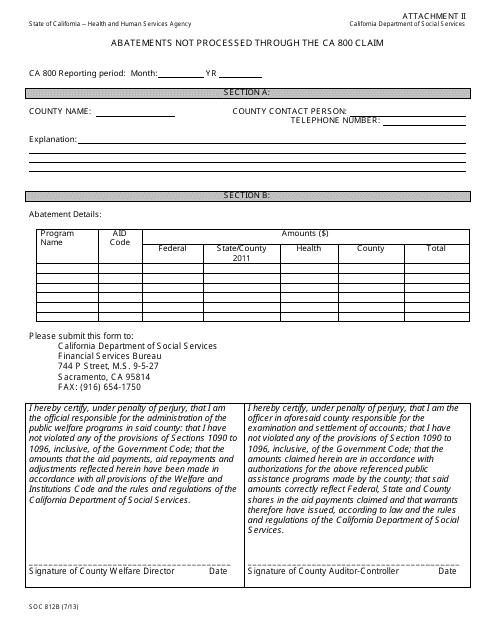

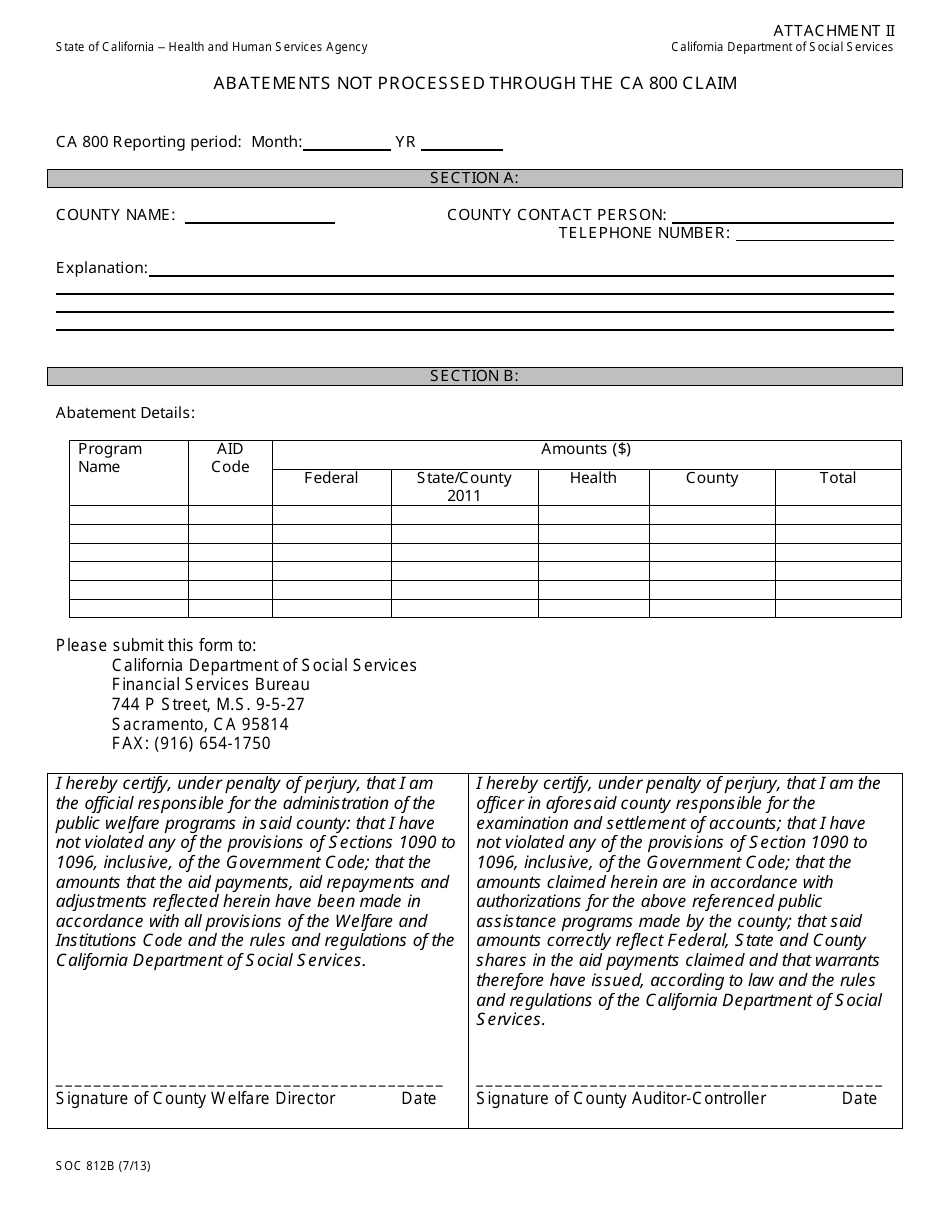

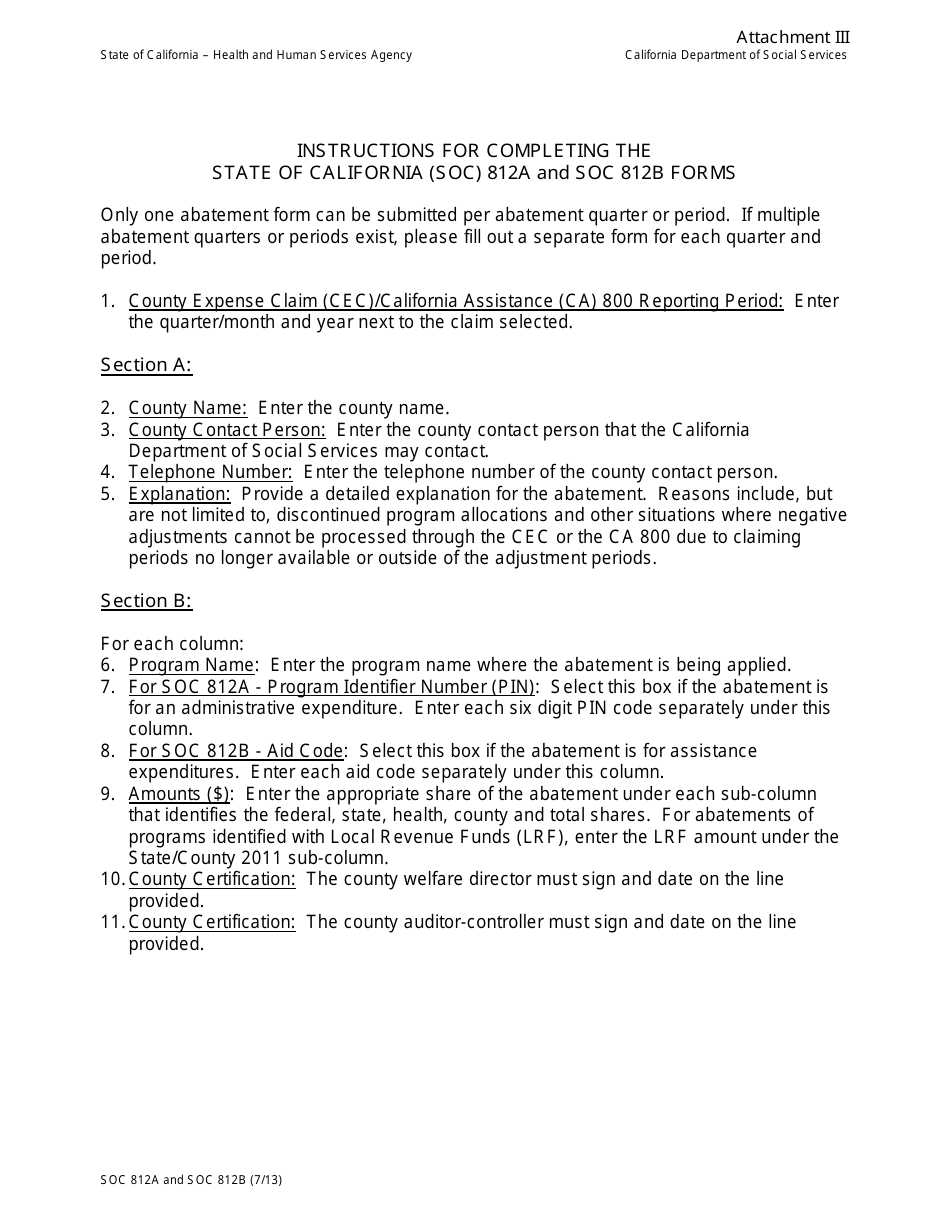

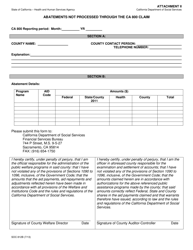

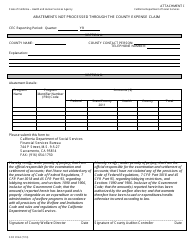

Form SOC812B Attachment II Abatements Not Processed Through the Ca 800 Claim - California

What Is Form SOC812B Attachment II?

This is a legal form that was released by the California Department of Social Services - a government authority operating within California.The document is a supplement to Form SOC812B, Abatements Not Processed Through the Ca 800 Claim. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is the Form SOC812B?

A: Form SOC812B is a form used in California for abatements not processed through the Ca 800 claim.

Q: What are abatements?

A: Abatements are reductions or cancellations of taxes, penalties, or interest owed.

Q: What does it mean for abatements to not be processed through the Ca 800 claim?

A: If abatements are not processed through the Ca 800 claim, it means they are handled in a different way.

Q: Why would abatements not be processed through the Ca 800 claim?

A: Abatements may not be processed through the Ca 800 claim if there is a different process or form specifically for handling them.

Q: What is the purpose of Attachment II on the Form SOC812B?

A: Attachment II on the Form SOC812B is used to provide additional details or documentation related to the abatements.

Form Details:

- Released on July 1, 2013;

- The latest edition provided by the California Department of Social Services;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form SOC812B Attachment II by clicking the link below or browse more documents and templates provided by the California Department of Social Services.