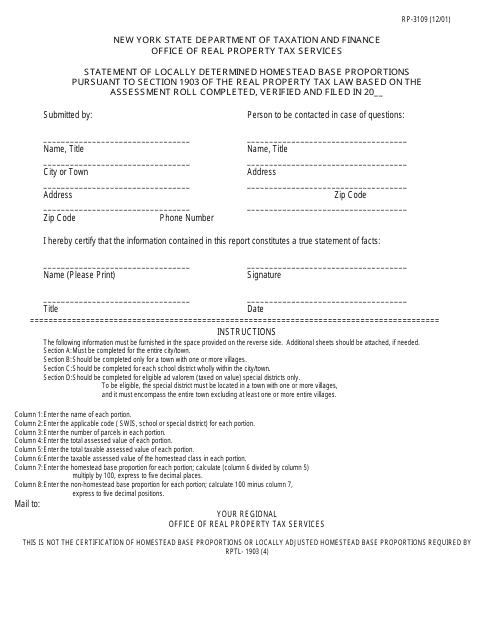

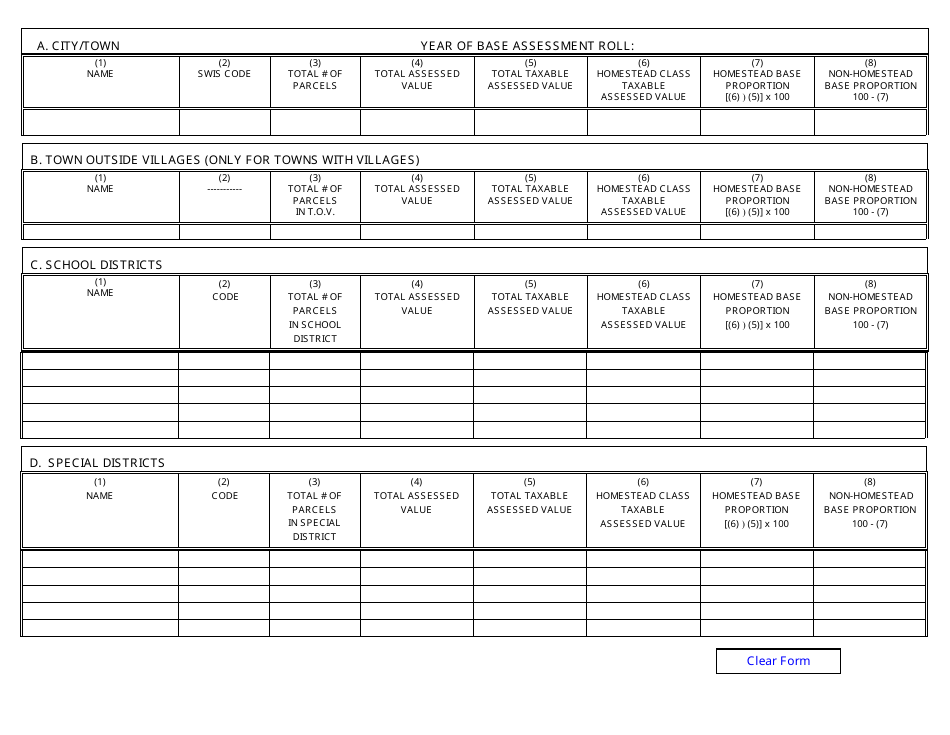

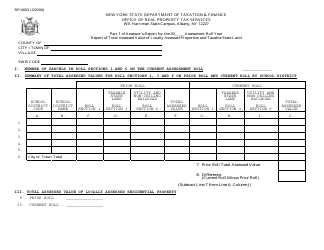

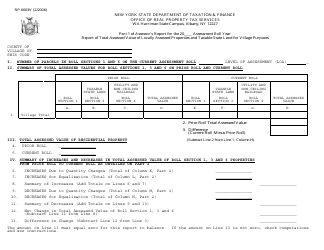

Form RP-3109 Statement of Locally Determined Homestead Base Proportions - New York

What Is Form RP-3109?

This is a legal form that was released by the New York State Department of Taxation and Finance - a government authority operating within New York. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form RP-3109?

A: Form RP-3109 is the Statement of Locally Determined Homestead Base Proportions for properties in New York.

Q: What is the purpose of Form RP-3109?

A: The purpose of Form RP-3109 is to determine the homestead base proportions for property tax calculations.

Q: Who needs to complete Form RP-3109?

A: Property owners in New York who are applying for homestead base proportions need to complete Form RP-3109.

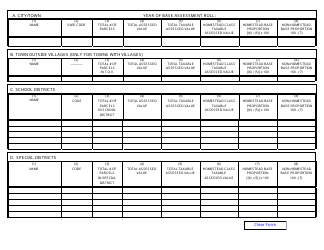

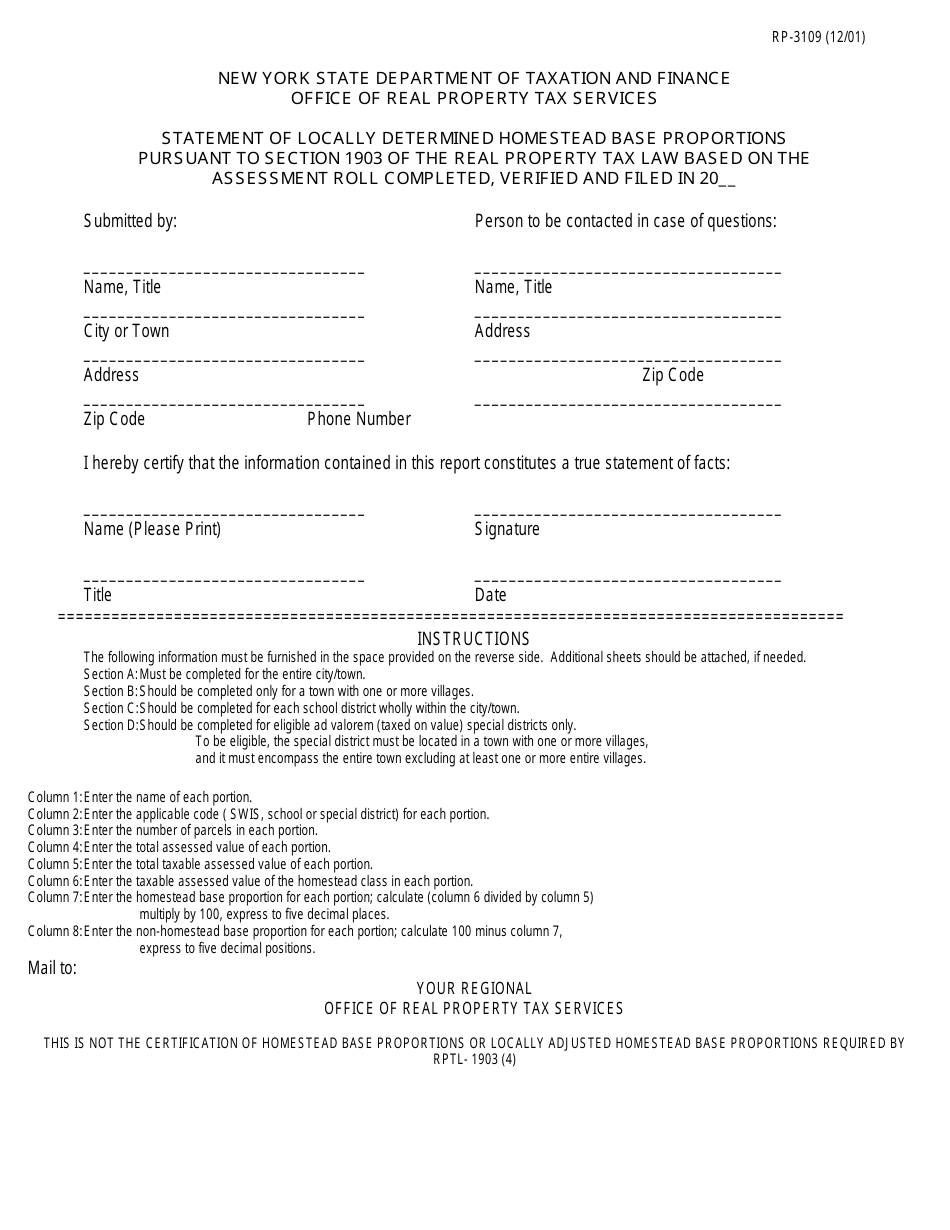

Q: What information is required on Form RP-3109?

A: Form RP-3109 requires information about the property, including the homeowner's legal name, property address, and property identification number.

Q: When should I submit Form RP-3109?

A: Form RP-3109 should be submitted prior to the taxable status date, which is set by the local assessor.

Q: What happens after I submit Form RP-3109?

A: After you submit Form RP-3109, the local assessor will review the information and determine the homestead base proportions for your property.

Q: Are there any fees associated with Form RP-3109?

A: No, there are no fees associated with submitting Form RP-3109.

Q: What if I disagree with the homestead base proportions determined by the local assessor?

A: If you disagree with the homestead base proportions determined by the local assessor, you may have the right to file an appeal or request a review of the assessment.

Form Details:

- Released on December 1, 2001;

- The latest edition provided by the New York State Department of Taxation and Finance;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form RP-3109 by clicking the link below or browse more documents and templates provided by the New York State Department of Taxation and Finance.