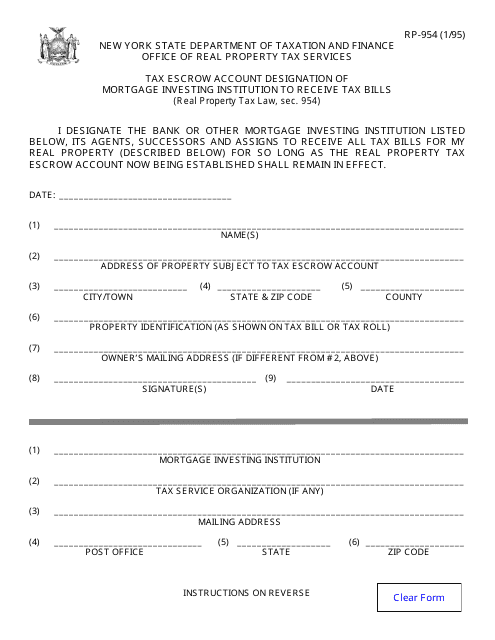

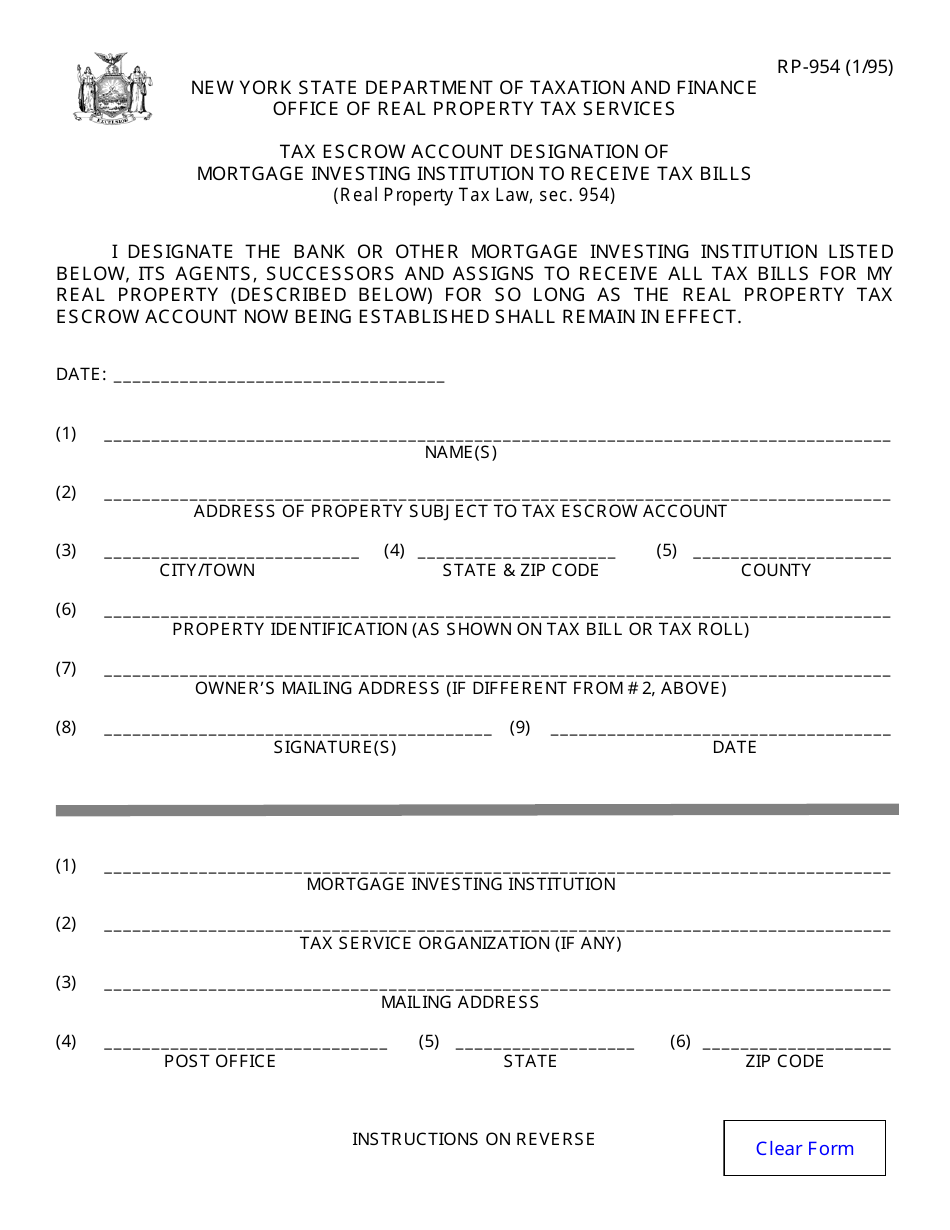

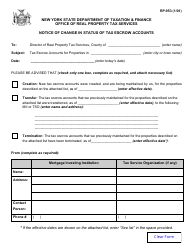

Form RP-954 Tax Escrow Account Designation of Mortgage Investing Institution to Receive Tax Bills - New York

What Is Form RP-954?

This is a legal form that was released by the New York State Department of Taxation and Finance - a government authority operating within New York. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form RP-954?

A: Form RP-954 is the Tax Escrow Account Designation of Mortgage Investing Institution to Receive Tax Bills in New York.

Q: What is the purpose of Form RP-954?

A: The purpose of Form RP-954 is to designate a mortgage investing institution to receive tax bills for a property.

Q: Who needs to file Form RP-954?

A: Property owners who have a tax escrow account with a mortgage investing institution in New York need to file Form RP-954.

Q: How do I fill out Form RP-954?

A: You must provide your name, address, property information, and the name and address of your mortgage investing institution on Form RP-954.

Q: Is there a deadline for filing Form RP-954?

A: There is no specific deadline mentioned for filing Form RP-954. However, it is advisable to submit the form as soon as possible.

Q: Can I change the designated mortgage investing institution?

A: Yes, you can change the designated mortgage investing institution by submitting a new Form RP-954 to the tax department and informing your current mortgage investing institution.

Q: Are there any fees associated with filing Form RP-954?

A: No, there are no fees associated with filing Form RP-954.

Q: What happens after I submit Form RP-954?

A: After you submit Form RP-954, your designated mortgage investing institution will receive your tax bills and be responsible for paying your property taxes on your behalf.

Form Details:

- Released on January 1, 1995;

- The latest edition provided by the New York State Department of Taxation and Finance;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form RP-954 by clicking the link below or browse more documents and templates provided by the New York State Department of Taxation and Finance.

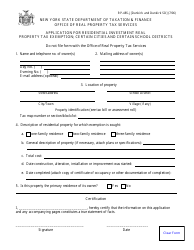

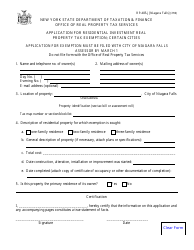

![Document preview: Form RP-485-K [UTICA SD] Application for Residential Investment Real Property Tax Exemption; Certain School Districts - City of Utica, New York](https://data.templateroller.com/pdf_docs_html/1349/13498/1349829/form-rp-485-k-utica-sd-application-for-residential-investment-real-property-tax-exemption-certain-school-districts-city-of-utica-new-york.png)

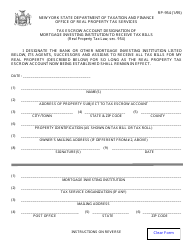

![Document preview: Form RP-485-I [JAMESTOWN SD] Application for Residential Investment Real Property Tax Exemption; Certain School Districts - New York](https://data.templateroller.com/pdf_docs_html/578/5786/578655/form-rp-485-i-jamestown-sd-application-residential-investment-real-property-tax-exemption-certain-school-districts-new-york.png)