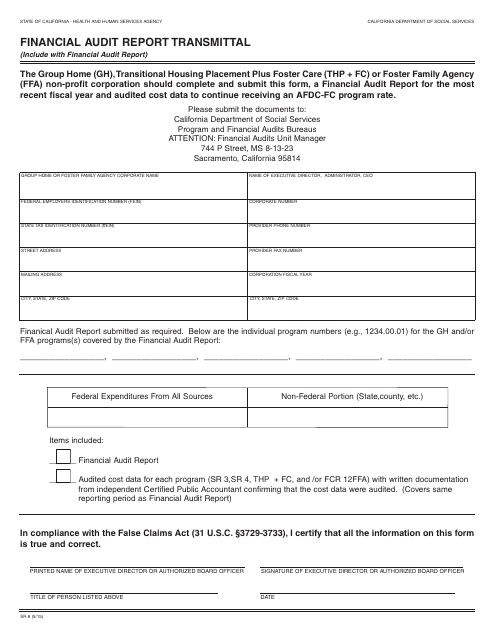

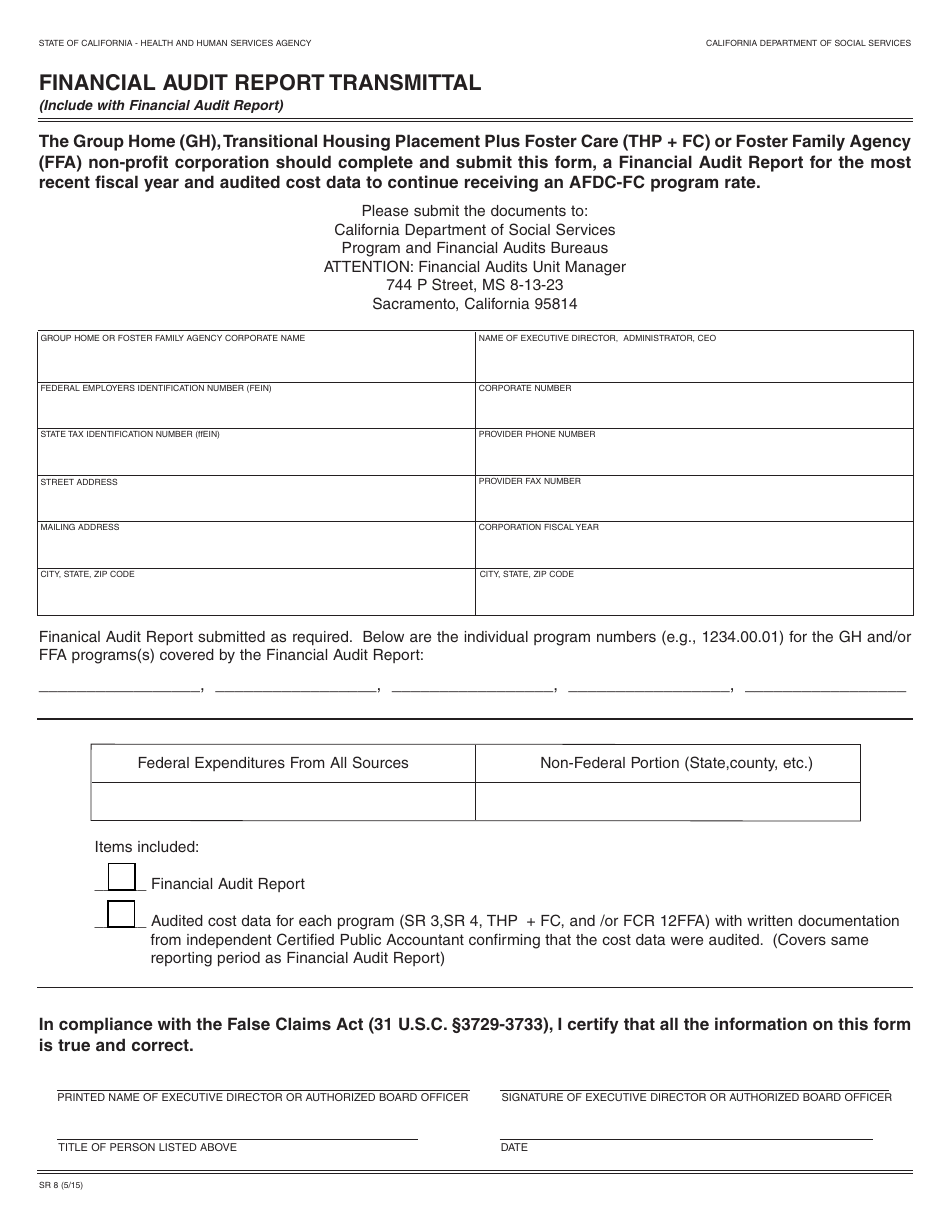

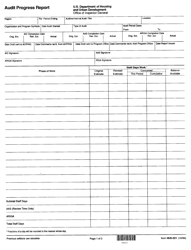

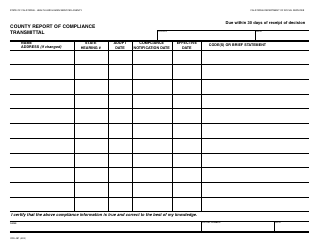

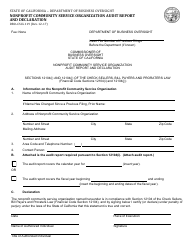

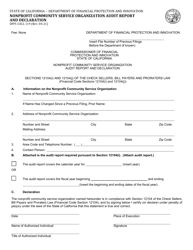

Form SR8 Financial Audit Report Transmittal - California

What Is Form SR8?

This is a legal form that was released by the California Department of Social Services - a government authority operating within California. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form SR8?

A: Form SR8 is the Financial Audit Report Transmittal form in California.

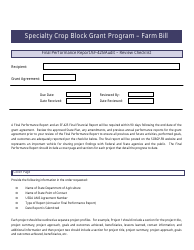

Q: What is the purpose of Form SR8?

A: The purpose of Form SR8 is to transmit the financial audit report to the appropriate authorities in California.

Q: Who needs to file Form SR8?

A: Any organization or entity that is required to conduct a financial audit in California needs to file Form SR8.

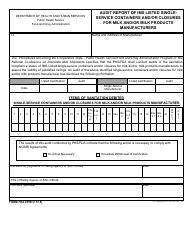

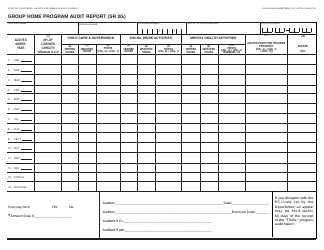

Q: What information is required on Form SR8?

A: Form SR8 requires information such as the name and contact information of the organization, details of the financial audit report, and the date of the report.

Q: When is Form SR8 due?

A: The due date for filing Form SR8 may vary depending on the specific requirements and regulations of California. It is important to check with the appropriate regulatory agency for the exact due date.

Q: Are there any filing fees for Form SR8?

A: The filing fees for Form SR8 may vary depending on the specific requirements and regulations of California. It is important to check with the appropriate regulatory agency for the exact fees.

Q: What happens if I fail to file Form SR8?

A: Failure to file Form SR8 or late filing may result in penalties or other legal consequences. It is essential to comply with the filing requirements to avoid any issues.

Form Details:

- Released on May 1, 2015;

- The latest edition provided by the California Department of Social Services;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form SR8 by clicking the link below or browse more documents and templates provided by the California Department of Social Services.