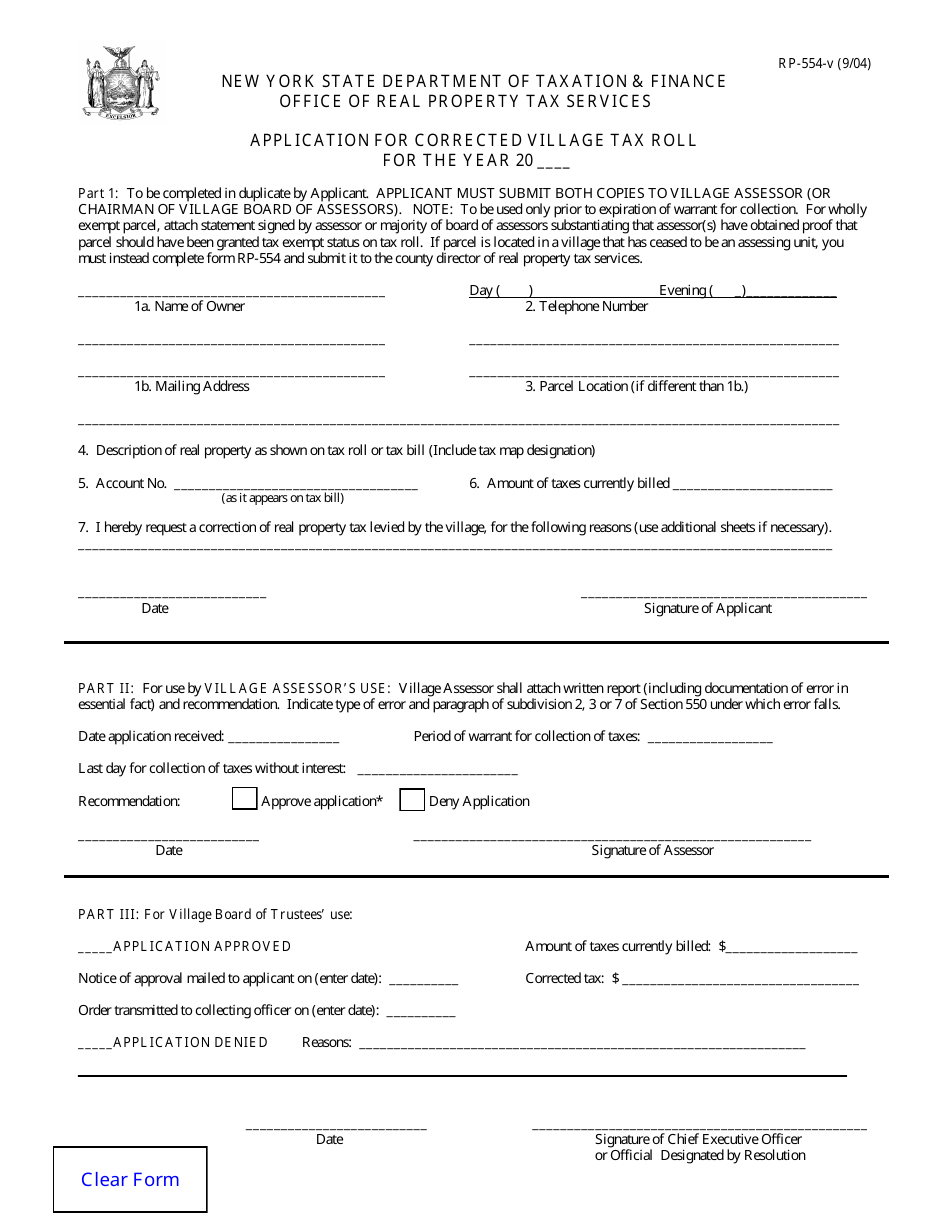

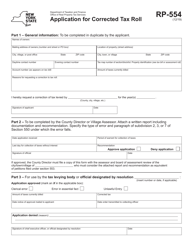

Form RP-554-V Application for Corrected Village Tax Roll - New York

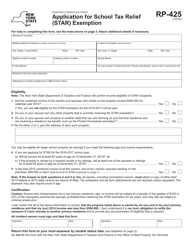

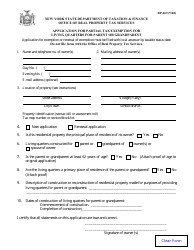

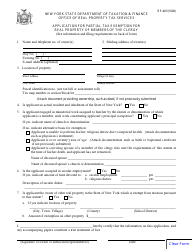

What Is Form RP-554-V?

This is a legal form that was released by the New York State Department of Taxation and Finance - a government authority operating within New York. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form RP-554-V?

A: Form RP-554-V is an application for correcting the village tax roll in New York.

Q: Why would I need to use Form RP-554-V?

A: You would need to use Form RP-554-V if you believe there is an error or omission on the village tax roll.

Q: What information do I need to provide on Form RP-554-V?

A: You need to provide your contact information, the property information, and the details of the correction you are requesting.

Q: Is there a deadline for submitting Form RP-554-V?

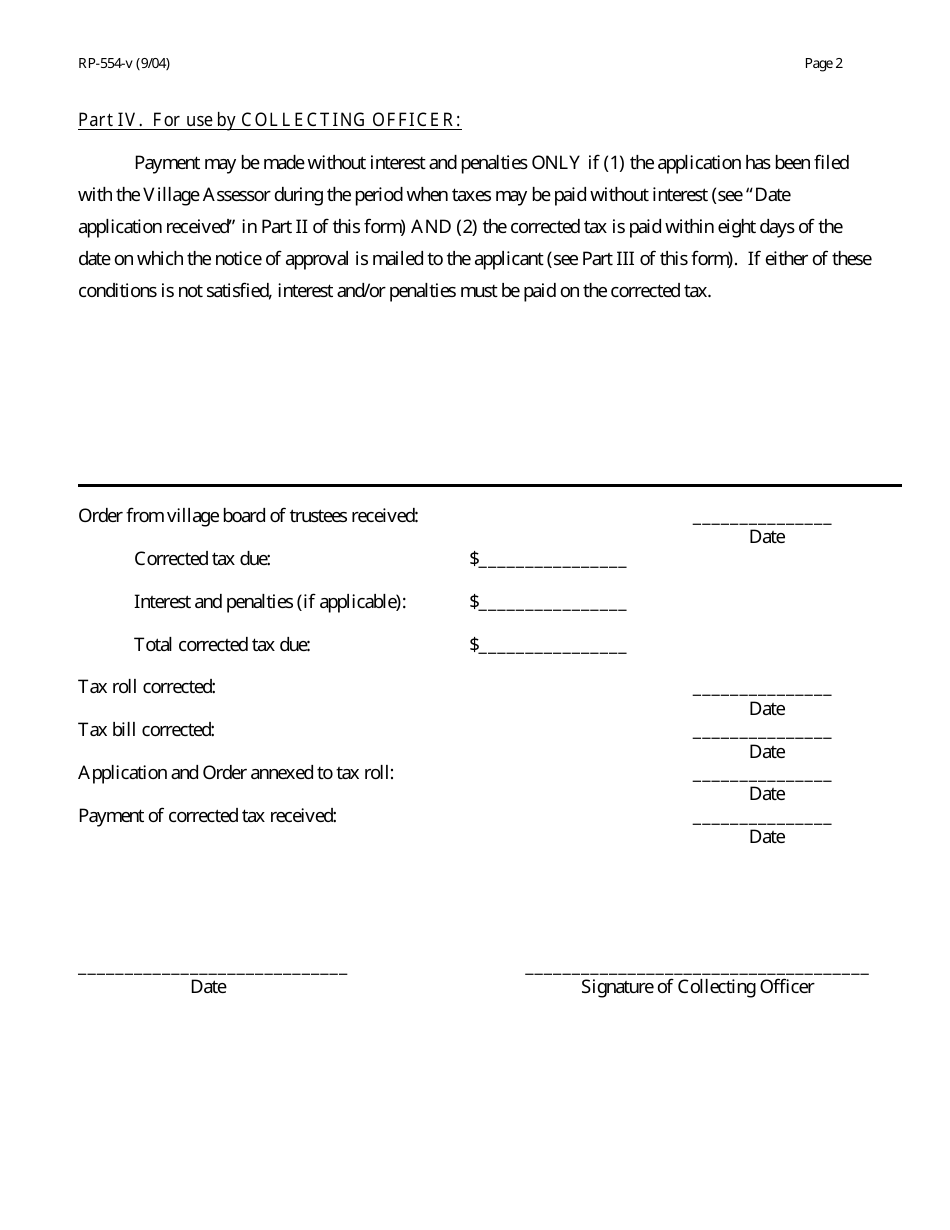

A: Yes, you must submit Form RP-554-V within 60 days from the date of the final completion of the last assessment roll.

Q: Is there a fee for submitting Form RP-554-V?

A: No, there is no fee for submitting Form RP-554-V.

Form Details:

- Released on September 1, 2004;

- The latest edition provided by the New York State Department of Taxation and Finance;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form RP-554-V by clicking the link below or browse more documents and templates provided by the New York State Department of Taxation and Finance.