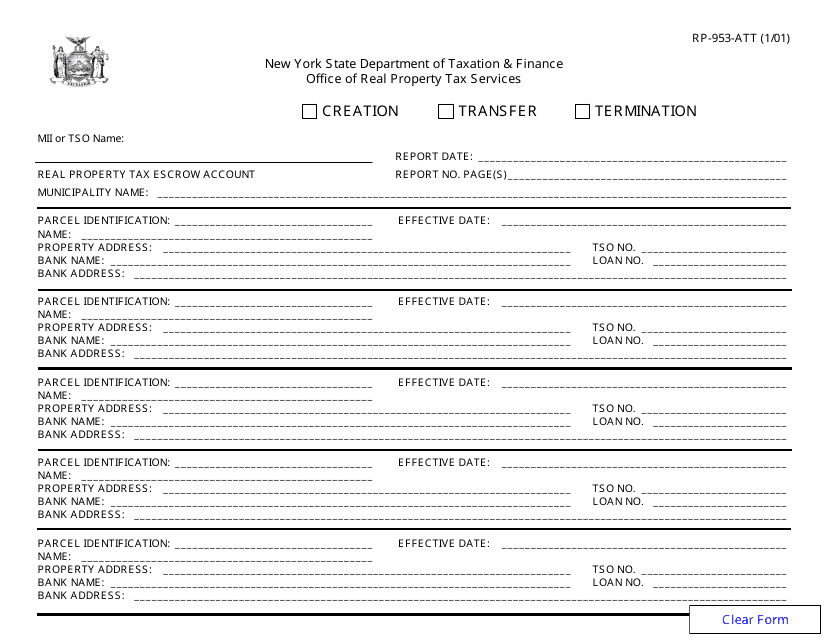

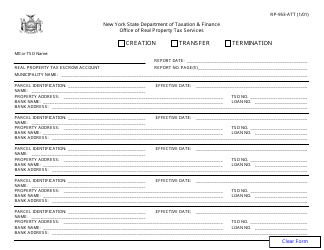

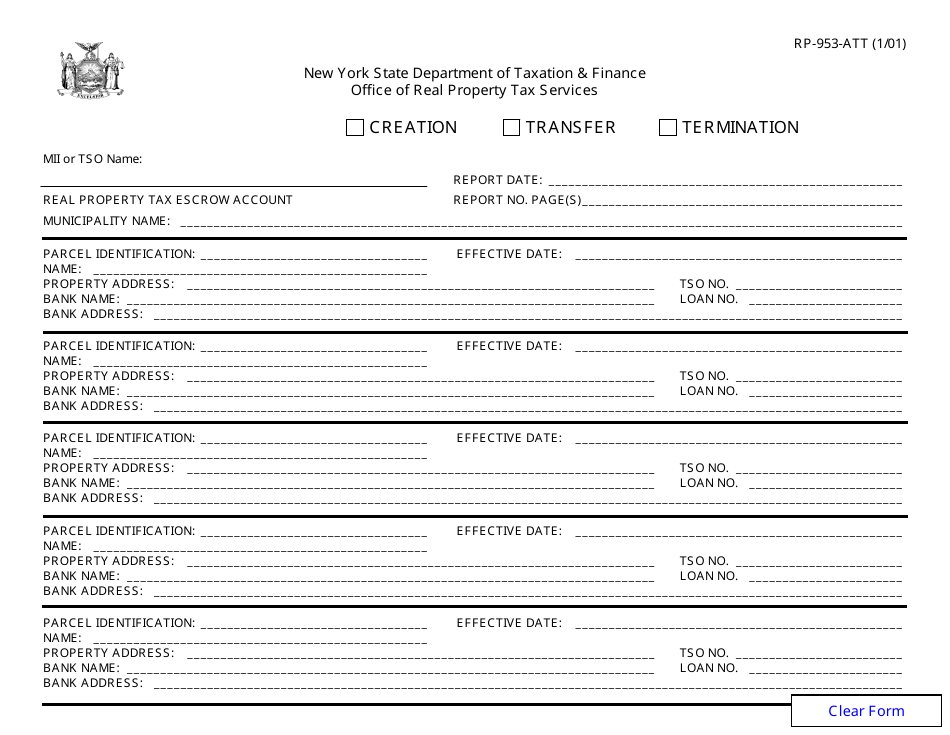

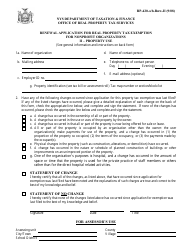

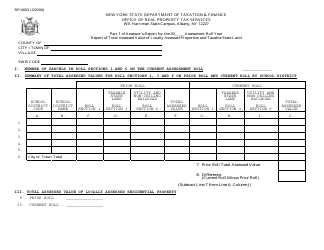

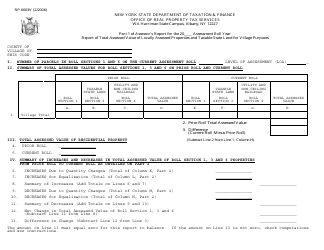

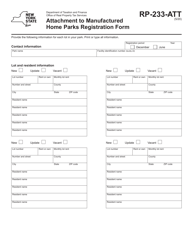

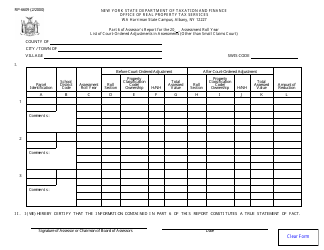

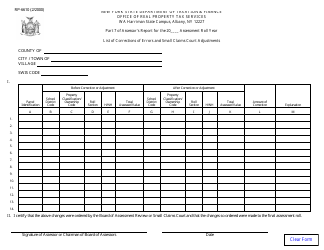

Form RP-953-ATT List of Affected Properties - New York

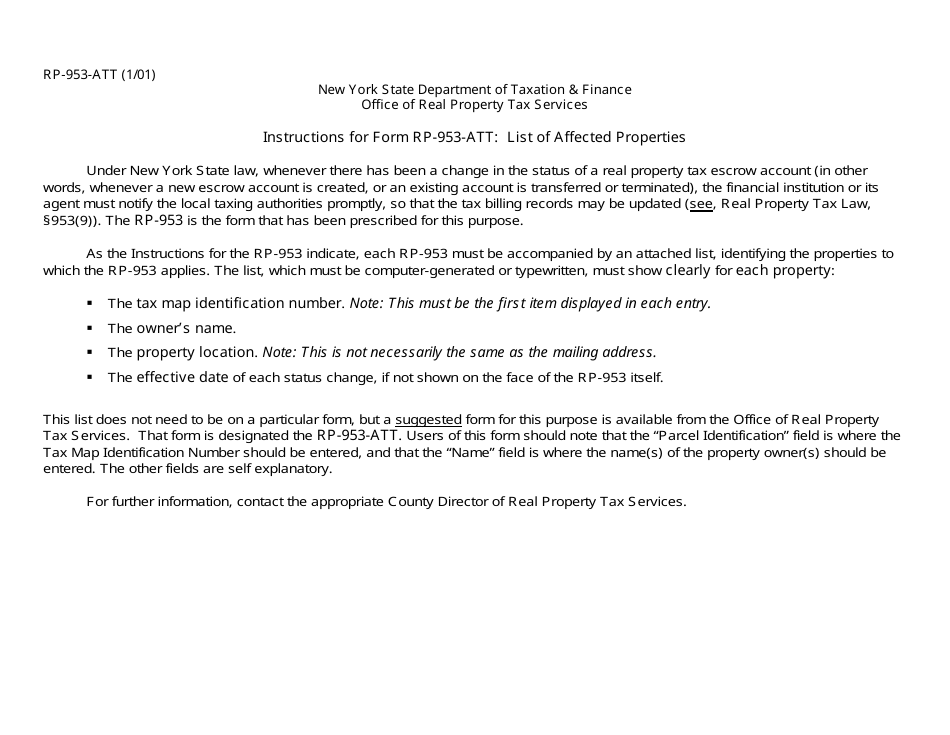

What Is Form RP-953-ATT?

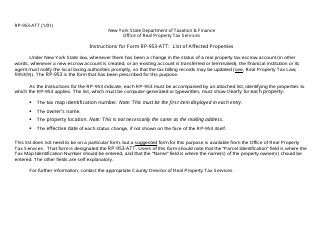

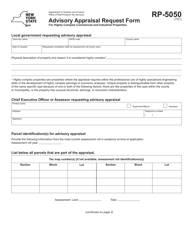

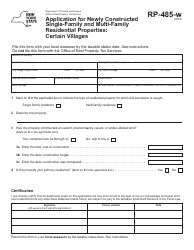

This is a legal form that was released by the New York State Department of Taxation and Finance - a government authority operating within New York. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form RP-953-ATT?

A: Form RP-953-ATT is a form used in New York to list of affected properties.

Q: Who uses Form RP-953-ATT?

A: Form RP-953-ATT is typically used by property owners or authorized representatives in New York.

Q: What is the purpose of Form RP-953-ATT?

A: The purpose of Form RP-953-ATT is to provide a list of affected properties for specific purposes, such as tax assessment or property valuation.

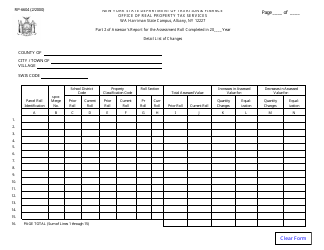

Q: What information is included in Form RP-953-ATT?

A: Form RP-953-ATT includes details about the properties, such as addresses, property dimensions, and other relevant information.

Q: Is there a fee to submit Form RP-953-ATT?

A: There is no fee to submit Form RP-953-ATT.

Q: Are there any deadlines for submitting Form RP-953-ATT?

A: Deadlines for submitting Form RP-953-ATT may vary depending on the specific purpose. It is recommended to check with the relevant authority or tax office for the deadline.

Q: Do I need to submit Form RP-953-ATT every year?

A: The need to submit Form RP-953-ATT may vary depending on the specific purpose. It is best to consult with the relevant authority or tax office to determine the frequency of submission.

Form Details:

- Released on January 1, 2001;

- The latest edition provided by the New York State Department of Taxation and Finance;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form RP-953-ATT by clicking the link below or browse more documents and templates provided by the New York State Department of Taxation and Finance.