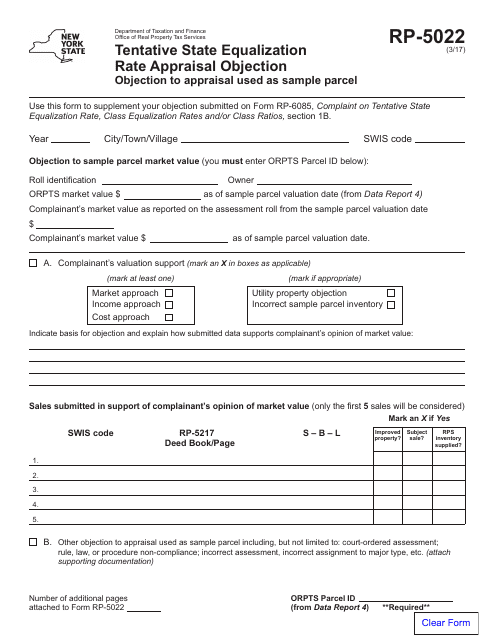

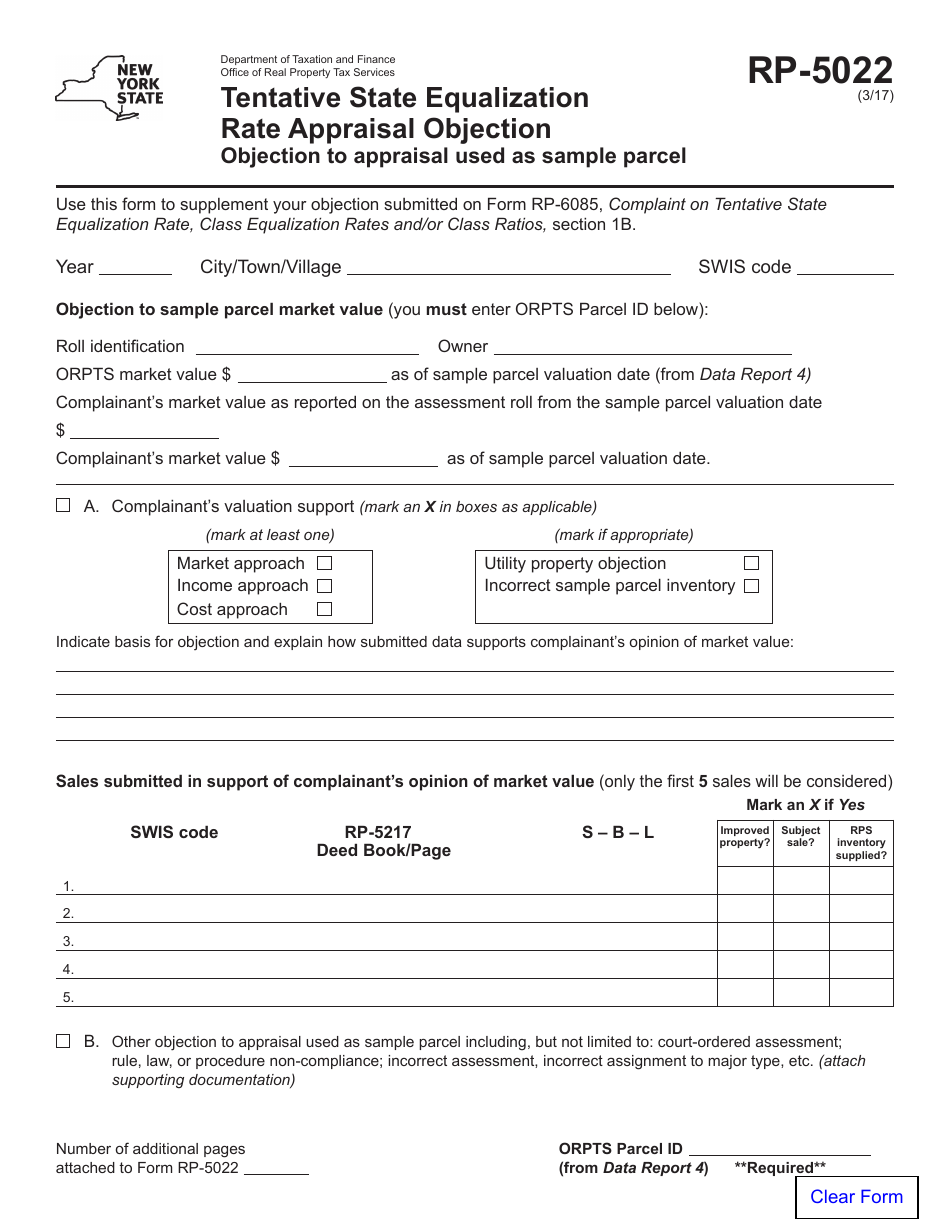

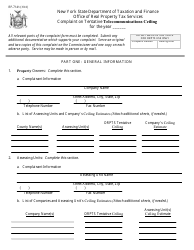

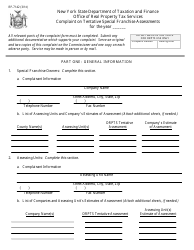

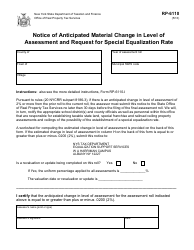

Form RP-5022 Tentative State Equalization Rate Appraisal Objection - New York

What Is Form RP-5022?

This is a legal form that was released by the New York State Department of Taxation and Finance - a government authority operating within New York. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

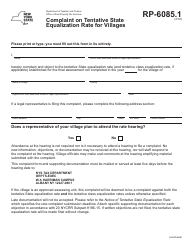

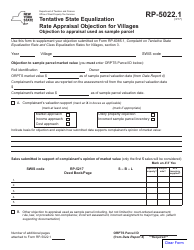

Q: What is Form RP-5022?

A: Form RP-5022 is the Tentative State Equalization Rate Appraisal Objection form in New York.

Q: What is the purpose of Form RP-5022?

A: The purpose of Form RP-5022 is to file an objection to the tentative state equalization rate appraisal in New York.

Q: When should I use Form RP-5022?

A: You should use Form RP-5022 when you disagree with the tentative state equalization rate appraisal of your property in New York and want to file an objection.

Q: Are there any filing fees for Form RP-5022?

A: There are no filing fees for submitting Form RP-5022 in New York.

Q: What information do I need to provide on Form RP-5022?

A: You will need to provide your property details, reasons for the objection, and supporting evidence along with Form RP-5022.

Q: What happens after I submit Form RP-5022?

A: After you submit Form RP-5022, the assessors will review your objection and make a determination. You will be notified of the decision in writing.

Q: Can I appeal the decision made on my Form RP-5022?

A: Yes, if you disagree with the decision made on your Form RP-5022, you have the right to appeal to the New York State Board of Real PropertyTax Services.

Form Details:

- Released on March 1, 2017;

- The latest edition provided by the New York State Department of Taxation and Finance;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form RP-5022 by clicking the link below or browse more documents and templates provided by the New York State Department of Taxation and Finance.