This version of the form is not currently in use and is provided for reference only. Download this version of

Form RP-5050

for the current year.

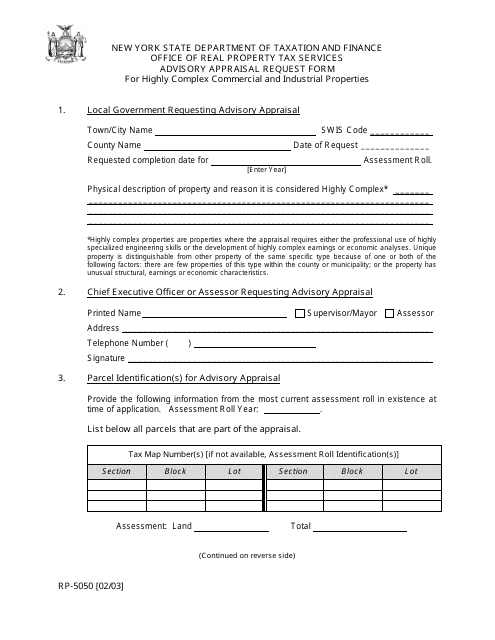

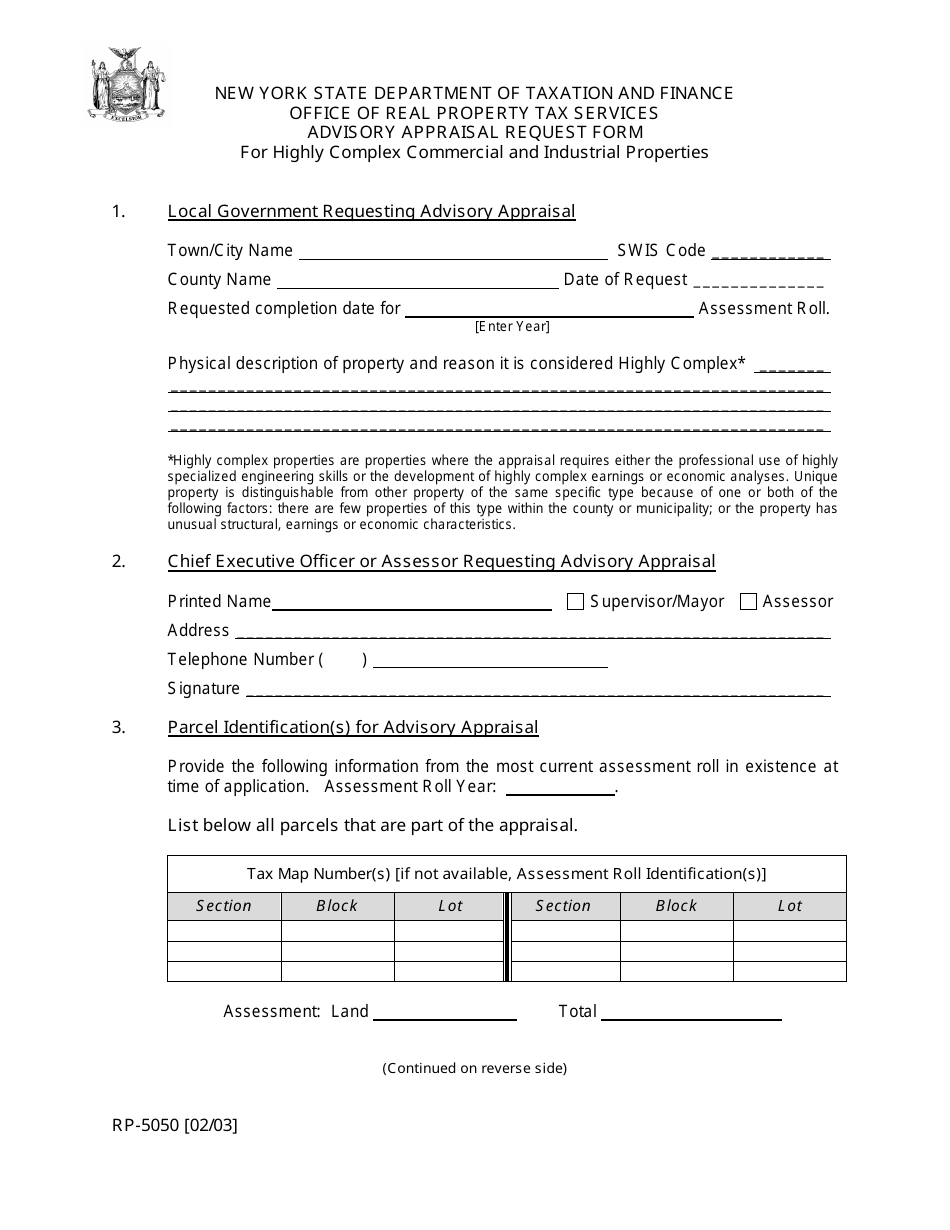

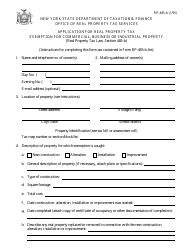

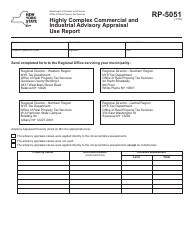

Form RP-5050 Advisory Appraisal Request Form for Highly Complex Commercial and Industrial Properties - New York

What Is Form RP-5050?

This is a legal form that was released by the New York State Department of Taxation and Finance - a government authority operating within New York. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is the RP-5050 form?

A: The RP-5050 form is the Advisory Appraisal Request Form for Highly Complex Commercial and Industrial Properties in New York.

Q: Who can use the RP-5050 form?

A: The RP-5050 form can be used by property owners, assessors, and taxpayers in New York.

Q: What is the purpose of the RP-5050 form?

A: The RP-5050 form is used to request an advisory appraisal for highly complex commercial and industrial properties.

Q: What does 'highly complex' mean in this context?

A: 'Highly complex' refers to commercial and industrial properties with unique characteristics or specialized uses that may require additional expertise to assess.

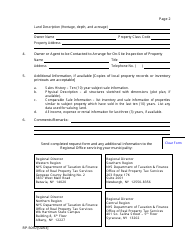

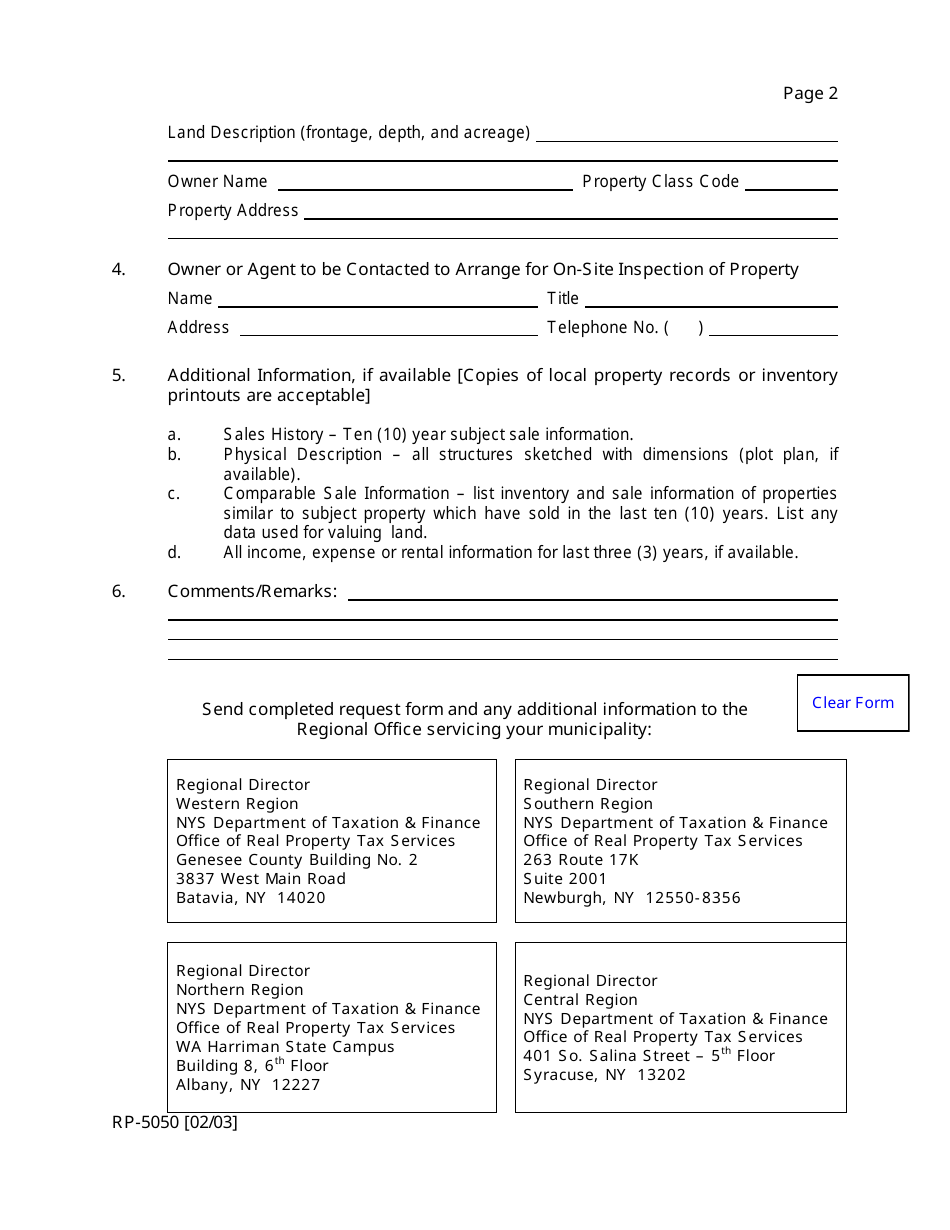

Q: What information is required on the RP-5050 form?

A: The RP-5050 form requires detailed information about the property, including its location, ownership details, and specific requests for the advisory appraisal.

Q: Are there any fees associated with the RP-5050 form?

A: There may be fees associated with the advisory appraisal request, which can vary depending on the jurisdiction and complexity of the property.

Q: How long does it take to receive the advisory appraisal?

A: The timeframe for receiving the advisory appraisal can vary, but it generally takes several weeks to a few months.

Q: What can I do with the advisory appraisal?

A: The advisory appraisal can be used as a tool for property owners, assessors, and taxpayers to understand the market value of highly complex commercial and industrial properties.

Q: Can the advisory appraisal be used for tax assessment purposes?

A: The advisory appraisal may be used as supporting documentation for tax assessment purposes, but it does not determine the final assessment value.

Q: Are there any specific instructions or guidelines for completing the RP-5050 form?

A: Yes, the RP-5050 form includes instructions and guidelines that should be followed carefully to ensure the accurate and complete submission of the request.

Q: Who should I contact for further assistance or questions related to the RP-5050 form?

A: For further assistance or questions related to the RP-5050 form, you should contact the New York State Department of Taxation and Finance or your local assessor's office.

Form Details:

- Released on February 1, 2003;

- The latest edition provided by the New York State Department of Taxation and Finance;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form RP-5050 by clicking the link below or browse more documents and templates provided by the New York State Department of Taxation and Finance.