This version of the form is not currently in use and is provided for reference only. Download this version of

Form SOC409

for the current year.

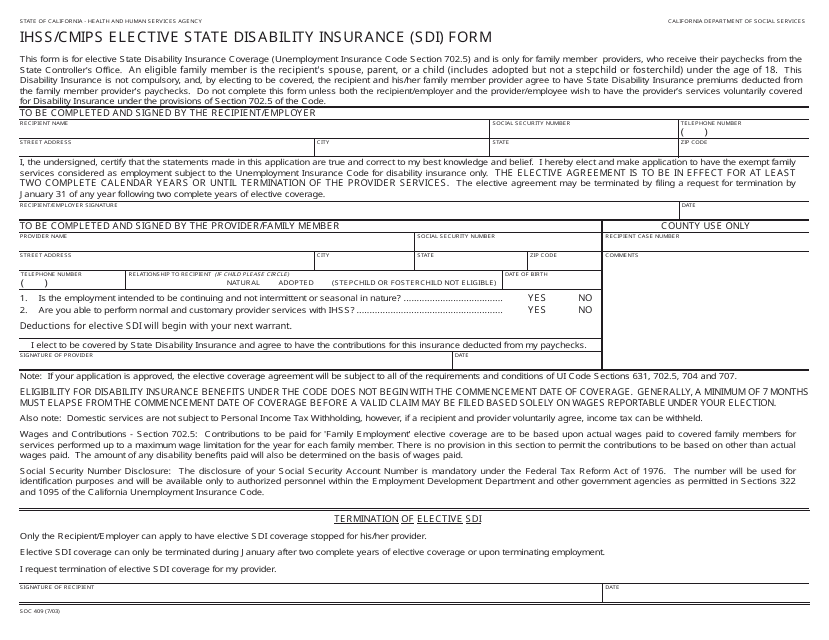

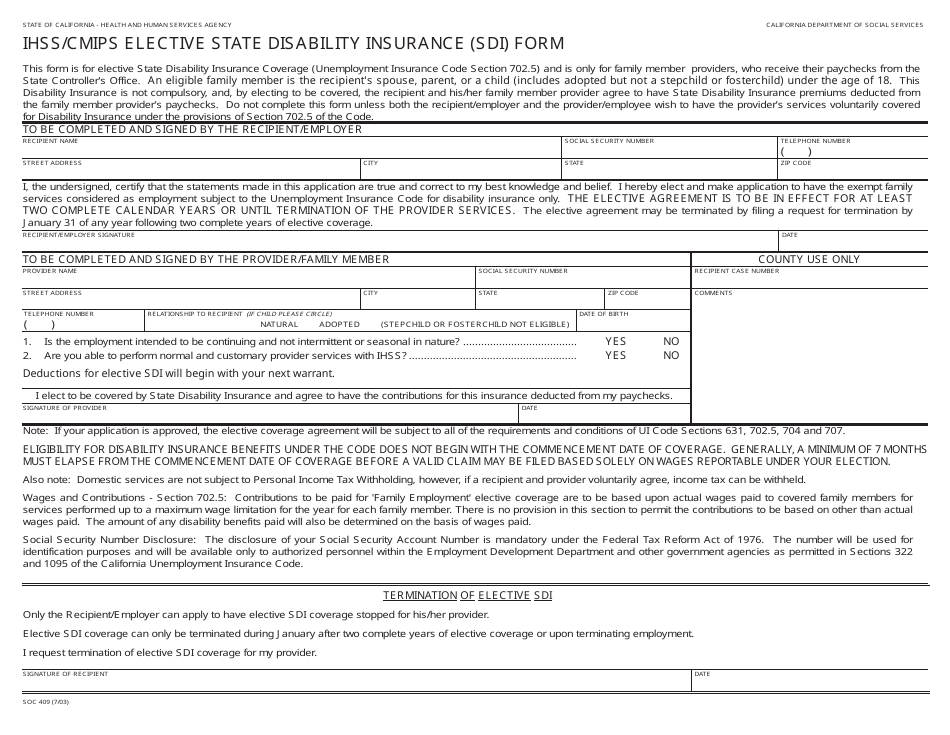

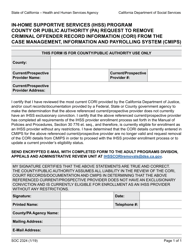

Form SOC409 Ihss / Cmips Elective State Disability Insurance (Sdi) Form - California

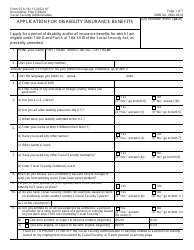

What Is Form SOC409?

This is a legal form that was released by the California Department of Social Services - a government authority operating within California. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is SOC409?

A: SOC409 is a form used for Elective State Disability Insurance (SDI) in California.

Q: What is IHSS/CMISS?

A: IHSS/CMISS refers to the In-Home Supportive Services/Case Management Information and Payrolling System.

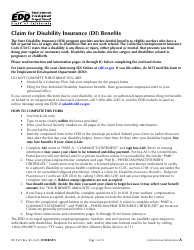

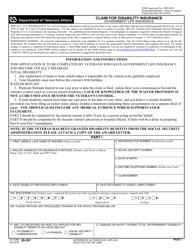

Q: What is Elective State Disability Insurance?

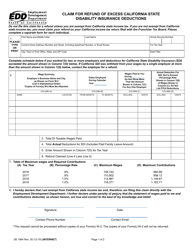

A: Elective State Disability Insurance (SDI) is a program in California that provides partial wage replacement to eligible workers who are unable to work due to a non-work-related illness, injury, or pregnancy.

Q: Who is eligible for Elective State Disability Insurance?

A: Workers who have paid into the SDI program through payroll deductions and meet certain eligibility criteria may be eligible for Elective State Disability Insurance.

Q: What is the purpose of the SOC409 form?

A: The SOC409 form is used to apply for Elective State Disability Insurance benefits in California.

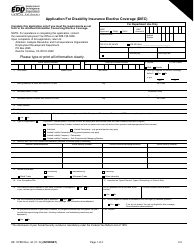

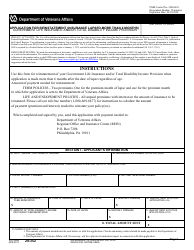

Q: What information is required on the SOC409 form?

A: The SOC409 form requires personal and employment information, details about the disability or condition, and certification from a healthcare provider.

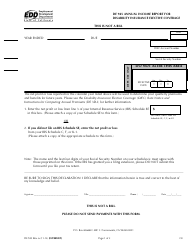

Q: How long does it take to process the SOC409 form?

A: Processing times for the SOC409 form vary, but it typically takes a few weeks to receive a decision on eligibility and benefit amount.

Q: What happens after I submit the SOC409 form?

A: After submitting the SOC409 form, the EDD will review the application, verify eligibility, and determine the amount of disability benefits to be paid.

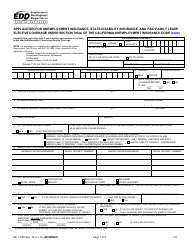

Q: How are Elective State Disability Insurance benefits paid?

A: Elective State Disability Insurance benefits are paid through direct deposit or by a debit card.

Q: Is there a waiting period for Elective State Disability Insurance benefits?

A: Yes, there is a seven-day waiting period before benefits can be paid for the first week of disability.

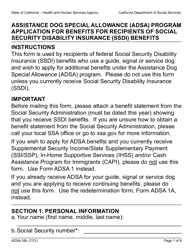

Q: Can I receive Elective State Disability Insurance benefits while receiving IHSS/CMISS services?

A: Yes, in some cases, individuals receiving In-Home Supportive Services (IHSS) or Case Management Information and Payrolling System (CMISS) services may be eligible for Elective State Disability Insurance benefits.

Q: Are Elective State Disability Insurance benefits taxable?

A: Yes, Elective State Disability Insurance benefits are subject to federal income tax, but not California state income tax.

Q: What should I do if my SOC409 application is denied?

A: If your SOC409 application is denied, you have the right to appeal the decision and request a hearing.

Form Details:

- Released on July 1, 2003;

- The latest edition provided by the California Department of Social Services;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form SOC409 by clicking the link below or browse more documents and templates provided by the California Department of Social Services.