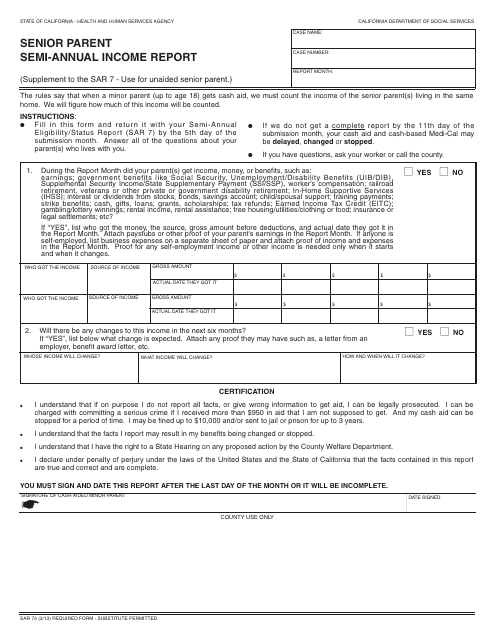

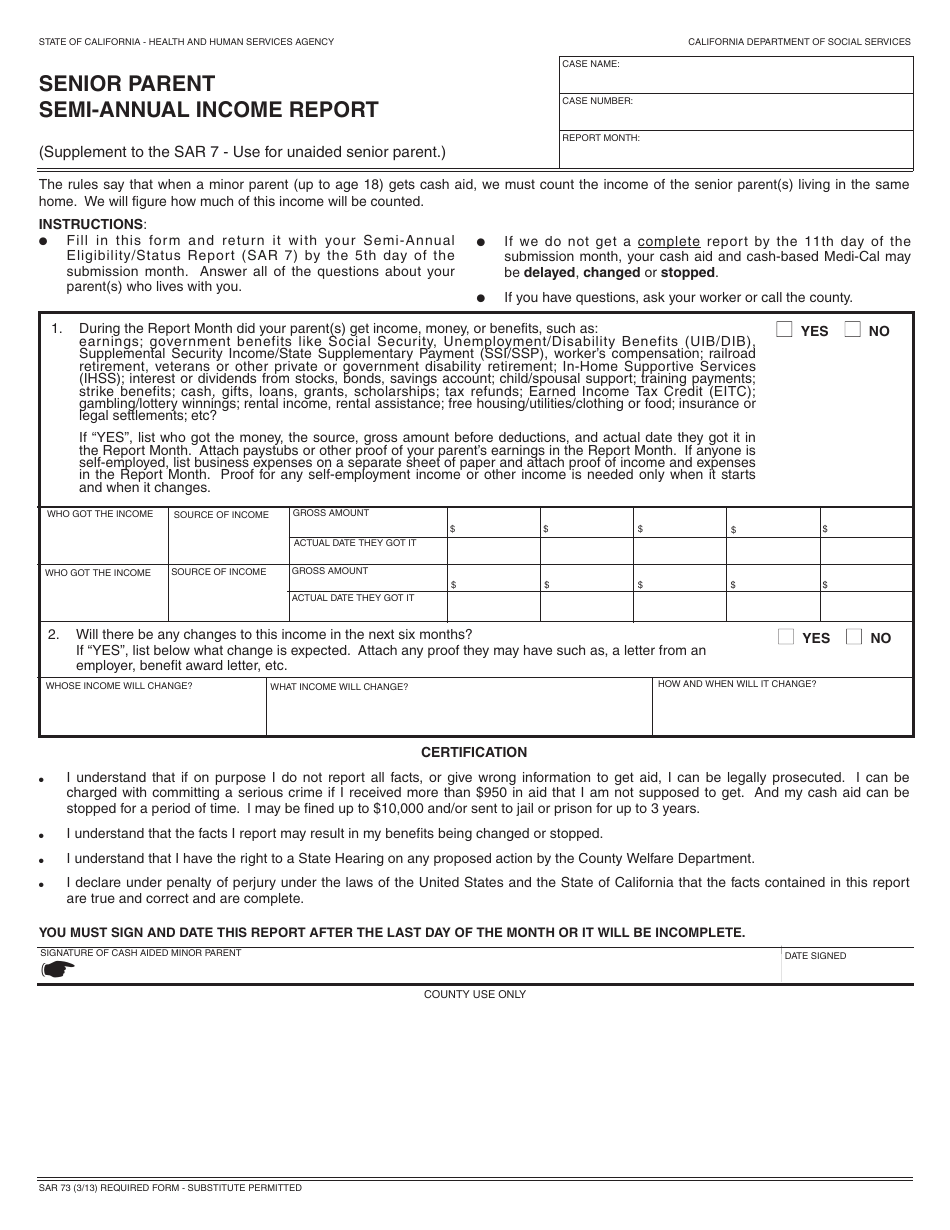

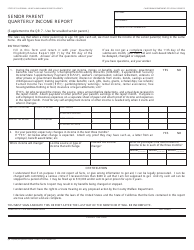

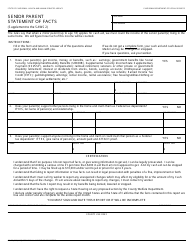

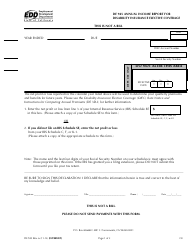

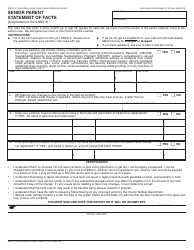

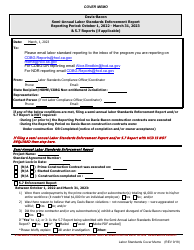

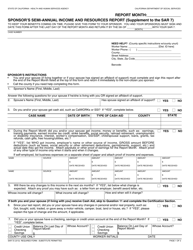

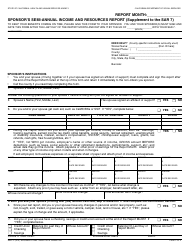

Form SAR73 Senior Parent Semi-annual Income Report - California

What Is Form SAR73?

This is a legal form that was released by the California Department of Social Services - a government authority operating within California. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

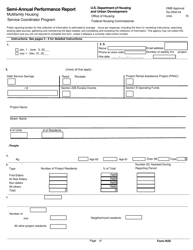

Q: What is the SAR73 Senior Parent Semi-annual Income Report?

A: SAR73 is a form used in California to report the income of a senior parent.

Q: Who needs to fill out the SAR73 form?

A: Senior parents who are receiving certain benefits in California may need to fill out the SAR73 form.

Q: What is the purpose of the SAR73 form?

A: The SAR73 form is used to determine eligibility and the amount of benefits for senior parents in California.

Q: What information is required on the SAR73 form?

A: The SAR73 form requires information about the senior parent's income, assets, and expenses.

Q: How often is the SAR73 form required to be filled out?

A: The SAR73 form needs to be filled out semi-annually, meaning every six months.

Form Details:

- Released on March 1, 2013;

- The latest edition provided by the California Department of Social Services;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form SAR73 by clicking the link below or browse more documents and templates provided by the California Department of Social Services.