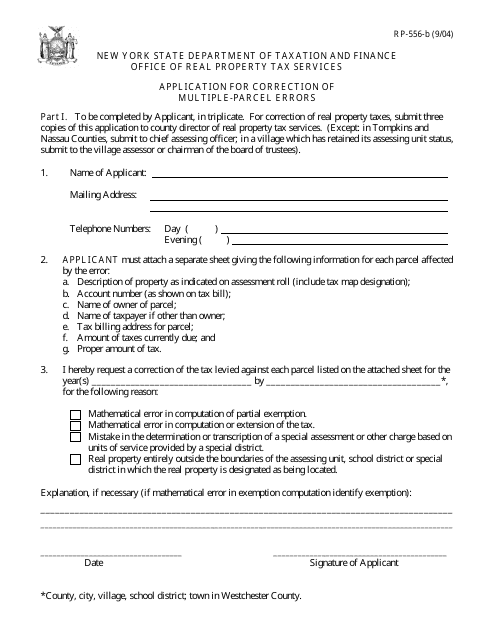

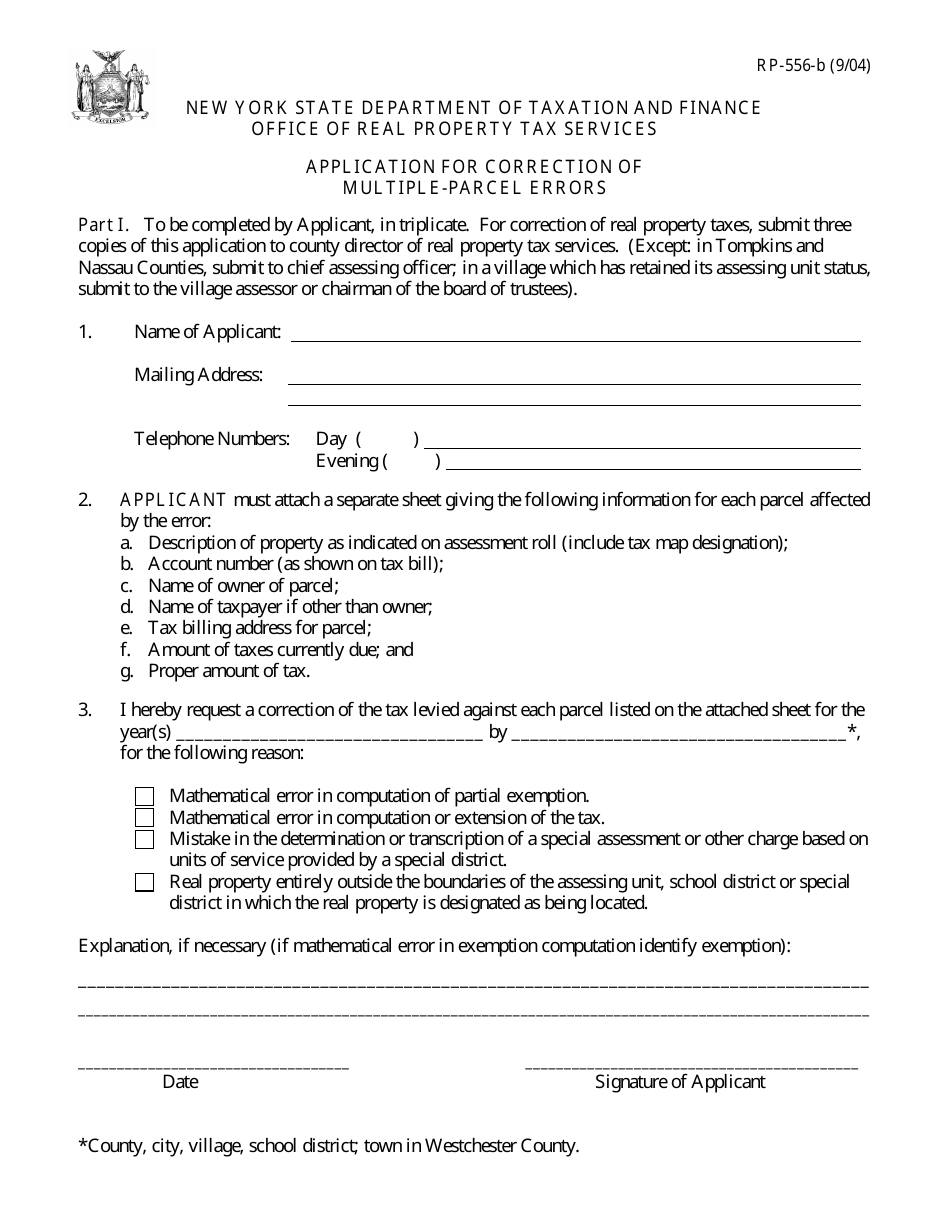

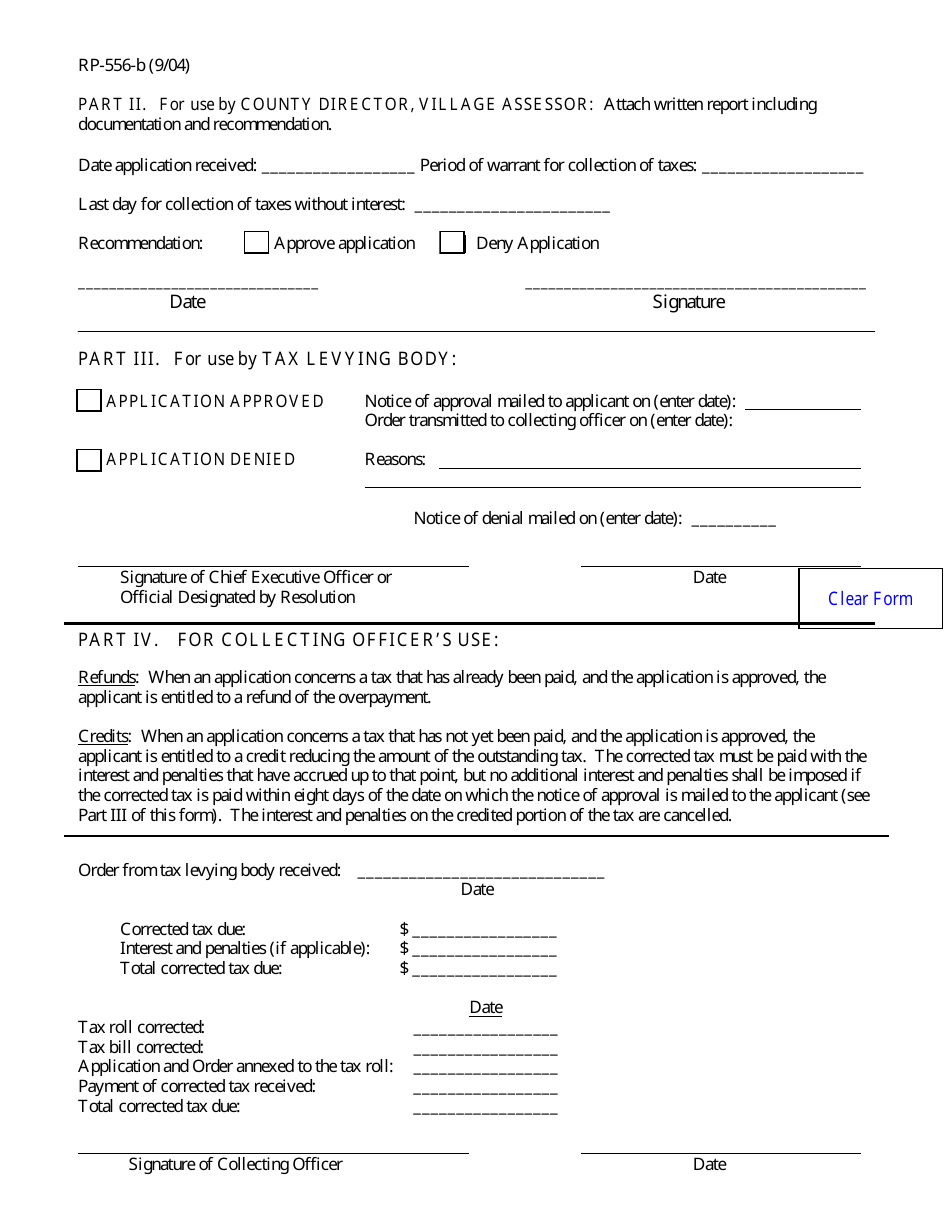

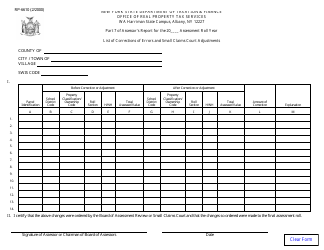

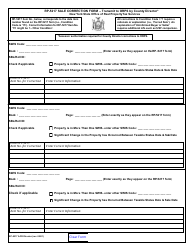

Form RP-556-B Application for Correction of Multiple-Parcel Errors - New York

What Is Form RP-556-B?

This is a legal form that was released by the New York State Department of Taxation and Finance - a government authority operating within New York. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form RP-556-B?

A: Form RP-556-B is an application for correction of multiple-parcel errors in New York.

Q: Who can use Form RP-556-B?

A: Property owners or their authorized agents can use Form RP-556-B to apply for correction of multiple-parcel errors.

Q: What is a multiple-parcel error?

A: A multiple-parcel error is an error in the property tax records where two or more parcels have been combined or divided incorrectly.

Q: How do I fill out Form RP-556-B?

A: You need to provide information about the affected parcels and the correction you are requesting. Follow the instructions on the form.

Q: Is there a fee for filing Form RP-556-B?

A: There is no fee for filing Form RP-556-B.

Form Details:

- Released on September 1, 2004;

- The latest edition provided by the New York State Department of Taxation and Finance;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form RP-556-B by clicking the link below or browse more documents and templates provided by the New York State Department of Taxation and Finance.