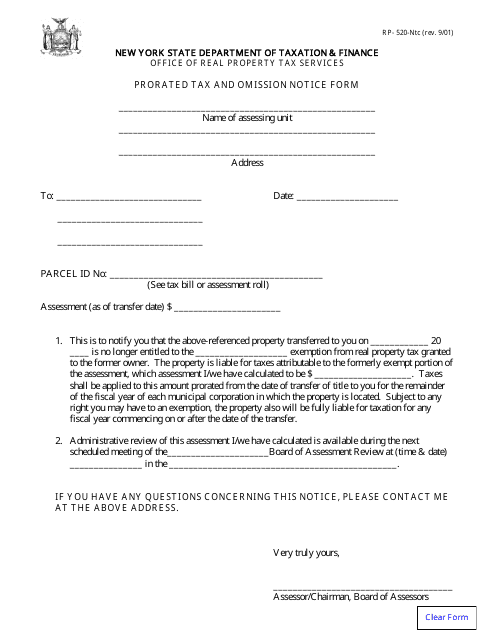

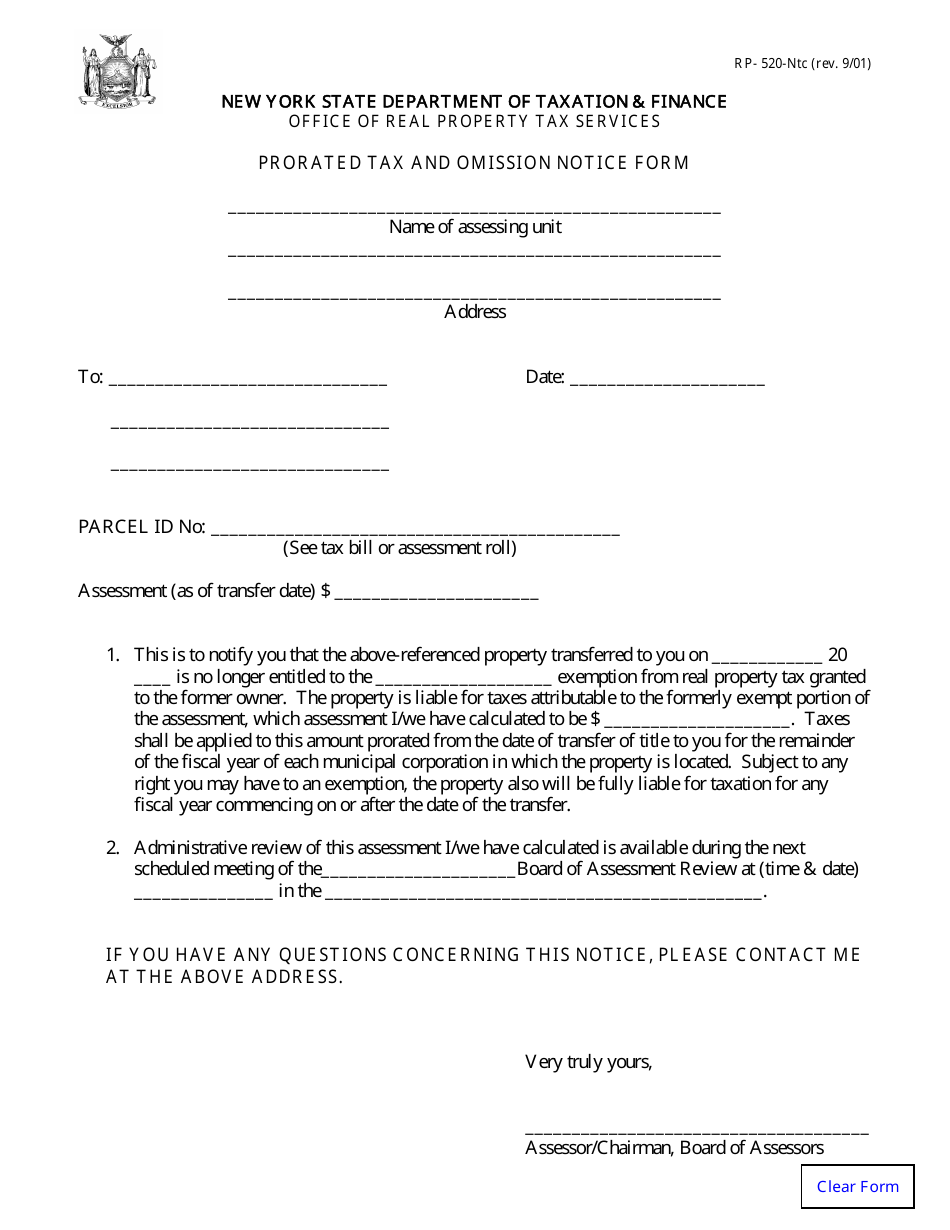

Form RP-520-NTC Prorated Tax and Omission Notice Form - New York

What Is Form RP-520-NTC?

This is a legal form that was released by the New York State Department of Taxation and Finance - a government authority operating within New York. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form RP-520-NTC?

A: Form RP-520-NTC is the Prorated Tax and Omission Notice Form in New York.

Q: What is the purpose of Form RP-520-NTC?

A: The purpose of Form RP-520-NTC is to report prorated taxes and address any omissions in property tax assessments in New York.

Q: Who needs to file Form RP-520-NTC?

A: Property owners or their representatives who discover errors or omissions in their property tax assessments need to file Form RP-520-NTC.

Q: When should Form RP-520-NTC be filed?

A: Form RP-520-NTC should be filed as soon as errors or omissions are discovered in the property tax assessments.

Q: Is there a deadline for filing Form RP-520-NTC?

A: Yes, Form RP-520-NTC must be filed within three years from the date of the original tentative assessment roll or the final assessment roll showing the error or omission.

Q: Are there any fees associated with filing Form RP-520-NTC?

A: Yes, there is a filing fee for Form RP-520-NTC. The fee amount depends on the total assessed value of the property.

Q: What supporting documents should be included with Form RP-520-NTC?

A: Supporting documents such as income and expense statements, appraisals, or other relevant documents should be included with Form RP-520-NTC to support the requested changes.

Q: What happens after filing Form RP-520-NTC?

A: After filing Form RP-520-NTC, the local assessor will review the request and make a determination. You will receive a written notice of the decision.

Q: Can I appeal the decision made after filing Form RP-520-NTC?

A: Yes, if you disagree with the assessor's decision, you have the right to file a formal written complaint or commence a judicial proceeding.

Form Details:

- Released on September 1, 2001;

- The latest edition provided by the New York State Department of Taxation and Finance;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form RP-520-NTC by clicking the link below or browse more documents and templates provided by the New York State Department of Taxation and Finance.