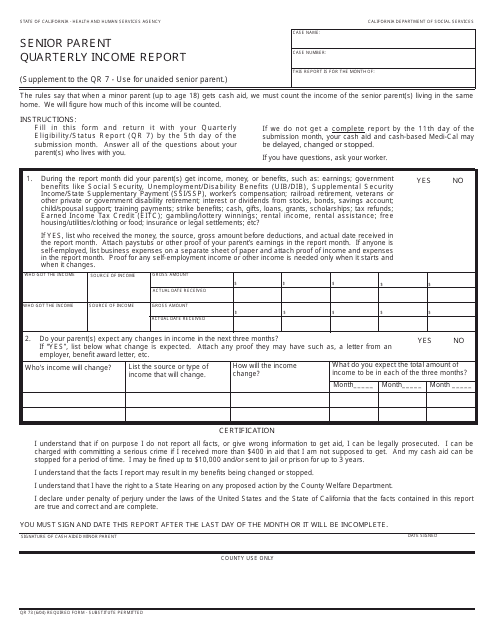

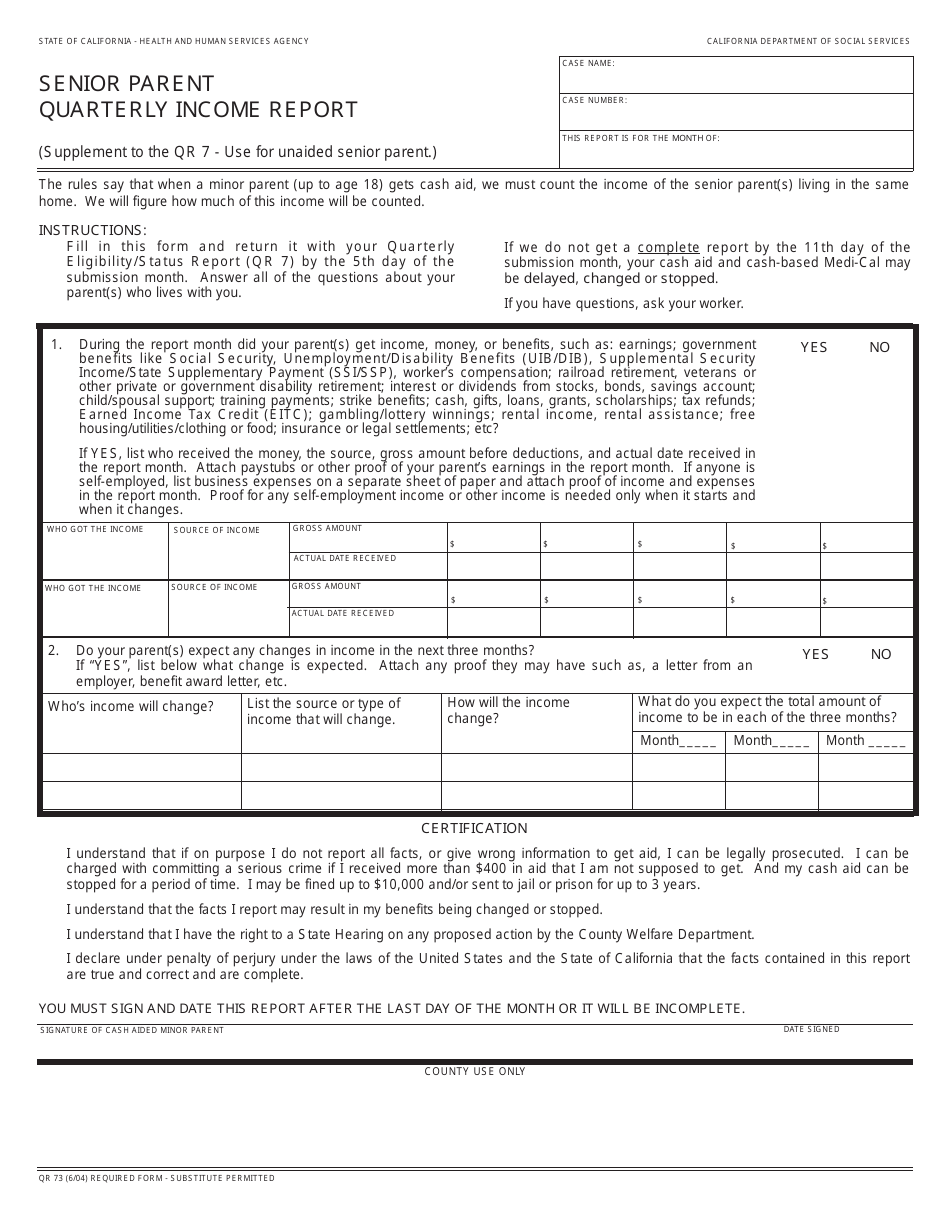

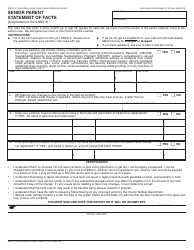

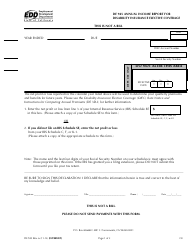

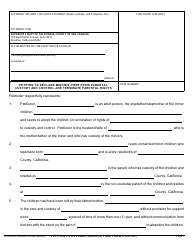

Form QR73 Senior Parent Quarterly Income Report - California

What Is Form QR73?

This is a legal form that was released by the California Department of Social Services - a government authority operating within California. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is the purpose of Form QR73?

A: Form QR73 is used to report the quarterly income of senior parents in California.

Q: Who is required to fill out Form QR73?

A: Senior parents residing in California are required to fill out Form QR73.

Q: How often do senior parents need to fill out Form QR73?

A: Senior parents need to fill out Form QR73 on a quarterly basis.

Q: What information is required on Form QR73?

A: Form QR73 requires information about the senior parent's income during the quarter.

Q: Is Form QR73 only for parents in California?

A: Yes, Form QR73 is specifically for senior parents residing in California.

Q: What happens if I don't fill out Form QR73?

A: Failure to fill out Form QR73 may result in a loss or reduction of benefits for the senior parent.

Q: Is there a deadline for submitting Form QR73?

A: Yes, Form QR73 needs to be submitted within the specified deadline for the quarter.

Q: Are there any exemptions for filling out Form QR73?

A: Exemptions may apply for certain circumstances, so it is best to consult with the California Department of Health Care Services.

Q: What should I do if I need help filling out Form QR73?

A: If you need assistance in filling out Form QR73, you can contact the California Department of Health Care Services for guidance.

Form Details:

- Released on June 1, 2004;

- The latest edition provided by the California Department of Social Services;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form QR73 by clicking the link below or browse more documents and templates provided by the California Department of Social Services.