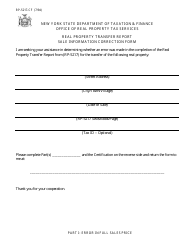

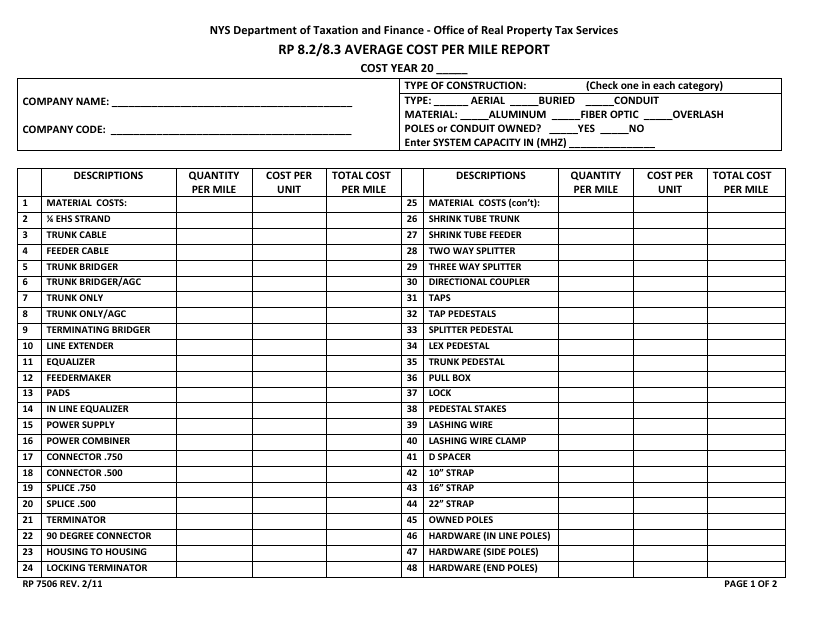

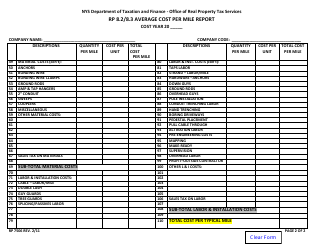

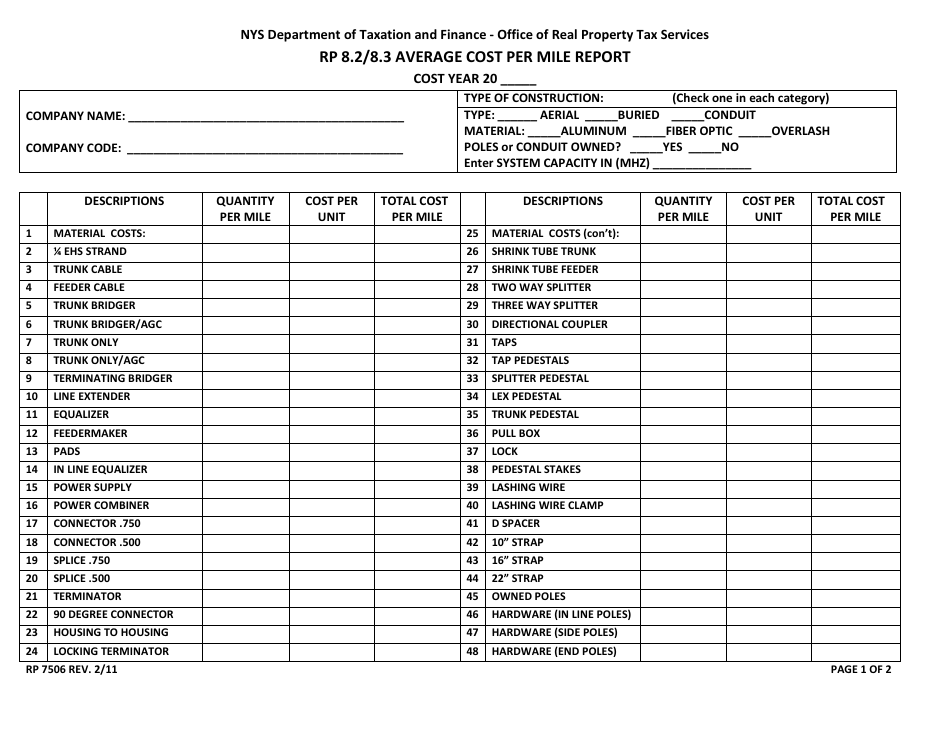

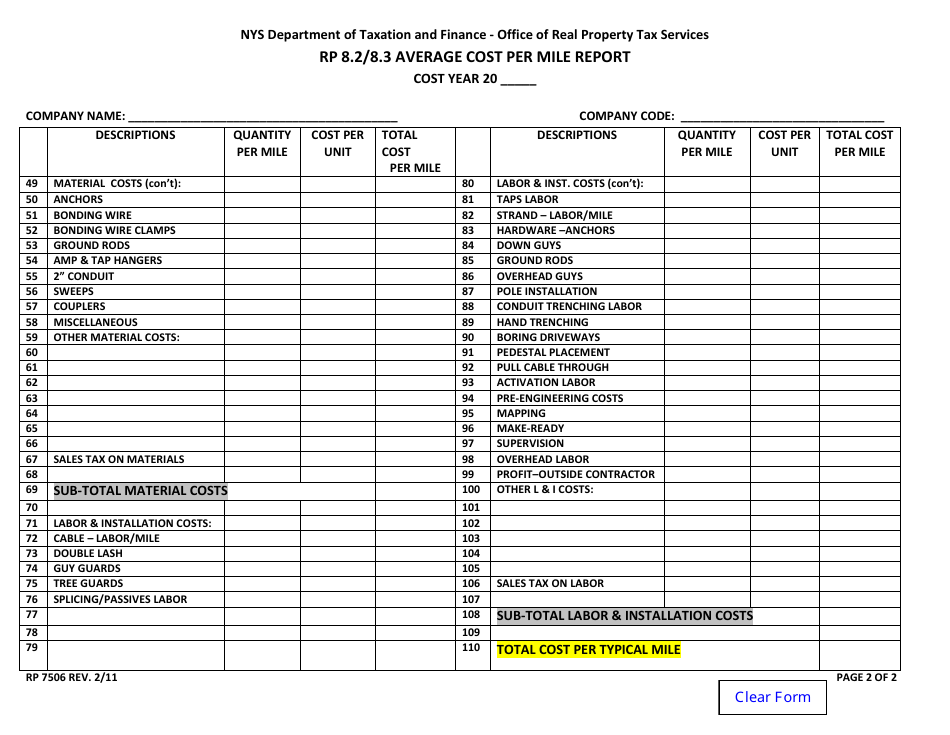

Form RP-7506 Rp 8.2 / 8.3 Average Cost Per Mile Report - New York

What Is Form RP-7506?

This is a legal form that was released by the New York State Department of Taxation and Finance - a government authority operating within New York. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is the form RP-7506?

A: The form RP-7506 is the Average Cost Per Mile Report.

Q: What is the purpose of the form RP-7506?

A: The purpose of the form RP-7506 is to calculate and report the average cost per mile for vehicles.

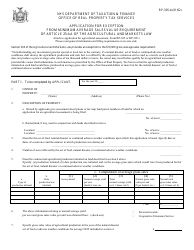

Q: Who is required to file the form RP-7506?

A: Anyone in New York who owns or operates vehicles for commercial purposes is required to file the form RP-7506.

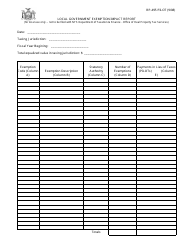

Q: What information is included in the form RP-7506?

A: The form RP-7506 includes information about the vehicle, its operating expenses, and the total miles traveled.

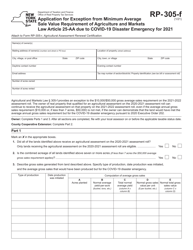

Q: What is the average cost per mile?

A: The average cost per mile is the total operating expenses divided by the total miles traveled.

Form Details:

- Released on February 1, 2011;

- The latest edition provided by the New York State Department of Taxation and Finance;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form RP-7506 by clicking the link below or browse more documents and templates provided by the New York State Department of Taxation and Finance.

![Document preview: Form RP-466-C [SUFFOLK] SUPP Report of Enrolled Member of Volunteer Fire Company, Fire Department or Ambulance Service (For Use in Suffolk County Only) - New York](https://data.templateroller.com/pdf_docs_html/1733/17338/1733889/form-rp-466-c-suffolk-supp-report-enrolled-member-volunteer-fire-company-fire-department-or-ambulance-service-use-in-suffolk-county-only-new-york.png)