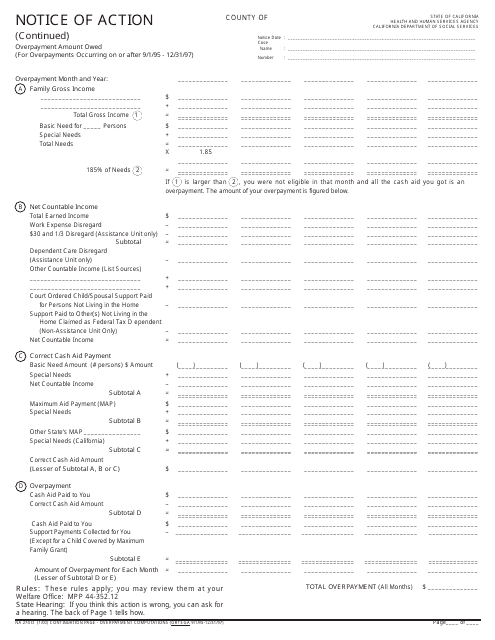

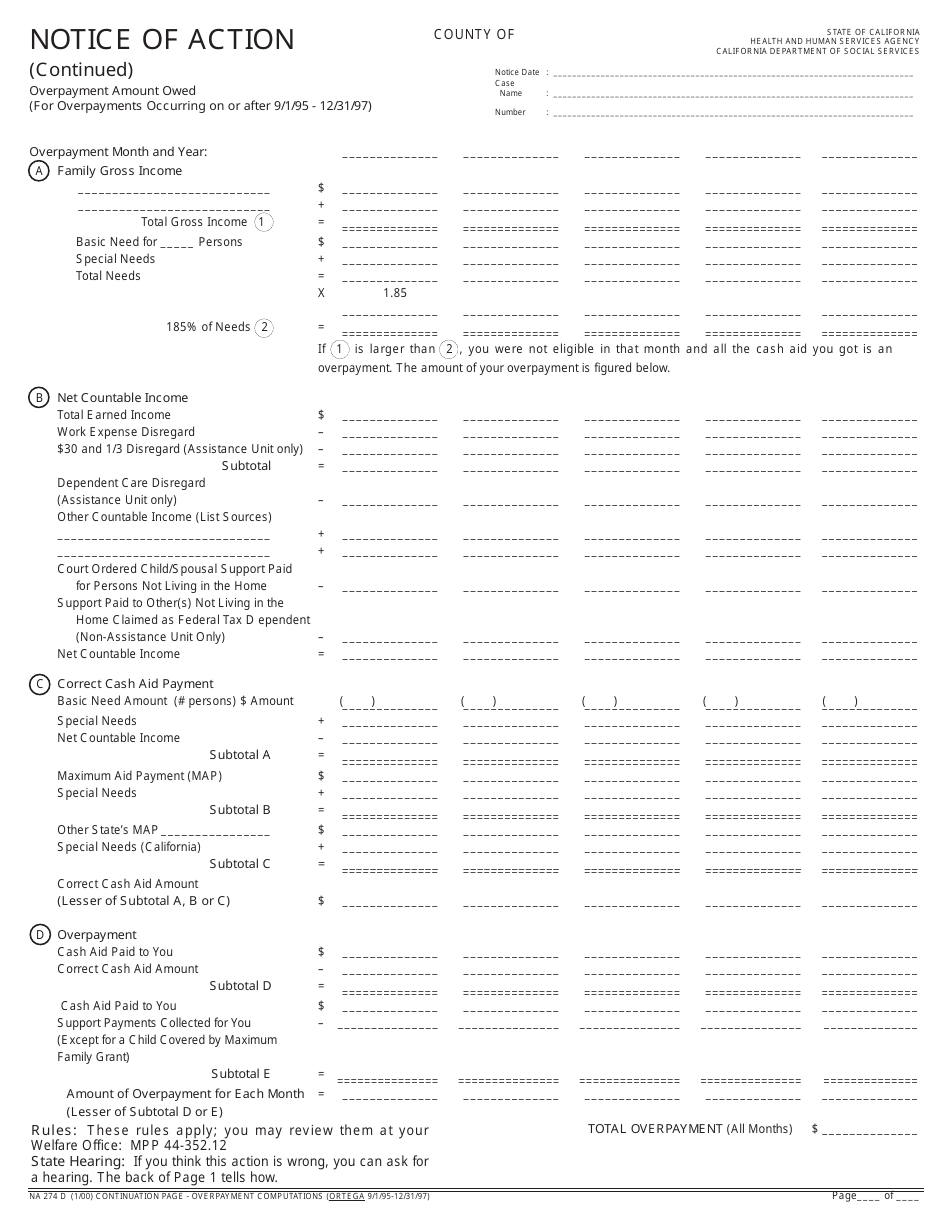

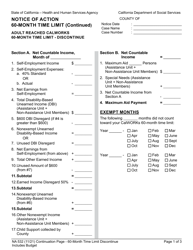

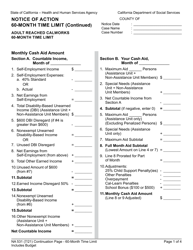

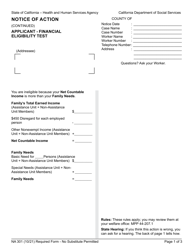

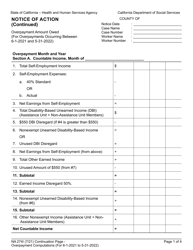

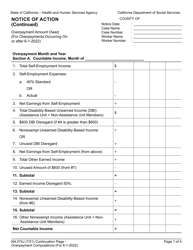

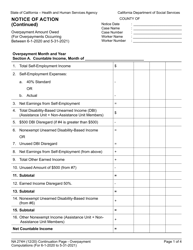

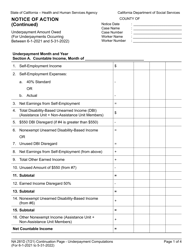

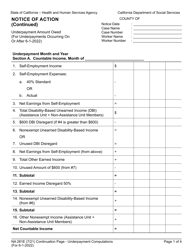

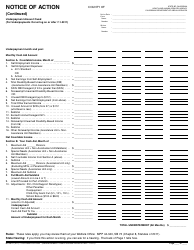

Form NA274D Notice of Action - Continuation Page - Overpayment Amount Owed (For Overpayments Occurring on or After 9 / 1 / 95 - 12 / 31 / 97) - California

What Is Form NA274D?

This is a legal form that was released by the California Department of Social Services - a government authority operating within California. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form NA274D?

A: Form NA274D is a Notice of Action - Continuation Page for overpayment amount owed.

Q: What is an overpayment?

A: An overpayment is when someone receives more benefits or payments than they are entitled to.

Q: What time period does Form NA274D cover?

A: Form NA274D covers overpayments occurring between September 1, 1995, and December 31, 1997.

Q: Who should use Form NA274D?

A: Form NA274D is used by individuals who owe overpayment amounts for that specific time period in California.

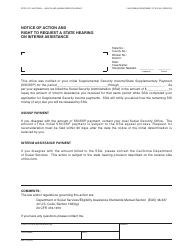

Q: What should I do if I receive Form NA274D?

A: If you receive Form NA274D, you should carefully review the details of the overpayment and take appropriate action as instructed.

Q: What happens if I owe overpayment amounts?

A: If you owe overpayment amounts, you may be required to repay the balance in full or set up a repayment plan with the relevant authority.

Q: Is there a deadline for responding to Form NA274D?

A: There may be a deadline for responding to Form NA274D, so it is important to read the instructions carefully and take timely action.

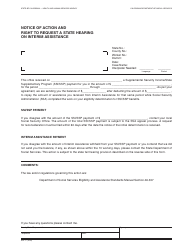

Q: Can I dispute the overpayment amount?

A: If you believe there is an error in the overpayment amount, you can dispute it by following the instructions provided on Form NA274D.

Q: What are the consequences of not paying the overpayment amount?

A: Failure to repay the overpayment amount may result in legal actions, such as wage garnishment or tax refund offset.

Q: Can I request a waiver for the overpayment amount?

A: In some cases, you may be eligible to request a waiver for the overpayment amount if you meet certain criteria. Consult the instructions on Form NA274D for more information.

Q: What should I do if I cannot afford to repay the overpayment amount?

A: If you cannot afford to repay the overpayment amount, you should contact the relevant authority to discuss possible alternatives, such as a repayment plan based on your financial situation.

Form Details:

- Released on January 1, 2000;

- The latest edition provided by the California Department of Social Services;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form NA274D by clicking the link below or browse more documents and templates provided by the California Department of Social Services.