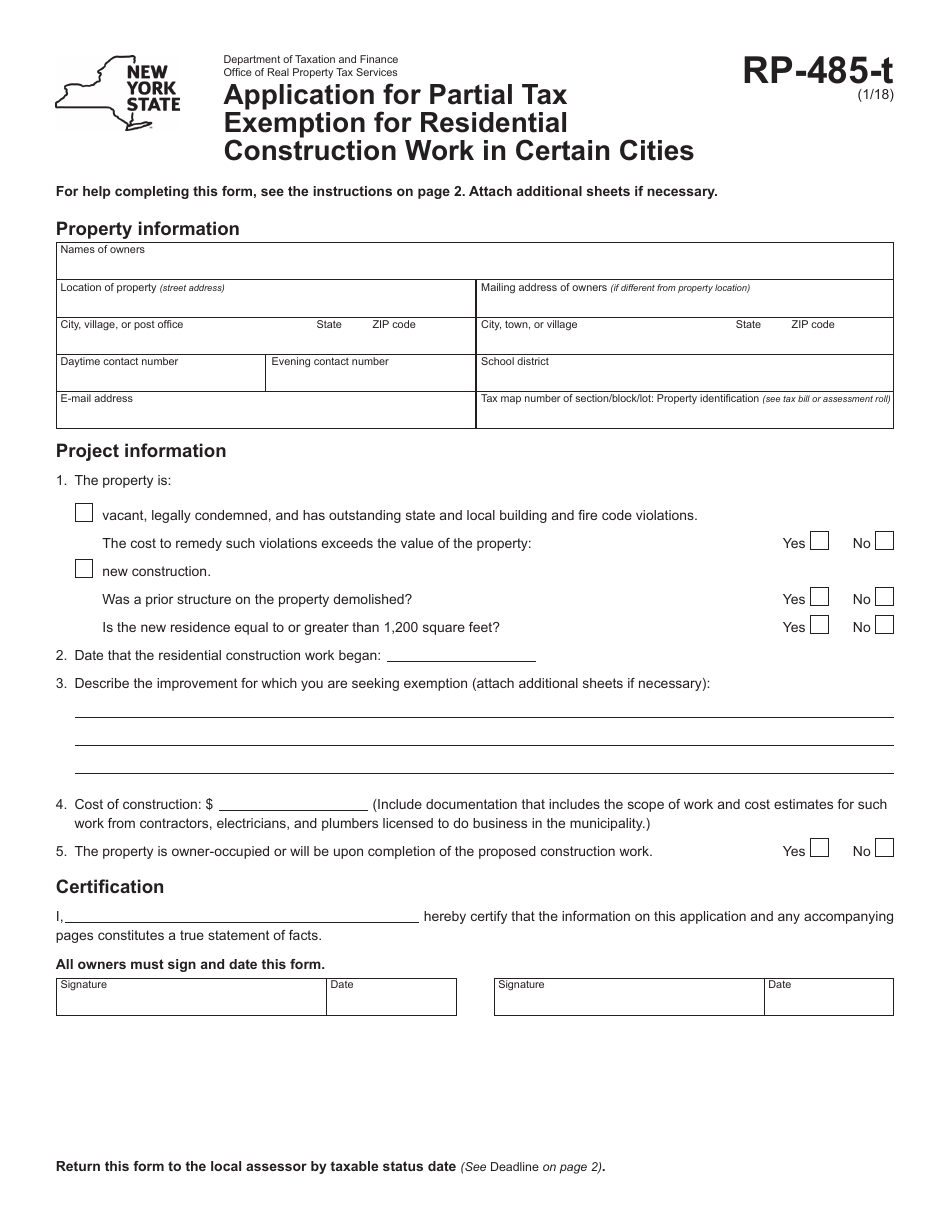

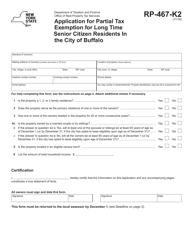

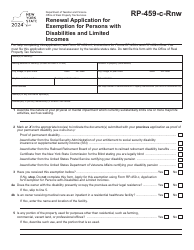

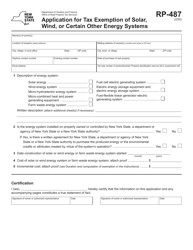

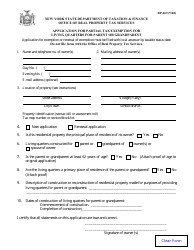

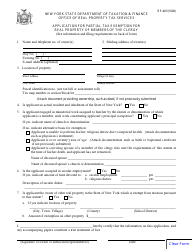

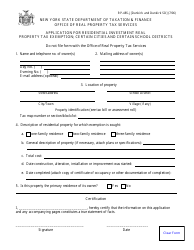

Form RP-485-T Application for Partial Tax Exemption for Residential Construction Work in Certain Cities - New York

What Is Form RP-485-T?

This is a legal form that was released by the New York State Department of Taxation and Finance - a government authority operating within New York. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is form RP-485-T?

A: Form RP-485-T is an application for partial tax exemption for residential construction work in certain cities in New York.

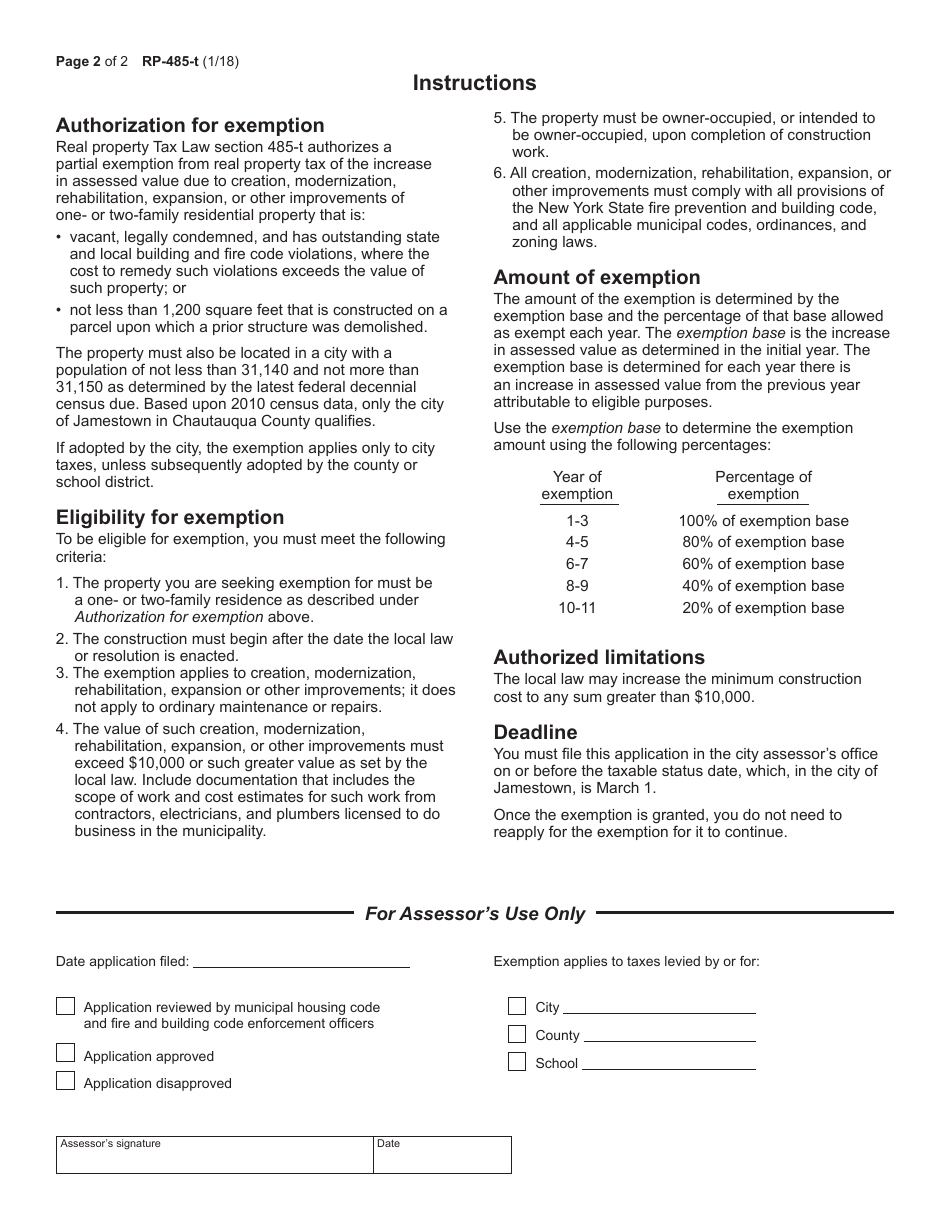

Q: Who is eligible to apply for this exemption?

A: Individuals or entities engaged in residential construction work in certain cities in New York may be eligible to apply for this exemption.

Q: What is the purpose of this tax exemption?

A: The purpose of this tax exemption is to provide partial relief from certain taxes for qualifying residential construction work.

Q: Which cities in New York offer this tax exemption?

A: Certain cities in New York, as specified by the local government, offer this tax exemption.

Q: What taxes does this exemption apply to?

A: This exemption may apply to various taxes, such as sales and use tax, mortgage recording tax, and real estate transfer tax.

Q: How can I apply for the exemption?

A: To apply for the exemption, you need to complete and submit form RP-485-T to the appropriate local government office.

Q: Are there any deadlines for applying?

A: Specific deadlines for applying may vary depending on the local government requirements. It is important to check with the local government office for the applicable deadlines.

Q: Is there a fee to file the application?

A: There is generally no fee to file the application, but it is advisable to confirm with the local government office.

Form Details:

- Released on January 1, 2018;

- The latest edition provided by the New York State Department of Taxation and Finance;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form RP-485-T by clicking the link below or browse more documents and templates provided by the New York State Department of Taxation and Finance.