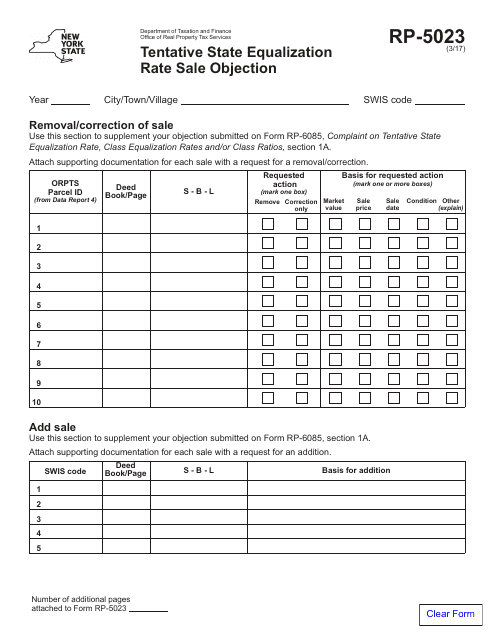

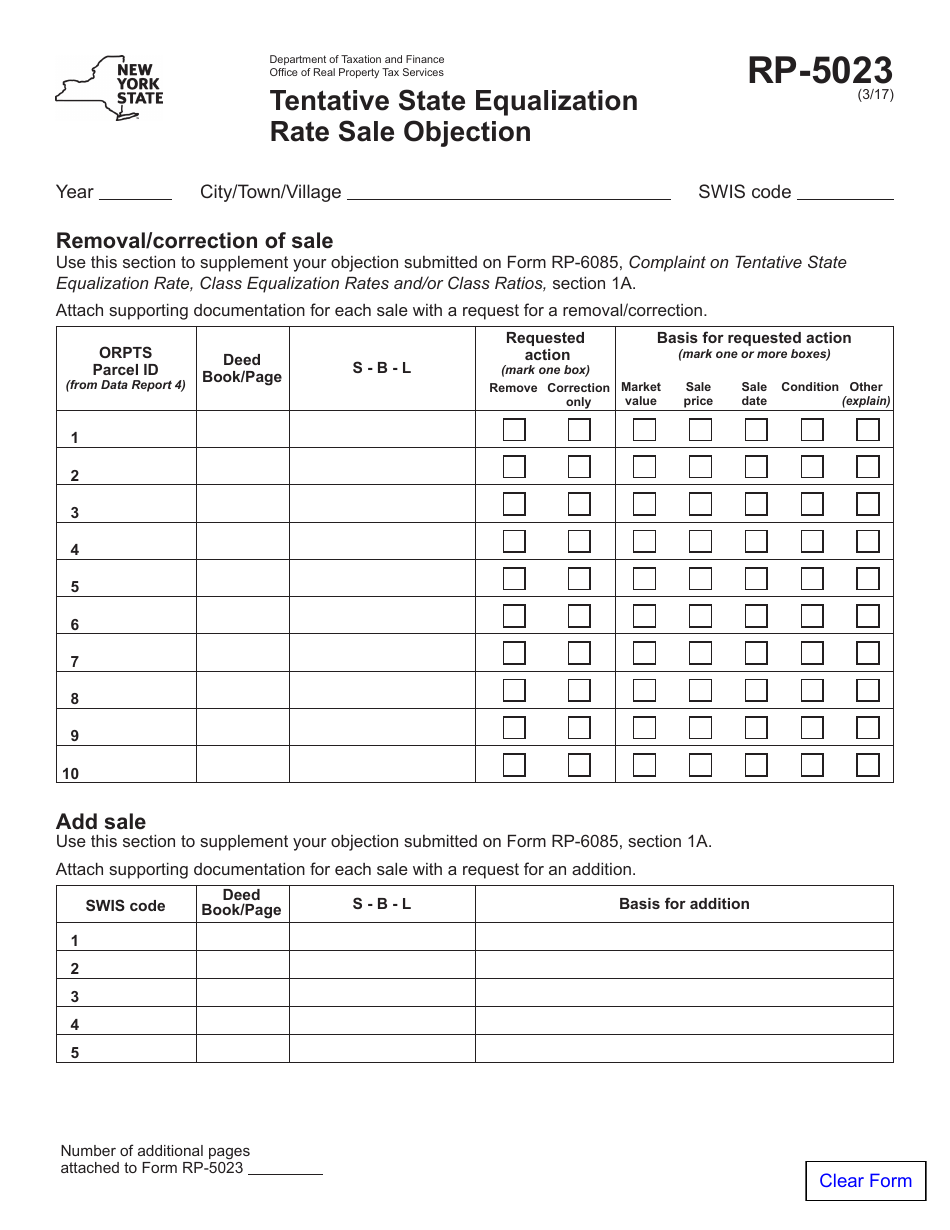

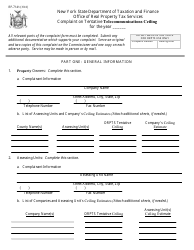

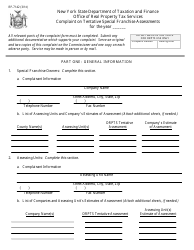

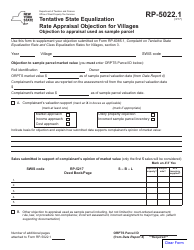

Form RP-5023 Tentative State Equalization Rate Sale Objection - New York

What Is Form RP-5023?

This is a legal form that was released by the New York State Department of Taxation and Finance - a government authority operating within New York. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

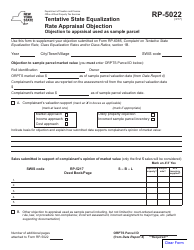

Q: What is Form RP-5023?

A: Form RP-5023 is the Tentative State Equalization Rate Sale Objection form in New York.

Q: What is the purpose of Form RP-5023?

A: The purpose of Form RP-5023 is to file an objection to the tentative state equalization rate for a property sale in New York.

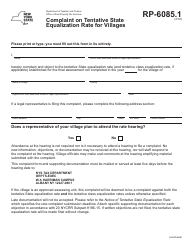

Q: Who needs to fill out Form RP-5023?

A: Property owners or their representatives who wish to object to the tentative state equalization rate for a property sale in New York need to fill out Form RP-5023.

Q: Is there a deadline to submit Form RP-5023?

A: Yes, there is a deadline to submit Form RP-5023. It must be filed within 30 days after the tentative state equalization rate has been published.

Q: What information is required on Form RP-5023?

A: Form RP-5023 requires information such as the property owner's name, property location, and reasons for the objection to the tentative state equalization rate.

Q: What happens after submitting Form RP-5023?

A: After submitting Form RP-5023, the local board of assessment review will review the objection and make a determination regarding the state equalization rate for the property sale.

Q: Can I appeal the decision made after submitting Form RP-5023?

A: Yes, if you are not satisfied with the decision made by the local board of assessment review, you have the option to file a formal appeal.

Q: Are there any fees associated with Form RP-5023?

A: There are no fees associated with submitting Form RP-5023.

Q: Is Form RP-5023 specific to New York?

A: Yes, Form RP-5023 is specific to the state of New York.

Form Details:

- Released on March 1, 2017;

- The latest edition provided by the New York State Department of Taxation and Finance;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form RP-5023 by clicking the link below or browse more documents and templates provided by the New York State Department of Taxation and Finance.